Amundi Dow Jones Industrial Average UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the calculation of Net Asset Value (NAV) is fundamental to successful ETF investing. The Amundi Dow Jones Industrial Average UCITS ETF tracks the performance of the Dow Jones Industrial Average, mirroring its movements. Let's break down the NAV calculation process:

The Components of NAV

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF represents the net asset value of the underlying holdings. This primarily consists of:

- Stocks: The ETF holds a basket of stocks representing the 30 companies comprising the Dow Jones Industrial Average. Each stock's weighting within the ETF reflects its weight in the index.

- Cash and other assets: The ETF may also hold small amounts of cash and other liquid assets to facilitate trading and cover expenses.

- Liabilities: These are the ETF's expenses, including management fees and other operational costs.

The core NAV calculation is straightforward:

Market Value of Assets – Liabilities = NAV

The market value of assets is determined by the current market prices of the constituent stocks, updated daily. Currency exchange rates play a role if the underlying assets are denominated in currencies other than the ETF's base currency. The NAV is typically calculated at the end of each trading day.

Impact of Market Fluctuations on NAV

The price fluctuations of the Dow Jones Industrial Average directly influence the Amundi Dow Jones Industrial Average UCITS ETF's NAV.

- Positive Market Movement: When the Dow Jones Industrial Average rises, the market value of the ETF's holdings increases, leading to a higher NAV.

- Negative Market Movement: Conversely, a decline in the Dow Jones Industrial Average results in a lower market value and, consequently, a lower NAV.

Volatility in the market creates daily fluctuations in the NAV. A highly volatile market will see more significant daily changes in the ETF's NAV compared to a calmer market. For example, a sudden economic downturn could lead to a sharp decrease in the NAV, while positive economic news might cause a substantial increase.

Understanding the Difference Between NAV and Market Price

While the NAV represents the intrinsic value of the ETF's holdings, the market price is the price at which the ETF is actually traded on the exchange. Differences arise due to several factors:

- Bid-Ask Spread: The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). This spread contributes to the discrepancy between NAV and market price.

- Supply and Demand: Market forces of supply and demand also affect the ETF's market price. High demand can push the price above the NAV, while low demand can push it below.

- Arbitrage Opportunities: In some cases, the difference between NAV and market price might create arbitrage opportunities for sophisticated investors. If the market price is significantly below the NAV, an investor could buy the ETF and potentially profit from the price converging towards the NAV.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring and understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for making informed investment choices.

Monitoring NAV for Performance Tracking

Tracking the NAV over time provides a clear picture of the ETF's performance.

- Performance Visualization: Using charts and graphs, you can visualize NAV trends, identifying periods of growth and decline.

- Benchmark Comparison: Comparing the NAV performance to the benchmark index (Dow Jones Industrial Average) helps assess the ETF's tracking efficiency. A well-performing ETF will closely mirror the index's movements.

NAV and Investment Strategies

NAV is a vital factor in formulating investment strategies.

- Dollar-Cost Averaging: Regular investments regardless of NAV fluctuations can mitigate risk.

- Buy/Sell Decisions: While not the sole determinant, NAV can inform decisions to buy (when it's low) or sell (when it's high), aligning with your risk tolerance and investment goals.

- Investment Indicators: Use NAV in conjunction with other indicators (e.g., volume, market sentiment) for a more holistic investment approach.

Accessing Real-time and Historical NAV Data

You can access real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF through various sources:

- Amundi's Website: The official Amundi website is a primary source for accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news sites often provide real-time and historical ETF data, including NAV.

- Brokerage Platforms: Your brokerage account will likely display the current NAV alongside the market price of the ETF.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF through NAV Understanding

Understanding the Net Asset Value (NAV) is essential for effective investing in the Amundi Dow Jones Industrial Average UCITS ETF. By monitoring NAV, comparing it to the market price, and using it in conjunction with other investment indicators, you can make better-informed decisions and potentially optimize your investment strategy. Regularly tracking the NAV allows you to assess the ETF's performance and adjust your approach as needed. Deepen your understanding of the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value (NAV) today! Learn more about effective ETF investment strategies using NAV.

