Understanding Ethereum's Price: A Comprehensive Analysis Of Market Factors And Future Trends

Table of Contents

Technological Factors Influencing Ethereum's Price

Ethereum's price is intrinsically linked to its technological advancements and the growth of its ecosystem. Several key factors play a significant role:

Ethereum 2.0 and its Impact

The transition to Ethereum 2.0, with its shift to a proof-of-stake (PoS) consensus mechanism, is a game-changer. This upgrade promises several improvements directly impacting the price:

- Increased Transaction Speed: PoS drastically reduces transaction times, leading to a smoother user experience.

- Reduced Fees: Lower transaction fees make Ethereum more accessible to a wider range of users and applications.

- Environmental Benefits: PoS significantly reduces Ethereum's energy consumption, addressing a major criticism of proof-of-work blockchains.

- Staking Rewards: Users who stake their ETH to secure the network earn rewards, potentially increasing demand for ETH.

- Network Security Improvements: PoS is generally considered more secure than proof-of-work, further enhancing investor confidence.

These improvements could lead to increased adoption, driving up demand and potentially pushing the price higher. Conversely, delays or unforeseen complications in the 2.0 rollout could negatively impact price.

Development and Ecosystem Growth

The thriving ecosystem built on Ethereum is another significant price driver. The number of decentralized applications (dApps), the total value locked (TVL) in decentralized finance (DeFi) protocols, and the overall developer activity all contribute to Ethereum's value:

- Number of Active dApps: A growing number of dApps indicates increased utility and adoption of the platform.

- Total Value Locked (TVL) in DeFi Protocols: High TVL demonstrates significant capital flowing into Ethereum-based DeFi projects.

- New Projects Built on Ethereum: A constant influx of new projects shows the platform's attractiveness to developers and entrepreneurs.

- Developer Activity: High developer activity signifies ongoing innovation and improvement of the Ethereum network.

A vibrant and expanding ecosystem translates to higher demand for ETH, leading to potential price appreciation.

Scalability Solutions and Their Effects

Scalability has been a historical challenge for Ethereum. Layer-2 solutions like Polygon, Optimism, and Arbitrum aim to alleviate this by processing transactions off the main chain, thereby increasing throughput and reducing costs:

- Reduced Transaction Fees: Layer-2 solutions significantly lower transaction fees, making Ethereum more affordable for everyday users.

- Increased Throughput: They allow for a higher volume of transactions to be processed per second, improving network efficiency.

- Improved User Experience: Faster and cheaper transactions contribute to a better user experience, encouraging wider adoption.

- Impact on Network Congestion: Layer-2 solutions mitigate network congestion, a common problem on Ethereum's mainnet.

Successful layer-2 scaling solutions could significantly boost Ethereum's adoption and subsequently, its price.

Market Factors Affecting Ethereum's Price

Beyond technological factors, various market forces significantly influence Ethereum's price.

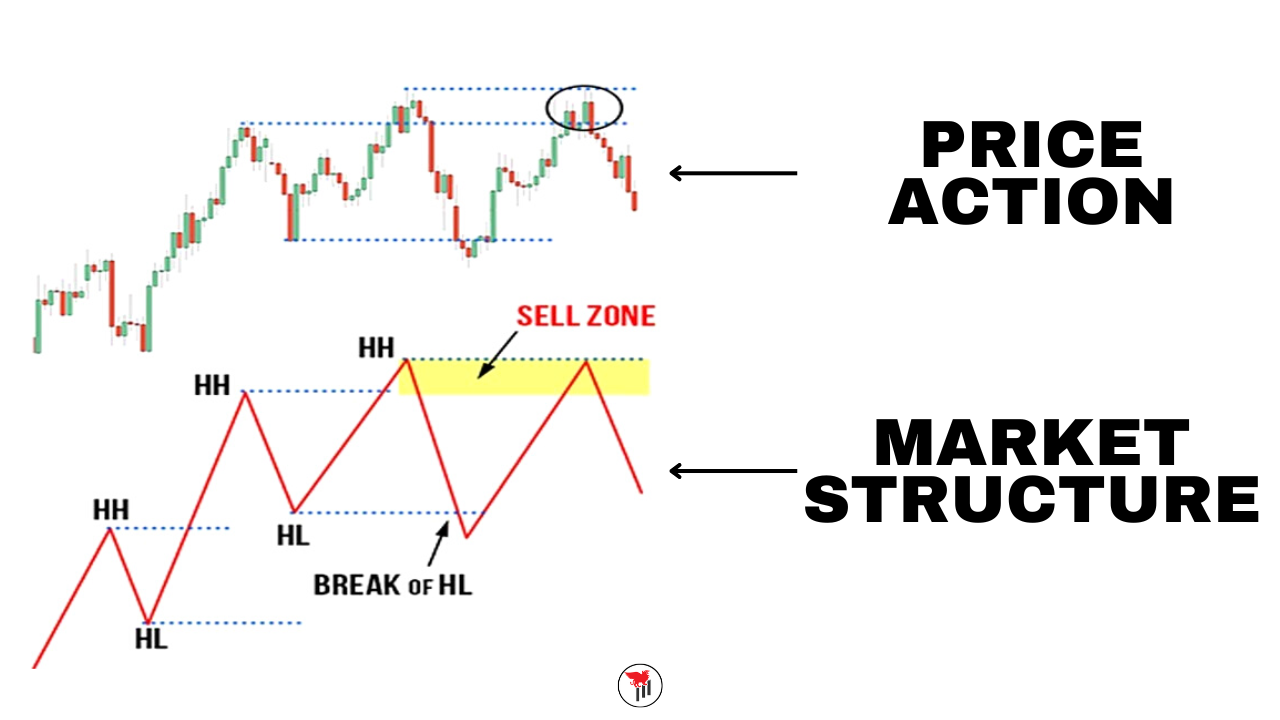

Bitcoin's Influence

Bitcoin's price often acts as a bellwether for the entire cryptocurrency market, including Ethereum:

- Historical Price Correlation: Ethereum's price has historically shown a degree of correlation with Bitcoin's price movements.

