6% Kering Share Slump After Poor First Quarter Performance

Table of Contents

Declining Sales Figures Across Key Brands

The Kering share slump can largely be attributed to underwhelming sales figures across several of its key brands. While some brands experienced moderate growth, the overall performance fell short of expectations, leading to investor concern.

Gucci's Underperformance

Gucci, a cornerstone of Kering's portfolio, significantly underperformed in the first quarter. This "Gucci sales decline" is a major contributor to the overall Kering share slump. Several factors likely contributed to this shortfall:

- Year-over-Year (YoY) sales decreased by 14%: This represents a sharp decline compared to the same period last year.

- Quarter-over-Quarter (QoQ) sales dropped by 8%: This indicates a worsening trend even within the current year.

- Market saturation: The intense competition within the luxury handbag market may have led to a plateauing of demand for Gucci's products.

- Changing consumer preferences: Younger generations may be shifting their preferences towards other luxury brands or alternative styles.

- Increased competition: The rise of new and emerging luxury brands is posing a challenge to Gucci's market dominance.

Yves Saint Laurent's Moderate Growth

While Yves Saint Laurent (YSL) showed moderate growth, it wasn't enough to offset Gucci's decline. Analyzing "Yves Saint Laurent sales" provides a more nuanced picture:

- YoY growth of 5%: While positive, this growth rate is significantly lower than previous quarters and years.

- QoQ growth of 2%: This demonstrates slowing momentum even within the first quarter.

- Successful marketing campaigns: Targeted marketing initiatives may have contributed to some growth but were insufficient to counterbalance the overall slump.

- New product launches: While new product introductions stimulated some interest, they weren't impactful enough to drive substantial growth.

Impact of Other Kering Brands

The performance of other Kering brands further exacerbated the overall situation. While some brands showed resilience, their positive contributions were not sufficient to counterbalance the negative impact of Gucci's underperformance. Considering the "Kering portfolio" as a whole:

- Bottega Veneta experienced a slight decline in sales. This indicates that the overall luxury market slowdown is affecting more than just Gucci.

- Balenciaga maintained relatively stable sales. This highlights the importance of brand diversification within Kering's strategy.

- The combined performance of these other brands was insufficient to offset the losses from Gucci. This underscores the significant weight Gucci carries within Kering's overall financial performance.

Macroeconomic Factors and Geopolitical Risks

Beyond internal factors, significant macroeconomic and geopolitical challenges contributed to the Kering share slump.

Global Inflation and Recessionary Fears

The current global economic climate, marked by high inflation and recessionary fears, significantly impacts luxury consumer spending. The keyword phrase "luxury goods recession" aptly describes the situation:

- Inflation erodes purchasing power: High inflation reduces disposable income, especially among high-net-worth individuals who are the primary consumers of luxury goods.

- Recessionary fears dampen consumer confidence: Uncertainty about the future economic outlook prompts consumers to curtail discretionary spending, including luxury purchases.

- "Inflation impact on luxury" is substantial: The luxury goods sector is particularly sensitive to economic downturns as it caters to discretionary spending.

Geopolitical Instability

Geopolitical instability, including the ongoing war in Ukraine and persistent supply chain disruptions, further impacted Kering's operations:

- The war in Ukraine created significant uncertainty in the European market. This uncertainty directly affects consumer sentiment and potentially impacts sales within the region.

- Supply chain disruptions impacted production and delivery times. These disruptions led to increased costs and potentially reduced product availability.

- "Geopolitical risk" is a growing concern: The interconnectedness of global supply chains makes the luxury goods industry vulnerable to disruptions stemming from geopolitical instability.

Strategic Responses and Future Outlook

Kering is likely implementing several strategies to address the current slump and improve its future outlook.

Kering's Strategies for Recovery

Kering is expected to implement strategies for recovery, focusing on revitalizing its brands and adapting to the changing market landscape. Understanding "Kering strategy" is crucial:

- Cost-cutting measures: Streamlining operations and reducing expenses are likely to be implemented to improve profitability.

- Refreshed marketing campaigns: New marketing initiatives aimed at re-energizing brand image and attracting new customer segments are anticipated.

- New product launches and collaborations: Introducing innovative products and collaborating with other brands might help to stimulate demand.

- "Brand revitalization" is key: Focusing on enhancing the desirability and relevance of key brands is crucial for long-term success.

