XRP Price Prediction: Analyzing The Impact Of The Grayscale ETF Application

Table of Contents

Grayscale's ETF Application: A Potential Catalyst for Crypto Market Growth

Grayscale's application for a Bitcoin exchange-traded fund (ETF) is a monumental event for the cryptocurrency industry. Its approval would signify a significant step towards greater institutional adoption and regulatory clarity, potentially transforming the crypto market landscape. This isn't just about Bitcoin; the ripple effects could significantly influence altcoins like XRP.

- Increased institutional interest in Bitcoin could lead to a spillover effect on altcoins like XRP. As institutional investors gain more comfortable access to Bitcoin through an ETF, their interest might extend to other cryptocurrencies with unique functionalities and use cases, like XRP.

- Regulatory clarity surrounding ETFs could boost investor confidence across the crypto market. An approved Bitcoin ETF would set a precedent, potentially paving the way for the approval of other crypto ETFs, including those potentially featuring XRP in the future. This clarity could significantly reduce the risk perception associated with crypto investments.

- Higher trading volume and liquidity are likely outcomes of ETF approval. Increased accessibility and institutional participation would naturally lead to a rise in trading volume and improved liquidity for Bitcoin, which could positively affect the broader market, including XRP.

- Potential for price appreciation in the broader crypto market. A successful Bitcoin ETF could trigger a wave of positive sentiment, leading to price appreciation not only for Bitcoin but also for many altcoins, potentially boosting XRP's value.

XRP's Unique Position in the Crypto Landscape

XRP distinguishes itself from Bitcoin through its distinct use cases, primarily focused on facilitating cross-border payments and financial transactions via RippleNet. This inherent difference means that XRP's price reaction to the Grayscale ETF application might diverge from Bitcoin's.

- XRP's focus on payments and financial technology differentiates it from Bitcoin's store-of-value approach. While Bitcoin is often seen as digital gold, XRP's utility in real-world financial transactions makes it a more actively traded asset.

- The ongoing legal battle between Ripple and the SEC could influence XRP's price regardless of the ETF outcome. The SEC lawsuit's resolution will likely be a far more significant factor in XRP's short-term price than the Grayscale ETF application. A positive resolution could significantly boost XRP's value.

- Successful adoption of RippleNet could drive demand for XRP independent of the broader market trends. As more financial institutions integrate RippleNet, the demand for XRP as a transactional currency could increase, creating a separate upward pressure on its price.

- XRP's market capitalization and its position relative to other cryptocurrencies will also play a role. Its current ranking and overall market dominance will influence investor perception and investment flows.

Positive Scenario: ETF Approval and its Impact on XRP Price

If Grayscale's ETF application is approved, the positive sentiment could significantly boost XRP's price.

- Potential percentage increase in XRP price: A conservative estimate might be a 15-25% increase in the short term, but a more significant rise is possible depending on the overall market reaction.

- Increased trading volume and market capitalization: Higher liquidity and increased institutional interest would likely drive up trading volume and XRP's market capitalization.

- Impact on XRP's adoption and user base: The overall positive market sentiment could attract new users and businesses to the XRP ecosystem.

- Factors contributing to the price surge: Increased investor confidence, higher liquidity, and positive news surrounding the broader crypto market would all contribute to the potential price surge.

Negative Scenario: ETF Rejection and its Impact on XRP Price

Conversely, if the ETF application is rejected, the impact on XRP could be negative, although not necessarily catastrophic.

- Potential percentage decrease in XRP price: A potential decrease of 10-15% is possible in the short term, primarily driven by a negative sentiment ripple effect across the crypto market.

- Impact on investor sentiment and trading volume: Rejection could dampen investor sentiment and potentially lead to a decrease in trading volume for XRP.

- The influence of regulatory uncertainty on XRP's price: Continued regulatory uncertainty could keep a lid on XRP's price growth even if other factors are positive.

- Alternative factors that could impact XRP's price independent of the ETF outcome: The Ripple-SEC case and RippleNet adoption remain key drivers regardless of the ETF's fate.

Analyzing Other Influencing Factors on XRP Price

Beyond the Grayscale ETF application, several other factors could significantly influence XRP's price.

