Is Refinancing Federal Student Loans Worth It?

Table of Contents

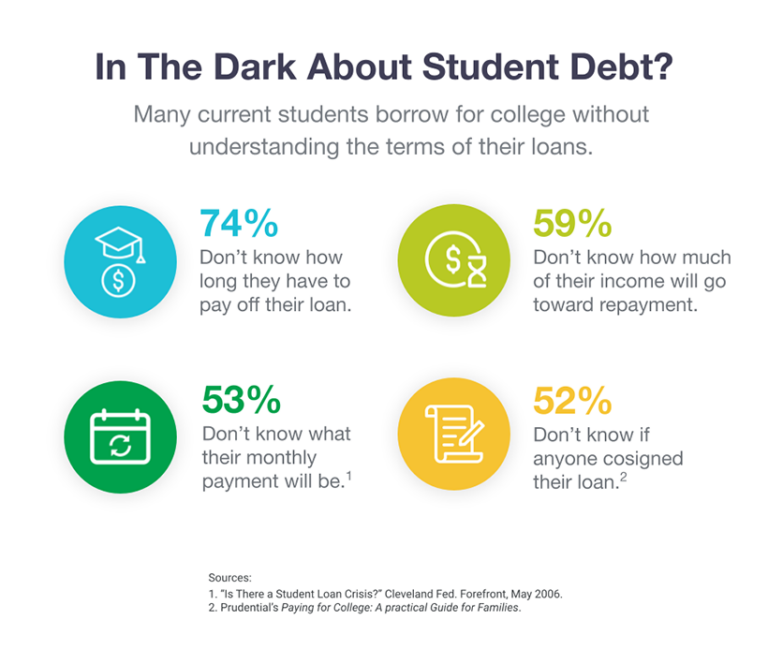

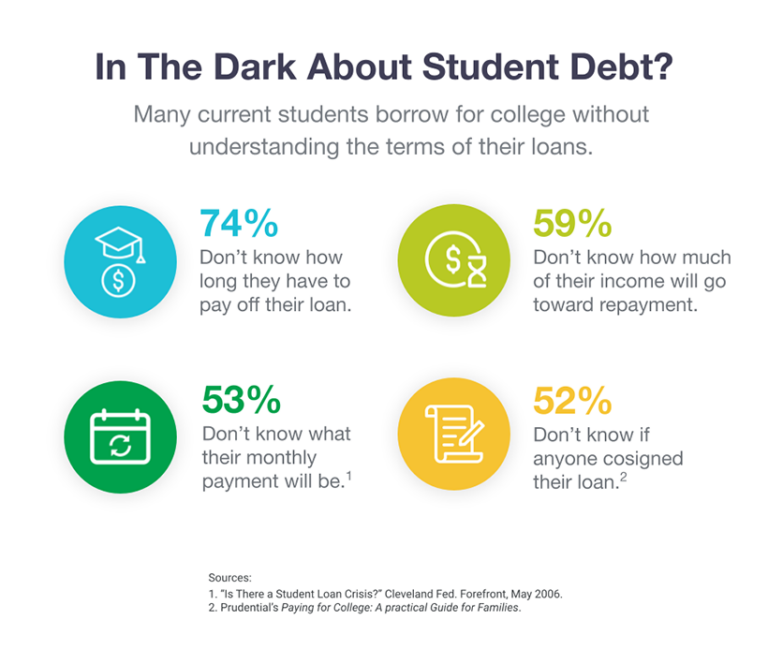

Millions of Americans are burdened by student loan debt. Refinancing federal student loans presents a potential solution, offering the allure of lower monthly payments and a reduced overall interest rate. However, it's a decision demanding careful consideration. This guide will help you determine if refinancing your federal student loans is the right choice for your unique financial situation.

Potential Benefits of Refinancing Federal Student Loans

Lower Interest Rates

Refinancing your federal student loans can significantly lower your interest rate, resulting in substantial savings over the life of the loan. Federal student loan interest rates are often higher than those offered by private lenders for refinancing.

- Comparison: Average interest rates on federal student loans typically range from 5% to 8%, while private refinancing options might offer rates as low as 3% to 6%, depending on your creditworthiness.

- Influencing Factors: Several factors impact your interest rate, including your credit score, the loan amount, and whether you have a co-signer. A higher credit score generally qualifies you for a lower rate. A larger loan amount might also lead to a slightly higher rate.

- Savings Example: Let's say you have a $50,000 federal student loan with a 7% interest rate. Refinancing to a 4% interest rate could save you thousands of dollars in interest payments over the loan's term. Use an online student loan refinance calculator to determine your potential savings.

Simplified Repayment

Refinancing consolidates multiple federal student loans into a single, streamlined monthly payment. This simplifies your finances and improves budgeting.

- Convenience: Managing one monthly payment instead of several is significantly more convenient and reduces the risk of missed payments.

- Budgeting: A single, predictable payment makes budgeting easier, allowing for better financial planning and debt management.

- Organization: Simplified repayment improves financial organization, making it easier to track your progress toward paying off your student loans.

Shorter Loan Term

Refinancing allows you to potentially shorten your loan term, enabling faster debt payoff.

