Why Current Stock Market Valuations Shouldn't Deter Investors: A BofA Viewpoint

Table of Contents

The Limitations of Traditional Valuation Metrics

Traditional valuation metrics, while helpful, often present an incomplete picture. Relying solely on one metric can lead to flawed conclusions.

The P/E Ratio's Shortcomings

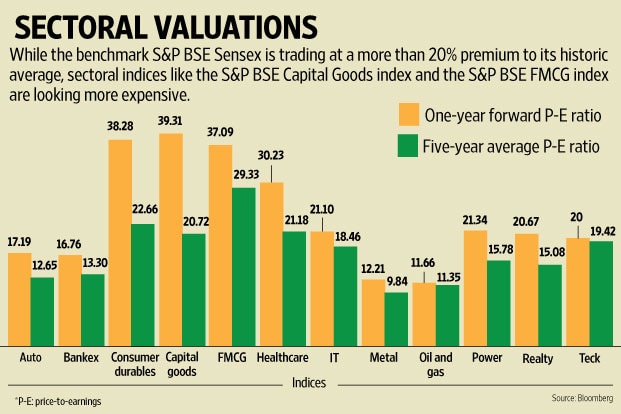

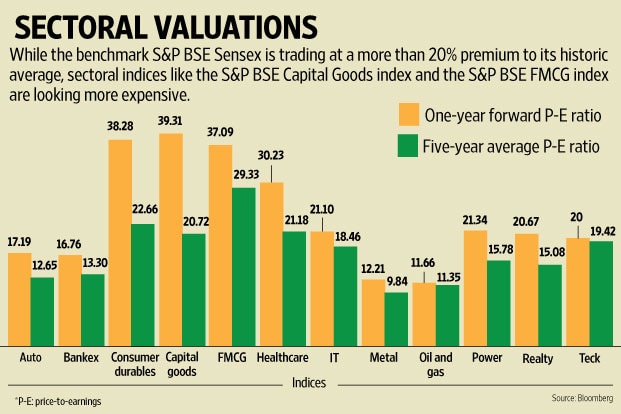

The Price-to-Earnings (P/E) ratio, a widely used valuation metric, has significant limitations.

-

Impact of Low Interest Rates: Low interest rates artificially inflate valuations across asset classes, including equities. When bond yields are low, investors are more willing to accept lower current earnings in exchange for future growth potential, pushing P/E ratios higher.

-

Industry-Specific P/E Ratios: P/E ratios vary significantly across industries. Comparing the P/E ratio of a technology company with that of a utility company is inherently flawed due to differing growth trajectories and risk profiles.

-

Future Earnings Growth Expectations: The P/E ratio reflects current earnings. However, future earnings growth expectations are crucial. A high P/E ratio can be justified if the company is anticipated to experience substantial earnings growth in the coming years.

-

Bullet points:

- P/E ratios vary across sectors; comparing them across different industries can be misleading.

- Interest rates significantly impact valuations; low rates can inflate P/E ratios.

- Long-term growth prospects matter more than current P/E; future earnings potential is key.

Beyond P/E: A Broader Perspective

A comprehensive valuation requires considering multiple metrics beyond the P/E ratio.

-

Price-to-Sales Ratio: The Price-to-Sales (P/S) ratio can provide insights, especially for companies with low or negative earnings. It compares a company's market capitalization to its revenue.

-

Cash Flow and Dividend Yields: Analyzing cash flow and dividend yields offers further valuable insights into a company's financial health and ability to generate returns for investors. Consistent cash flow and attractive dividend yields can offset concerns about high P/E ratios.

-

Limitations of Historical Data: Using only historical data to predict future performance is inherently risky. The future is uncertain, and past performance does not guarantee future results.

-

Bullet points:

- Diversify valuation approaches; use a range of metrics for a comprehensive assessment.

- Cash flow is a key indicator of financial health; it’s often a more stable metric than earnings.

- Dividend yields provide an income stream; they can be a significant part of total returns.

- Past performance is not indicative of future results; always factor in future growth potential.

