High Stock Market Valuations: BofA's Analysis And Investor Guidance

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA employs a robust methodology to assess market valuations, incorporating various metrics and models. Their analysis often involves examining price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and discounted cash flow (DCF) models, comparing current values to historical averages and projected future earnings. Recent BofA reports suggest a range of perspectives on current market valuation levels, often flagging specific sectors as overvalued while others might be considered fairly valued or even undervalued.

For example, a recent BofA report may highlight that the S&P 500's P/E ratio is significantly above its historical average, indicating potentially high valuations. However, they might also point out specific sectors, such as technology or healthcare, where valuations are less extreme, offering a nuanced perspective. This is crucial for investors to avoid broad generalizations.

- Specific valuation metrics used by BofA: P/E ratio, P/S ratio, Price-to-book ratio (P/B), Dividend yield, DCF analysis.

- BofA's assessment of specific sectors or market segments: BofA's reports often provide sector-specific valuation analysis, highlighting potential overvaluation in certain sectors (e.g., tech) and undervaluation in others (e.g., energy).

- Comparison to historical valuation levels: BofA analysts frequently compare current market valuations to historical averages and standard deviations, helping to contextualize current levels within a long-term perspective. This helps determine if current valuations represent a significant deviation from historical norms.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors and market dynamics contribute to current high stock market valuations. Understanding these factors is crucial for informed investment decisions.

Macroeconomic Factors:

- Low interest rates: Historically low interest rates have made borrowing cheaper, stimulating economic growth and encouraging investment in equities.

- Inflationary pressures: While inflation can negatively impact valuations, moderate inflation can sometimes be accompanied by strong corporate earnings, supporting higher stock prices. However, high and unpredictable inflation presents a significant risk.

- Strong corporate earnings: Robust corporate earnings, particularly in certain sectors, can justify higher stock prices, based on future growth potential.

- Geopolitical events: Global uncertainty and geopolitical events (e.g., wars, trade disputes) can influence investor sentiment and lead to both market volatility and potential investment opportunities.

Other Factors:

-

Investor sentiment: Optimistic investor sentiment can drive up stock prices even in the face of potentially high valuations. Conversely, negative sentiment can lead to sharp market corrections.

-

Technological advancements: Rapid technological progress and innovation in sectors like artificial intelligence and biotechnology can drive significant growth and higher valuations.

-

Monetary policy: Central bank policies, such as quantitative easing, can influence liquidity and market valuations.

-

Specific examples: The recent period of low interest rates significantly influenced stock market valuations. Strong corporate earnings in the technology sector have contributed to high valuations in that segment. Geopolitical risks, such as the war in Ukraine, have created market uncertainty.

BofA's Recommendations for Investors Facing High Stock Market Valuations

BofA's recommendations for investors navigating high stock market valuations often emphasize a cautious yet balanced approach. While they may not necessarily advocate for a complete market exit, they typically recommend a strategic approach focused on risk management and diversification.

- Specific investment strategies: BofA often suggests a focus on quality companies with strong fundamentals, sustainable earnings growth, and robust balance sheets.

- Sectors or asset classes: They might suggest overweighting sectors they consider undervalued relative to the overall market and underweighting those seen as overvalued.

- Risk mitigation techniques: Diversification across different asset classes, sectors, and geographies is a key recommendation, along with employing hedging strategies to protect against market downturns.

Alternative Investment Strategies in a High-Valuation Market

When stock market valuations are high, investors often explore alternative investment strategies to diversify their portfolios and potentially reduce risk.

-

Bonds: Bonds can offer a degree of stability, particularly in periods of market uncertainty. However, yields may be low in a low-interest-rate environment.

-

Real estate: Real estate can be a good diversifier and potentially offer inflation protection. However, it is less liquid than stocks.

-

Commodities: Commodities like gold and oil can act as inflation hedges. Their prices can be volatile.

-

Alternative assets: Private equity and hedge funds offer access to alternative investment opportunities, but often come with higher fees and less liquidity.

-

Specific examples: Investing in high-quality corporate bonds could offer a degree of stability, while investing in real estate investment trusts (REITs) might provide both income and inflation protection.

Conclusion: Actionable Insights on High Stock Market Valuations

BofA's analysis of high stock market valuations highlights the importance of careful consideration and strategic decision-making for investors. Their recommendations emphasize diversification, risk management, and a focus on quality companies with strong fundamentals. Understanding the factors contributing to these valuations—from low interest rates to strong corporate earnings and geopolitical events—is crucial for navigating the market effectively. While there may be opportunities within specific sectors, a balanced and cautious approach is advisable. Take proactive steps to review your portfolio and adjust your investment strategy accordingly, ensuring it aligns with your risk tolerance and long-term financial goals in this environment of high stock market valuations.

