XRP Surges Past Bitcoin: SEC's Grayscale XRP ETF Filing Sparks Crypto Rally

Table of Contents

The Grayscale XRP ETF Filing: A Game Changer?

Grayscale Investments, a prominent digital currency asset manager, has submitted an application to the Securities and Exchange Commission (SEC) for an XRP exchange-traded fund (ETF). This move is monumental, potentially signifying a significant shift in regulatory acceptance of XRP. The approval of an XRP ETF would represent a landmark achievement, opening the doors for institutional investors to participate in the XRP market more easily and legally.

This increased institutional interest could lead to:

- Increased liquidity for XRP: A surge in trading volume is expected, making it easier to buy and sell XRP.

- Greater mainstream adoption: The availability of an ETF on major exchanges would expose XRP to a much wider audience of investors.

- Potential for price appreciation: Increased demand from institutional investors could drive up the price of XRP considerably.

- Reduced regulatory uncertainty: SEC approval would signal a degree of regulatory acceptance, potentially reducing future legal challenges.

However, it's crucial to acknowledge the challenges. The SEC's approval process is notoriously rigorous, and there's no guarantee that the application will be successful. Legal challenges and regulatory hurdles remain potential obstacles.

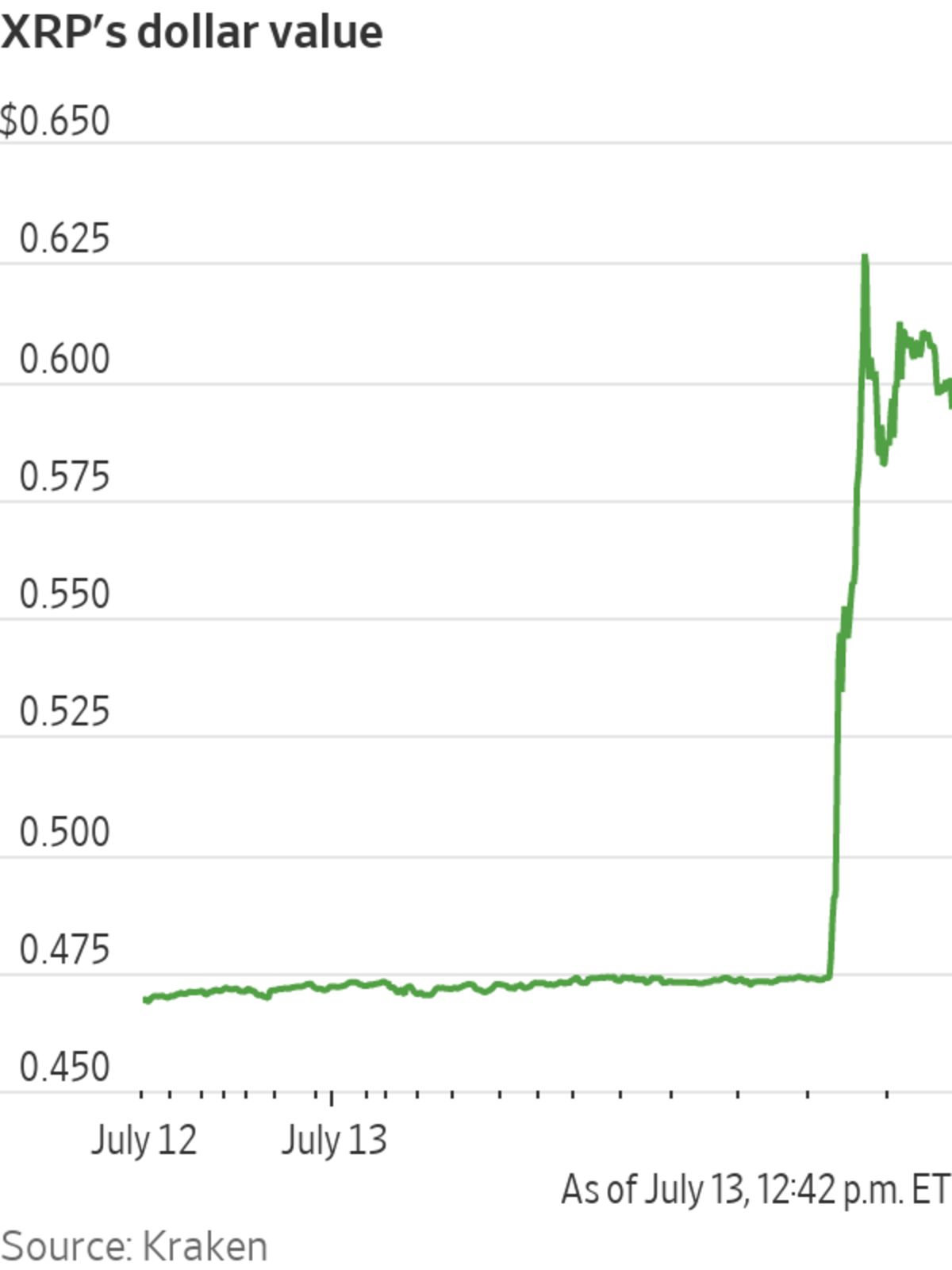

XRP's Price Surge: Analyzing the Rally

The XRP price surge following Grayscale's filing has been nothing short of spectacular. While precise figures fluctuate, XRP saw a percentage increase in price exceeding [Insert Percentage Increase Here]% in a short period. This outpaced Bitcoin's performance during the same timeframe, highlighting the significant market reaction specifically to the XRP ETF news. [Optional: Include a relevant chart or graph showcasing the price increase].

Several factors contributed to this rally:

- Specific percentage increase in XRP price: [Insert Specific Percentage]

- Comparison with Bitcoin's price performance: [Insert Comparison Data]

- Mention of trading volume changes: [Insert Data on Trading Volume Increase]

- Analysis of market capitalization changes: [Insert Data on Market Cap Change]

Beyond the Grayscale news, positive sentiment surrounding XRP's technology and potential use cases, coupled with general positive market sentiment, likely amplified the price increase. Analysts offer mixed forecasts, with some predicting a sustained rally if the ETF is approved, while others caution about potential short-term corrections.

The Impact on the Broader Cryptocurrency Market

The XRP price surge and the Grayscale filing are having a noticeable impact on the broader cryptocurrency landscape. The increased investor confidence sparked by this development has potentially positive ripple effects:

- Increased investor confidence: The positive news surrounding XRP is boosting confidence in the overall crypto market.

- Potential for a broader altcoin rally: The success of XRP might encourage investors to explore other altcoins.

- Influence on Bitcoin's dominance: The XRP rally might temporarily reduce Bitcoin's dominance in the market.

