Trump's Tax Bill: A Divided Congress And The Future Of The Economy

Table of Contents

Key Provisions of Trump's Tax Bill

Trump's Tax Bill, officially known as the Tax Cuts and Jobs Act, significantly altered the American tax code. Its provisions impacted corporations, individuals, and pass-through businesses, sparking considerable debate about its overall effectiveness.

Corporate Tax Cuts

The most significant change was the slashing of the corporate tax rate from 35% to 21%. Proponents argued this would stimulate economic growth by encouraging investment and job creation.

- Increased Corporate Profits: Many companies did indeed experience increased profits following the tax cut. However, the extent to which these profits translated into increased investment and wages remains a subject of ongoing debate.

- Repatriation of Overseas Funds: The bill incentivized companies to bring back billions of dollars in overseas profits, temporarily boosting the economy.

- Impact on Investment and Job Creation: While some companies increased investment and hiring, others used the extra capital for stock buybacks or to increase shareholder dividends, leading to criticisms that the intended job creation effects were limited. The Congressional Budget Office, for example, projected only modest job growth as a result.

Individual Tax Cuts

The bill also included various changes to individual income taxes, impacting different income groups differently.

- Changes in Tax Brackets: While some tax brackets were lowered, the standard deduction was also increased, benefiting many taxpayers.

- Child Tax Credit Expansion: The child tax credit was significantly expanded, providing more relief to families with children.

- Temporary Provisions: It's important to note that several individual tax cuts were temporary, meaning tax rates reverted to higher levels after a few years, leading to a tax increase for many in subsequent years. This temporary nature fueled criticism of the bill's long-term sustainability and fairness. The impact on different income levels varied greatly; some experienced significant tax savings, while others saw little to no change, highlighting concerns about income inequality.

Pass-Through Business Deductions

The bill also modified tax deductions for pass-through businesses, such as sole proprietorships, partnerships, and S corporations.

- Increased Deductions: These businesses were allowed to deduct up to 20% of their qualified business income (QBI). This provision aimed to provide tax relief to small business owners.

- Potential for Tax Avoidance: The complexity of the QBI deduction led to concerns about potential tax avoidance strategies.

- Impact on Small Business Owners: The effect on small business owners varied depending on factors like income and business structure. Many small business owners benefited, but the overall economic impact is still being debated.

Congressional Divisions over Trump's Tax Bill

The passage of Trump's Tax Bill was highly partisan, reflecting deep divisions within Congress.

Party-Line Votes

The bill passed with almost entirely Republican votes in both the House and the Senate. Democrats uniformly opposed the legislation.

- Republican Arguments: Republicans primarily argued that the bill would stimulate economic growth, create jobs, and benefit American businesses and families.

- Democratic Arguments: Democrats countered that the tax cuts disproportionately favored wealthy individuals and corporations, exacerbating income inequality and adding significantly to the national debt. They also pointed to the lack of long-term economic benefits. Specific Representatives from both parties voiced strong opinions, highlighting the political polarization surrounding the bill.

Concerns and Criticisms

Economists and various interest groups raised numerous concerns about the long-term effects of the Trump tax cuts.

- National Debt Increase: The tax cuts were projected to increase the national debt substantially over the long term, as revenue was significantly reduced. The Committee for a Responsible Federal Budget, for example, offered detailed projections on the increasing national debt due to reduced federal revenues.

- Impact on Social Programs: Critics worried that the increased debt would necessitate cuts to social programs and crucial government services in the future.

- Increased Inequality: The disproportionate benefit for high-income earners fueled concerns that the tax cuts would further exacerbate existing income inequality.

Economic Impact of Trump's Tax Bill - A Retrospective

Assessing the overall economic impact of Trump's Tax Bill requires examining both its short-term and long-term consequences.

Short-Term Effects

Immediately following the bill's passage, there was a noticeable boost in some economic indicators.

- GDP Growth: The economy experienced a period of moderate GDP growth. However, disentangling the direct effect of the tax cuts from other contributing factors remains a challenge for economists.

