XRP On The Brink Of A Record High: The Role Of The Grayscale ETF

Table of Contents

The Potential Impact of a Grayscale ETF on the Crypto Market

The approval of a Bitcoin ETF, particularly one from a reputable firm like Grayscale, would dramatically reshape the cryptocurrency landscape. It signifies a significant step towards mainstream acceptance and increased institutional involvement. This has several key implications:

- Increased institutional investment in crypto: ETFs provide a regulated and accessible entry point for institutional investors, including hedge funds and pension funds, who have previously hesitated due to regulatory uncertainty and operational complexities. This influx of capital could dramatically increase market liquidity.

- Greater regulatory clarity and acceptance: The approval process itself implies a degree of regulatory oversight and acceptance of cryptocurrencies by financial authorities, reducing uncertainty and boosting investor confidence.

- Increased price volatility in the short term, followed by potential stabilization: An initial surge in price is highly probable, followed by a period of adjustment as the market absorbs the influx of new capital. Long-term, however, increased liquidity often leads to greater price stability.

- Attraction of new investors to the market due to easier access: ETFs simplify cryptocurrency investment, making it more accessible to retail investors who might otherwise be intimidated by the complexities of direct crypto exchanges.

These generalized effects could significantly benefit XRP. Increased market liquidity and investor confidence could translate to higher trading volumes and potentially propel XRP's price upwards.

XRP's Current Market Position and Future Outlook

XRP has experienced a rollercoaster ride in recent years, significantly impacted by ongoing legal battles with the SEC. Despite this, its market capitalization remains substantial, demonstrating resilience within the crypto market.

- Recent partnerships or developments impacting XRP: The ongoing development of Ripple's technology and its adoption by various financial institutions could provide a strong foundation for future growth. Strategic partnerships and collaborations continue to enhance the utility and adoption of XRP.

- Ongoing legal battles and their potential influence on price: The outcome of the SEC lawsuit against Ripple will undoubtedly significantly impact XRP's price. A positive resolution could lead to a dramatic price surge.

- Overall sentiment of the XRP community and its effect on price: The XRP community remains actively engaged, showcasing unwavering support for the project. A positive outlook and belief in XRP's long-term potential contribute to price resilience and potential growth.

The convergence of these factors, particularly a positive resolution to the legal battles coupled with increased market confidence driven by a Grayscale ETF, could propel XRP to a new all-time high.

The Ripple Effect: How a Grayscale Bitcoin ETF Could Influence XRP

While Bitcoin and XRP aren't perfectly correlated, a Grayscale Bitcoin ETF approval could indirectly influence XRP's price through several mechanisms:

- Potential spillover effects from a Bitcoin ETF approval onto altcoins like XRP: The positive sentiment generated by a successful Bitcoin ETF could spill over into the broader altcoin market, boosting investor interest in assets like XRP.

- Analyze the sentiment shift within the broader crypto market: A successful Bitcoin ETF would likely signal a significant shift in the overall market sentiment towards cryptocurrencies, benefitting not just Bitcoin but many other digital assets.

- Potential for increased trading volume in XRP: The increased liquidity and investor activity spurred by a Bitcoin ETF could lead to heightened trading volume in XRP, further boosting its price.

A Grayscale Bitcoin ETF, therefore, could act as a catalyst for increased interest and investment in XRP, indirectly but significantly influencing its price trajectory.

Understanding the Regulatory Landscape and its Impact on XRP

The regulatory landscape surrounding cryptocurrencies remains complex and ever-evolving. This uncertainty, particularly regarding XRP and its ongoing legal challenges, significantly impacts its price volatility.

- Detail the SEC's stance on XRP and its potential implications: The SEC's view on XRP is crucial. A favourable ruling could unlock significant price appreciation, while an unfavorable outcome could lead to further price drops.

- Explain how a positive regulatory outcome could boost XRP's price: Regulatory clarity and a positive ruling could dramatically increase investor confidence, leading to substantial price increases.

- Discuss the uncertainty surrounding regulations and its potential impact on price volatility: The ongoing uncertainty surrounding regulations contributes to price volatility, making XRP a relatively high-risk investment.

Conclusion

A Grayscale Bitcoin ETF approval could have a profound, albeit indirect, positive impact on XRP's price. Increased institutional investment, improved market sentiment, and potential spillover effects from Bitcoin's success could all contribute to XRP reaching a new all-time high. However, the regulatory landscape remains a critical factor, and the outcome of the SEC lawsuit significantly impacts XRP's future. Stay informed about the progress of the Grayscale ETF application and the ongoing legal cases surrounding XRP. Understand the risks and rewards before investing in XRP. Begin your research on XRP and the potential impact of the Grayscale ETF today!