- Attracting new investors to the crypto space: Positive news often attracts new investors, potentially expanding the overall market.

The short-term implications could include increased volatility across the market. In the long term, the outcome of the SEC's decision will play a pivotal role in shaping the future trajectory of not just XRP but the entire cryptocurrency ecosystem.

Regulatory Implications and Future Outlook for XRP

The SEC's decision on Grayscale's XRP ETF application will have profound implications for the future regulation of XRP and other crypto assets. Several scenarios are possible:

- SEC's stance on XRP and potential legal challenges: Approval would likely set a precedent for other crypto assets. Rejection could lead to further legal battles.

- Impact on other similar cryptocurrencies: The decision will influence the regulatory landscape for other cryptocurrencies with similar characteristics.

- Long-term implications for the crypto industry: The outcome could significantly impact the growth and adoption of cryptocurrencies globally.

- Predictions for future price movements: Approval is likely to lead to further price appreciation, while rejection could cause a significant drop.

Current trends suggest a bullish outlook for XRP if the ETF is approved. However, the uncertainty surrounding the SEC's decision makes accurate long-term predictions challenging.

Conclusion

XRP's remarkable price surge, fueled by Grayscale's XRP ETF filing, has undeniably shaken up the cryptocurrency market. The potential impact is enormous, and the SEC's decision will significantly shape the future of XRP and the broader crypto landscape. The Grayscale XRP ETF filing stands as a potentially transformative moment, and its outcome will redefine the regulatory environment for cryptocurrencies. Stay updated on the XRP situation, research XRP investments carefully, monitor the XRP market, and learn more about XRP ETFs before making any investment decisions. Remember to conduct thorough research and only invest what you can afford to lose.

Featured Posts

-

Scathing Comment On Mariners Sparks Outrage Against Yankees Broadcaster

May 07, 2025

Scathing Comment On Mariners Sparks Outrage Against Yankees Broadcaster

May 07, 2025 -

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025 -

Simone Biles Warning After Paris Olympics Incident No More Unwanted Touching

May 07, 2025

Simone Biles Warning After Paris Olympics Incident No More Unwanted Touching

May 07, 2025 -

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025 -

The Last Of Us Part 2 Trailer Pedro Pascal And Bella Ramsey Preview Intense Moments

May 07, 2025

The Last Of Us Part 2 Trailer Pedro Pascal And Bella Ramsey Preview Intense Moments

May 07, 2025

Latest Posts

-

Get A Sneak Peek Of Krypto In The New Superman Film

May 08, 2025

Get A Sneak Peek Of Krypto In The New Superman Film

May 08, 2025 -

Xrp Price Poised For Record High Following Grayscale Etf Sec Review

May 08, 2025

Xrp Price Poised For Record High Following Grayscale Etf Sec Review

May 08, 2025 -

Cute Krypto Highlights In New Superman Movie Footage

May 08, 2025

Cute Krypto Highlights In New Superman Movie Footage

May 08, 2025 -

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025 -

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025