Rockwell Automation Leads Market Surge: Earnings Beat Expectations

Table of Contents

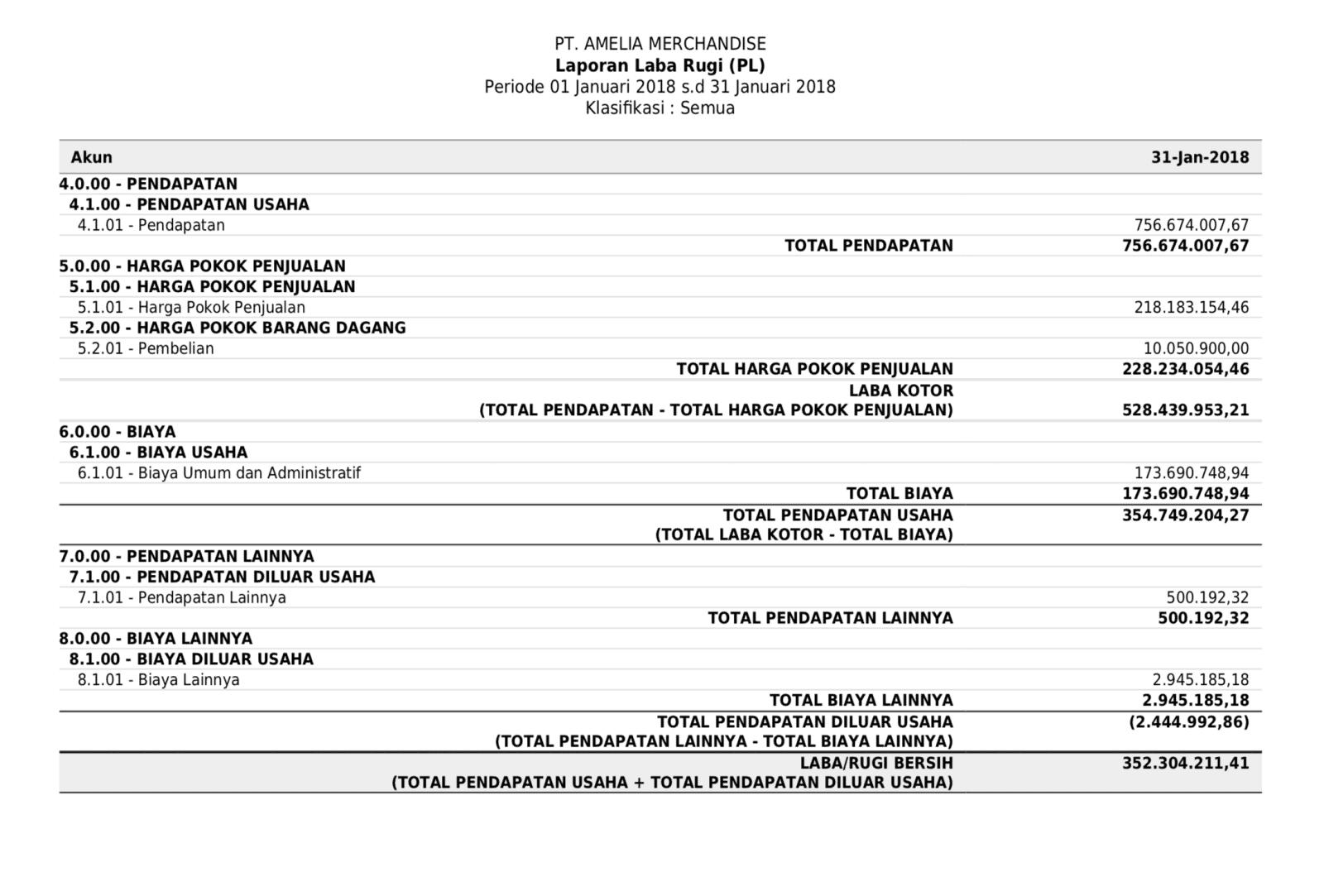

Strong Q[Quarter] Earnings: A Detailed Look at the Numbers

Rockwell Automation's Q[Quarter] earnings report showcased a truly impressive performance. The company significantly outperformed analyst expectations, demonstrating robust revenue growth and a substantial increase in earnings per share (EPS). This financial success paints a positive picture of the company's current market position and future prospects within the industrial automation sector.

Let's examine the key figures:

- EPS: [Insert Specific EPS Figure] representing a [Percentage Change]% increase compared to the same quarter last year and exceeding analyst predictions of [Analyst Prediction].

- Revenue Growth: Total revenue reached [Insert Revenue Figure], showcasing a [Percentage Change]% increase year-over-year. This growth can be largely attributed to [mention key contributing factors, e.g., strong demand in specific sectors].

- Revenue Breakdown: [Insert a breakdown of revenue by segment if available, e.g., Industrial Automation segment grew by X%, while Process Solutions grew by Y%].

