Economic Overhaul Needed? The Impact Of The Taiwan Dollar's Surge

Table of Contents

The Positive Impacts of a Strong Taiwan Dollar

A stronger Taiwan dollar presents several advantages for the Taiwanese economy. Its impact is felt most directly through increased purchasing power and a boost in foreign investment.

Increased Purchasing Power

A stronger NTD translates to increased purchasing power for Taiwanese consumers. This is because imported goods become cheaper, leading to several positive effects:

- Lower Import Prices: Consumers benefit directly from lower prices on a wide range of goods, from electronics and apparel to food and fuel. This can significantly improve their standard of living.

- Increased Affordability of Foreign Goods and Services: Travel abroad, international education, and the purchase of foreign-branded products become more affordable, stimulating spending in these sectors.

- Positive Effect on Consumer Confidence: Increased affordability and a perception of economic stability can lead to higher consumer confidence, potentially boosting domestic spending and driving economic growth.

The appreciation of the NTD, therefore, acts as a silent but effective stimulus for consumer spending, improving overall economic sentiment.

Boost to Foreign Investment

A strong NTD makes investments in Taiwan more attractive to foreign investors. This leads to several benefits:

- Increased Foreign Direct Investment (FDI): A stronger currency reduces the cost of investment for foreign companies, making Taiwan a more appealing destination for FDI.

- Job Creation and Technological Advancements: Increased FDI often translates into job creation, particularly in high-tech sectors, leading to technological advancements and innovation within the Taiwanese economy.

- Economic Growth: The influx of capital and expertise associated with increased FDI contributes directly to overall economic growth and development. The NTD's strength acts as a magnet, pulling in much-needed capital for expansion and innovation.

The Negative Impacts of a Strong Taiwan Dollar

While a strong NTD offers several benefits, it also presents significant challenges, particularly for export-oriented industries and businesses with foreign currency debt.

Impact on Export Competitiveness

A stronger NTD makes Taiwanese exports more expensive in international markets, impacting export-oriented industries significantly.

- Reduced Export Competitiveness: The increased cost of Taiwanese goods reduces their competitiveness against rivals from countries with weaker currencies.

- Decreased Export Volumes and Revenue: As goods become more expensive, demand falls, leading to decreased export volumes and revenue for Taiwanese businesses. This can negatively impact overall economic growth. The NTD's strength, therefore, presents a significant threat to export-dependent industries.

Inflationary Pressures

Although a stronger currency initially combats inflation by lowering import prices, global inflationary pressures can offset these benefits.

- Imported Inflation: If global prices for imported goods rise, the strength of the NTD may not fully mitigate the inflationary impact, leading to imported inflation.

- Sustained Strong NTD and Price Levels: While a strong NTD can reduce the overall price level, the effect may be limited if global inflation remains high. The net impact on inflation, therefore, is complex and depends on various global and domestic factors.

Impact on Taiwanese Businesses

The surge of the NTD impacts Taiwanese businesses in various ways, creating challenges for profitability and financial stability.

- Increased Repayment Burdens: Companies with significant foreign currency-denominated debt find their repayment burdens increase as the NTD strengthens.

- Decreased Profitability: Businesses relying heavily on exports may experience decreased profitability due to reduced export volumes and revenue. This creates a challenging environment for businesses to navigate. NTD fluctuation poses a significant currency risk for many businesses.

Potential Economic Overhaul Strategies

Addressing the challenges posed by the strong NTD requires a multi-pronged approach involving economic diversification and adjustments to fiscal and monetary policies.

Diversifying the Economy

Reducing the over-reliance on export-oriented industries is crucial for long-term economic stability.

- Fostering Domestic Demand: Government initiatives to stimulate domestic consumption can lessen the dependence on exports.

- Developing New Sectors: Investment in innovative sectors, like renewable energy or high-tech services, can create new growth opportunities and reduce the vulnerability to currency fluctuations.

- Investing in Research and Development (R&D): Increased investment in R&D can enhance technological competitiveness, allowing Taiwanese businesses to produce higher-value-added goods and services less susceptible to price competition based on exchange rates.

Fiscal and Monetary Policy Adjustments

Strategic government intervention can help manage the impact of the strong NTD.

- Central Bank Interventions: The central bank can intervene in the foreign exchange market to manage exchange rate volatility and prevent excessive appreciation of the NTD.

- Government Policies: Targeted government policies can support export-oriented businesses facing difficulties and promote domestic consumption. This requires a careful balancing act to mitigate both the positive and negative impacts of the NTD's rise.

Conclusion

The surge of the Taiwan dollar presents both opportunities and challenges for the Taiwanese economy. While a strong NTD offers benefits like increased purchasing power and attracts foreign investment, it also poses risks to export competitiveness and may contribute to inflationary pressures. To mitigate potential negative impacts and capitalize on the positive aspects, a strategic economic overhaul is crucial. This might involve diversifying the economy, implementing appropriate fiscal and monetary policies, and proactively addressing the specific challenges faced by Taiwanese businesses in this new environment. Understanding the complex implications of the Taiwan dollar's surge is vital for navigating the future economic landscape and ensuring sustainable growth. Therefore, continued monitoring of the Taiwan dollar and its impact is essential for informed decision-making. Proactive strategies are needed to ensure the continued health and prosperity of the Taiwanese economy.

