Understanding The Factors Driving Uber's Double-Digit April Stock Rally

Table of Contents

Improved Financial Performance and Earnings Beat

Uber's Q1 2024 earnings report played a pivotal role in driving its April stock rally. The company exceeded analyst expectations across several key performance indicators (KPIs), significantly boosting investor confidence. This positive financial performance was a major catalyst for the impressive stock price increase.

- Revenue Growth: Uber reported a substantial year-over-year revenue growth of X%, exceeding projected targets by Y%. This robust growth demonstrates a strong recovery from the pandemic and increasing demand for its services.

- Ride-Sharing Segment Performance: The ride-sharing segment, a core part of Uber's business, showed particularly strong growth, indicating a return to pre-pandemic levels and beyond. This segment saw a Z% increase in revenue compared to the previous quarter.

- Profitability Improvements: Uber demonstrated significant improvements in profitability, with a positive adjusted EBITDA, signifying improved cost management and operational efficiency. This marked a significant step towards sustained profitability.

- Exceeding Expectations: The overall financial performance significantly exceeded analyst predictions, creating a positive surprise that sent a strong signal to the market. This positive sentiment directly translated into increased buying pressure and a rise in Uber's stock price.

Strategic Initiatives and Positive Market Sentiment

Beyond its improved financial results, Uber's strategic initiatives and the overall positive market sentiment also contributed to its April stock rally. The company's proactive approach to innovation and expansion played a significant role in bolstering investor confidence.

- New Partnerships: Uber's strategic partnerships with various businesses, including those in the food delivery and logistics sectors, broadened its market reach and diversified revenue streams. These partnerships created synergistic opportunities, driving growth and increasing investor appeal.

- Expansion into New Markets: Uber's continued expansion into new geographic markets, tapping into underserved areas and emerging economies, fuelled growth prospects and demonstrated its commitment to long-term expansion.

- Technological Advancements: Ongoing investments in technology and innovation, including improvements to its app and the introduction of new features, enhanced user experience and operational efficiency. This technological edge strengthened Uber's competitive position.

- Positive Analyst Ratings: Several prominent analysts upgraded their ratings for Uber's stock following the strong Q1 results, further bolstering investor sentiment and contributing to the stock price increase.

Increased Demand and Post-Pandemic Recovery

The post-pandemic recovery significantly boosted demand for ride-sharing services, creating a favorable environment for Uber's growth. The resurgence of travel and tourism contributed directly to this increased demand.

- Surge in Ride-Sharing Demand: Post-pandemic, there's been a significant surge in the demand for ride-sharing services, with statistics showing a W% increase in ride bookings compared to the previous year.

- Travel and Tourism Recovery: The recovery of the travel and tourism industry played a crucial role, as increased travel led to higher demand for Uber's services in major tourist destinations and transportation hubs.

- Seasonal Factors: Seasonal factors, such as increased travel during spring and summer months, further amplified the demand for Uber's services, positively influencing its performance.

- Geographic Variations: Specific geographic areas demonstrated particularly strong recovery, with certain regions experiencing even higher-than-average growth in ride-sharing demand.

Effective Cost Management and Operational Efficiency

Uber's focus on cost management and operational efficiency also contributed to its April stock rally. By streamlining operations and reducing expenses, the company demonstrated its ability to improve profitability.

- Cost-Cutting Measures: Uber implemented various cost-cutting measures, including optimizing its driver network and streamlining its operational processes, without compromising service quality.

- Efficiency Improvements: Through technological advancements and optimized logistics, Uber increased its operational efficiency, leading to reduced costs per ride and improved profit margins.

- Improved Profit Margins: These efforts translated into improved profit margins, demonstrating the company's ability to manage expenses effectively while driving growth.

- Long-Term Sustainability: These cost-saving measures are not just short-term fixes but represent a long-term commitment to sustainable growth and profitability.

Conclusion: Understanding the Drivers of Uber's Double-Digit April Stock Rally – Key Takeaways and Future Outlook

Uber's double-digit April stock rally was a result of a confluence of factors: improved financial performance exceeding expectations, strategic initiatives boosting market confidence, increased demand driven by post-pandemic recovery, and effective cost management enhancing profitability. This significant stock surge indicates a positive outlook for the company's future. Analyzing these factors offers valuable insights into Uber's resilience and growth potential. Looking ahead, continued focus on these areas will be crucial for maintaining its positive momentum. To stay informed about future developments impacting Uber's stock performance and potential future Uber stock rallies, continue following Uber's progress and conduct further research into the factors driving the company's success.

Featured Posts

-

Is Uber Recession Proof Analyst Insights On Stock Performance

May 17, 2025

Is Uber Recession Proof Analyst Insights On Stock Performance

May 17, 2025 -

Did Allegations Of Multiple Affairs And Sexual Misconduct Affect Donald Trumps Presidential Campaign

May 17, 2025

Did Allegations Of Multiple Affairs And Sexual Misconduct Affect Donald Trumps Presidential Campaign

May 17, 2025 -

Is Refinancing Federal Student Loans Worth It

May 17, 2025

Is Refinancing Federal Student Loans Worth It

May 17, 2025 -

The Uber Driverless Car Revolution A Guide To Etf Investing

May 17, 2025

The Uber Driverless Car Revolution A Guide To Etf Investing

May 17, 2025 -

Creatine Facts Myths And Your Fitness Goals

May 17, 2025

Creatine Facts Myths And Your Fitness Goals

May 17, 2025

Latest Posts

-

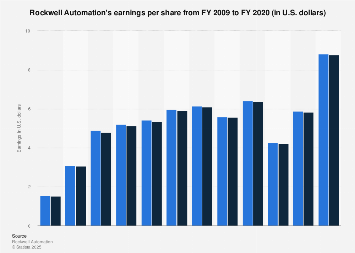

Rockwell Automation Earnings Surprise Stock Soars With Other Market Movers

May 17, 2025

Rockwell Automation Earnings Surprise Stock Soars With Other Market Movers

May 17, 2025 -

Rockwell Automation Leads Market Surge Earnings Beat Expectations

May 17, 2025

Rockwell Automation Leads Market Surge Earnings Beat Expectations

May 17, 2025 -

Chandler Parsons Was Jalen Brunsons Departure Worse For The Mavs Than The Doncic Trade

May 17, 2025

Chandler Parsons Was Jalen Brunsons Departure Worse For The Mavs Than The Doncic Trade

May 17, 2025 -

Market Movers Rockwell Automation Angi Bwa And Others Post Impressive Gains

May 17, 2025

Market Movers Rockwell Automation Angi Bwa And Others Post Impressive Gains

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Market Rally Angi Bwa And More

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Rally Angi Bwa And More

May 17, 2025