Palantir Stock Rally: New Analyst Forecasts And Future Outlook

Table of Contents

Recent Analyst Upgrades Fueling the Palantir Stock Rally

Several analyst firms have recently upgraded their price targets and ratings for Palantir, significantly contributing to the recent stock rally. This positive sentiment shift reflects growing confidence in the company's prospects.

- Analyst A (Goldman Sachs): On October 26, 2023, Goldman Sachs raised its price target for PLTR from $10 to $15, citing strong Q3 earnings and increased contract wins. [Link to Goldman Sachs report - replace with actual link if available]

- Analyst B (Morgan Stanley): On November 1, 2023, Morgan Stanley upgraded its rating on Palantir from "Underweight" to "Equal-Weight," highlighting the company's progress in expanding its commercial customer base and the potential for increased profitability in the long term. [Link to Morgan Stanley report - replace with actual link if available]

- Overall Sentiment Shift: The overall sentiment among analysts covering PLTR has become more positive, with several firms issuing bullish reports in recent weeks. This positive coverage has undoubtedly fueled investor interest and contributed to the stock price increase.

Key Factors Driving the Palantir Stock Price Increase

The Palantir stock price increase isn't solely due to analyst upgrades. Several fundamental factors are driving this rally:

- Strong Q3 2023 Earnings Report: Palantir exceeded expectations in its Q3 2023 earnings report, showcasing strong revenue growth and improved margins. This positive performance boosted investor confidence. [Link to Palantir Q3 Earnings Report - replace with actual link if available]

- New Contract Wins: Significant new contract wins with both government and commercial clients are a major catalyst for the Palantir stock rally. These contracts demonstrate the growing demand for Palantir's data analytics and AI platforms. This includes substantial deals in the defense and intelligence sectors, as well as expansions in the commercial sector.

- Positive Developments in Key Product Areas: Improvements and increased adoption of Palantir's flagship products, Foundry and AIP (Artificial Intelligence Platform), have also contributed to the positive sentiment. These advancements showcase the company's ongoing innovation and its ability to adapt to the evolving needs of its clients.

- Increased Investor Confidence: The combination of strong earnings, new contracts, and product advancements has led to a significant increase in investor confidence in Palantir's long-term growth potential, further fueling the PLTR stock price increase.

Analyzing the Risks and Potential Downsides of Investing in PLTR

While the outlook for Palantir is positive, it's crucial to acknowledge the inherent risks associated with investing in PLTR stock:

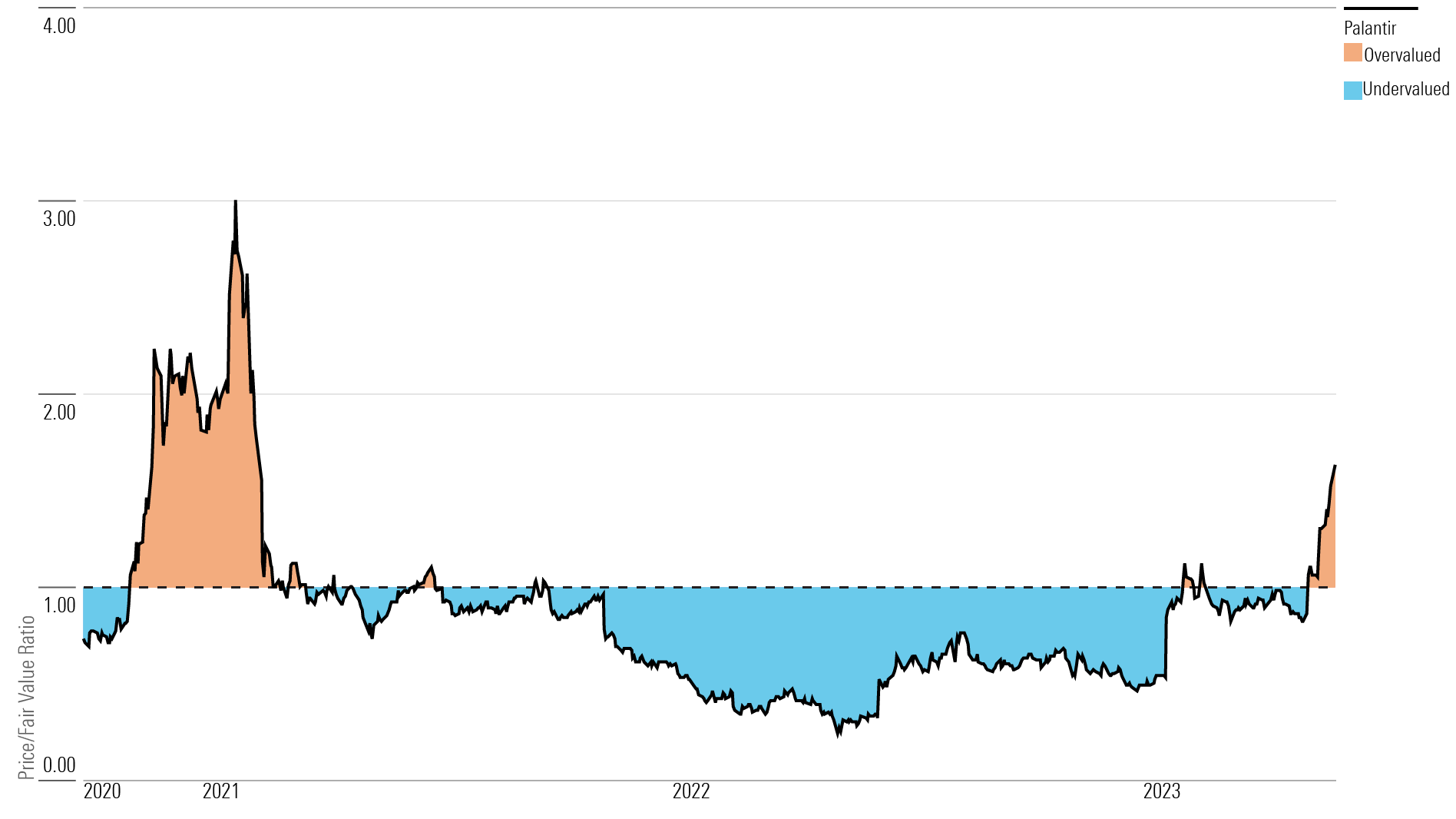

- High Valuation: Palantir's stock valuation remains relatively high compared to some of its competitors in the big data and AI market. This high valuation makes the stock susceptible to price corrections if the company fails to meet investor expectations.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending and potential regulatory hurdles.

- Competition in the Big Data and AI Market: The big data and AI market is highly competitive, with established players and emerging startups vying for market share. Intense competition could pressure Palantir's margins and growth prospects.

- Potential for Future Regulatory Scrutiny: Given Palantir's work with government agencies, the company is subject to potential regulatory scrutiny regarding data privacy and security.

Predicting the Future Outlook for Palantir Stock

Based on the recent analyst upgrades, strong earnings, and new contract wins, the short-term outlook for Palantir stock appears positive. Many analysts predict further price increases in the near future. However, the long-term outlook depends on several factors, including the company's ability to continue to secure new contracts, successfully expand its commercial business, and manage its high valuation.

- Short-Term Prediction: Based on current analyst forecasts, a continued, albeit potentially moderate, rise in the PLTR stock price is anticipated in the short term.

- Long-Term Growth Potential: Palantir's long-term growth potential hinges on its success in expanding its commercial clientele and leveraging its AI capabilities. The market for big data analytics and AI is vast, offering significant opportunities for growth.

- Factors Impacting Future Performance: Factors like increased competition, macroeconomic conditions, and regulatory changes could negatively impact future performance. Conversely, successful product innovation, strategic partnerships, and strong execution could drive further growth.

Conclusion

The recent Palantir stock rally is primarily driven by positive analyst forecasts, strong Q3 earnings, significant new contract wins, and growing confidence in the company's future. While the short-term outlook appears bullish, investors should carefully consider the inherent risks, including the high valuation and dependence on government contracts, before making any investment decisions. Conduct thorough research and stay informed about the latest news and analyst forecasts regarding the Palantir stock rally to optimize your investment strategy. Remember to consult a financial advisor before making any investment decisions related to Palantir stock (PLTR) or any other security.

Featured Posts

-

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 10, 2025

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 10, 2025 -

Indonesia Reserve Drop Rupiah Depreciation Impacts Foreign Exchange Holdings

May 10, 2025

Indonesia Reserve Drop Rupiah Depreciation Impacts Foreign Exchange Holdings

May 10, 2025 -

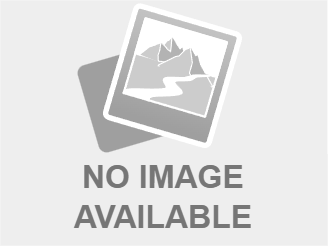

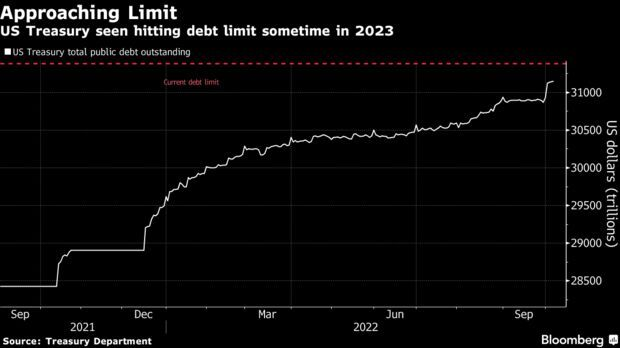

Us Debt Ceiling August Deadline Looms Treasury Warns

May 10, 2025

Us Debt Ceiling August Deadline Looms Treasury Warns

May 10, 2025 -

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025 -

Find Elizabeth Arden Skincare At Walmart Prices

May 10, 2025

Find Elizabeth Arden Skincare At Walmart Prices

May 10, 2025