XRP On The Verge Of A Breakthrough: Examining ETF Potential, SEC Actions, And Future Outlook

Table of Contents

The Potential of XRP ETFs

The potential approval of XRP Exchange-Traded Funds (ETFs) could be a game-changer for the cryptocurrency. ETFs offer a regulated and accessible way for investors to gain exposure to XRP, potentially unlocking significant growth.

Increased Liquidity and Accessibility

XRP ETFs could dramatically increase liquidity and accessibility for investors, potentially boosting demand.

- Easier investment for retail investors: Investing in XRP currently requires navigating cryptocurrency exchanges, a process that can be complex and intimidating for many retail investors. ETFs offer a far simpler route, allowing access through standard brokerage accounts.

- Increased trading volume and price stability: Institutional investors, who often prefer the regulated environment of ETFs, would likely increase their XRP holdings, leading to higher trading volume and potentially greater price stability.

- Potential for significant price appreciation: The increased demand driven by ETF listings could lead to a significant price appreciation of XRP, benefiting both existing holders and new investors.

Regulatory Hurdles and Approvals

The SEC's stance on crypto ETFs remains a significant hurdle. Approval would signal a major shift in the regulatory landscape for XRP and other cryptocurrencies.

- Analysis of current SEC actions: The SEC's recent actions regarding other cryptocurrencies provide clues about their potential approach to XRP ETF applications. A thorough understanding of these actions is crucial to predicting the likelihood of XRP ETF approval.

- Comparison to other cryptocurrencies: Comparing XRP's regulatory situation to that of other cryptocurrencies seeking ETF approval reveals similarities and differences that might influence the SEC's decision-making process. This comparative analysis can inform predictions about the approval timeline.

- Potential timelines and market impact: Speculating on potential timelines for ETF approvals requires considering various factors, including the SEC's review process, market conditions, and the overall regulatory climate. The speed of approval will significantly impact XRP's market price and investor sentiment.

The Ongoing SEC vs. Ripple Lawsuit and its Implications

The SEC's lawsuit against Ripple Labs, the company behind XRP, has cast a long shadow over the cryptocurrency's trajectory. The outcome of this legal battle will have profound implications for XRP's future.

Recent Developments and Legal Arguments

A detailed understanding of the ongoing SEC lawsuit is crucial for assessing XRP's future. This includes analyzing recent court rulings and the legal arguments presented by both sides.

- Key legal arguments: Both the SEC and Ripple have presented compelling arguments. Analyzing these arguments – focusing on the SEC's claims of unregistered securities offerings and Ripple's defense – is vital to predicting the likely outcome.

- Potential outcomes and their impact: Several outcomes are possible, ranging from a complete SEC victory to a dismissal of the charges. Each outcome will significantly impact XRP's price, regulatory standing, and overall market perception.

- Potential for settlement and consequences: The possibility of a settlement between the SEC and Ripple cannot be discounted. The terms of any settlement would profoundly impact XRP's future and its price.

Impact on XRP Price and Market Sentiment

The lawsuit's progression directly affects investor confidence and XRP's price volatility.

- Historical price movements: Examining XRP's historical price movements in relation to significant legal developments reveals correlations that can be used to predict future price reactions.

- Influence of media coverage: Media coverage plays a significant role in shaping public perception and investor sentiment. Understanding how media narratives impact XRP's price is crucial for informed decision-making.

- Predictive modeling: While not foolproof, predictive modeling based on various lawsuit outcomes can offer valuable insights into potential price fluctuations.

The Future Outlook for XRP: Price Predictions and Technological Advancements

Looking ahead, XRP's future hinges on its adoption, utility, and technological advancements.

Adoption and Utility

XRP's potential use cases extend beyond its initial purpose as a bridge currency.