- Market Sentiment: Overall market sentiment towards cryptocurrencies significantly impacts both Bitcoin and Ethereum.

- Overall Crypto Market Trends: Broad trends in the crypto market, such as bull or bear markets, affect both assets.

When Bitcoin's price rises, Ethereum often follows suit, and vice versa. However, it's important to note that the correlation is not always perfect.

Regulatory Landscape and Government Policies

Government regulations and policies play a crucial role in shaping investor sentiment and Ethereum's price:

- Regulatory Uncertainty: Uncertainty about regulatory frameworks can create volatility in the market.

- Potential Bans: The threat of government bans can negatively impact investor confidence.

- Tax Implications: Tax policies related to cryptocurrencies can affect investment decisions and price.

- Positive Governmental Stances on Blockchain Technology: Positive government approaches towards blockchain can boost investor confidence and prices.

Clear and favorable regulatory environments tend to lead to increased investor confidence and potentially higher prices.

Supply and Demand Dynamics

The basic principles of supply and demand govern Ethereum's price:

- Total Ethereum Supply: The total number of ETH in existence.

- Circulating Supply: The number of ETH currently in circulation.

- Burning Mechanisms: Mechanisms that remove ETH from circulation, potentially reducing supply.

- Institutional Adoption: Increased adoption by institutional investors can drive demand.

- Retail Investor Sentiment: The overall sentiment of retail investors significantly impacts demand.

Increased demand relative to supply will typically push the price upwards, and vice versa.

Predicting Future Trends of Ethereum's Price

Predicting the future price of Ethereum is inherently speculative. However, we can analyze potential scenarios based on existing trends:

Long-Term Price Predictions (Cautious Approach)

Predicting specific price targets is irresponsible. However, several factors could influence long-term growth:

- Factors Influencing Long-Term Growth: Widespread adoption, successful scaling solutions, continued ecosystem growth, and positive regulatory developments.

- Potential Challenges and Risks: Competition from other blockchains, regulatory hurdles, and unforeseen technological challenges.

- Scenarios for Different Levels of Adoption: Different levels of adoption could lead to vastly different price outcomes.

Long-term price movements will depend on the interplay of these factors.

Factors Affecting Future Volatility

Several factors are likely to contribute to price fluctuations in the future:

- Major Technological Upgrades: Successful or unsuccessful upgrades could trigger significant price swings.

- Regulatory Developments: New regulations or policy changes could cause short-term volatility.

- Macroeconomic Factors: Global economic events can impact the cryptocurrency market as a whole.

- Market Sentiment Shifts: Sudden shifts in investor sentiment can lead to dramatic price fluctuations.

Understanding these factors is crucial for navigating the volatility inherent in the Ethereum market.

Conclusion

Understanding Ethereum's price requires a multifaceted approach, encompassing both technological advancements and market dynamics. Technological improvements like Ethereum 2.0, the growth of the DeFi ecosystem, and successful scaling solutions are all positive indicators for long-term growth. However, market factors such as Bitcoin's price movements, regulatory landscapes, and overall investor sentiment play a crucial role in short-term price fluctuations. By carefully considering these factors, investors can make more informed decisions. The key takeaway is that understanding these interwoven forces is essential for navigating the complexities of the Ethereum market. To continue your journey in understanding Ethereum's price, explore additional resources, stay updated on the latest news, and follow key influencers in the Ethereum ecosystem. Subscribe to relevant newsletters to stay informed about future developments and continue deepening your understanding of this dynamic cryptocurrency.

Featured Posts

-

Trump Described As Transformational President By Carney In D C

May 08, 2025

Trump Described As Transformational President By Carney In D C

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025 -

Top Krypto Stories Of All Time

May 08, 2025

Top Krypto Stories Of All Time

May 08, 2025 -

Thunder Pacers Injury News Game On March 29th

May 08, 2025

Thunder Pacers Injury News Game On March 29th

May 08, 2025 -

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025

Latest Posts

-

The Top 10 Krypto Stories You Need To Read

May 08, 2025

The Top 10 Krypto Stories You Need To Read

May 08, 2025 -

Kryptos Greatest Adventures A Selection Of The Best Stories

May 08, 2025

Kryptos Greatest Adventures A Selection Of The Best Stories

May 08, 2025 -

New Superman Movie 5 Minute Krypto Preview Unveiled

May 08, 2025

New Superman Movie 5 Minute Krypto Preview Unveiled

May 08, 2025 -

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025 -

Consumer Protection Agency Sues Lidl For Alleged Plus App Issues

May 08, 2025

Consumer Protection Agency Sues Lidl For Alleged Plus App Issues

May 08, 2025