Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Forecast

Table of Contents

Palantir's Technological Advantage and Innovation

Palantir's success is intrinsically linked to its technological prowess. Its cutting-edge platforms and commitment to innovation are key drivers in Palantir's path to a trillion-dollar market cap.

Data Integration and Advanced Analytics

Palantir's Foundry platform is a game-changer. It integrates disparate data sources – from structured databases to unstructured text and images – providing unparalleled insights. This capability is crucial across various sectors:

- Government: Foundry helps intelligence agencies analyze vast datasets to identify threats and improve national security.

- Healthcare: It enables faster drug discovery, personalized medicine, and improved patient outcomes through efficient data analysis.

- Finance: Foundry empowers financial institutions with risk management tools, fraud detection capabilities, and enhanced investment strategies using sophisticated data analytics.

These applications highlight the power of Palantir's data integration and advanced analytics capabilities, driving significant value for its clients and fueling its own growth trajectory. The use of big data, AI, and machine learning within Foundry is central to this success.

Artificial Intelligence (AI) and Machine Learning (ML) Advancements

Palantir is aggressively investing in AI and ML, developing AI-powered solutions that enhance its platform's capabilities. This focus on predictive analytics and autonomous systems is critical for future growth. Specific examples include:

- Automated anomaly detection: Identifying unusual patterns and potential threats in real-time.

- Predictive modeling: Forecasting future trends and outcomes based on historical data.

- AI-driven insights generation: Automating the process of extracting meaningful insights from complex datasets.

These advancements in AI and machine learning are not just incremental improvements; they represent a fundamental shift towards more efficient and insightful data analysis, solidifying Palantir's position in the market.

Focus on Cutting-Edge Technologies

Palantir isn't resting on its laurels. The company is actively exploring emerging technologies to further enhance its offerings and maintain its competitive edge:

- Quantum computing: Exploring the potential of quantum computing to drastically accelerate data processing and analysis.

- Blockchain technology: Investigating the use of blockchain for secure data management and transaction processing.

These ventures into quantum computing and blockchain technology position Palantir for future growth, showcasing its commitment to staying at the forefront of technological innovation and driving its path to a trillion-dollar market cap.

Expanding Market Penetration and Customer Acquisition

Technological superiority is only half the equation. Palantir's ability to expand its market penetration and acquire new customers is equally crucial.

Government Contracts and International Expansion

Palantir has established a strong presence within the government sector, securing significant contracts. Future growth will rely on:

- Expanding existing government contracts: Securing extensions and increasing the scope of existing agreements.

- International expansion: Targeting new government agencies and defense organizations globally.

This strategy, coupled with effective international expansion strategies, will provide substantial revenue streams.

Targeting New Verticals and Industries

Diversification is key. Palantir is actively targeting new verticals beyond the government sector:

- Healthcare: Providing solutions for drug discovery, clinical trials, and patient care.

- Finance: Offering fraud detection, risk management, and investment analysis tools.

This market diversification reduces reliance on any single sector, enhancing long-term growth potential and contributing significantly to Palantir’s path to a trillion-dollar market cap.

Strategic Partnerships and Acquisitions

Palantir employs a strategy of strategic partnerships and acquisitions to expand its reach and capabilities:

- Partnerships: Collaborating with technology providers and industry leaders to integrate complementary solutions.

- Acquisitions: Acquiring companies with specialized technologies or market expertise.

These strategic partnerships and mergers and acquisitions will further accelerate growth and bolster Palantir’s competitive advantage.

Financial Projections and Valuation Drivers

Achieving a trillion-dollar market cap necessitates robust financial performance.

Revenue Growth and Profitability

Palantir's historical revenue growth is impressive. Sustaining this growth, coupled with improving profitability, is paramount:

- Projecting Compound Annual Growth Rate (CAGR): Analyzing past performance to project future revenue growth over the next decade.

- Improving profit margins: Implementing cost-cutting measures and increasing efficiency to enhance profitability.

These financial projections need to demonstrate significant and sustainable revenue growth and profitability to support the trillion-dollar valuation.