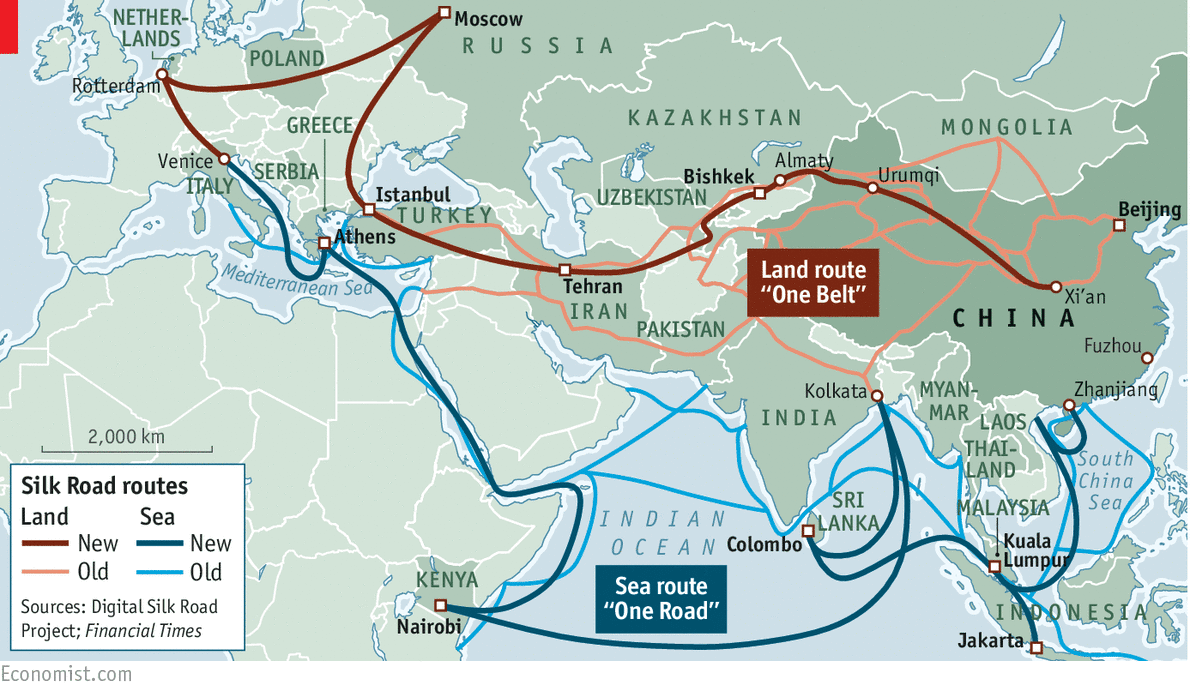

- Cross-border payments: XRP's speed and low transaction fees make it attractive for cross-border payments, potentially increasing its adoption by financial institutions.

- Technological advancements: Future technological advancements could enhance XRP's functionality and value proposition, potentially expanding its use cases.

- Comparative analysis: Comparing XRP's utility and capabilities against other cryptocurrencies provides valuable insights into its competitive landscape and potential for future growth.

Long-Term Price Projections

Offering long-term price projections for XRP is inherently speculative, but considering various scenarios is essential.

- Price prediction models: Different price prediction models exist, each relying on different assumptions and methodologies. Understanding these models and their limitations is important.

- Influencing factors: A wide range of factors can influence XRP's price, including regulatory developments, market sentiment, technological advancements, and competition from other cryptocurrencies.

- Risk disclaimer: Investing in cryptocurrencies carries significant risk. Any price predictions should be treated with caution, and investors should only invest what they can afford to lose.

Conclusion

The future of XRP remains inextricably linked to the outcomes of the SEC lawsuit and the potential for ETF approval. While significant uncertainties exist, the possibility of a breakthrough is undeniable. The potential increase in liquidity through ETFs, combined with a positive resolution to the legal battle, could propel XRP to new heights. However, investors should always conduct thorough research and understand the inherent risks involved before investing in any cryptocurrency, including XRP. Stay informed on the latest developments surrounding XRP and its potential to revolutionize the finance world. Continue your research on XRP and make informed decisions about your investment strategy.

Featured Posts

-

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025 -

Oklahoma City Thunder Vs Indiana Pacers Injury Report March 29

May 08, 2025

Oklahoma City Thunder Vs Indiana Pacers Injury Report March 29

May 08, 2025 -

Xrps Stalled Recovery A Look At The Derivatives Market

May 08, 2025

Xrps Stalled Recovery A Look At The Derivatives Market

May 08, 2025 -

1 050 Price Increase At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025

1 050 Price Increase At And T Sounds Alarm On Broadcoms V Mware Deal

May 08, 2025 -

Xrp Regulatory Status Analyzing The Secs Stance

May 08, 2025

Xrp Regulatory Status Analyzing The Secs Stance

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025