World Trading Tournament (WTT) 2023: AIMSCAP's Performance Review

Table of Contents

AIMSCAP's Pre-Tournament Preparations and Strategy

AIMSCAP's success in the World Trading Tournament (WTT) 2023 wasn't accidental; it stemmed from meticulous preparation and a well-defined strategy.

Team Composition and Expertise

AIMSCAP assembled a diverse team boasting expertise across various financial markets. Their strength lay in their combined experience:

- Alex Johnson: Lead Trader, specializing in forex and algorithmic trading with over 10 years of experience.

- Sarah Chen: Cryptocurrency specialist, with a proven track record in identifying emerging trends in the digital asset market.

- David Lee: Equity market expert, focusing on technical analysis and swing trading strategies.

This team utilized a unique blend of fundamental and technical analysis, incorporating advanced quantitative models into their decision-making process. Their methodology emphasized identifying high-probability setups across diverse asset classes.

Risk Management and Capital Allocation

A crucial aspect of AIMSCAP's strategy was robust risk management. They implemented:

- Strict stop-loss orders on all positions to limit potential losses.

- Careful position sizing, ensuring no single trade exceeded a predetermined percentage of their overall capital.

- Diversification across asset classes to mitigate the impact of adverse market movements.

Before the tournament, AIMSCAP conducted extensive backtesting and simulations using historical market data to fine-tune their strategies and risk parameters. This rigorous preparation played a pivotal role in their consistent performance during the World Trading Tournament (WTT) 2023.

AIMSCAP's Performance During the WTT 2023

AIMSCAP's performance throughout the World Trading Tournament (WTT) 2023 was marked by both calculated risks and astute decision-making.

Key Trading Decisions and Their Outcomes

Several key trades defined AIMSCAP's journey:

- Successful Trade: A long position in Ethereum (ETH) during a period of rising market sentiment, resulting in a 15% profit. The team accurately predicted the positive market shift based on their technical analysis and fundamental research.

- Successful Trade: A short position in GBP/USD during a period of economic uncertainty, generating an 8% profit. This trade demonstrated their ability to capitalize on macroeconomic events.

- Unsuccessful Trade: A leveraged trade in the S&P 500 that resulted in a 5% loss. This trade highlights the inherent risks of leveraged positions and emphasizes the importance of risk management, even for experienced traders.

These trades reflect AIMSCAP's ability to adapt to changing market conditions and capitalize on opportunities across various asset classes. The market volatility during the tournament significantly impacted their trading strategies, forcing them to remain agile and adapt quickly.

Overall Profitability and Ranking

AIMSCAP secured a commendable 7th place ranking in the World Trading Tournament (WTT) 2023, achieving a total profitability of 22%. This impressive result surpasses many participating teams. [Insert a chart or graph here visualizing their performance over the tournament duration]. Despite facing challenges such as unexpected market fluctuations and increased competition, AIMSCAP demonstrated resilience and strategic adaptability.

Analysis of AIMSCAP's Strengths and Weaknesses

A comprehensive review of AIMSCAP's performance in the World Trading Tournament (WTT) 2023 reveals both notable strengths and areas for potential refinement.

Identifying Strengths

AIMSCAP’s success can be attributed to:

- Diverse Expertise: The team’s combined knowledge across multiple asset classes provided a significant advantage.

- Rigorous Risk Management: Their disciplined approach to risk management minimized potential losses.

- Adaptability: Their ability to adjust their strategies in response to changing market conditions proved crucial.

Areas for Improvement

While AIMSCAP displayed remarkable skill, there's always room for improvement:

- Enhanced Diversification: Expanding their portfolio beyond current asset classes could further mitigate risk.

- Refinement of Leveraged Trading Strategies: A more cautious approach to leveraged trades might minimize losses during volatile periods.

- Increased Automation: Exploring automated trading systems could optimize trade execution and efficiency.

Conclusion

AIMSCAP's participation in the World Trading Tournament (WTT) 2023 showcased their exceptional trading skills, strategic planning, and disciplined risk management. Their 7th place finish and 22% profitability highlight their competitive edge. While their strengths were evident, focusing on diversification and refining leveraged trading strategies will further enhance their performance in future World Trading Tournament (WTT) competitions. Learn more about the exciting world of competitive trading and follow AIMSCAP's journey in future World Trading Tournament (WTT) competitions! Stay updated on AIMSCAP's strategies and performance by following their social media channels for insights into future World Trading Tournament (WTT) participation.

Featured Posts

-

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 21, 2025

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 21, 2025 -

Essai Routier Le Matin Auto Au Volant De L Alfa Romeo Junior 1 2 Turbo Speciale

May 21, 2025

Essai Routier Le Matin Auto Au Volant De L Alfa Romeo Junior 1 2 Turbo Speciale

May 21, 2025 -

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025 -

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

Southport Tory Councillors Wife Imprisoned For Inciting Racial Hatred

May 21, 2025

Southport Tory Councillors Wife Imprisoned For Inciting Racial Hatred

May 21, 2025

Latest Posts

-

High Stock Market Valuations Bof As Analysis And Investor Guidance

May 21, 2025

High Stock Market Valuations Bof As Analysis And Investor Guidance

May 21, 2025 -

Understanding Stock Market Valuations Bof As Rationale For Investor Calm

May 21, 2025

Understanding Stock Market Valuations Bof As Rationale For Investor Calm

May 21, 2025 -

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 21, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 21, 2025 -

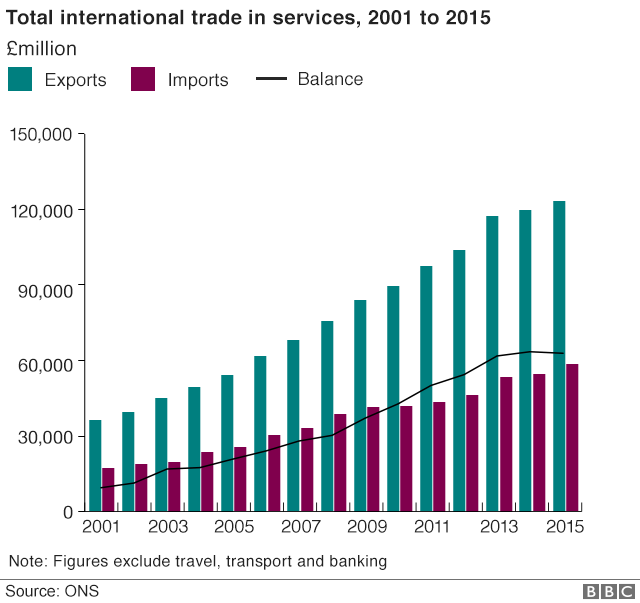

Brexits Economic Consequences The Case Of Uk Luxury Exports

May 21, 2025

Brexits Economic Consequences The Case Of Uk Luxury Exports

May 21, 2025 -

Uk Luxury Exports To The Eu Assessing The Brexit Impact

May 21, 2025

Uk Luxury Exports To The Eu Assessing The Brexit Impact

May 21, 2025