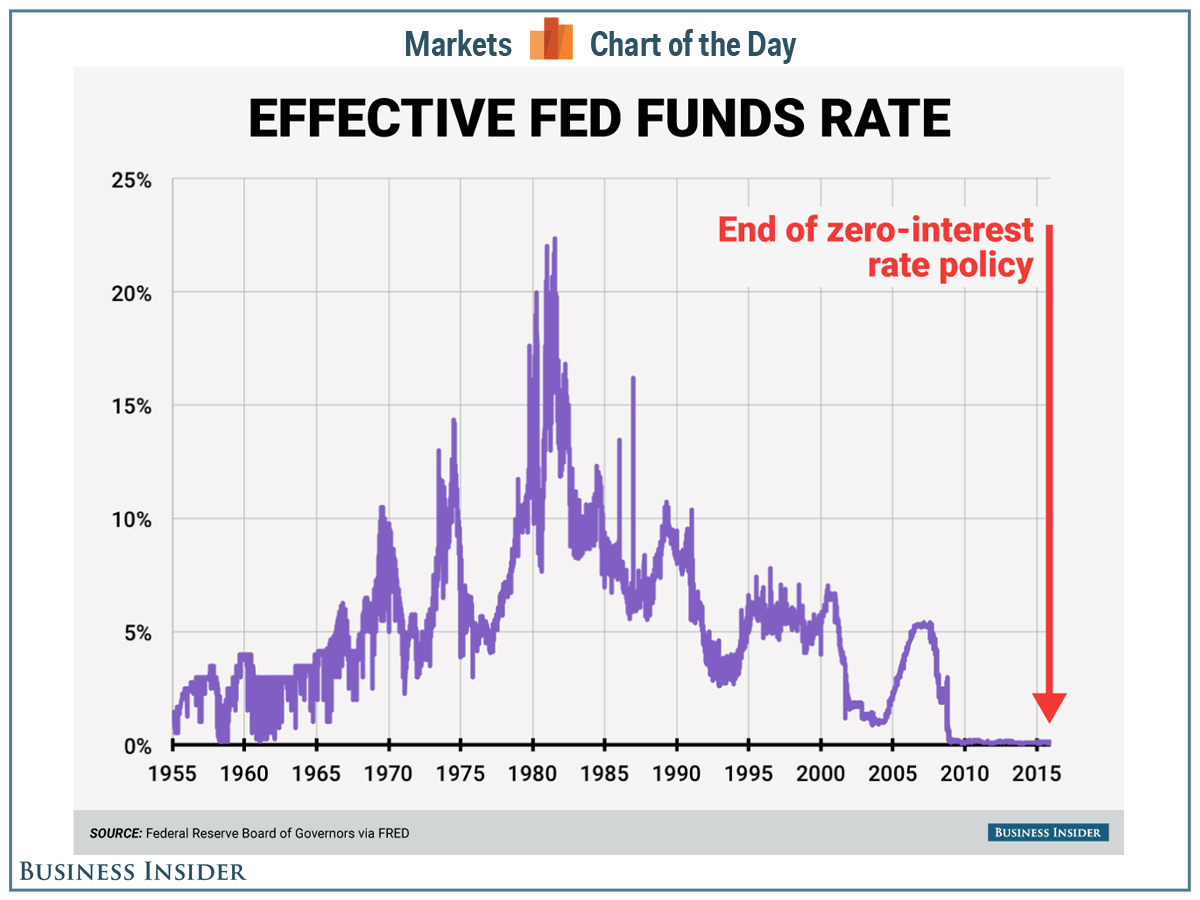

Investor Sentiment and Market Conditions

Investor confidence and broader market conditions significantly influence Palantir's valuation:

- Positive investor sentiment: Maintaining strong investor confidence through consistent performance and clear communication.

- Favorable market conditions: Benefiting from a positive economic climate and investor appetite for technology stocks.

Sustaining positive investor sentiment and navigating market fluctuations are crucial elements influencing Palantir's path to a trillion-dollar market cap.

Comparison to Competitors

Assessing Palantir's competitive landscape is essential:

- Identifying key competitors: Analyzing the strengths and weaknesses of major competitors in the data analytics space.

- Highlighting Palantir's competitive advantage: Emphasizing Palantir's unique technological capabilities and market position.

This comparison reveals Palantir’s competitive advantage and its prospects in the long run.

Conclusion: Palantir's Path to a Trillion-Dollar Market Cap: A 2030 Forecast

Palantir's journey towards a trillion-dollar market cap by 2030 depends on a combination of factors: its technological leadership, its ability to expand into new markets, and the sustained strength of its financial performance. The company's commitment to innovation, particularly in AI and emerging technologies, combined with a strategic approach to market expansion and customer acquisition, positions it well for future growth. However, maintaining investor confidence and navigating market fluctuations remain crucial. To further understand Palantir's potential, research its ongoing developments and consider exploring resources dedicated to Palantir's future and the potential for achieving this ambitious valuation. Understanding Palantir's growth potential is key for anyone interested in investing in Palantir or simply following the remarkable evolution of this data analytics powerhouse.

Featured Posts

-

Post La Fire Housing Crisis Are Landlords Exploiting Renters

May 10, 2025

Post La Fire Housing Crisis Are Landlords Exploiting Renters

May 10, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Betting Trends

May 10, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Betting Trends

May 10, 2025 -

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025 -

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025 -

Stock Market Prediction Will These 2 Stocks Beat Palantir In 3 Years

May 10, 2025

Stock Market Prediction Will These 2 Stocks Beat Palantir In 3 Years

May 10, 2025

Latest Posts

-

Public Confrontation Joanna Page Calls Out Wynne Evans Performance On Bbc

May 10, 2025

Public Confrontation Joanna Page Calls Out Wynne Evans Performance On Bbc

May 10, 2025 -

Data Breach Nhs Staff Allegedly Accessed Nottingham Stabbing Victim Records Illegally

May 10, 2025

Data Breach Nhs Staff Allegedly Accessed Nottingham Stabbing Victim Records Illegally

May 10, 2025 -

Wynne And Joanna All At Sea Book Review And Discussion

May 10, 2025

Wynne And Joanna All At Sea Book Review And Discussion

May 10, 2025 -

Dispute On Bbc Show Joanna Page Vs Wynne Evans

May 10, 2025

Dispute On Bbc Show Joanna Page Vs Wynne Evans

May 10, 2025 -

Exploring The Themes In Wynne And Joanna All At Sea

May 10, 2025

Exploring The Themes In Wynne And Joanna All At Sea

May 10, 2025