Rockwell Automation Earnings Surprise: Stock Soars With Other Market Movers

Table of Contents

Rockwell Automation's Q4 Earnings Beat Expectations

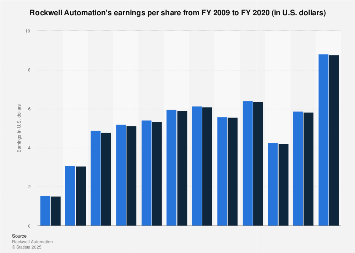

Rockwell Automation's Q4 2023 earnings report significantly outperformed expectations, showcasing robust financial performance and solidifying its position within the industrial automation industry.

Key Performance Indicators Exceeded Forecasts

- Revenue Growth: Revenue growth was exceptionally strong, surpassing analyst projections by a significant margin. The company reported a [Insert Percentage]% increase in revenue compared to the same quarter last year, reaching $[Insert Revenue Figure] in total revenue. This strong growth signals a high demand for Rockwell Automation's products and services.

- Earnings Per Share (EPS): EPS also dramatically exceeded estimates, reaching $[Insert EPS Figure], significantly higher than the anticipated $[Insert Analyst Estimate]. This demonstrates the company's effective cost management and strong operational efficiency.

- Strong Sectoral Growth: Key industrial sectors like automotive and food & beverage contributed significantly to the positive results. Increased investment in automation within these sectors drove demand for Rockwell Automation's solutions.

Factors Contributing to the Positive Results

Several factors contributed to Rockwell Automation's outstanding Q4 performance:

- Increased Automation Demand: A global surge in demand for automation solutions across various industries fueled substantial growth. Businesses are increasingly investing in automation to improve efficiency, productivity, and competitiveness.

- Strategic Initiative Success: The successful execution of Rockwell Automation's strategic initiatives, focused on innovation and market expansion, played a crucial role in exceeding expectations.

- Robust Backlog: A strong backlog indicates continued future growth and provides a solid foundation for sustained performance in subsequent quarters.

- Product Innovation: The introduction of innovative products and technological advancements has enhanced Rockwell Automation's competitiveness and attracted new customers.

- Operational Efficiency: Effective cost management and operational efficiency contributed to improved profit margins and boosted the bottom line.

Impact on Rockwell Automation's Stock Price and Market Position

The positive earnings report had an immediate and significant impact on Rockwell Automation's stock price and market position.

Significant Stock Price Increase Post-Earnings

Following the release of the Q4 earnings report, Rockwell Automation's stock price experienced a substantial [Insert Percentage]% increase, closing at $[Insert Stock Price]. This surge significantly outperformed the overall market's performance on that day, indicating strong investor confidence. Trading volume also increased dramatically, further emphasizing investor interest.

Rockwell Automation's Strengthened Position in the Industrial Automation Sector

The Q4 results have strengthened Rockwell Automation's position as a leader in the industrial automation sector. Its competitive advantage stems from its comprehensive portfolio of automation solutions, strong customer relationships, and commitment to technological innovation. [Mention any recent acquisitions or partnerships that contributed to the success]. This positions Rockwell Automation favorably against competitors for continued market share gains.

Investor Sentiment and Future Outlook for Rockwell Automation

The market reacted positively to Rockwell Automation's earnings surprise, with analysts expressing bullish sentiment.

Positive Analyst Ratings and Price Target Adjustments

Following the earnings announcement, several financial analysts upgraded their ratings on Rockwell Automation stock and adjusted their price targets upwards. [Insert examples of analyst ratings and price targets]. This reflects a positive outlook on the company's future prospects.

Potential Risks and Challenges

Despite the positive outlook, Rockwell Automation faces potential challenges, including:

- Supply Chain Disruptions: Ongoing supply chain disruptions could impact production and delivery timelines.

- Economic Slowdown: A potential economic slowdown could reduce demand for industrial automation solutions.

It's crucial to acknowledge these factors when assessing Rockwell Automation's future performance.

Long-Term Growth Prospects

Rockwell Automation's long-term strategy focuses on expanding its market share, continuing product innovation, and leveraging the growing demand for automation. The company's strong backlog and strategic initiatives suggest robust long-term growth potential within the dynamic industrial automation market. Continued investments in research and development, coupled with strategic acquisitions, will further enhance its competitive edge.

