Trump's Tariff Decision Sends Euronext Amsterdam Stocks Soaring

Table of Contents

The Unexpected Surge in Euronext Amsterdam Stock Prices

Analyzing the immediate market reaction:

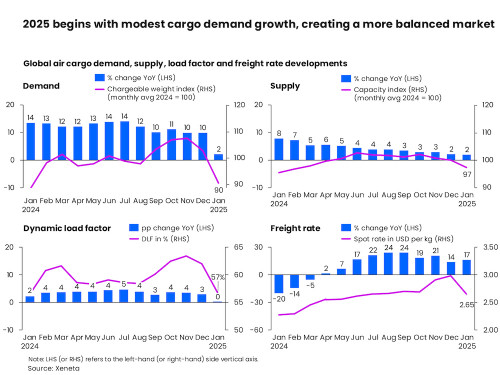

Following the tariff announcement, Euronext Amsterdam experienced a remarkable increase in its key indices. The AEX index, for example, saw a jump of X% within the first trading day, while the AMX index rose by Y%. This wasn't uniform across all sectors; the technology and financial sectors experienced the most significant gains, outperforming other European markets. Charts illustrating these dramatic shifts clearly show the immediate market response.

- Sharp increase in trading volume: The volume of trades executed on Euronext Amsterdam significantly increased, indicating heightened investor activity and interest.

- Positive investor sentiment: Market indicators like the VIX (volatility index) showed a decrease, suggesting a reduction in investor anxiety, despite the generally negative global sentiment surrounding the tariff decision.

- Short-term vs. long-term implications: While the short-term outlook appeared positive for many Amsterdam-listed companies, the long-term implications remain uncertain and depend heavily on the evolving trade landscape.

Why Did Amsterdam Stocks Soar Despite Negative Global Sentiment?

The counter-intuitive market reaction in Amsterdam warrants further analysis. Several factors likely contributed to this surge:

-

Redirected trade flows: Investors may be anticipating that Dutch companies will benefit from trade being redirected away from the US, potentially capturing a larger share of the European and global markets.

-

Increased competitiveness: The tariffs could inadvertently make Dutch companies more competitive in certain sectors, attracting more investment and boosting their stock prices.

-

Weakening of the US dollar: A weaker US dollar, often a consequence of trade disputes, can positively impact companies that export a significant portion of their products outside the US, increasing their profitability when their earnings are converted back to Euros.

-

Europe's position as a potential beneficiary: Some analysts suggest that Europe could emerge as a net beneficiary of trade realignment, with companies in the Netherlands well-positioned to capitalize on this shift.

-

Specific examples: Specific examples of companies thriving post-tariff announcement should be highlighted here. For example, [Company A], a major player in [industry], saw its stock price rise significantly due to [specific reasons related to the tariff decision].

The Broader Implications of Trump's Tariff Decision on European Markets

Impact on other European stock exchanges:

While Euronext Amsterdam showed a surprising surge, other major European stock exchanges reacted differently. The London Stock Exchange, for example, experienced a more muted response, while Frankfurt and Paris showed slight declines. This divergence can be attributed to several factors, including the specific sectors dominant in each market and the degree to which those sectors are affected by the Trump tariffs.

- Comparison of percentage changes: A comparative analysis of percentage changes across different European exchanges reveals the varied impact of the tariff decision.

- Sector-specific performance: Examining the performance of specific sectors across exchanges helps explain the divergence in overall market reactions.

- Overall European market sentiment: The overall European market sentiment remained cautious despite the positive performance of Euronext Amsterdam, indicating a degree of uncertainty about the future impact of these trade policies.

Long-term effects on trade relations and investment:

The long-term consequences of Trump's tariff decision on EU-US trade relations are far-reaching and potentially destabilizing. The impact on foreign direct investment (FDI) in the Netherlands and Europe is particularly relevant.

- Potential for trade disputes and retaliatory measures: The potential for escalating trade disputes and retaliatory measures between the US and the EU poses significant risks to both economies.

- Uncertainty for businesses: Companies operating in both the US and the EU face significant uncertainty as they navigate shifting trade policies and potential disruptions to supply chains.

