Understanding Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for a Measured Approach to Stock Market Valuations

BofA's analysts highlight several factors mitigating concerns about overvaluation, emphasizing a nuanced view beyond headline numbers. They encourage investors to look beyond the short-term noise and focus on the long-term potential for growth.

-

Focus on long-term growth potential: Instead of reacting to daily price swings, BofA advocates for assessing the intrinsic value of companies based on their long-term earnings potential and future growth prospects. This involves analyzing factors such as innovation, market share, and competitive advantages. Understanding a company's long-term trajectory is key to accurate stock market valuation.

-

Consideration of interest rate impacts on valuations: Interest rate changes significantly influence stock valuations. BofA's analysis incorporates the impact of current and projected interest rates on discounted cash flow models and other valuation techniques. Rising interest rates can impact future earnings estimations, leading to adjustments in stock prices and valuations.

-

Emphasis on the importance of earnings growth and its correlation with stock prices: BofA emphasizes the strong correlation between a company's earnings growth and its stock price. Sustainable earnings growth is a key driver of long-term stock appreciation and is a crucial element in accurate stock market valuation.

-

Analysis of specific sectors and their individual valuations: BofA doesn't apply a one-size-fits-all approach. Their analysis considers the unique characteristics and growth prospects of different sectors, recognizing that valuations vary significantly across industries. This sector-specific approach to stock market valuation is crucial for identifying undervalued opportunities.

-

Highlighting opportunities in undervalued sectors: By analyzing sector-specific valuations, BofA identifies sectors and individual stocks that are potentially undervalued relative to their long-term growth potential. This provides investors with opportunities to find value in the market even during periods of uncertainty.

Understanding Key Valuation Metrics: P/E Ratio, PEG Ratio, and More

Several key metrics are used to assess stock market valuations. Understanding these metrics is crucial for making informed investment decisions.

-

Price-to-Earnings Ratio (P/E): The P/E ratio is calculated by dividing the market price per share by the earnings per share (EPS). A high P/E ratio suggests that investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. Conversely, a low P/E ratio might suggest undervaluation. It's essential to compare P/E ratios within the same sector, as different industries have varying typical P/E ranges. For example, a tech company might have a higher P/E than a utility company, reflecting higher growth expectations.

-

Price-to-Earnings Growth Ratio (PEG): The PEG ratio considers both the P/E ratio and the company's earnings growth rate. It's calculated by dividing the P/E ratio by the earnings growth rate. A PEG ratio of 1 is often considered neutral, while a PEG ratio below 1 might indicate undervaluation, and above 1, overvaluation. The PEG ratio offers a more nuanced perspective on valuation than the P/E ratio alone.

-

Price-to-Book Ratio (P/B): The P/B ratio compares a company's market capitalization to its book value (assets minus liabilities). It's particularly relevant for asset-heavy companies. A high P/B ratio suggests that the market is valuing the company's assets at a premium. A low P/B ratio might suggest undervaluation, although it's crucial to consider the quality of the company's assets.

-

Price-to-Sales Ratio (P/S): The P/S ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings, as it provides an alternative valuation metric. A low P/S ratio can suggest undervaluation, especially when compared to industry peers.

Analyzing Sector-Specific Stock Market Valuations

BofA's approach acknowledges that valuations differ across industry segments. A thorough understanding of sector-specific dynamics is crucial for accurate stock market valuation.

-

Relatively Overvalued Sectors: BofA might identify sectors like certain technology sub-sectors or consumer discretionary as relatively overvalued due to factors such as high growth expectations already priced into the market or potential regulatory headwinds.

-

Undervalued Sectors: Sectors like energy or certain industrials might be deemed undervalued based on factors like cyclical downturns or market mispricing of their long-term growth potential.

-

Impact of Technological Advancements: Rapid technological changes can significantly influence sector valuations. Industries undergoing disruption might see lower valuations initially, while those benefiting from technological innovation might command higher premiums.

-

Influence of Regulatory Changes: New regulations can drastically impact sector valuations. For example, stricter environmental regulations could affect energy companies' valuations, while changes in healthcare regulations could impact pharmaceutical companies.

The Importance of Long-Term Investing in the Context of Stock Market Valuations

BofA stresses the importance of a long-term perspective when it comes to stock market valuations.

-

Avoiding Emotional Decision-Making: Short-term market fluctuations can trigger emotional responses leading to impulsive buy or sell decisions. A long-term strategy helps mitigate these risks.

-

Benefits of Diversification: A diversified portfolio across various sectors and asset classes reduces the impact of individual stock price fluctuations on overall portfolio value, leading to greater stability and potentially higher returns over the long term.

-

Strategies for Risk Management: Long-term investors can employ various risk management strategies, such as dollar-cost averaging and strategic rebalancing, to mitigate potential losses and maximize returns over time.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio – adjusting asset allocations to maintain your target proportions – helps to lock in profits from well-performing assets and reinvest in potentially undervalued sectors.

