US Economic Factors And Their Influence On Elon Musk's Net Worth

Table of Contents

The Stock Market's Crucial Role

Elon Musk's net worth is heavily tied to the performance of his publicly traded company, Tesla. Understanding the intricacies of the stock market is therefore crucial to understanding the fluctuations in his wealth.

Tesla's Stock Performance

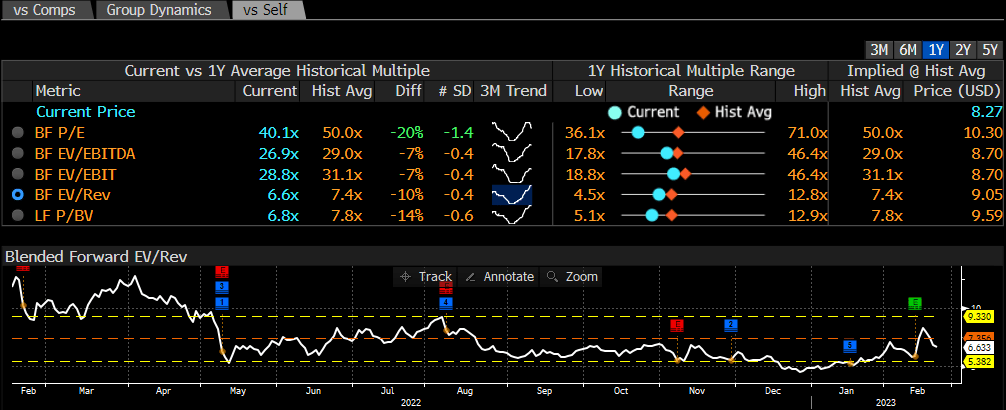

Tesla's stock price is the primary driver of Elon Musk's net worth. Any significant movement in the stock directly translates into a substantial change in his wealth.

- Impact of Positive/Negative News: Positive news, such as record-breaking sales figures, innovative product announcements (like new vehicle models or energy solutions), or advancements in autonomous driving technology, generally leads to a surge in Tesla's stock price and a corresponding increase in Musk's net worth. Conversely, negative news, including production delays, regulatory hurdles, or negative media coverage, can cause the stock to plummet, impacting his wealth significantly.

- Effect of Market Sentiment: Overall investor sentiment towards the electric vehicle (EV) sector and the broader technology market heavily influences Tesla's stock performance. Positive market sentiment boosts Tesla's stock, while negative sentiment can trigger sell-offs.

- Role of Investor Confidence: Investor confidence in Tesla's long-term growth prospects, its ability to maintain its technological edge, and its capacity to navigate challenges in the competitive automotive industry directly impact its market capitalization and, consequently, Musk's net worth.

- Influence of Technological Advancements and Competition: Tesla's continuous innovation and its ability to stay ahead of the competition are critical factors in maintaining investor confidence and driving stock prices. The emergence of new competitors in the EV market can, however, put downward pressure on Tesla's stock and Musk's net worth.

SpaceX's Valuation and Future Prospects

While SpaceX is a privately held company, its valuation significantly contributes to Elon Musk's overall net worth. The company's success and future prospects directly influence this valuation.

- Funding Rounds: Successful funding rounds at increasingly higher valuations directly increase Musk's stake and therefore his wealth.

- Potential for Future IPO: A potential initial public offering (IPO) of SpaceX would significantly increase its valuation and dramatically boost Musk's net worth, as his ownership stake would be reflected in the publicly traded shares.

- Competition in the Space Industry: SpaceX's competitive landscape, including rivals like Blue Origin and other emerging space companies, impacts investor sentiment and future valuations. Maintaining a leading position in the space exploration industry is crucial for maintaining SpaceX's high valuation.

- Government Contracts and Their Impact: Securing lucrative government contracts for space exploration and launch services is vital for SpaceX’s financial health and influences its overall valuation.

Macroeconomic Influences

Broader macroeconomic trends significantly influence Elon Musk's wealth, affecting both Tesla's sales and investor behavior.

Inflation and Interest Rates

Changes in inflation and interest rates impact both consumer spending and investor behavior, which directly affect Tesla's sales and its stock price.

- Effects of High Inflation on Consumer Purchasing Power: High inflation reduces consumer purchasing power, potentially impacting demand for Tesla's relatively expensive vehicles.

- How Interest Rate Hikes Influence Investor Risk Appetite: Interest rate hikes can increase borrowing costs for companies and reduce investor risk appetite, leading to a decline in stock prices, including Tesla's.

- Impact on Tesla's Production Costs: Inflationary pressures can also increase Tesla's production costs, affecting profitability and consequently, its stock price.

Economic Recessions and Market Corrections

Economic downturns can severely impact Elon Musk's net worth, given the cyclical nature of the stock market and the sensitivity of luxury goods (including Tesla vehicles) to economic fluctuations.

