Bitcoin Price Analysis: Is This A Critical Juncture?

Table of Contents

Recent Market Trends and Technical Indicators

Short-Term Price Fluctuations

Bitcoin experienced a sharp dip below $25,000 on [Date], followed by a recovery towards $27,000 on [Date]. This volatility highlights the inherent risk associated with Bitcoin investment.

- Support and Resistance Levels: The $25,000 level acted as significant support, while resistance seems to be forming around $28,000. A breach of either level could indicate a stronger directional trend.

- Trading Volume: Trading volume increased significantly during these price swings, suggesting heightened market activity and potential for further movement.

- Significant News Events: The recent [mention specific news event, e.g., regulatory announcement or macroeconomic factor] likely contributed to the price fluctuation, impacting investor sentiment. Analyzing the Bitcoin price chart meticulously is crucial in understanding these shifts. This technical analysis Bitcoin approach helps us isolate key drivers of short-term price behavior.

Long-Term Bitcoin Price Trends

Examining the Bitcoin price history reveals a pattern of cyclical bull and bear markets. The current price action bears some resemblance to previous periods before significant price increases, but also shows similarities to periods preceding corrections.

- Key Milestones: Bitcoin's journey from its inception to its current price shows periods of explosive growth followed by substantial corrections. Comparing the current market sentiment and technical indicators to previous bull and bear market cycles can provide valuable insights.

- Comparing to Past Cycles: While historical performance doesn't guarantee future results, studying past cycles can help identify potential patterns and assess the likelihood of a continuation of the current trend. A deep dive into Bitcoin price history is essential for understanding long-term price trends and informing our Bitcoin price prediction 2024 and beyond.

Key Technical Indicators

Several technical indicators provide signals about the potential direction of the Bitcoin price.

- Bitcoin RSI: The Relative Strength Index (RSI) is currently [mention RSI value] suggesting [overbought/oversold/neutral].

- Bitcoin MACD: The Moving Average Convergence Divergence (MACD) is [mention MACD signal] indicating [bullish/bearish/neutral].

- Moving Average Bitcoin: The 50-day and 200-day moving averages are [mention current relationship between moving averages - e.g., crossing, diverging]. This suggests [mention interpretation]. Analyzing these Bitcoin RSI, MACD and moving average indicators together provides a clearer picture.

Fundamental Factors Influencing Bitcoin Price

Regulatory Landscape

The regulatory landscape surrounding Bitcoin significantly impacts its price and adoption. Increased regulatory clarity in some jurisdictions could boost investor confidence, while stricter regulations elsewhere may hinder growth.

- Specific Regulatory Developments: [Mention specific examples of recent regulatory actions in different countries, focusing on their potential effects on Bitcoin.] Understanding the implications of Bitcoin regulation is crucial.

Adoption and Institutional Investment

Growing institutional investment and broader adoption are key drivers of Bitcoin's price. Increased acceptance by large corporations and financial institutions adds legitimacy and stability to the market.

- Recent Investments: [Mention recent examples of significant institutional investments in Bitcoin.] The continued interest from Bitcoin whales and institutional investors is a positive signal for long-term growth. The potential launch of a Bitcoin ETF could further accelerate adoption.

Macroeconomic Factors

Broader macroeconomic conditions significantly influence Bitcoin's price. Inflation, interest rate hikes, and economic uncertainty can affect investor risk appetite and Bitcoin's performance.

- Connection to Economic Factors: [Explain how specific macroeconomic trends, such as inflation or recessionary fears, might correlate with Bitcoin's price.] Bitcoin is often viewed as an inflation hedge, which can affect its price during periods of high inflation. Understanding the interplay between Bitcoin and the economy is essential for informed decision-making. The Bitcoin market cap reflects the overall valuation and can be a key indicator of market sentiment.

Potential Scenarios and Predictions

Bullish Case

A bullish scenario could see Bitcoin's price surge significantly.

- Factors Contributing: Factors like increased institutional adoption, regulatory clarity, and a positive macroeconomic environment could fuel a Bitcoin bull run. This could lead to a Bitcoin price target exceeding $XXX,XXX.

Bearish Case

A bearish scenario might result in a substantial price decline.

- Factors Leading to Decline: Factors such as increased regulatory pressure, a significant macroeconomic downturn, or a major security breach could trigger a Bitcoin bear market and potentially a Bitcoin price crash.

Neutral Case

A neutral scenario suggests a period of consolidation or sideways trading.

- Reasons for Sideways Movement: Uncertainty in the market, conflicting signals from technical indicators, and a wait-and-see attitude among investors could lead to a period of Bitcoin price consolidation.

