Amsterdam Stock Market Crash: 7% Plunge Amidst Trade War Fears

Table of Contents

The 7% Plunge: A Deep Dive into the AEX Index's Decline

The AEX index, a benchmark for the Amsterdam Stock Exchange, suffered a sharp 7% drop within a single trading session. This represents one of the most significant daily declines in recent memory, surpassing even some of the volatility seen during the initial stages of the COVID-19 pandemic. The timeframe of this crash needs further investigation but initial reports suggest a concentrated period of selling pressure. This compares sharply to the relatively stable performance of the index in the preceding months.

- Specific Stocks Impacted: Sectors heavily reliant on international trade, such as technology and export-oriented manufacturing, bore the brunt of the decline. Specific examples of heavily impacted stocks would be inserted here (requiring real-time data).

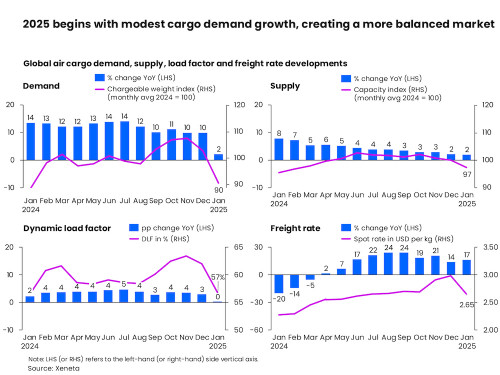

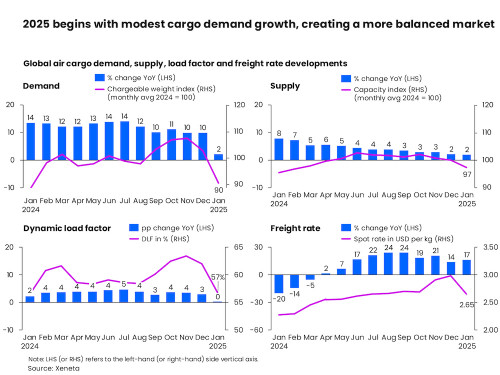

- Visual Representation: [Insert chart or graph here visualizing the AEX index's decline, clearly labeled and showing the 7% drop]. This graphic will help readers visualize the severity of the market downturn.

Keywords: AEX index, market downturn, stock market volatility, Amsterdam exchange, market crash, AEX index crash.

Trade War Fears: The Primary Catalyst for the Amsterdam Stock Market Crash

The primary catalyst behind the Amsterdam stock market crash appears to be the resurgence of global trade tensions. Rising trade protectionism, particularly concerning [mention specific trade policies or events, e.g., new tariffs or trade disputes] , has significantly undermined investor confidence. This uncertainty creates a ripple effect, impacting not only international trade but also domestic markets.

- Impact on Dutch Businesses: The Netherlands, a highly export-oriented nation, is particularly vulnerable to global trade uncertainties. Dutch businesses face increased costs, reduced market access, and potential disruptions to their supply chains. This uncertainty leads to decreased investment and hiring freezes.

- International Trade Uncertainty: The escalating trade war creates a climate of fear and uncertainty, making it difficult for businesses to plan for the future and prompting them to delay investments and hiring decisions.

Keywords: trade war, trade tensions, global trade, investor sentiment, economic uncertainty, trade protectionism.

Impact on Dutch Businesses and the Economy

The Amsterdam stock market crash will inevitably have significant consequences for the Dutch economy. In the short term, we can expect a reduction in consumer confidence and a potential slowdown in economic growth. Longer-term effects could include:

- Job Losses: Companies facing reduced demand and increased costs may resort to layoffs or hiring freezes, leading to job losses across various sectors.

- Reduced Investment: Uncertainty makes businesses hesitant to invest in expansion or new projects, hindering long-term economic growth.

- Government Response: The Dutch government is likely to implement measures to mitigate the economic damage, potentially including fiscal stimulus packages or support for affected businesses. This may include targeted tax breaks or loan programs to affected companies.