Featured Posts

-

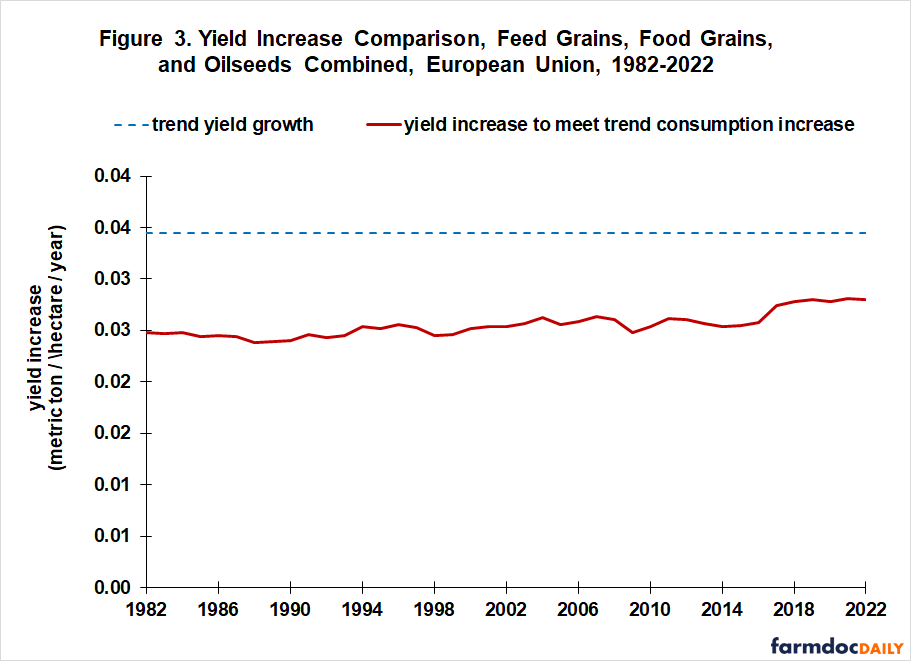

Macrons Push For European Union Self Sufficiency A Rejection Of Us Imports

May 21, 2025

Macrons Push For European Union Self Sufficiency A Rejection Of Us Imports

May 21, 2025 -

Antiques Roadshow Arrest Follows Shocking National Treasure Revelation

May 21, 2025

Antiques Roadshow Arrest Follows Shocking National Treasure Revelation

May 21, 2025 -

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 21, 2025

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 21, 2025 -

Nyt Mini Crossword April 20 2025 Complete Answers And Hints

May 21, 2025

Nyt Mini Crossword April 20 2025 Complete Answers And Hints

May 21, 2025 -

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025

Latest Posts

-

