XRP Regulatory Status: Analyzing The SEC's Stance

Table of Contents

The SEC's Case Against Ripple

The SEC's lawsuit against Ripple alleges that Ripple conducted an unregistered securities offering of XRP. The core of the SEC's argument rests on the assertion that XRP sales constituted the offering and sale of investment contracts, violating federal securities laws. The SEC applies the Howey Test, a four-pronged legal framework used to determine whether an investment is a security. The SEC contends that Ripple's various sales methods, including programmatic sales, institutional sales, and direct sales to retail investors, all contributed to the creation of an investment contract.

- Summary of the SEC's complaint against Ripple: The SEC argues that Ripple sold billions of XRP without registering them as securities, defrauding investors.

- Explanation of the Howey Test and its relevance to the case: The Howey Test examines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC claims XRP satisfies all four prongs.

- Key arguments presented by the SEC regarding XRP's classification: The SEC emphasizes Ripple's control over XRP distribution, marketing materials promoting profit potential, and the expectation of price appreciation based on Ripple’s efforts.

- Ripple's counterarguments and defense strategy: Ripple argues that XRP is a decentralized, utility token used for payments and not an investment contract. They point to the wide distribution and independent trading of XRP.

Key Arguments in the Ripple vs. SEC Case

The heart of the Ripple vs. SEC case lies in the interpretation of the Howey Test. Both sides present compelling arguments regarding each prong. The SEC focuses on Ripple's various sales channels, claiming that the expectation of profit from Ripple's efforts is inherent across all sales methods. Ripple counters by arguing that programmatic sales, in particular, lack the necessary elements for an investment contract, and that sales to institutional investors are not dependent on Ripple’s efforts.

- Detailed breakdown of the four prongs of the Howey Test: Each prong – investment of money, common enterprise, reasonable expectation of profits, and efforts of others – is fiercely debated.

- Analysis of Ripple's various sales channels and their relevance to the SEC's claims: The SEC scrutinizes different sales channels—programmatic sales, institutional sales, and retail sales—to demonstrate a consistent pattern of unregistered securities offerings. Ripple highlights differences between these sales models to demonstrate that not all qualify as securities offerings.

- Examination of expert testimony and legal precedents cited by both parties: Both sides present extensive expert testimony and legal precedent to support their interpretations of the Howey Test.

- Discussion of the potential impact of programmatic sales versus institutional or retail sales: The SEC's case hinges on how the different types of XRP sales impacted investors’ expectations of profit and their reliance on Ripple’s efforts.

The Implications for XRP Investors

The ongoing legal uncertainty surrounding XRP presents significant risks for investors. The outcome of the case could drastically impact XRP's price and market adoption. A ruling in favor of the SEC could lead to a significant decline in XRP's value and potential legal repercussions for past investors. Conversely, a ruling in Ripple's favor would likely boost XRP's price and increase confidence in the project.

- Potential scenarios following the court's decision: The court could rule in favor of the SEC, deeming XRP a security, or in favor of Ripple, providing regulatory clarity. A partial ruling affecting certain sales methods is also possible.

- The impact of regulatory clarity (or lack thereof) on XRP's value: Regulatory clarity will be crucial for determining future investor sentiment and XRP's market position.

- Risks associated with investing in cryptocurrencies facing regulatory scrutiny: Investing in cryptocurrencies under regulatory investigation involves high risk, including potential losses and legal complexities.

- Advice for investors considering exposure to XRP: Investors should carefully consider the risks involved, diversify their portfolio, and stay informed about the case's developments.

The Broader Impact on the Cryptocurrency Market

The Ripple case carries significant implications for the broader cryptocurrency market. The outcome will set a critical precedent for how the SEC classifies digital assets and potentially influence regulation of other cryptocurrencies. A ruling against Ripple could lead to increased scrutiny of other projects and further regulatory actions. Conversely, a favorable ruling for Ripple could provide some regulatory clarity and potentially boost investor confidence in the space.

- Potential ripple effects (pun intended) on other crypto projects: The SEC's approach to XRP could inform its stance on other cryptocurrencies, particularly those with similar sales and distribution mechanisms.

- How the outcome could influence future SEC enforcement actions: The decision could significantly influence how the SEC regulates the broader crypto market and impact future enforcement actions.

- The long-term impact on investor confidence and market stability: Regulatory uncertainty can negatively affect investor confidence and market stability. A clear ruling, regardless of the outcome, could help restore some stability.

- The potential for a clearer regulatory landscape for cryptocurrencies in the US: The case could pave the way for a more defined regulatory framework for digital assets in the US, even if that framework is initially unfavorable to many crypto projects.

Conclusion

This article has explored the complexities of the XRP regulatory status, focusing on the SEC's stance and the ongoing legal battle with Ripple. The outcome of this case will have significant implications for XRP investors and the broader cryptocurrency market, potentially shaping the future of digital asset regulation. The legal arguments and interpretations of the Howey Test are critical to understanding the potential ramifications.

Call to Action: Stay informed about the evolving XRP regulatory landscape. Continue to research and understand the legal arguments and implications of the SEC's stance on XRP before making any investment decisions. Understanding the intricacies of XRP regulatory status is paramount for navigating this dynamic and potentially risky market.