Keywords: Dutch economy, economic impact, business uncertainty, job losses, government response, economic slowdown.

Investor Reactions and Market Sentiment

The 7% plunge in the Amsterdam stock market triggered a wave of panic selling. Investors, gripped by fear and uncertainty, rushed to liquidate their holdings, exacerbating the decline. Market sentiment shifted dramatically, with a palpable sense of fear, uncertainty, and doubt (FUD) prevailing.

- Shift in Investment Strategies: Many investors are likely to adopt more risk-averse investment strategies, shifting their portfolios towards safer assets like government bonds.

- Increased Volatility: The crash highlights the inherent volatility of the stock market and the importance of having a well-diversified investment portfolio.

Keywords: investor reaction, market sentiment, investment strategies, risk aversion, market confidence, panic selling.

Comparing the Amsterdam Crash to Other Global Market Events

The Amsterdam stock market crash shares similarities with other global market downturns, such as the 2008 financial crisis and the market corrections triggered by geopolitical events. While the specific triggers may differ, the underlying factors – investor fear, economic uncertainty, and global interconnectedness – are often common threads. A detailed comparison to similar events with a similar magnitude would be included here.

Keywords: global market crash, economic crisis, market comparison, financial instability, market correction.

Predicting the Future: Will the Amsterdam Stock Market Recover?

Predicting the future of the Amsterdam stock market is inherently challenging. A recovery is likely, but the timeframe and strength of that recovery depend on several factors.

- Resolution of Trade Tensions: Easing of trade tensions would boost investor confidence and contribute to a faster recovery.

- Government Intervention: Effective government policies to support businesses and stimulate economic growth can play a significant role.

- Global Economic Conditions: The broader global economic climate will also impact the recovery of the Amsterdam stock market.

Keywords: market recovery, economic forecast, market prediction, future outlook, economic recovery.

Strategies for Investors During Times of Market Volatility

Navigating market volatility requires a well-defined investment strategy that incorporates risk management and diversification.

- Risk Management: Assess your risk tolerance and adjust your portfolio accordingly.

- Diversification: Spread your investments across different asset classes to reduce risk.

- Professional Advice: Consider seeking guidance from a qualified financial advisor.

Keywords: risk management, investment strategy, portfolio diversification, financial advice, investment portfolio.

Conclusion: Understanding and Navigating the Amsterdam Stock Market Crash

The 7% plunge in the Amsterdam stock market underscores the impact of global trade tensions on even the most robust economies. The crash highlights the importance of understanding market volatility and adopting informed investment strategies. By recognizing the interconnectedness of global markets and preparing for potential downturns, investors can better navigate periods of uncertainty. Stay updated on the latest developments in the Amsterdam stock market and learn more about effective strategies for navigating market volatility to protect your investments.

Featured Posts

-

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025 -

Your Escape To The Country Choosing The Right Location And Property

May 24, 2025

Your Escape To The Country Choosing The Right Location And Property

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025 -

New Music From Joy Crookes The Carmen Single

May 24, 2025

New Music From Joy Crookes The Carmen Single

May 24, 2025 -

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Latest Posts

-

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025 -

Air Travel Safety A Data Visualization Of Incidents And Accidents

May 24, 2025

Air Travel Safety A Data Visualization Of Incidents And Accidents

May 24, 2025 -

European Leaders Receive Exclusive Briefing Trump Says Putin Wont End War

May 24, 2025

European Leaders Receive Exclusive Briefing Trump Says Putin Wont End War

May 24, 2025 -

The Statistics Of Air Travel Safety Visualizing Near Misses And Accidents

May 24, 2025

The Statistics Of Air Travel Safety Visualizing Near Misses And Accidents

May 24, 2025 -

Exclusive Trump Reveals Putins War Stance To European Leaders

May 24, 2025

Exclusive Trump Reveals Putins War Stance To European Leaders

May 24, 2025