2% LVMH Share Drop After Q1 Sales Figures Fall Short

Table of Contents

Disappointing Q1 Sales Figures: A Detailed Breakdown

LVMH's Q1 2024 financial report revealed a concerning picture. While the company didn't release complete granular data immediately, early reports indicated a noticeable shortfall compared to both analyst expectations and the previous year's performance. This underperformance highlights a potential shift in the luxury goods market landscape.

- Specific Percentage Drop: While precise figures varied depending on the source, reports suggested a noticeable percentage drop in sales across various product categories. Fashion and leather goods experienced a steeper decline than other divisions, suggesting a potential shift in consumer preferences or decreased spending in these areas.

- Geographical Breakdown: The geographical breakdown of sales revealed significant underperformance in key markets, particularly in Asia, where the slowdown in China had a significant impact. Europe and the US showed more resilience, but still fell short of initial projections.

- Brand-Specific Performance: Although LVMH doesn't publicly disclose performance for every individual brand within its portfolio, analysts highlighted several brands that contributed significantly to the sales decline. The underperformance in some high-profile brands underscored the challenges the company faces in maintaining consistent growth across all areas of its business.

These LVMH Q1 results, characterized by a revenue decline, clearly indicate that the luxury goods giant is not immune to the global economic uncertainties. Analyzing the sales performance requires a deeper understanding of the factors impacting the luxury market as a whole.

Impact of Slowing Chinese Demand on LVMH's Performance

China has long been a cornerstone of LVMH's growth strategy, representing a significant portion of its overall revenue. The slowing Chinese economy, coupled with evolving consumer preferences and geopolitical factors, has had a considerable impact on LVMH’s Q1 performance.

- Decline in Chinese Consumer Spending: Statistics show a clear reduction in Chinese consumer spending on luxury goods in Q1 2024. This slowdown is attributed to various factors, including economic uncertainty, a shift towards domestic brands, and stricter government regulations.

- LVMH's Response: LVMH has implemented several strategies to address this slowdown, including focusing on digital engagement with Chinese consumers, diversifying its product offerings to cater to evolving tastes, and potentially investing more heavily in its local Chinese operations. However, the effectiveness of these strategies remains to be seen.

- Competitive Landscape: Competitor brands, particularly those with a stronger focus on the domestic Chinese market or those catering to changing consumer preferences, may be benefiting from LVMH's relative slowdown in China.

Understanding the dynamics of the Chinese luxury market is critical to analyzing LVMH’s overall performance. The reliance on this key market makes LVMH particularly vulnerable to shifts in Chinese consumer behavior and economic conditions.

Macroeconomic Headwinds and Their Influence on Luxury Goods Sales

Beyond China, broader macroeconomic factors have significantly influenced luxury goods sales globally. Inflation, rising interest rates, and recessionary fears all contribute to a challenging environment for luxury brands like LVMH.

- Impact on Consumer Purchasing: Inflation erodes purchasing power, making luxury goods less accessible to consumers. Rising interest rates increase borrowing costs, potentially discouraging high-value purchases. Recessionary fears further dampen consumer confidence and reduce spending on discretionary items like luxury goods.

- Competitive Comparison: While LVMH isn't alone in facing these challenges, comparing its performance to other luxury brands reveals how effectively it's navigating this complex macroeconomic environment. Some competitors may have demonstrated greater resilience or more effective mitigation strategies.

- Mitigation Strategies: LVMH has likely employed various strategies to offset these macroeconomic effects, including optimizing pricing, streamlining operations, and focusing on cost efficiency. The effectiveness of these strategies will influence future financial performance.

Market Reaction and Investor Sentiment Following the Q1 Report

The market's immediate reaction to LVMH's Q1 sales report was a significant decline in its share price. This underscores the impact of the disappointing results on investor confidence and reveals a level of market volatility.

- Share Price Drop: The 2% drop in LVMH's share price is a tangible indicator of investor concern and highlights the market's sensitivity to even slight underperformance by a leading luxury goods company.

- Analyst Reactions: Analysts reacted to the news by revising their forecasts for LVMH's future performance, reflecting a degree of uncertainty about the company's ability to quickly recover. Some downgraded their outlook, reflecting cautious predictions.

- Comparison to Competitors: A comparison of LVMH's stock performance with other luxury goods companies provides further insight into the market's overall sentiment and helps to determine whether the decline is specific to LVMH or a broader trend in the luxury sector.

