BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Positive Outlook on the Market

BofA maintains a relatively optimistic stance on the market, basing their assessment on several key factors. Their positive outlook significantly influences their reassurance regarding current stock market valuations.

Strong Earnings Growth Projections

BofA forecasts continued strong corporate earnings growth, a key pillar supporting their view on current valuations. This anticipated growth helps justify the current market pricing.

- Technology and Healthcare Sectors: BofA projects robust growth in the technology and healthcare sectors, driven by innovation and increasing demand.

- Consumer Discretionary Spending: Despite inflationary pressures, BofA anticipates continued, albeit moderated, growth in consumer discretionary spending, benefiting related companies.

- Data Source: BofA's Global Research reports consistently highlight these projections, citing specific data and financial modeling to support their claims.

The relationship between earnings growth and stock valuations is straightforward: higher projected earnings typically support higher stock prices. Investors are willing to pay more for companies expected to generate significant future profits.

Resilient Corporate Balance Sheets

BofA highlights the surprisingly resilient financial health of many corporations. Strong balance sheets, characterized by low debt levels and ample cash reserves, contribute significantly to market stability and investor confidence.

- Low Debt Levels Across Sectors: Many companies emerged from the pandemic with significantly reduced debt loads, bolstering their resilience against economic headwinds.

- Strong Cash Positions: High cash reserves provide companies with a buffer to navigate economic uncertainty and invest in future growth opportunities.

- BofA Research: BofA's credit analysis and corporate financial reports underline the robust nature of corporate balance sheets, mitigating concerns about higher valuations.

Strong balance sheets reduce the risk associated with higher valuations. Companies with healthy finances are better equipped to withstand economic downturns and continue delivering returns to investors.

Inflationary Pressures Easing

BofA's analysis suggests that inflationary pressures are gradually easing, impacting stock valuations positively. This easing inflation contributes to a more favorable investment environment.

- CPI Data: Recent Consumer Price Index (CPI) data shows a moderation in inflation, aligning with BofA's predictions.

- Federal Reserve Actions: The Federal Reserve's actions to combat inflation, although impacting interest rates, are viewed by BofA as ultimately contributing to long-term price stability.

- BofA's Inflation Forecasts: BofA's economic forecasts anticipate a continued, though potentially gradual, decline in inflation rates over the coming quarters.

Lower inflation expectations generally support higher valuations. When inflation is under control, investors are more confident about future earnings and are willing to pay higher prices for stocks.

Addressing Investor Concerns about Valuation Metrics

While acknowledging that some valuation metrics may appear high, BofA addresses investor concerns through a nuanced perspective.

Understanding Price-to-Earnings Ratios (P/E)

Concerns often center on high Price-to-Earnings (P/E) ratios. However, BofA provides context.

- Historical Context: BofA contextualizes current P/E ratios within their historical range, arguing that while elevated, they aren't unprecedented considering current economic conditions and growth prospects.

- Acceptable P/E Ranges: BofA suggests that acceptable P/E ranges vary depending on factors like industry, growth rates, and risk profiles. They outline these variations in their research.

- Beyond P/E Ratios: BofA emphasizes the importance of considering other valuation metrics like Price-to-Sales (P/S) ratios and Price/Earnings to Growth (PEG) ratios for a more comprehensive assessment.

Focusing solely on P/E ratios can be misleading. A holistic approach using multiple valuation metrics provides a more balanced and accurate picture of a company's worth.

The Role of Interest Rates

Rising interest rates are a major concern for investors. BofA acknowledges this but offers a balanced perspective.

- Interest Rate Trajectory: BofA offers predictions on the future trajectory of interest rates, suggesting a potential plateau or even slight decline in the near future.

- Impact on Valuations and Profitability: BofA analyzes how higher interest rates can impact both valuations and corporate profitability. Their models incorporate these potential effects.

- BofA's Valuation Models: BofA explicitly addresses how they account for interest rate impacts within their complex valuation models, providing transparency to their assessment.

While higher interest rates can affect stock valuations, BofA's analysis indicates that their impact is factored into their overall assessment and doesn't negate their positive outlook.

Long-Term Growth Potential

BofA's reassurances are rooted in a focus on long-term growth potential, arguing that current valuations reflect future prospects rather than just current earnings.

- High-Growth Sectors: BofA identifies several sectors with significant long-term growth potential, justifying premium valuations. Examples may include renewable energy, artificial intelligence, and biotechnology.

- Technological Advancements: BofA highlights the role of technological advancements in driving long-term economic growth and supporting higher valuations.

Long-term growth expectations can justify seemingly high valuations in the short term. Investors are willing to pay a premium for companies with promising future growth prospects.

Conclusion: BofA's Reassurance and the Future of Stock Market Valuations

BofA's positive outlook rests on several key pillars: strong earnings growth projections, resilient corporate balance sheets, easing inflationary pressures, and significant long-term growth potential. While acknowledging that some valuation metrics may appear high, their analysis suggests these valuations are not inherently unsustainable or a cause for immediate concern.

The key takeaway is that a balanced assessment, considering multiple factors and long-term perspectives, is crucial. BofA's research demonstrates that their positive assessment of current stock market valuations is based on a comprehensive and nuanced analysis.

To gain a deeper understanding of BofA's perspective and the current market dynamics, we encourage you to review their research reports and analysis. Make informed investment decisions based on a thorough understanding of BofA's reassurances on stock market valuations. [Link to BofA Global Research (if available)]. Remember, assessing stock market valuations requires a comprehensive view, accounting for both short-term fluctuations and long-term growth potential.

Featured Posts

-

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025

Walliams Slams Cowell Amid Britains Got Talent Dispute

May 21, 2025 -

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 21, 2025 -

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025 -

April Nyc Concert Vybz Kartel Confirmed At Barclay Center

May 21, 2025

April Nyc Concert Vybz Kartel Confirmed At Barclay Center

May 21, 2025 -

Wireless Headphones Even Better Than Before

May 21, 2025

Wireless Headphones Even Better Than Before

May 21, 2025

Latest Posts

-

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025 -

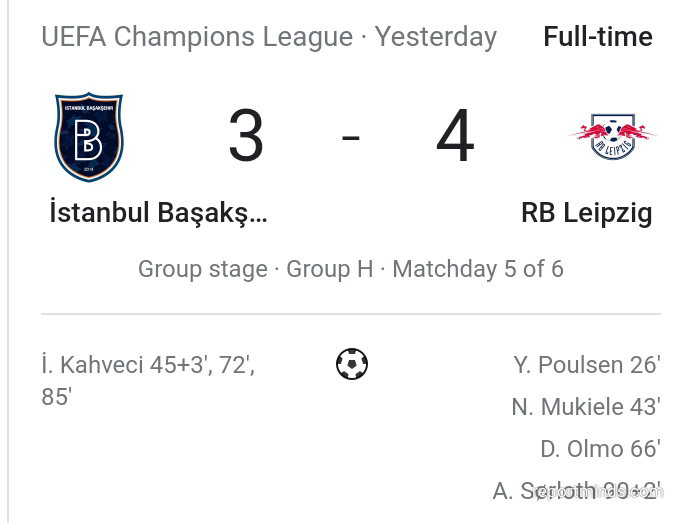

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025 -

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025 -

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025 -

Gladbach Defeat Mainz Strengthens Top Four Bid

May 21, 2025

Gladbach Defeat Mainz Strengthens Top Four Bid

May 21, 2025