- How Recessions Affect Consumer Demand for Luxury Goods: During recessions, consumer demand for discretionary purchases like Tesla vehicles tends to decrease.

- Investor Behavior During Market Corrections: Market corrections, often accompanying recessions, witness a significant flight to safety by investors, leading to stock market sell-offs.

- Resilience of Tesla and SpaceX in Economic Downturns: The resilience of Tesla and SpaceX to weather economic downturns will play a crucial role in mitigating the negative impact on Musk's net worth.

Government Regulations and Policies

Government regulations and policies significantly influence both Tesla and SpaceX, consequently impacting Elon Musk's net worth.

Impact of Tax Policies

Changes in US tax laws significantly impact Musk's net worth, particularly concerning capital gains and corporate taxes.

- Capital Gains Taxes: The rate of capital gains taxes on the sale of Tesla stock directly influences the amount of wealth Musk retains after selling shares.

- Corporate Tax Rates: Changes in corporate tax rates for Tesla and SpaceX directly affect their profitability and, thus, their valuations.

- Potential Tax Implications for SpaceX and Tesla: Future tax policies could significantly alter the financial landscape for both companies, affecting their valuations and Musk's net worth.

Environmental Regulations

Environmental regulations, particularly those encouraging electric vehicle adoption and regulating emissions, play a significant role in Tesla's success and profitability.

- Regulations on Emissions Standards: Stringent emissions standards benefit Tesla, as its electric vehicles are naturally compliant, giving it a competitive advantage over traditional automakers.

- Incentives for Electric Vehicle Adoption: Government incentives for purchasing electric vehicles boost demand for Tesla's products.

- Potential Impact of Stricter Environmental Policies on Tesla's Production Costs and Profitability: While generally beneficial, stricter environmental regulations could increase Tesla's production costs if they necessitate changes in manufacturing processes or supply chains.

Conclusion

The relationship between US Economic Factors and Elon Musk's Net Worth is undeniably complex and multifaceted. His immense wealth acts as a powerful indicator of the US economy's health and direction, showcasing the interplay between macroeconomic conditions, stock market performance, technological innovation, and government policies. Understanding this intricate relationship requires a close examination of various economic indicators and their impact on major companies like Tesla and SpaceX. Understanding the intricate relationship between US Economic Factors and Elon Musk's Net Worth is crucial for comprehending broader economic trends. Continue your research to gain a deeper insight into these dynamic forces shaping our world.

Featured Posts

-

Hurun Report 2025 Elon Musk Still Tops The List Despite Significant Net Worth Loss

May 10, 2025

Hurun Report 2025 Elon Musk Still Tops The List Despite Significant Net Worth Loss

May 10, 2025 -

Using Ai To Create A Podcast A Novel Approach To Scatological Document Processing

May 10, 2025

Using Ai To Create A Podcast A Novel Approach To Scatological Document Processing

May 10, 2025 -

Microsoft Activision Deal Ftc Files Appeal Against Court Decision

May 10, 2025

Microsoft Activision Deal Ftc Files Appeal Against Court Decision

May 10, 2025 -

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025 -

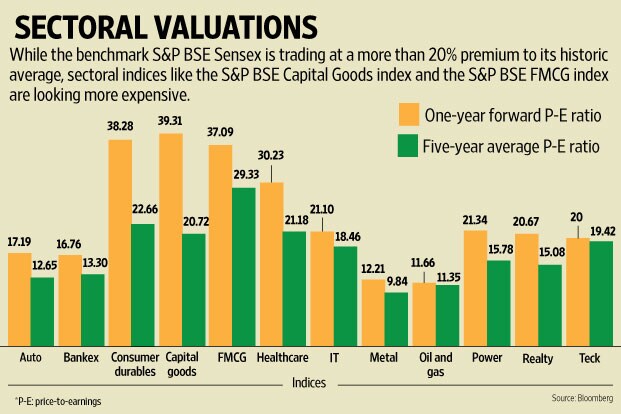

Why Current Stock Market Valuations Shouldnt Deter Investors A Bof A Viewpoint

May 10, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors A Bof A Viewpoint

May 10, 2025

Latest Posts

-

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025 -

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 10, 2025

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 10, 2025 -

Revised Palantir Stock Price Predictions Following Recent Market Gains

May 10, 2025

Revised Palantir Stock Price Predictions Following Recent Market Gains

May 10, 2025 -

Palantir Stock Rally New Analyst Forecasts And Future Outlook

May 10, 2025

Palantir Stock Rally New Analyst Forecasts And Future Outlook

May 10, 2025 -

Predicting The Future Palantirs New Deal With Nato And Public Sector Ai

May 10, 2025

Predicting The Future Palantirs New Deal With Nato And Public Sector Ai

May 10, 2025