Conclusion: Analyzing the 2% LVMH Share Drop and What it Means for the Future

The 2% LVMH share drop following the release of its Q1 sales figures reflects a confluence of factors. Slowing Chinese demand, macroeconomic headwinds, and the overall market reaction all contributed to this significant decline. While LVMH remains a dominant player in the luxury goods market, these challenges highlight the need for adaptive strategies to navigate a complex and increasingly volatile global economic landscape. The long-term implications remain uncertain, but the company's response to these challenges will shape its future performance and investor confidence. To stay informed about LVMH's performance and the future of the luxury goods market, regularly follow reputable financial news sources, monitor the LVMH share price, and understand the ongoing impact of factors influencing LVMH's Q1 sales and beyond.

Featured Posts

-

Green Spaces And Mental Wellbeing A Seattle Pandemic Perspective

May 24, 2025

Green Spaces And Mental Wellbeing A Seattle Pandemic Perspective

May 24, 2025 -

Dax Surge Will A Wall Street Rebound Dampen Celebrations

May 24, 2025

Dax Surge Will A Wall Street Rebound Dampen Celebrations

May 24, 2025 -

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025 -

Gucci Supply Chain Shakeup Massimo Vians Departure

May 24, 2025

Gucci Supply Chain Shakeup Massimo Vians Departure

May 24, 2025 -

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

Ai

May 24, 2025

Ai

May 24, 2025 -

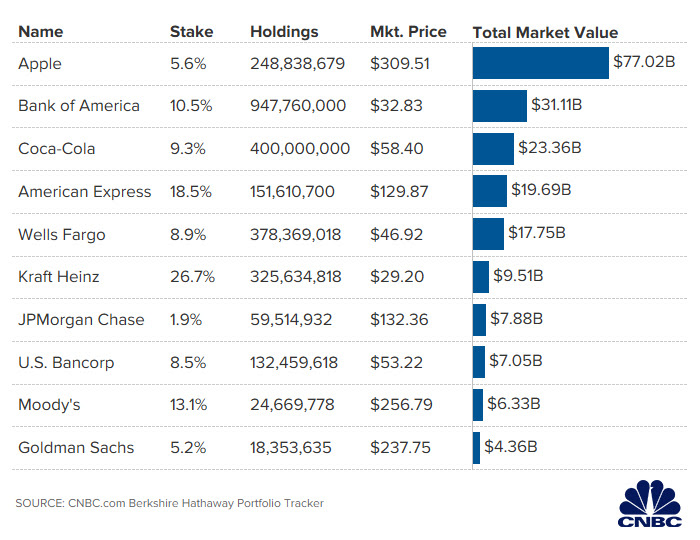

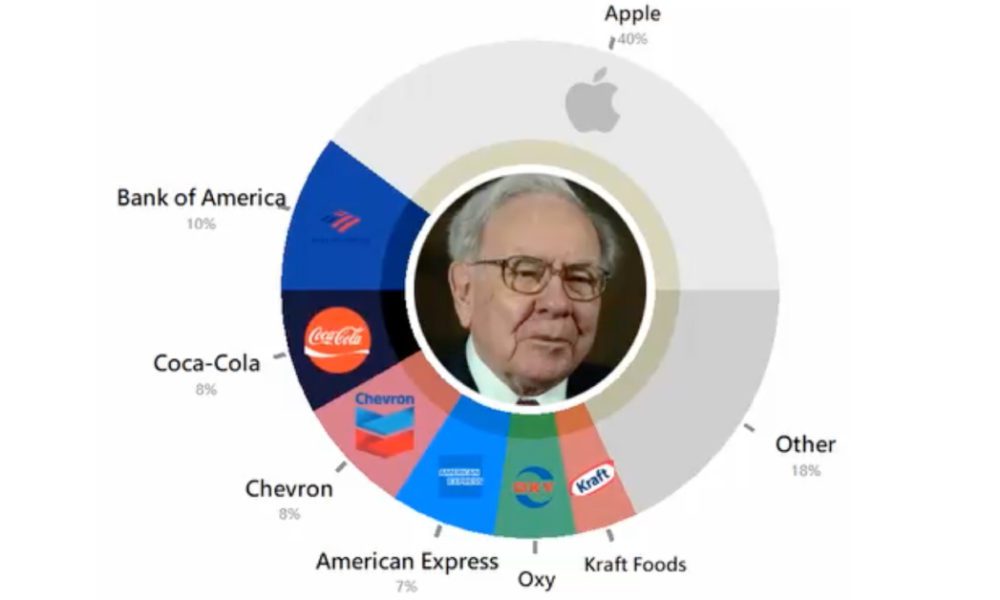

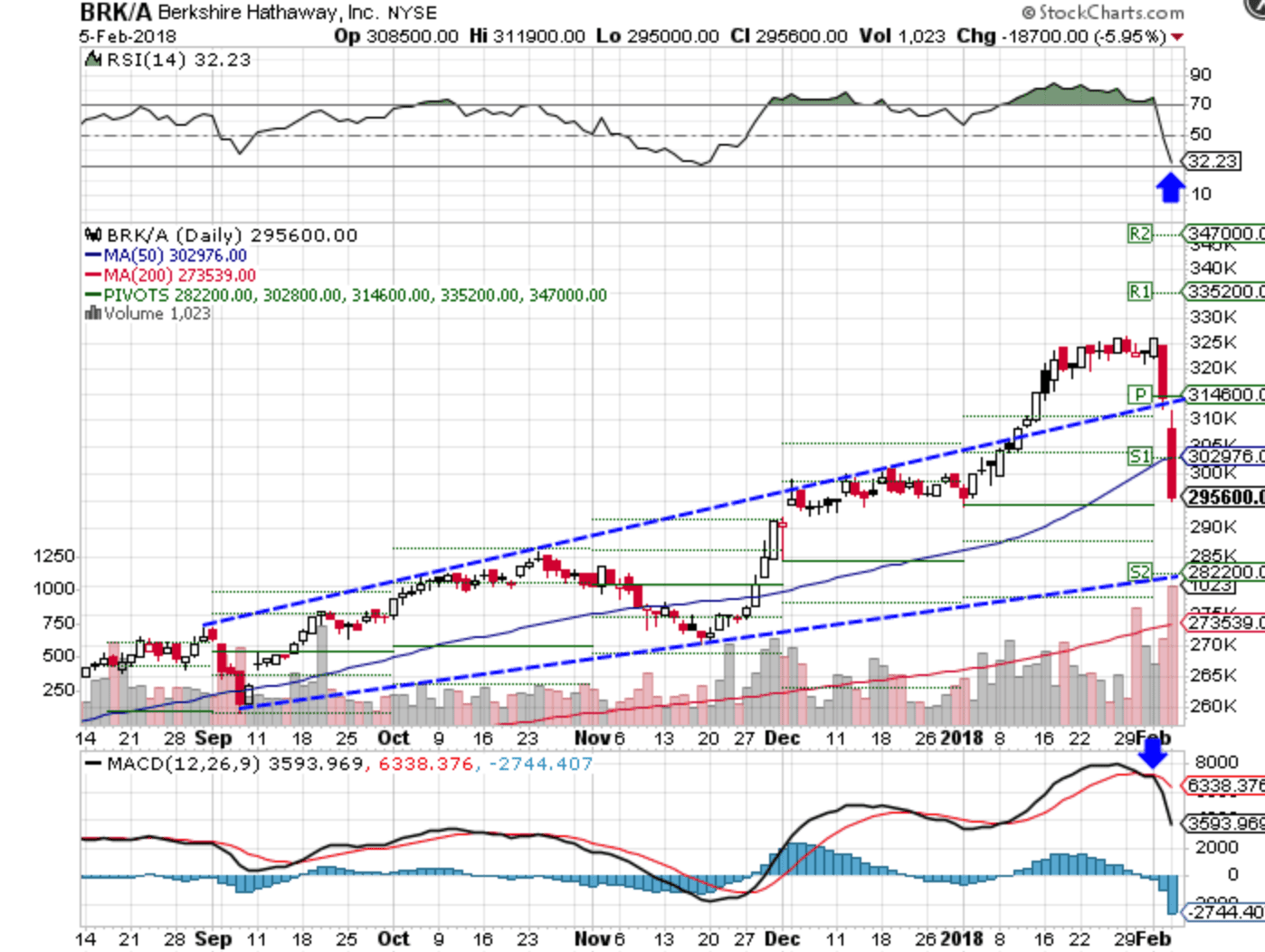

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025