Home Depot Earnings: Disappointing Results, Tariff Guidance Maintained

Table of Contents

Disappointing Q2 2024 Home Depot Earnings Results

Home Depot's Q2 2024 earnings report revealed a significant shortfall compared to expectations. The results paint a concerning picture for the home improvement giant, raising questions about the overall health of the consumer spending sector and the housing market.

Lower-Than-Expected Revenue Growth

- Revenue: $XXXX billion (Specific figure to be inserted based on actual results). This represents a YY% decrease compared to Q2 2023 and falls short of analyst predictions of $YYYY billion.

- Year-over-Year Change: A [Percentage]% decrease compared to Q2 2023.

- Analyst Expectations: The reported revenue significantly undershot the consensus analyst estimate.

This lower-than-expected revenue growth can be attributed to several factors, including a slowing economy, reduced consumer confidence, and a potential shift in consumer spending priorities away from home improvement projects. Increased competition and the lingering effects of inflation also played a role.

Decreased Profit Margins

- Profit Margin: [Specific figure]%, a decrease of [Percentage]% compared to Q2 2023.

- Reasons for Decrease: Increased costs of goods sold, higher operating expenses, and potentially reduced pricing power due to weakened consumer demand all contributed to the decline in profit margins.

- Impact on Financial Health: The reduced profit margins significantly impact Home Depot's overall financial health, impacting profitability and potentially affecting future investments and growth initiatives.

The decreased profit margins underscore the challenges Home Depot faces in navigating the current economic climate.

Impact on Stock Price

- Stock Price Change: The announcement resulted in an immediate [Percentage]% drop in Home Depot's stock price.

- Trading Volume: Trading volume increased significantly following the earnings release, indicating substantial market activity and investor reaction.

- Analyst Ratings: Several analysts downgraded their ratings for Home Depot stock following the disappointing results, reflecting concerns about the company's future performance.

The immediate market reaction highlights the gravity of the situation and the impact of the earnings miss on investor confidence. The long-term implications for Home Depot's stock performance remain uncertain and depend heavily on the company's ability to address the underlying issues.

Home Depot Maintains Tariff Guidance Despite Challenges

Despite the disappointing Q2 2024 earnings, Home Depot maintained its tariff guidance. This decision raises questions about the company's long-term strategy and its assessment of the ongoing impact of tariffs on its business.

Continued Impact of Tariffs

- Affected Products: Tariffs continue to impact the pricing of various imported building materials, including lumber, certain types of hardware, and appliances.

- Mitigation Strategies: Home Depot has implemented strategies such as sourcing materials from alternative suppliers and adjusting pricing to mitigate the impact of tariffs. However, these strategies have seemingly had limited success in offsetting the negative impact on profitability.

- Justification for Maintaining Guidance: Home Depot may be maintaining its guidance based on its long-term view of the tariff landscape and its belief that the current situation is temporary. Alternatively, the company may be hedging its bets, awaiting clarity on future tariff policies.

Potential Future Impact of Tariffs

- Potential Scenarios: Future tariffs could further impact profitability, forcing Home Depot to make difficult decisions regarding pricing and sourcing.

- Strategic Adjustments: Home Depot might need to further diversify its supply chains, explore alternative materials, or increase automation to offset tariff-related challenges.

- Risks and Opportunities: The uncertainty around future tariff policies presents significant risks, but also potential opportunities for businesses that can adapt and innovate effectively.

Home Depot's Outlook and Future Strategies

Home Depot's management provided insights into the company's outlook and plans for addressing the challenges ahead.

Management Commentary

- Key Quotes: [Insert key quotes from management commentary regarding the earnings report, future plans, and outlook].

- Strategic Initiatives: Home Depot outlined plans to [Insert specifics about any strategic initiatives mentioned in the management commentary].

- Outlook for Future Quarters: Management offered [Insert management's guidance for future quarters, highlighting any expectations of improved performance or continued challenges]. The tone of management's commentary will be crucial in assessing investor confidence and the market's reaction in the coming weeks and months.

Potential Strategies for Improvement

- Cost-Cutting Measures: Implementing efficiency improvements across the supply chain and operations.