Analyst Predictions and Investor Sentiment

Financial analysts have offered varied predictions regarding Kering's future performance. Assessing "Kering stock forecast" is critical for understanding investor sentiment:

- Some analysts maintain a positive outlook, citing Kering's strong brand portfolio and long-term growth potential. This reflects confidence in the company's ability to navigate the current challenges.

- Others have expressed concerns, highlighting the persistent macroeconomic headwinds and the need for a swift and effective recovery strategy. This reflects the uncertainty surrounding the company's short-term prospects.

- "Investor confidence" is shaken: The Kering share slump indicates a decline in investor confidence, emphasizing the need for decisive action from the company.

Conclusion:

The 6% Kering share slump reflects the vulnerability of the luxury goods sector to macroeconomic factors and evolving consumer preferences. While Gucci's underperformance played a significant role, the overall performance of the Kering portfolio and global economic conditions contributed to the downturn. Kering's strategic response will be crucial in determining the company's future trajectory. To stay updated on Kering's performance and the luxury market, continue following our coverage of the Kering share slump and other relevant news. Understanding the nuances of the Kering share slump and its implications for the luxury market is crucial for investors and industry observers alike.

Featured Posts

-

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Glastonbury 2024 Us Bands Cryptic Message Fuels Speculation

May 24, 2025

Glastonbury 2024 Us Bands Cryptic Message Fuels Speculation

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025 -

130th Anniversary Of The Dreyfus Affair A Demand For Justice

May 24, 2025

130th Anniversary Of The Dreyfus Affair A Demand For Justice

May 24, 2025

Latest Posts

-

Ai

May 24, 2025

Ai

May 24, 2025 -

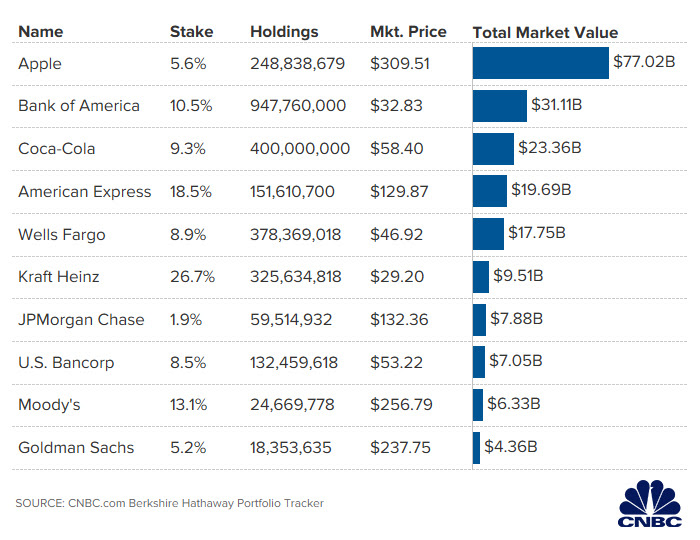

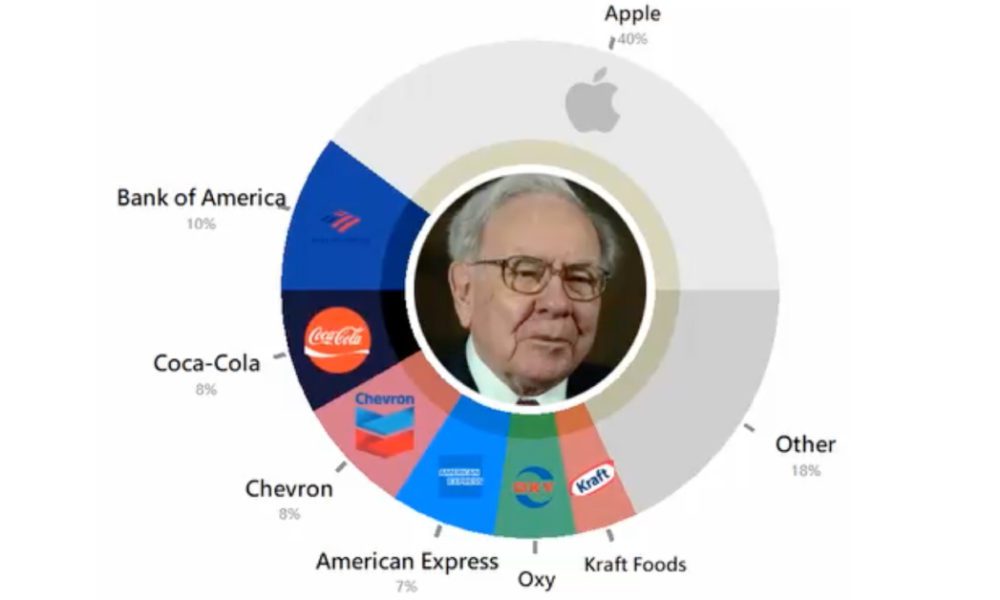

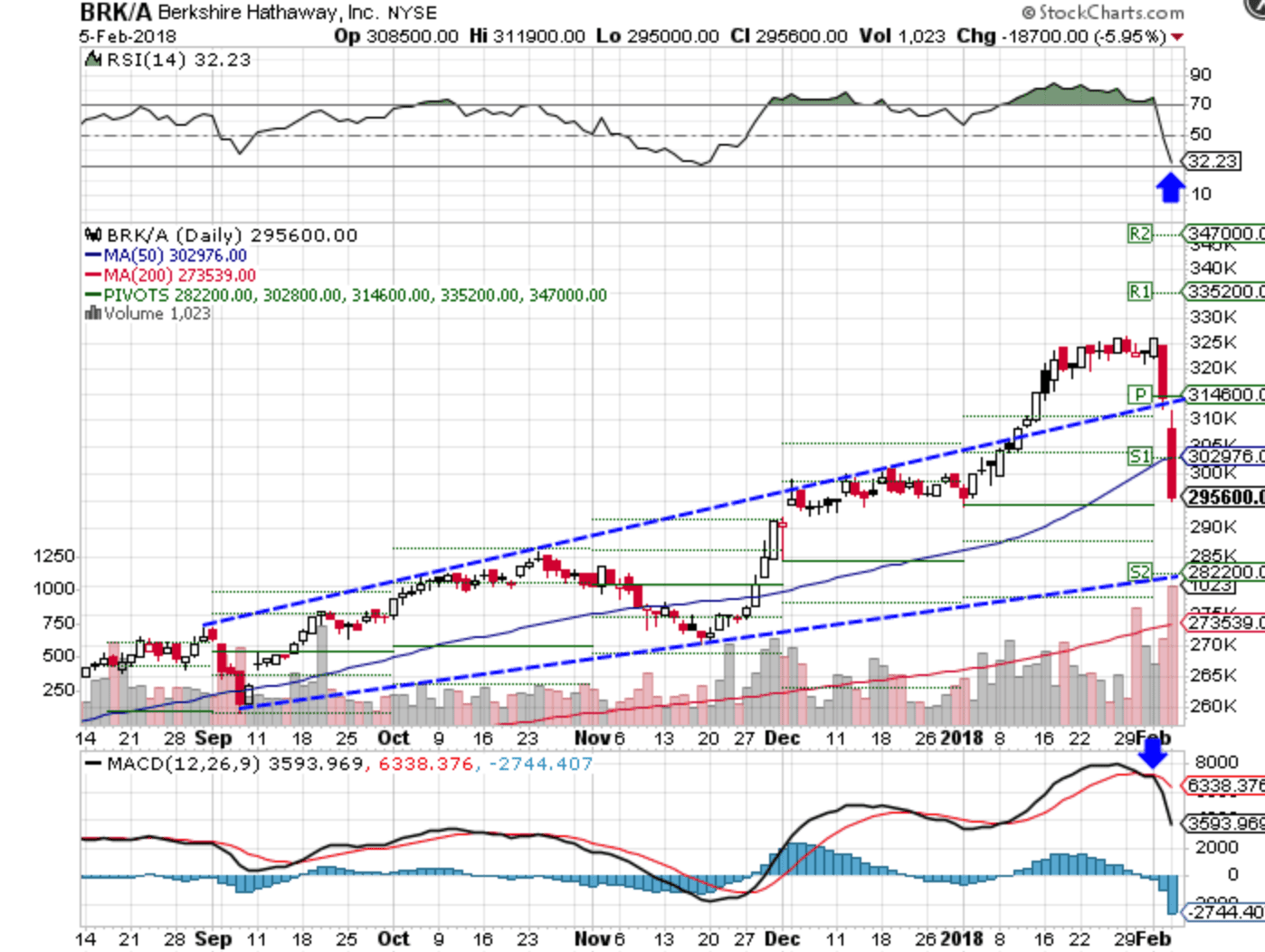

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025