Conclusion

Rockwell Automation's unexpected earnings surge has significantly boosted investor confidence and propelled its stock price higher, solidifying its position as a key player in the industrial automation market. While challenges remain, the company's strong performance and positive outlook suggest promising growth prospects. Understanding Rockwell Automation's earnings reports and market movements is crucial for informed investment decisions. Stay informed on Rockwell Automation's performance and the evolving landscape of the industrial automation sector. Follow our blog for more updates on Rockwell Automation and other key market movers.

Featured Posts

-

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Channel And Time

May 17, 2025

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Channel And Time

May 17, 2025 -

Melania Trump Current Status And Role As Former First Lady

May 17, 2025

Melania Trump Current Status And Role As Former First Lady

May 17, 2025 -

Alkaras Propusta Finale Barselone Zbog Povrede Rune Slavi

May 17, 2025

Alkaras Propusta Finale Barselone Zbog Povrede Rune Slavi

May 17, 2025 -

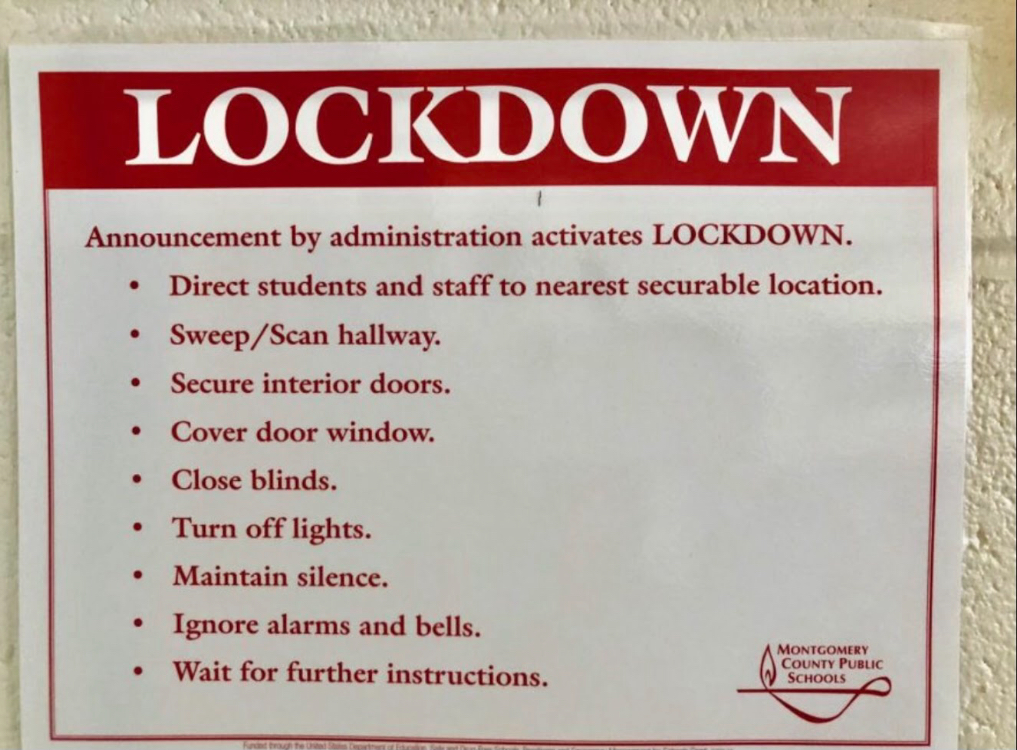

The Evolution Of Lockdown Protocols In Florida Schools A Generational Perspective

May 17, 2025

The Evolution Of Lockdown Protocols In Florida Schools A Generational Perspective

May 17, 2025 -

Dominacija Ige Svjontek Analiza Meca Protiv Ukrajinke

May 17, 2025

Dominacija Ige Svjontek Analiza Meca Protiv Ukrajinke

May 17, 2025

Latest Posts

-

Best Deals On Boston Celtics Finals Gear Under 20

May 17, 2025

Best Deals On Boston Celtics Finals Gear Under 20

May 17, 2025 -

Affordable Boston Celtics Finals Gear Shop Now Under 20

May 17, 2025

Affordable Boston Celtics Finals Gear Shop Now Under 20

May 17, 2025 -

Grab Boston Celtics Championship Gear Now Prices Under 20

May 17, 2025

Grab Boston Celtics Championship Gear Now Prices Under 20

May 17, 2025 -

Limited Time Offer Boston Celtics Finals Gear Under 20

May 17, 2025

Limited Time Offer Boston Celtics Finals Gear Under 20

May 17, 2025 -

Analyzing The Knicks Performance The Brunson Factor And Beyond

May 17, 2025

Analyzing The Knicks Performance The Brunson Factor And Beyond

May 17, 2025