Conclusion

Understanding stock market valuations is crucial for informed investment decisions. BofA's rationale promotes a calm, long-term approach, focusing on fundamental analysis and considering various valuation metrics beyond superficial headline numbers. By carefully analyzing key ratios like P/E, PEG, P/B, and P/S, and by understanding sector-specific valuations, investors can make more reasoned choices. Don't let short-term market fluctuations derail your long-term investment strategy. Continue to learn about stock market valuations and make informed decisions based on thorough research and a deep understanding of the underlying factors driving valuations.

Featured Posts

-

Ancelottis Future Uncertain Klopp Agents Statement On Real Madrid Role

May 21, 2025

Ancelottis Future Uncertain Klopp Agents Statement On Real Madrid Role

May 21, 2025 -

Nyt Crossword April 25 2025 Clues And Answers

May 21, 2025

Nyt Crossword April 25 2025 Clues And Answers

May 21, 2025 -

Manchester Citys Next Manager Could An Arsenal Legend Replace Guardiola

May 21, 2025

Manchester Citys Next Manager Could An Arsenal Legend Replace Guardiola

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 21, 2025

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 21, 2025

Latest Posts

-

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025 -

Big Bear Ai Stock Buy Or Sell

May 21, 2025

Big Bear Ai Stock Buy Or Sell

May 21, 2025 -

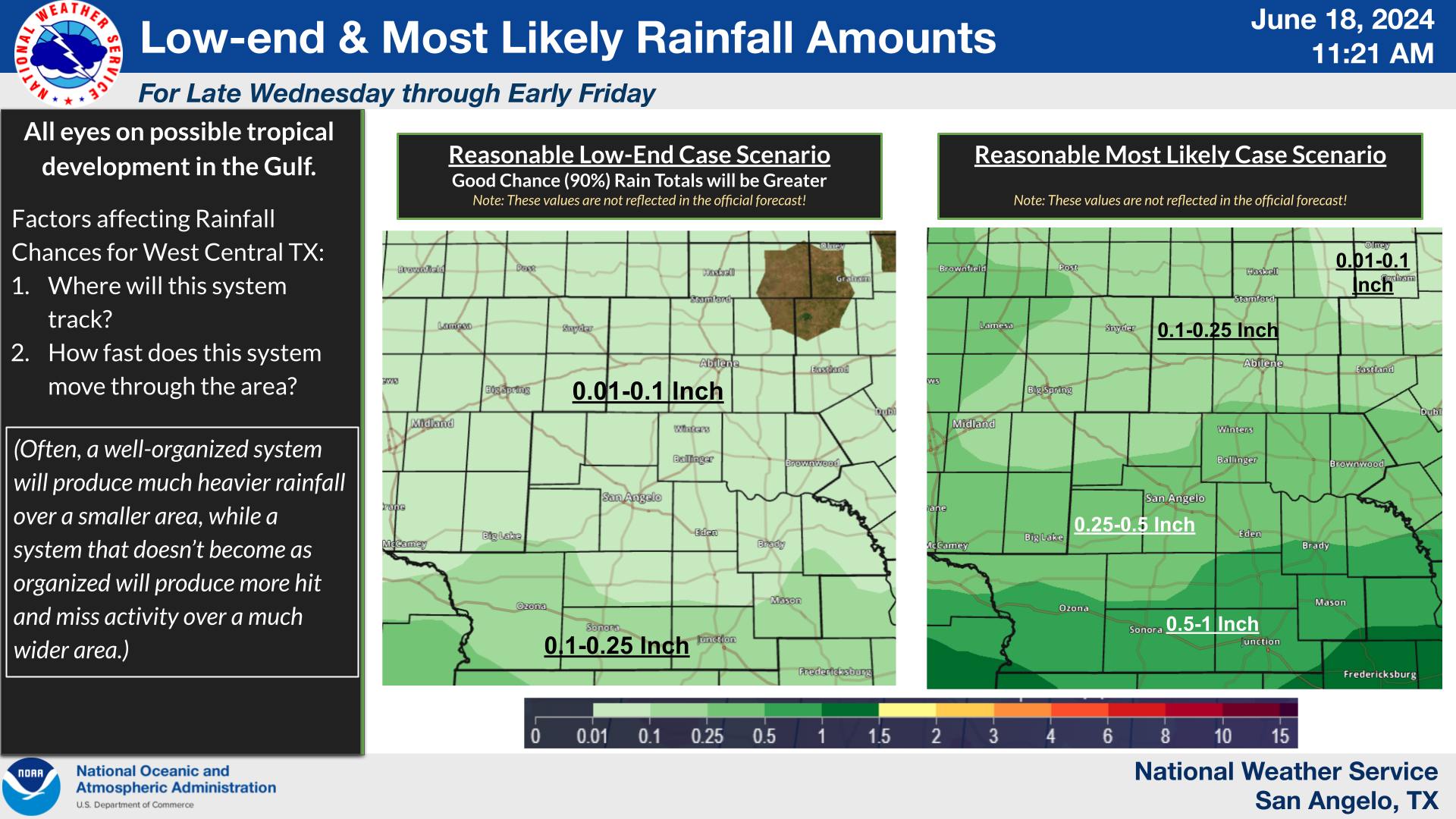

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025 -

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025 -

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025