Enjoying Breezy And Mild Days Activities And Destinations

May 21, 2025

Enjoying Breezy And Mild Days Activities And Destinations

May 21, 2025 -

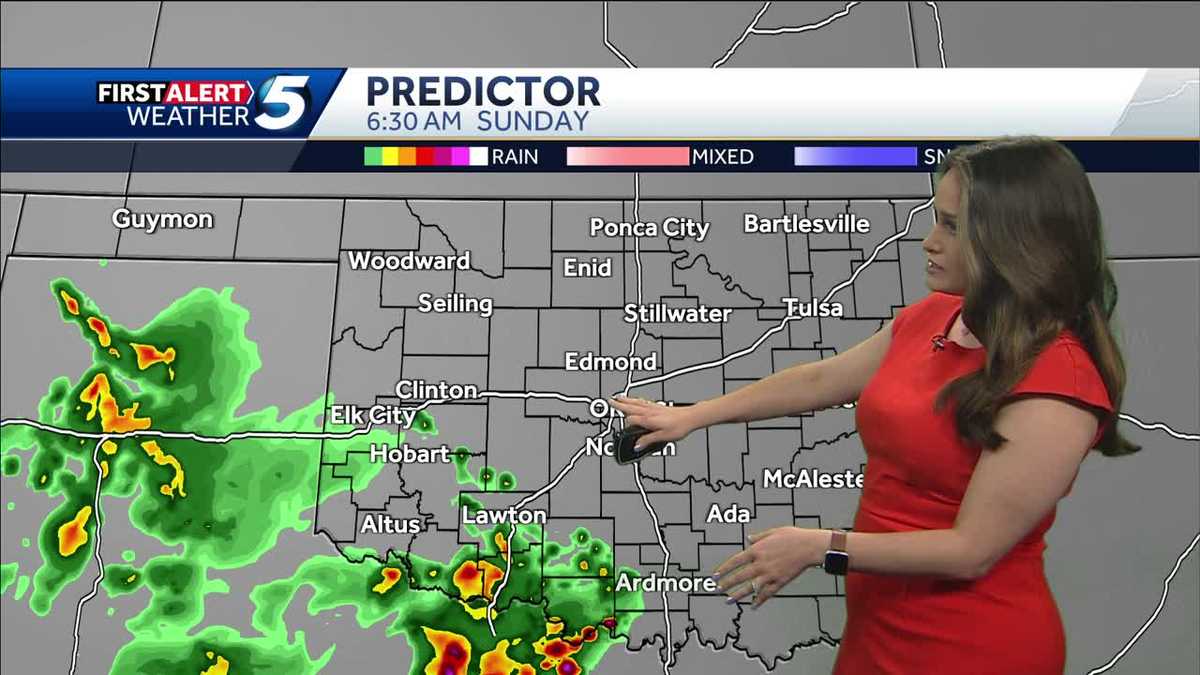

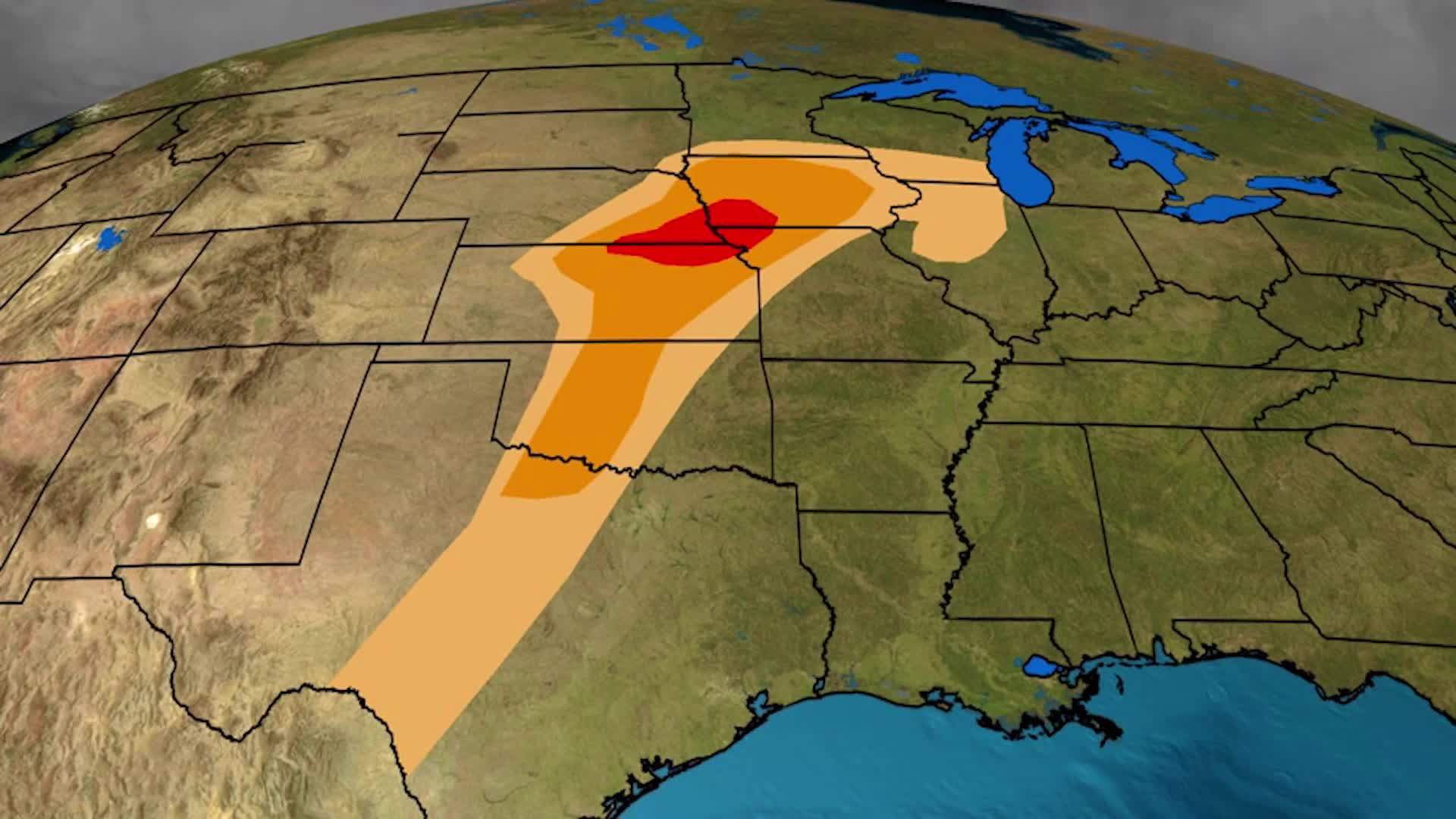

Increased Storm Probability Overnight Severe Weather Possible Monday

May 21, 2025

Increased Storm Probability Overnight Severe Weather Possible Monday

May 21, 2025 -

Monday Severe Weather Increased Storm Chance Overnight

May 21, 2025

Monday Severe Weather Increased Storm Chance Overnight

May 21, 2025 -

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 21, 2025

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 21, 2025 -

Overnight Storm Chances And Mondays Severe Weather Outlook

May 21, 2025

Overnight Storm Chances And Mondays Severe Weather Outlook

May 21, 2025