- Order Backlog: A healthy increase in the order backlog indicates strong future demand and continued growth momentum for Rockwell Automation. [Insert specific data on order backlog].

[Insert a chart or graph visually representing EPS, revenue growth, and order backlog data]. This visual representation will reinforce the key financial highlights and enhance reader understanding. The strong financial performance solidified Rockwell Automation's position as a leader in industrial automation stocks.

Driving Factors Behind Rockwell Automation's Success

Rockwell Automation's outstanding Q[Quarter] results weren't a fluke. Several key factors contributed to this market surge:

- Increased Demand for Automation Solutions: The ongoing trend of automation across various sectors, particularly automotive, food and beverage, and logistics, has significantly boosted demand for Rockwell Automation's products and services.

- Technological Innovation: Rockwell Automation's commitment to research and development, leading to innovative product launches and enhanced software solutions, has given them a competitive edge. [Mention specific examples of successful product launches or technological advancements].

- Strategic Partnerships and Collaborations: Collaborations with key players in the industry have expanded Rockwell Automation's reach and market access, facilitating growth and reinforcing its position as a key player.

- Operational Efficiency: Effective cost management and streamlined operational processes have maximized profitability and contributed to the impressive financial results.

These strategic initiatives and favorable market conditions have all worked in tandem to propel Rockwell Automation's success.

Implications for the Industrial Automation Market

Rockwell Automation's strong performance has significant implications for the broader industrial automation market. The results have:

- Boosted Investor Confidence: The strong earnings have increased investor confidence in the industrial automation sector as a whole, potentially leading to further investment and growth.

- Stimulated Market Growth: Rockwell Automation's success is a strong indicator of the continued growth trajectory within the industrial automation industry.

- Influenced Competitor Strategies: Competitors are likely to re-evaluate their strategies in response to Rockwell Automation's market dominance.

- Shaped Future Market Trends: Rockwell Automation's success highlights the importance of innovation, strategic partnerships, and operational efficiency in navigating the evolving industrial automation landscape.

The company's performance provides a valuable insight into the future direction of the industry.

Rockwell Automation Stock Performance and Investor Sentiment

The strong Q[Quarter] earnings had a positive impact on Rockwell Automation's stock price. [Insert details on stock price movements before, during, and after the earnings announcement]. Analyst ratings and price targets generally reflect a positive outlook. [Include specifics on analyst ratings and price targets if available]. Investor commentary and media coverage have largely been positive, highlighting the strong performance and future growth potential. Increased trading volume further underscores the market's significant reaction to the news.

Conclusion: Rockwell Automation's Continued Market Leadership

Rockwell Automation's exceptional Q[Quarter] earnings, driven by strong market demand, technological innovation, and strategic initiatives, solidify its position as a leader in the industrial automation market. The company's success offers valuable insights into the industry's future growth and underscores the potential for continued expansion within the sector. To stay informed about Rockwell Automation's future performance and the evolving landscape of industrial automation, continue to follow industry news and consider accessing resources such as [insert links to relevant resources, such as financial news websites or Rockwell Automation's investor relations page]. Investing in understanding Rockwell Automation and its continued success is a key to understanding the future of industrial automation.

Featured Posts

-

Laporan Keuangan Jenis Pentingnya Dan Aplikasinya Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Aplikasinya Untuk Bisnis Anda

May 17, 2025 -

Could Eminem Help Resurrect A Wnba Team In Detroit

May 17, 2025

Could Eminem Help Resurrect A Wnba Team In Detroit

May 17, 2025 -

Seattle Mariners Dominate Marlins With 14 0 First Inning Rout

May 17, 2025

Seattle Mariners Dominate Marlins With 14 0 First Inning Rout

May 17, 2025 -

Severances Lumon Industries A Look At Its Apple Like Corporate Design

May 17, 2025

Severances Lumon Industries A Look At Its Apple Like Corporate Design

May 17, 2025 -

Acidente Com Onibus Universitario Ao Menos Numero Feridos

May 17, 2025

Acidente Com Onibus Universitario Ao Menos Numero Feridos

May 17, 2025

Latest Posts

-

Imerominies And Zeygaria Nba Playoffs Ola Osa Prepei Na K Serete

May 17, 2025

Imerominies And Zeygaria Nba Playoffs Ola Osa Prepei Na K Serete

May 17, 2025 -

Brunson Expected Sunday Ankle Sprain Recovery Update

May 17, 2025

Brunson Expected Sunday Ankle Sprain Recovery Update

May 17, 2025 -

Nba Playoffs Pliris Enimerosi Gia Zeygaria Kai Agones

May 17, 2025

Nba Playoffs Pliris Enimerosi Gia Zeygaria Kai Agones

May 17, 2025 -

Jalen Brunson Injury Update Expected Back In Action Sunday

May 17, 2025

Jalen Brunson Injury Update Expected Back In Action Sunday

May 17, 2025 -

Close Call For Knicks Examining The Overtime Loss

May 17, 2025

Close Call For Knicks Examining The Overtime Loss

May 17, 2025