- Ripple's legal battle with the SEC: The outcome of this case remains the most significant factor affecting XRP's short-to-medium-term price.

- Adoption of XRP by new businesses and institutions: Increased adoption by financial institutions would strongly support XRP's price.

- Technological upgrades to the XRP Ledger: Improvements to the XRP Ledger's speed, scalability, and functionality could attract more users and boost its value.

- Overall cryptocurrency market trends and sentiment: The broader cryptocurrency market's performance will inevitably impact XRP's price.

Conclusion

Grayscale's ETF application holds significant potential for the crypto market, but its impact on XRP's price will depend on various interconnected factors, including the ETF's approval or rejection, Ripple's legal case, and the overall market sentiment. Predicting XRP's future price requires a nuanced understanding of these elements. The XRP price prediction remains highly dependent on these interacting variables.

Call to Action: Stay informed about the latest developments surrounding Grayscale's ETF application and its potential impact on the XRP price. Continue researching the XRP market and other relevant factors to make well-informed decisions about your investments in XRP. Regularly check for updates on XRP price prediction analyses for the most current insights.

Featured Posts

-

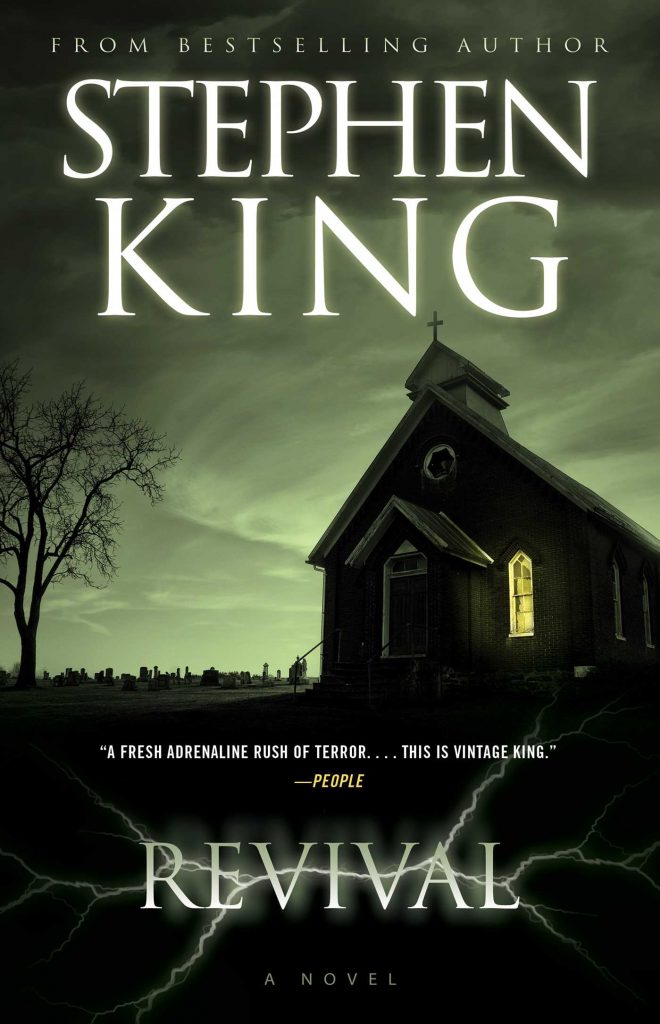

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date

May 08, 2025 -

Savage Land Showdown Rogue 2 Preview Featuring Ka Zar

May 08, 2025

Savage Land Showdown Rogue 2 Preview Featuring Ka Zar

May 08, 2025 -

Krachy Se Lahwr Py Ays Ayl Trafy Ka Sfr Jary

May 08, 2025

Krachy Se Lahwr Py Ays Ayl Trafy Ka Sfr Jary

May 08, 2025 -

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025 -

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025

Latest Posts

-

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025 -

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025 -

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025 -

Dwp Notification 12 Benefits Update Your Bank Account Information

May 08, 2025

Dwp Notification 12 Benefits Update Your Bank Account Information

May 08, 2025