Market Volatility Ahead: Billions In Bitcoin And Ethereum Options Expire Soon

Table of Contents

The Scale of the Expiring Options Contracts

The sheer size of the upcoming Bitcoin and Ethereum options expiry is unprecedented. Billions of dollars in open interest are at stake, making this event a major catalyst for potential price swings. Understanding the scale is crucial to gauging the potential market impact.

- Massive Dollar Amounts: Let's say, for example, that $3 billion in Bitcoin options and $2 billion in Ethereum options are set to expire. These figures represent a significant portion of the daily trading volume for both assets. (Note: Replace these example figures with actual, up-to-date data closer to the expiry date).

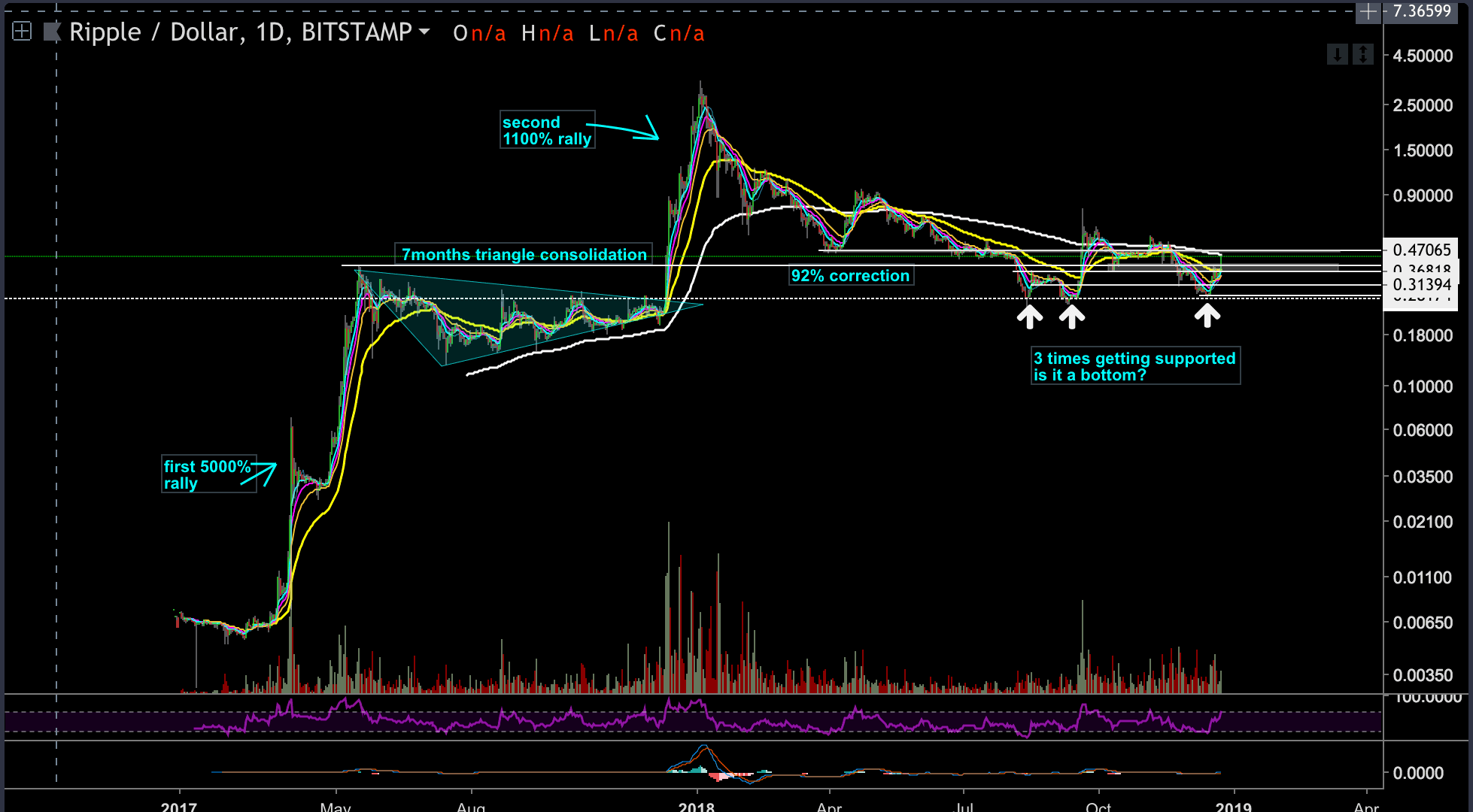

- Comparison to Previous Expirys: Comparing this event to previous large-scale options expiries can provide valuable insights. Analyzing past price movements following similar events will help us predict potential outcomes. We can look for patterns in price volatility and market sentiment leading up to and following previous expirations.