Conclusion

Our Bitcoin price analysis reveals that several factors – ranging from technical indicators and short-term price fluctuations to long-term trends and fundamental forces – influence Bitcoin's price. While the current situation presents both bullish and bearish possibilities, it's difficult to definitively label it a critical juncture. The interplay of regulatory changes, macroeconomic conditions, and institutional adoption will ultimately dictate Bitcoin's trajectory. Whether this period represents a significant turning point or a temporary pause remains uncertain.

Stay informed about the latest Bitcoin price analysis and remain vigilant as we navigate this potentially critical juncture in the cryptocurrency market. Continue your research using resources like [link to reputable charting website 1] and [link to reputable charting website 2] to make informed investment decisions. Understanding Bitcoin price predictions and the nuances of Bitcoin price analysis is key to navigating the volatile crypto market successfully.

Featured Posts

-

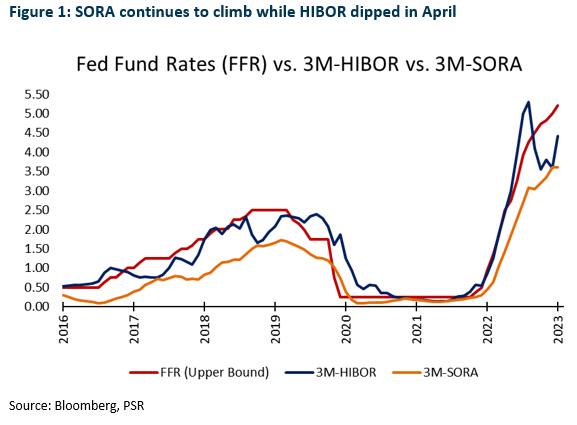

Post Intervention Analysis Hkd Usd And The Fall In Hong Kong Interest Rates

May 08, 2025

Post Intervention Analysis Hkd Usd And The Fall In Hong Kong Interest Rates

May 08, 2025 -

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025 -

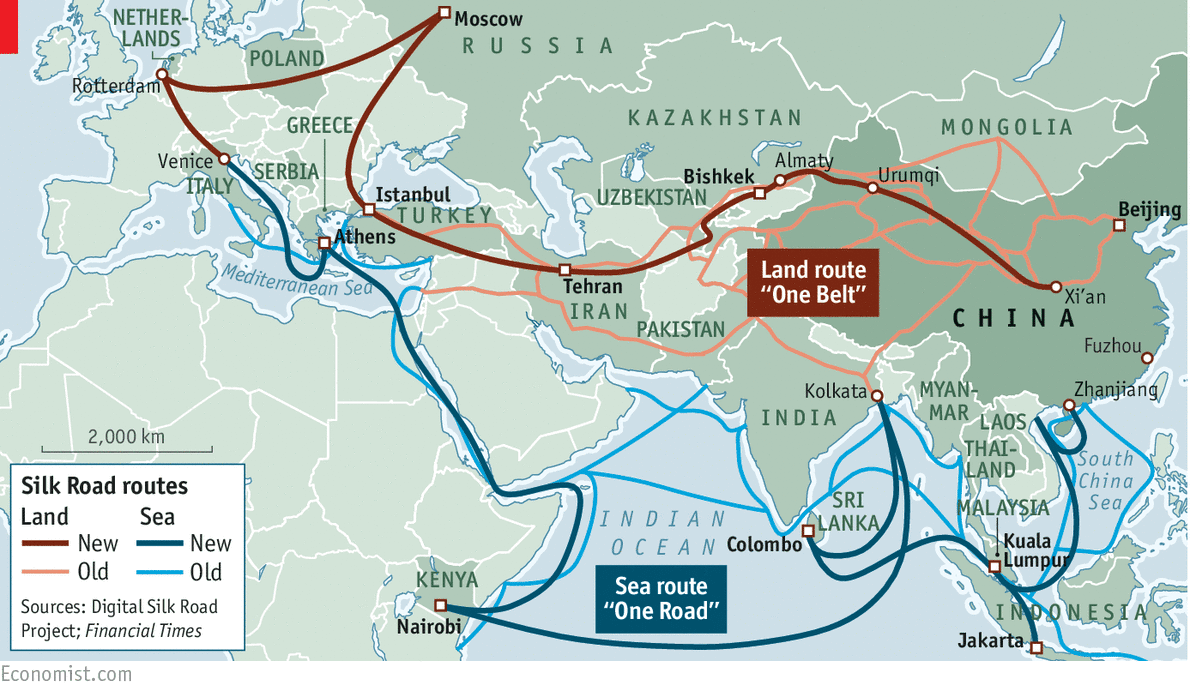

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025 -

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025 -

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Latest Posts

-

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025 -

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025 -

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025 -

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025 -

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025