Featured Posts

-

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025 -

Can The Thunder Overcome Memphis Key Matchup Analysis

May 08, 2025

Can The Thunder Overcome Memphis Key Matchup Analysis

May 08, 2025 -

Economic Overhaul Needed The Impact Of The Taiwan Dollars Surge

May 08, 2025

Economic Overhaul Needed The Impact Of The Taiwan Dollars Surge

May 08, 2025 -

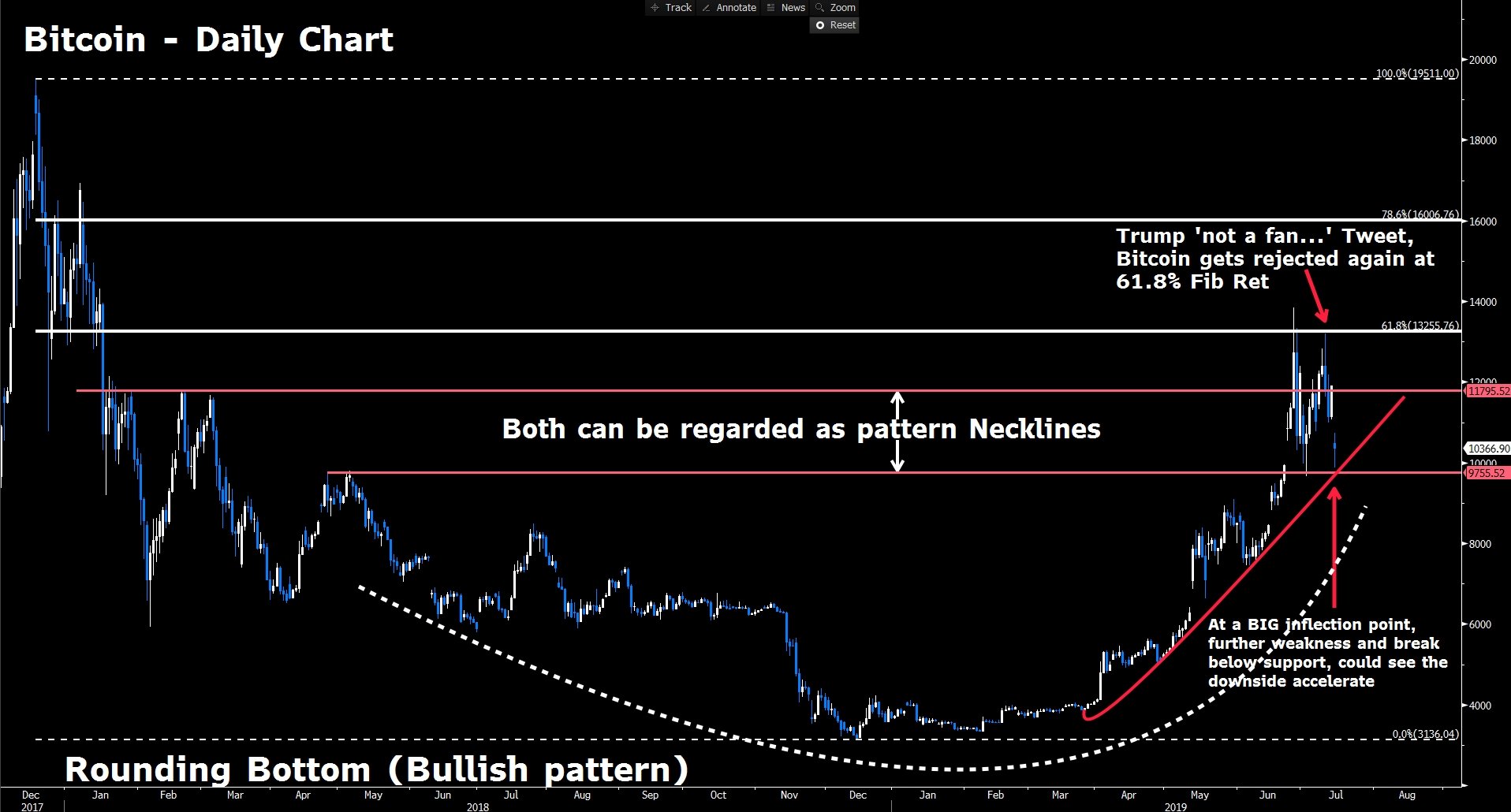

Bitcoin Price Analysis Is This A Critical Juncture

May 08, 2025

Bitcoin Price Analysis Is This A Critical Juncture

May 08, 2025 -

Xrp Price Prediction Analyzing The Impact Of The Grayscale Etf Application

May 08, 2025

Xrp Price Prediction Analyzing The Impact Of The Grayscale Etf Application

May 08, 2025

Latest Posts

-

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025 -

Will Jayson Tatum Suit Up Tonight Celtics Vs Nets Injury Report Analysis

May 08, 2025

Will Jayson Tatum Suit Up Tonight Celtics Vs Nets Injury Report Analysis

May 08, 2025 -

Celtics Injury Report Jayson Tatums Availability For Tonights Game Vs Nets

May 08, 2025

Celtics Injury Report Jayson Tatums Availability For Tonights Game Vs Nets

May 08, 2025 -

Abc Game Promo Tnt Announcers Funny Take On Jayson Tatum

May 08, 2025

Abc Game Promo Tnt Announcers Funny Take On Jayson Tatum

May 08, 2025