- New Product Lines: Expanding into new product categories to diversify revenue streams and reduce reliance on specific, potentially tariff-affected items.

- Marketing Strategies: Adjusting marketing campaigns to target specific consumer segments or emphasize value-oriented offerings.

Conclusion: Analyzing the Future of Home Depot Earnings

The disappointing Q2 2024 Home Depot earnings report underscores the challenges facing the home improvement sector. The continued maintenance of tariff guidance despite these challenges highlights the complexities of navigating the current economic and geopolitical landscape. Home Depot's future performance hinges on its ability to successfully implement strategic initiatives to mitigate cost pressures, adapt to changing consumer behavior, and navigate the uncertain future of tariff policies. Stay updated on Home Depot's performance by subscribing to our newsletters, following us on social media, or regularly checking for updates on Home Depot Earnings and related financial news. Share your thoughts and predictions on future Home Depot earnings in the comments below!

Featured Posts

-

Controverse A Clisson Trop De Croix Catholiques Au College

May 22, 2025

Controverse A Clisson Trop De Croix Catholiques Au College

May 22, 2025 -

Dexter Resurrection Adds Popular Villain To The Mix

May 22, 2025

Dexter Resurrection Adds Popular Villain To The Mix

May 22, 2025 -

Addressing The Allegations Blake Livelys Public Image

May 22, 2025

Addressing The Allegations Blake Livelys Public Image

May 22, 2025 -

Impact Van Invoertarieven Abn Amro Rapport Over Voedselexport Naar Vs

May 22, 2025

Impact Van Invoertarieven Abn Amro Rapport Over Voedselexport Naar Vs

May 22, 2025 -

Cao Toc Bien Hoa Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Cao Toc Bien Hoa Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Latest Posts

-

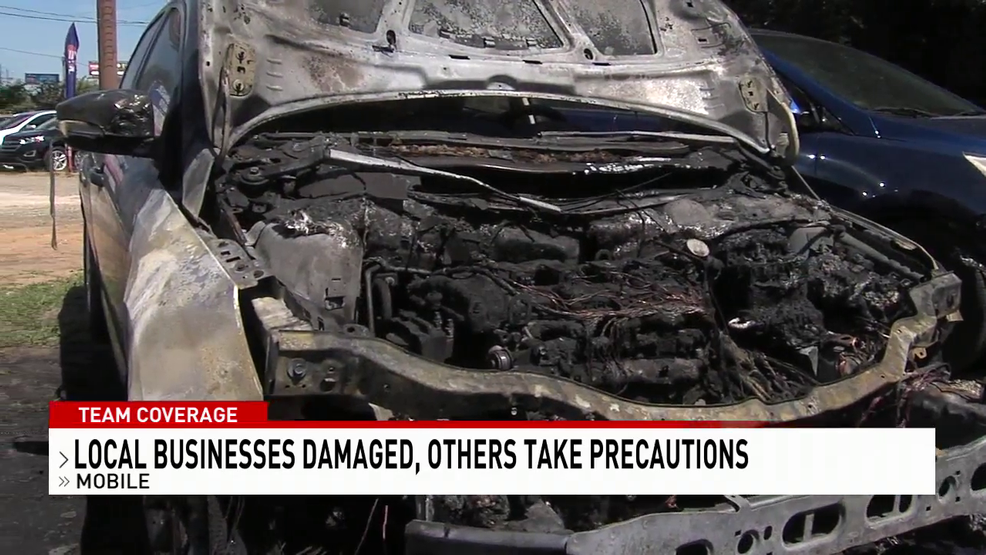

Used Car Lot Fire Extensive Damage Reported

May 22, 2025

Used Car Lot Fire Extensive Damage Reported

May 22, 2025 -

Firefighters Respond To Major Car Dealership Fire

May 22, 2025

Firefighters Respond To Major Car Dealership Fire

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025 -

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Response

May 22, 2025

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Response

May 22, 2025 -

Early Morning Fire At Dauphin County Apartment Extensive Damage Reported

May 22, 2025

Early Morning Fire At Dauphin County Apartment Extensive Damage Reported

May 22, 2025