Featured Posts

-

Consumer Protection Agency Sues Lidl For Alleged Plus App Issues

May 08, 2025

Consumer Protection Agency Sues Lidl For Alleged Plus App Issues

May 08, 2025 -

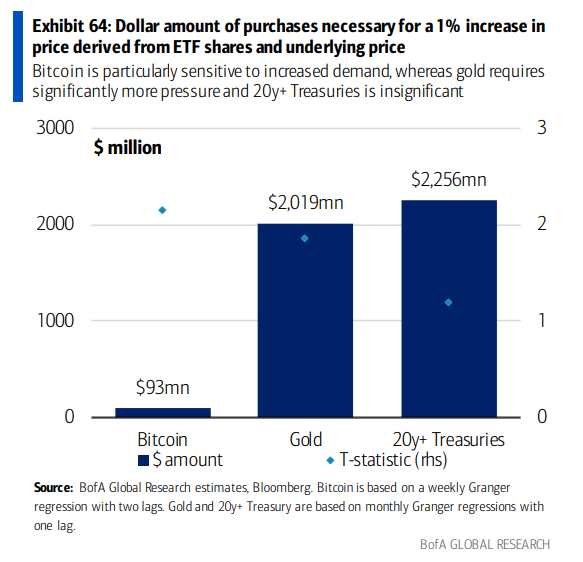

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025 -

Enhanced Gaming Analyzing Sonys Ps 5 Pro Upgrade

May 08, 2025

Enhanced Gaming Analyzing Sonys Ps 5 Pro Upgrade

May 08, 2025 -

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025 -

Fetterman Responds To Questions About His Health Following Ny Magazine Article

May 08, 2025

Fetterman Responds To Questions About His Health Following Ny Magazine Article

May 08, 2025

Latest Posts

-

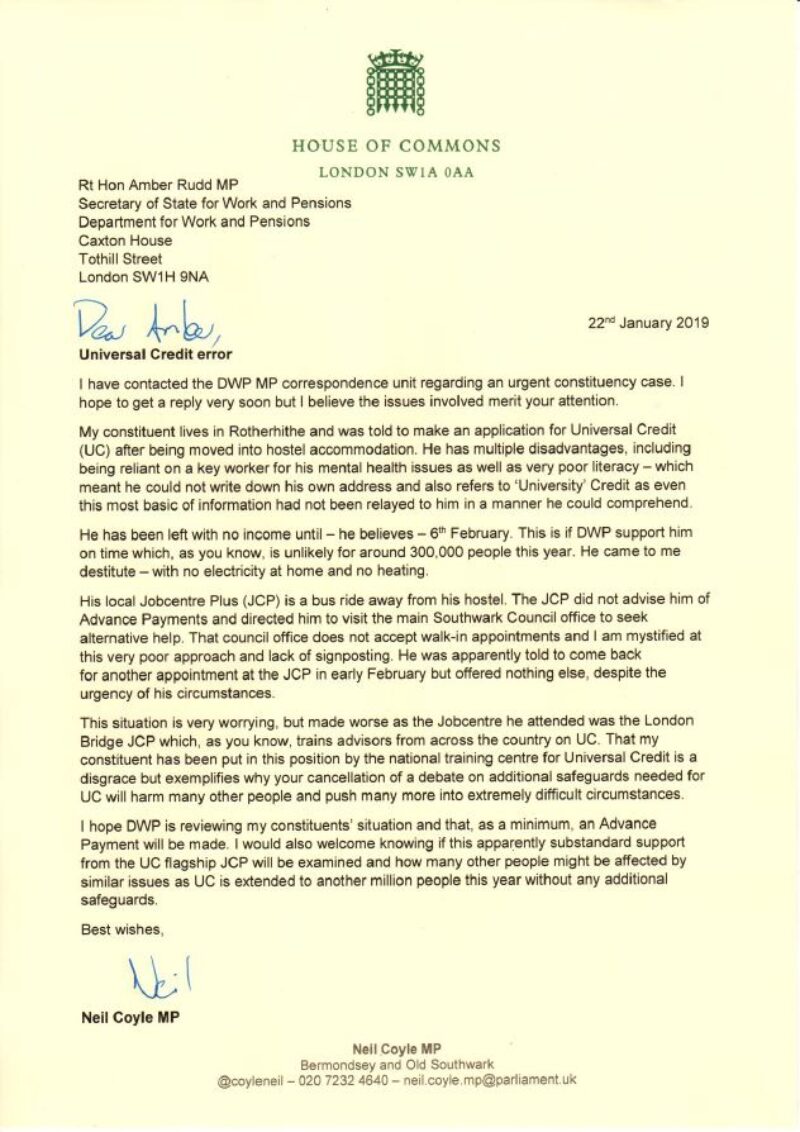

Universal Credit Refund Dwp To Pay Back 5 Billion In April And May

May 08, 2025

Universal Credit Refund Dwp To Pay Back 5 Billion In April And May

May 08, 2025 -

Dwp Announces 3 Month Warning Before Benefit Cuts For 355 000 Claimants

May 08, 2025

Dwp Announces 3 Month Warning Before Benefit Cuts For 355 000 Claimants

May 08, 2025 -

Important Dwp Message Action Needed For 12 Benefit Payments

May 08, 2025

Important Dwp Message Action Needed For 12 Benefit Payments

May 08, 2025 -

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

3 Month Warning 355 000 People Affected By Dwp Benefit Changes

May 08, 2025

3 Month Warning 355 000 People Affected By Dwp Benefit Changes

May 08, 2025