Featured Posts

-

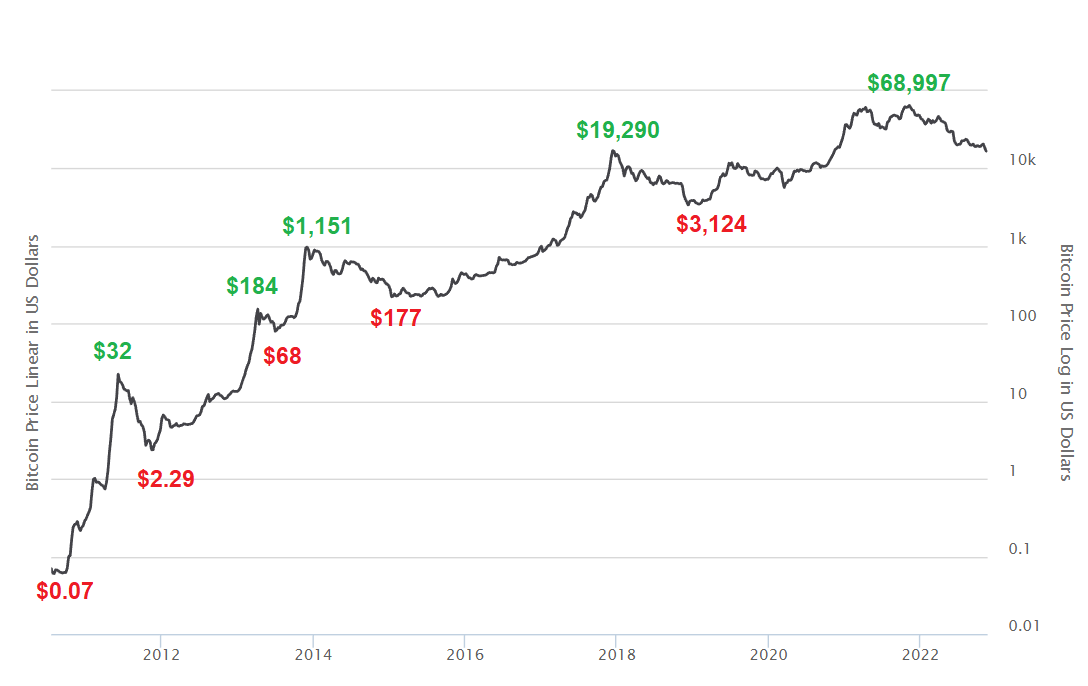

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025 -

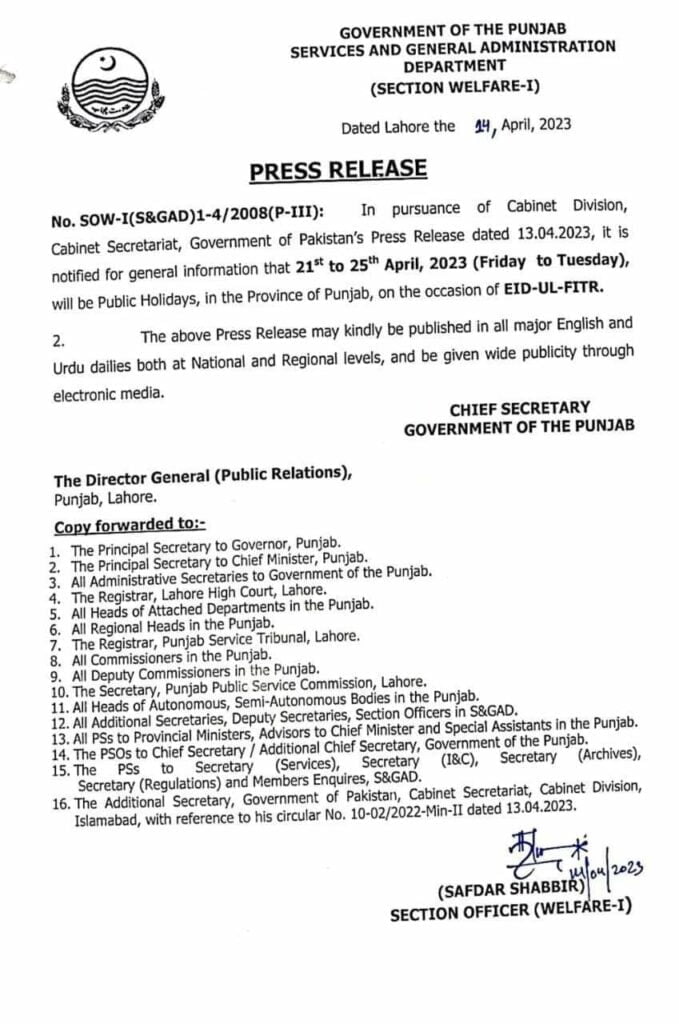

Lahore And Punjab Weather Eid Ul Fitr Outlook For The Next 48 Hours

May 08, 2025

Lahore And Punjab Weather Eid Ul Fitr Outlook For The Next 48 Hours

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025 -

Angels Farm System Mlb Insiders Deliver Harsh Assessment

May 08, 2025

Angels Farm System Mlb Insiders Deliver Harsh Assessment

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Latest Posts

-

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025 -

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Duyurulari Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Duyurulari Ve Basvuru Sartlari

May 08, 2025 -

Aj Aym Aym Ealm Ky 12wyn Brsy Mnayy Jaye Gy Qwmy Sth Pr Yadgar Tqaryb

May 08, 2025

Aj Aym Aym Ealm Ky 12wyn Brsy Mnayy Jaye Gy Qwmy Sth Pr Yadgar Tqaryb

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt 12wyn Brsy Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt 12wyn Brsy Ky Tqrybat

May 08, 2025