- Call and Put Distribution: A key factor in predicting market movement is analyzing the distribution of call (betting on price increase) and put (betting on price decrease) options. A heavy concentration of calls suggests bullish sentiment, while a dominance of puts implies a bearish outlook. This data offers valuable insight into the collective expectations of market participants.

Factors Contributing to Potential Volatility

Several factors beyond the sheer volume of expiring options could amplify the market's reaction. These factors interact to create a complex situation demanding careful consideration.

- Macroeconomic Factors: Global inflation rates, interest rate hikes by central banks, and overall economic uncertainty all significantly influence investor sentiment towards risk assets like Bitcoin and Ethereum. Negative economic news could trigger widespread selling pressure.

- Regulatory Uncertainty: Regulatory developments concerning cryptocurrencies in major jurisdictions can create sudden price fluctuations. Any new legislation or regulatory action, positive or negative, can significantly impact market sentiment and trading activity.

- Whale Activity: Large-scale transactions by "whales" (individuals or entities holding substantial cryptocurrency) can influence price movements. Their buying or selling activity can create significant upward or downward pressure on prices. Monitoring these transactions is vital for understanding short-term market shifts.

- Market Sentiment: The overall market sentiment, as measured through social media sentiment analysis, news headlines, and trading volume, significantly impacts price action. Negative news and widespread fear can lead to rapid sell-offs, while positive news and optimism can drive prices higher.

Potential Price Scenarios Following Expiry

Several scenarios could unfold following the options expiry. Predicting the exact outcome is impossible, but understanding the possibilities is crucial for risk management.

- Bullish Scenario: If market sentiment remains positive, and the expiring options are heavily weighted towards calls, we could see a bullish price rally for both Bitcoin and Ethereum. Positive regulatory news or a positive macroeconomic shift could fuel this upward movement. (Visual Aid: Include a hypothetical chart depicting a bullish price movement).

- Bearish Scenario: A negative macroeconomic outlook coupled with a high concentration of put options could trigger a significant price drop. Negative regulatory announcements or a large sell-off by whales could exacerbate the bearish trend. (Visual Aid: Include a hypothetical chart showing a bearish price movement).

- Sideways Movement Scenario: If bullish and bearish pressures are balanced, we may see a period of sideways consolidation, with prices fluctuating within a relatively narrow range. This could occur if the macroeconomic factors and regulatory environment remain relatively neutral. (Visual Aid: Include a hypothetical chart illustrating sideways price movement).

Strategies for Navigating the Volatility

Navigating the increased volatility requires careful planning and risk management. The following strategies can help mitigate potential losses and capitalize on opportunities.

- Hedging Strategies: Investors can employ hedging strategies, such as using put options or shorting cryptocurrency futures contracts, to protect against potential price drops.

- Portfolio Diversification: Diversifying your cryptocurrency portfolio beyond Bitcoin and Ethereum can reduce the impact of volatility in either asset. Consider investing in other promising crypto projects or alternative asset classes.

- Active Position Management: During the expiry period, actively managing your positions, potentially adjusting your holdings based on price movements and market sentiment, can help limit losses or maximize gains.

- Thorough Research: Conducting thorough research and understanding the risks involved is crucial before making any investment decisions. Remember that past performance is not indicative of future results.

Conclusion

The upcoming expiry of billions of dollars in Bitcoin and Ethereum options presents a significant event with the potential to cause substantial market volatility. Understanding the scale of the expiring contracts, the influencing factors, and the various price scenarios is vital for investors. By employing sound risk management strategies, diversifying your portfolio, and actively managing your positions, you can navigate this period of uncertainty more effectively. Remember to regularly monitor the crypto market for further updates on Bitcoin and Ethereum options expiry and other crucial market events. Conduct your own thorough research before making any investment decisions related to Bitcoin options, Ethereum options, or the broader cryptocurrency market.

Featured Posts

-

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025 -

Daily Lotto Results Wednesday April 16th 2025

May 08, 2025

Daily Lotto Results Wednesday April 16th 2025

May 08, 2025 -

Inter Milan Progresses To Europa League Quarter Finals After Feyenoord Win

May 08, 2025

Inter Milan Progresses To Europa League Quarter Finals After Feyenoord Win

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025 -

The India Pakistan Border A History Of Conflict And Recent Escalation

May 08, 2025

The India Pakistan Border A History Of Conflict And Recent Escalation

May 08, 2025

Latest Posts

-

This Weeks Bitcoin Mining Boom Causes And Implications

May 08, 2025

This Weeks Bitcoin Mining Boom Causes And Implications

May 08, 2025 -

Bitcoin Mining A Deep Dive Into This Weeks Significant Rise

May 08, 2025

Bitcoin Mining A Deep Dive Into This Weeks Significant Rise

May 08, 2025 -

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025 -

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025