Featured Posts

-

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025 -

Escape To The Country Building Your Dream Home In The Countryside

May 24, 2025

Escape To The Country Building Your Dream Home In The Countryside

May 24, 2025 -

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Latest Posts

-

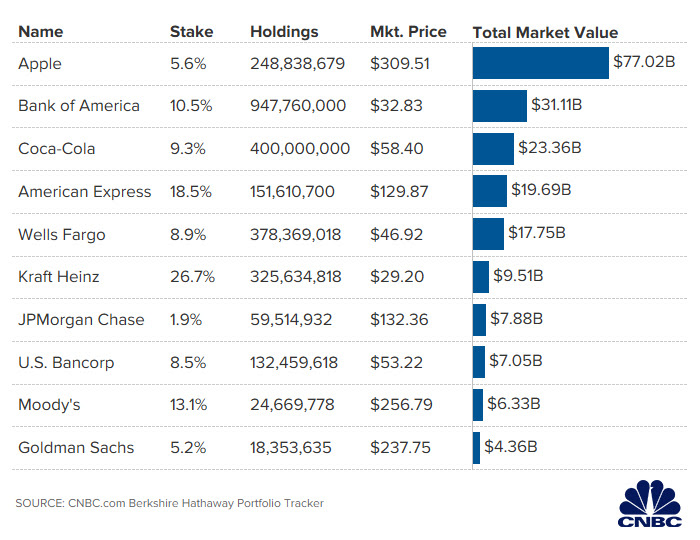

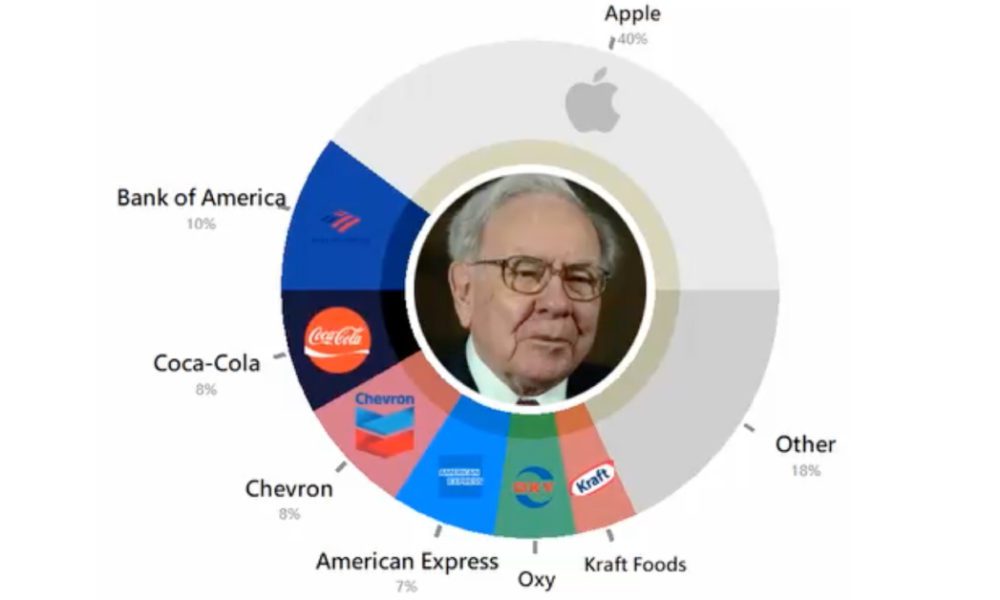

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

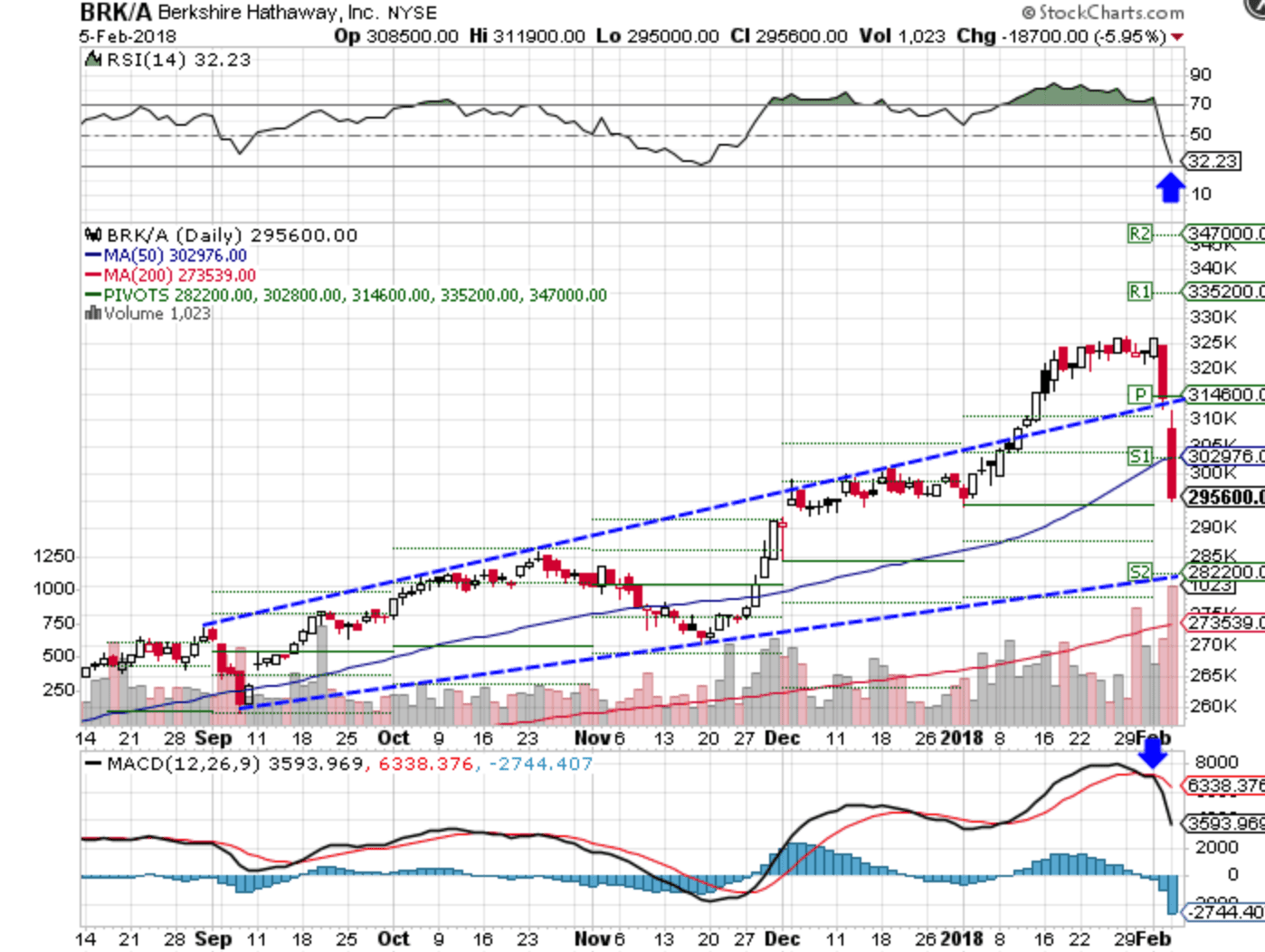

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025