The Impact of Low Interest Rates and Quantitative Easing

Low interest rates and quantitative easing (QE) have significantly influenced stock market valuations.

Low Rates Fuel Higher Valuations

Low interest rates make equities more attractive relative to bonds. When bond yields are low, investors seek higher returns elsewhere, pushing up demand for and valuations of equities.

-

Attractiveness of Equities: Low-interest-rate environments make the relatively higher returns offered by equities more appealing to investors.

-

Impact of Quantitative Easing: QE increases market liquidity, providing ample capital for investments, which can further inflate asset prices.

-

Central Bank Policies: Central bank policies significantly affect market sentiment. Expectations of continued low interest rates or further QE can support higher valuations.

-

Bullet points:

- Low rates make equities more appealing compared to fixed-income investments.

- QE increases market liquidity, leading to higher asset prices.

- Central bank actions affect investor confidence and influence market valuations.

Long-Term Growth Prospects and Future Earnings

Focusing solely on current valuations ignores the crucial aspect of future earnings growth potential.

Focusing on Future Growth Potential

Long-term investors should prioritize future growth potential over short-term valuation concerns.

-

Innovation and Technological Advancements: Innovation and technological advancements drive long-term economic growth and corporate earnings.

-

Global Economic Growth: Global economic growth significantly impacts corporate earnings. Strong global growth translates to higher corporate profits.

-

Disruptive Technologies: Disruptive technologies can reshape industries, creating new opportunities for growth and investment.

-

Bullet points:

- Long-term growth outweighs short-term valuation concerns.

- Innovation drives future earnings; invest in companies with strong innovation pipelines.

- Global economic growth impacts corporate profits; consider the global economic outlook.

- Disruptive technologies offer opportunities; identify and invest in companies leveraging these technologies.

Strategic Portfolio Allocation and Risk Management

Effective risk management is crucial in navigating market uncertainties.

Diversification and Asset Allocation

Diversification and strategic asset allocation are critical for long-term investment success.

-

Role of Bonds: Bonds and other asset classes can help reduce portfolio risk by providing diversification and reducing volatility.

-

Long-Term Investment Horizon: A long-term investment horizon allows investors to ride out market fluctuations and benefit from long-term growth.

-

Professional Investment Advice: Seeking professional investment advice can help investors develop and manage a suitable portfolio.

-

Bullet points:

- Diversify across asset classes; don't put all your eggs in one basket.

- A long-term horizon is crucial; avoid making impulsive decisions based on short-term market movements.

- Professional advice can help manage risk; consider working with a financial advisor.

- Rebalance your portfolio periodically; maintain your desired asset allocation over time.

Conclusion

While current stock market valuations may seem high, a nuanced perspective from BofA Global Research suggests they shouldn't deter long-term investors. By considering low interest rates, future earnings potential, and employing a well-diversified investment strategy, investors can effectively navigate these market conditions. Don't let perceived high stock market valuations prevent you from pursuing your investment goals. Consult with a financial advisor to develop a suitable long-term investment strategy tailored to your specific risk tolerance and financial objectives. Understanding the complexities of stock market valuations is key to successful long-term investing.

Featured Posts

-

Short Sweet And Scary A Stephen King Series For A Quick Binge

May 10, 2025

Short Sweet And Scary A Stephen King Series For A Quick Binge

May 10, 2025 -

Details Emerge In Racist Stabbing Death Of Man By Woman

May 10, 2025

Details Emerge In Racist Stabbing Death Of Man By Woman

May 10, 2025 -

High Potentials He Morgan Brother 5 Prominent Theories Regarding Davids Identity

May 10, 2025

High Potentials He Morgan Brother 5 Prominent Theories Regarding Davids Identity

May 10, 2025 -

Breaking Record Fentanyl Seizure Announced By Pam Bondi

May 10, 2025

Breaking Record Fentanyl Seizure Announced By Pam Bondi

May 10, 2025 -

2025 1078

May 10, 2025

2025 1078

May 10, 2025