- Trade-offs: A shorter loan term results in higher monthly payments but significantly reduces the total interest paid. Conversely, a longer term lowers monthly payments but increases the total interest paid over the life of the loan.

- Example: Choosing a 10-year repayment plan instead of a 15-year plan will mean higher monthly payments but will save you considerable interest in the long run.

- Financial Goals: Consider your financial situation and goals. Are you prioritizing faster debt repayment or lower monthly payments?

Potential Drawbacks of Refinancing Federal Student Loans

Loss of Federal Protections

A crucial drawback is the loss of federal student loan protections when refinancing.

- Income-Driven Repayment (IDR) Plans: IDR plans tie your monthly payments to your income, providing crucial support during financial hardship. These are lost with refinancing.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments during periods of financial difficulty; they are not available with private loans.

- Consequences of Hardship: Without these federal protections, financial hardship can lead to default and severely damage your credit.

Higher Interest Rates (for some borrowers)

If you have a low credit score, you may receive a higher interest rate from a private lender than your current federal rate.

- Credit Score Importance: A good credit score is essential for securing favorable interest rates on refinancing.

- Pre-qualification and Rate Shopping: Pre-qualify with multiple lenders to compare rates without impacting your credit score. Shop around to find the best offer.

- Financial Health: Work on improving your credit score before applying for refinancing to enhance your chances of getting a lower interest rate.

Prepayment Penalties

Some private lenders impose prepayment penalties if you pay off your loan early.

- Fine Print: Carefully review the terms and conditions of each lender's offer to avoid unexpected penalties.

- Comparison: Compare different lenders' terms and conditions to find one without prepayment penalties.

- Transparency: Choose lenders who are transparent about their fees and charges.

When Refinancing Federal Student Loans Makes Sense

Strong Credit Score

A strong credit score significantly improves your chances of obtaining a favorable interest rate.

- Good Credit Range: A credit score above 700 is generally considered good for refinancing.

- Credit Report Check: Check your credit report for errors and take steps to improve your score if needed.

- Credit Building: Building good credit takes time; consider strategies such as paying bills on time and managing credit responsibly.

Stable Income

Lenders require consistent and reliable income to qualify for refinancing.

- Demonstrating Stability: Provide proof of consistent income, such as pay stubs or tax returns.

- Employment History: A stable employment history strengthens your application.

- Financial Responsibility: A consistent income shows lenders you are financially responsible and capable of handling loan repayments.

Lower Interest Rate Potential

Refinancing only makes sense if you can secure a significantly lower interest rate than your current federal loan rate.

- Comparison Shopping: Compare rates from multiple lenders to ensure you're getting the best possible deal.

- Cost-Benefit Analysis: Carefully analyze the potential savings against the loss of federal protections.

- Financial Advice: Consider consulting a financial advisor to determine if refinancing aligns with your financial goals.

Conclusion

Refinancing federal student loans can be a beneficial strategy, but it's vital to weigh the advantages against the potential drawbacks. The loss of federal protections is a serious consideration. Before deciding, assess your credit score, income stability, and the potential interest rate savings. Use online calculators and compare offers from different lenders to understand your options.

Call to Action: Carefully evaluate if refinancing your federal student loans is the right choice for you. Explore different lenders, compare rates, and understand the terms before making a decision. Don't hesitate to seek professional financial advice regarding refinancing federal student loans.

Featured Posts

-

Josh Harts Injury Status Will He Play Against The Celtics On February 23rd

May 17, 2025

Josh Harts Injury Status Will He Play Against The Celtics On February 23rd

May 17, 2025 -

Miami Open 2025 Djokovic Va Alcaraz Cung Nhanh Dau Ai Se Vao Chung Ket

May 17, 2025

Miami Open 2025 Djokovic Va Alcaraz Cung Nhanh Dau Ai Se Vao Chung Ket

May 17, 2025 -

Iga Svjontek Dominantna Protiv Ukrajinske Teniserke Rezultati I Vesti

May 17, 2025

Iga Svjontek Dominantna Protiv Ukrajinske Teniserke Rezultati I Vesti

May 17, 2025 -

College Funding Parents Reduced Anxiety Continued Student Loan Dependence

May 17, 2025

College Funding Parents Reduced Anxiety Continued Student Loan Dependence

May 17, 2025 -

Claim Your Free Cowboy Bebop Fortnite Items Before They Re Gone

May 17, 2025

Claim Your Free Cowboy Bebop Fortnite Items Before They Re Gone

May 17, 2025

Latest Posts

-

Eid Al Fitr 2025 Dubai Travel Advisory And Expected Passenger Surge At Dxb

May 17, 2025

Eid Al Fitr 2025 Dubai Travel Advisory And Expected Passenger Surge At Dxb

May 17, 2025 -

New York Knicks Tom Thibodeau On 37 Point Loss A Call For Greater Resolve

May 17, 2025

New York Knicks Tom Thibodeau On 37 Point Loss A Call For Greater Resolve

May 17, 2025 -

Nba Playoffs Imerominies Agonon Kai Analysi Ton Zeygarion

May 17, 2025

Nba Playoffs Imerominies Agonon Kai Analysi Ton Zeygarion

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Odds Predictions And Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Odds Predictions And Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Betting

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Betting

May 17, 2025