- Shift in global supply chains: The tariff decision could lead to a shift in global supply chains, potentially benefiting some European countries at the expense of others.

Conclusion

President Trump's recent tariff decision, while negatively impacting some global markets, surprisingly led to a significant surge in stock prices on Euronext Amsterdam. This unexpected outcome highlights the complexity of international trade policy and its unpredictable consequences on various markets. The reasons behind this surge are multifaceted, ranging from the potential for redirected trade flows to the strengthening of certain sectors in the Netherlands. However, the long-term impact remains uncertain and requires careful monitoring. Understanding the nuances of how Trump's tariffs affect Euronext Amsterdam is crucial for effective investment strategies.

Call to Action: Understanding the implications of Trump's tariff decisions on Euronext Amsterdam and European markets is crucial for investors. Stay informed about future developments in international trade policy to navigate the complexities of the global market and make informed investment decisions regarding Euronext Amsterdam stocks and other impacted assets. Learn more about the impact of Trump's tariffs on the Euronext Amsterdam market by subscribing to our newsletter and following our analysis.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025 -

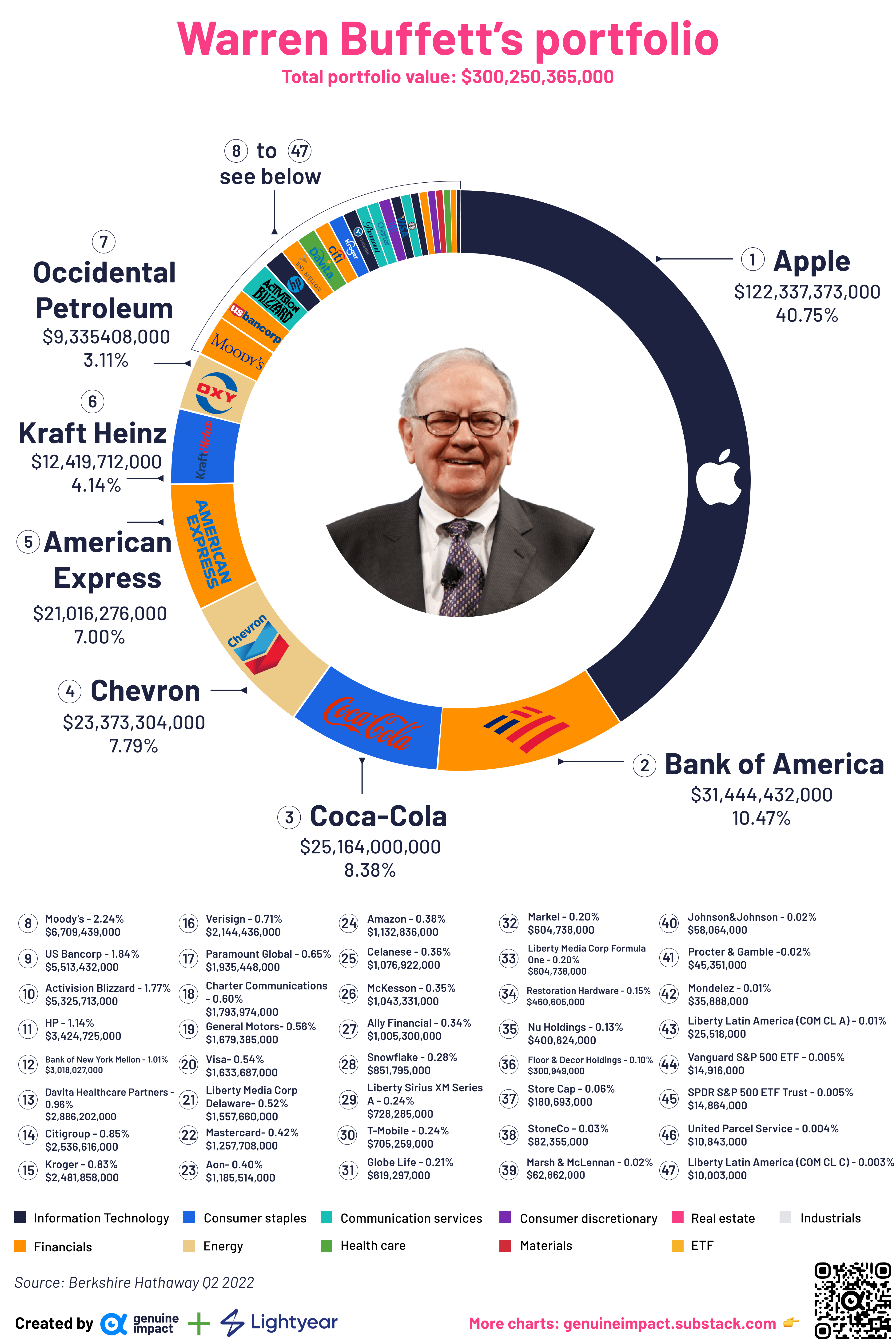

Apple Stock Under Pressure Analyzing The Impact Of Tariffs On Buffetts Portfolio

May 24, 2025

Apple Stock Under Pressure Analyzing The Impact Of Tariffs On Buffetts Portfolio

May 24, 2025 -

Za Den Na Kharkovschine Pozhenilis Pochti 40 Par Fotoreportazh

May 24, 2025

Za Den Na Kharkovschine Pozhenilis Pochti 40 Par Fotoreportazh

May 24, 2025 -

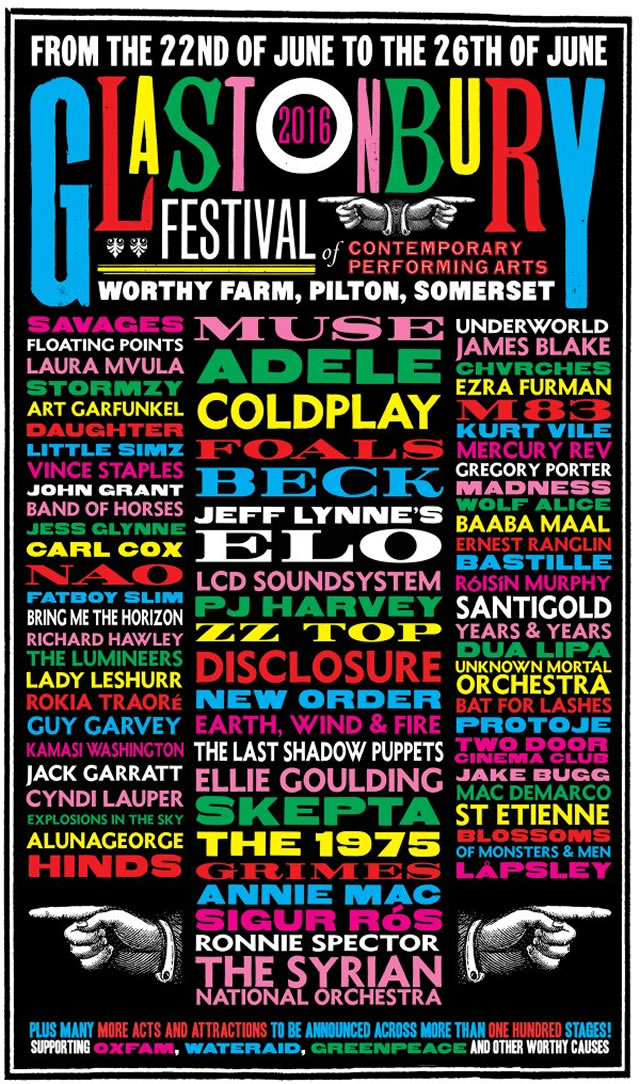

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Latest Posts

-

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025 -

Price Gouging Allegations Surface After La Fires A Reality Tv Stars Account

May 24, 2025

Price Gouging Allegations Surface After La Fires A Reality Tv Stars Account

May 24, 2025 -

Investment Guide The Countrys Promising New Business Centers

May 24, 2025

Investment Guide The Countrys Promising New Business Centers

May 24, 2025 -

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025 -

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025