- Inflation: Inflation remained relatively stable in the short term.

- Job Market Changes: The job market showed continued growth; however, attributing this solely to the tax cuts is difficult due to other concurrent economic trends. The Bureau of Economic Analysis provided the relevant data for this analysis.

Long-Term Consequences

The long-term consequences of Trump's Tax Bill are still unfolding and subject to considerable debate.

- National Debt: The national debt has continued to grow, raising concerns about the long-term fiscal health of the nation.

- Income Inequality: The impact on income inequality is complex and subject to ongoing research. Some studies have shown a widening gap, while others have presented a more nuanced picture.

- Future Generations: The increased national debt will likely burden future generations with higher taxes and reduced government services.

Conclusion

Trump's Tax Bill remains a highly debated topic, with its long-term effects still unfolding. While the bill aimed to stimulate economic growth through significant tax cuts, its impact has been complex and varied, dividing Congress and leaving a lasting mark on the American economy. Understanding the intricacies of Trump's Tax Bill, from its core provisions to its lasting consequences, is crucial for informed discussion about future economic policy. Continue exploring the intricacies of Trump's Tax Bill and its continuing impact on the US economy by researching further reputable sources and engaging in informed discussions.

Featured Posts

-

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis

May 22, 2025

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis

May 22, 2025 -

Home Depot Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025

Home Depot Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025 -

Switzerland Rebukes Chinas Military Exercises

May 22, 2025

Switzerland Rebukes Chinas Military Exercises

May 22, 2025 -

Loire Atlantique Quiz Culturel Sur Son Histoire Et Sa Gastronomie

May 22, 2025

Loire Atlantique Quiz Culturel Sur Son Histoire Et Sa Gastronomie

May 22, 2025 -

Musique Live Le Hellfest S Installe Au Noumatrouff

May 22, 2025

Musique Live Le Hellfest S Installe Au Noumatrouff

May 22, 2025

Latest Posts

-

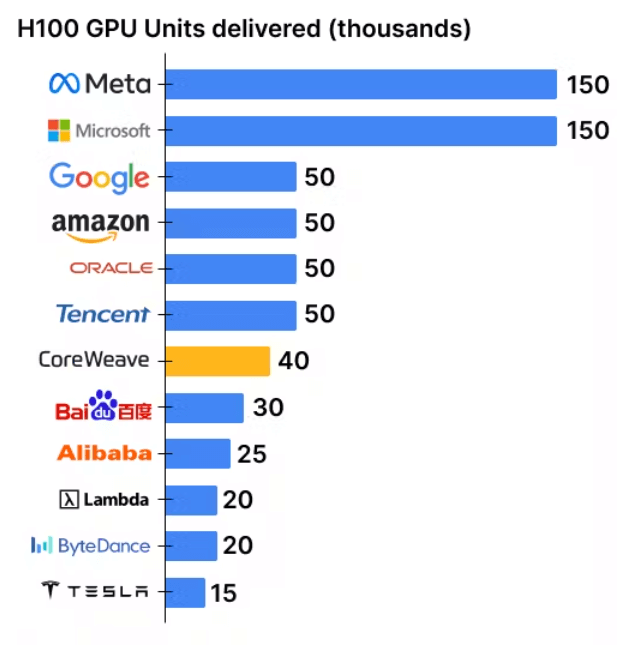

Analyzing Recent Developments In Core Weave Stock

May 22, 2025

Analyzing Recent Developments In Core Weave Stock

May 22, 2025 -

Understanding Core Weave Inc S Crwv Stock Increase On Tuesday

May 22, 2025

Understanding Core Weave Inc S Crwv Stock Increase On Tuesday

May 22, 2025 -

Whats Driving The Current Core Weave Stock Price

May 22, 2025

Whats Driving The Current Core Weave Stock Price

May 22, 2025 -

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau So Sanh Va Lua Chon

May 22, 2025

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau So Sanh Va Lua Chon

May 22, 2025 -

Core Weave Stock Market Trends And Future Predictions

May 22, 2025

Core Weave Stock Market Trends And Future Predictions

May 22, 2025