What's Driving The Current CoreWeave Stock Price?

Table of Contents

The Impact of AI on CoreWeave's Stock Price

The surge in artificial intelligence is undeniably a primary driver of CoreWeave's stock price. The demand for powerful GPU computing, essential for training and deploying sophisticated AI models, is skyrocketing. CoreWeave, with its specialized infrastructure designed for demanding AI workloads, is perfectly positioned to capitalize on this explosive growth.

- Increased demand for AI model training and inference: The development of advanced AI models requires immense computational power, creating a massive demand for GPU-based cloud computing services.

- CoreWeave's specialized infrastructure for AI workloads: CoreWeave offers a highly scalable and optimized infrastructure specifically tailored to the unique needs of AI applications, providing a significant competitive advantage.

- Potential for future partnerships and collaborations with AI companies: CoreWeave's strategic partnerships with leading AI companies could further fuel revenue growth and drive up the CoreWeave stock price. These collaborations could lead to exclusive access to cutting-edge AI technologies and broader market reach.

While precise figures are often confidential, analysts project substantial revenue growth for CoreWeave directly correlated with the continued adoption of AI across various industries. This growth trajectory significantly impacts the CoreWeave valuation and consequently, its stock price.

Competition and Market Share

CoreWeave operates in a competitive landscape, vying for market share with established giants like AWS, Google Cloud, and Microsoft Azure. However, CoreWeave differentiates itself through specialized infrastructure and strategic pricing.

- Key competitors and their market positions: AWS, Google Cloud, and Microsoft Azure dominate the overall cloud computing market, but CoreWeave focuses on a niche within this market – high-performance GPU computing.

- CoreWeave's market share and growth trajectory: While precise market share figures may not be publicly available, CoreWeave's rapid growth signifies a growing presence in the GPU cloud computing sector.

- Analysis of CoreWeave's differentiation strategies: CoreWeave’s focus on providing optimized infrastructure specifically designed for AI and high-performance computing provides a key point of differentiation, attracting customers who require specialized solutions.

Recent partnerships and strategic acquisitions could further solidify CoreWeave’s competitive standing and enhance its market share, thereby influencing its CoreWeave stock price positively.

Financial Performance and Investor Sentiment

Analyzing CoreWeave's financial reports provides crucial insights into its performance and influences investor sentiment. Positive financial results typically translate into increased investor confidence, driving up the CoreWeave stock price. Conversely, weaker-than-expected results can negatively impact the stock.

- Recent financial results and key performance indicators (KPIs): Examining revenue growth, profitability, and other key metrics helps assess CoreWeave's financial health and its ability to meet investor expectations.

- Analyst ratings and price targets: Tracking analyst ratings and price targets provides a gauge of market sentiment and future price expectations for CoreWeave stock.

- Impact of macroeconomic factors (e.g., interest rates, inflation) on investor sentiment: Broad economic conditions can impact investor risk appetite and influence overall market valuation, including CoreWeave's stock price.

Any significant news or announcements—positive or negative—regarding CoreWeave's financial performance or strategic initiatives will directly influence investor confidence and the CoreWeave stock price.

Technological Advancements and Future Growth Potential

CoreWeave’s commitment to technological innovation is a critical factor in its future growth prospects and, therefore, its stock price. Continuous investment in cutting-edge technologies positions the company for expansion into new markets and increased profitability.

- Investment in new infrastructure and technologies: CoreWeave’s ongoing investment in state-of-the-art hardware and software enhances its capabilities and strengthens its competitive position.

- Expansion into new geographic regions or service offerings: Expanding into new markets can unlock significant growth opportunities and increase revenue streams, positively impacting the CoreWeave stock price.

- Long-term growth projections and opportunities: Analyzing CoreWeave’s long-term growth potential, considering market trends and technological advancements, offers a valuable perspective on its future valuation.

Research and development (R&D) initiatives aimed at developing novel technologies and improving existing services will be crucial in driving future stock price appreciation.

Conclusion: Understanding the CoreWeave Stock Price and What's Next

In summary, the CoreWeave stock price is influenced by a complex interplay of factors, including the burgeoning demand for GPU computing driven by AI, the competitive landscape, the company's financial performance, and its potential for future growth. Understanding these dynamics is vital for making informed investment decisions regarding CoreWeave stock. The strong correlation between AI adoption and CoreWeave's specialized services, coupled with its strategic initiatives, points towards a significant growth trajectory. However, investors must also carefully consider competitive pressures and macroeconomic influences.

Stay informed about CoreWeave's stock price by following its financial reports, analyst ratings, and industry news to make informed investment decisions. Remember that all stock market investments carry inherent risk. Continue researching CoreWeave to better understand its future stock price movements.

Featured Posts

-

Core Weave Ipo Listing Price Set At 40 Less Than Projected 51

May 22, 2025

Core Weave Ipo Listing Price Set At 40 Less Than Projected 51

May 22, 2025 -

Todays Nyt Wordle Hints Answer And Help For April 12 1393

May 22, 2025

Todays Nyt Wordle Hints Answer And Help For April 12 1393

May 22, 2025 -

Diversification A Moncoutant Sur Sevre L Heritage De Clisson

May 22, 2025

Diversification A Moncoutant Sur Sevre L Heritage De Clisson

May 22, 2025 -

Core Weave Stock A Deep Dive Into Current Market Activity

May 22, 2025

Core Weave Stock A Deep Dive Into Current Market Activity

May 22, 2025 -

Peppa Pigs Parents Gender Reveal Party Details And Photos

May 22, 2025

Peppa Pigs Parents Gender Reveal Party Details And Photos

May 22, 2025

Latest Posts

-

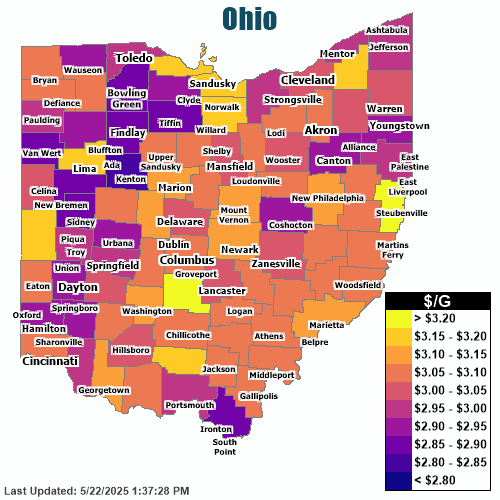

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025