Apple Stock Under Pressure: Analyzing The Impact Of Tariffs On Buffett's Portfolio

Table of Contents

The Impact of Tariffs on Apple's Production and Supply Chain

A significant portion of Apple's products are manufactured in China, making the company heavily reliant on Chinese factories for iPhone production and other devices. This reliance exposes Apple to the risks associated with the ongoing trade war and the imposition of tariffs on goods imported from China. These China tariffs directly increase Apple's production costs, impacting its bottom line and potentially its future Apple stock price.

- Increased Manufacturing Costs: Tariffs directly translate to higher costs for Apple, affecting everything from the iPhone to iPads and MacBooks. This increased expense per unit can significantly impact profitability margins.

- Higher Consumer Prices: To maintain profitability, Apple may be forced to pass these increased costs onto consumers, leading to higher prices for its products. This could dampen consumer demand, especially in price-sensitive markets.

- Supply Chain Disruptions: The ongoing trade uncertainty creates significant risks to Apple's carefully orchestrated supply chain. Delays and disruptions could further impact production and negatively affect Apple stock.

- Diversification Efforts: Apple is likely exploring alternative manufacturing locations to diversify its production base and mitigate its dependence on China. However, this is a complex and time-consuming process.

The specific tariffs impacting Apple products vary, but their cumulative effect is substantial. Quantifying the precise cost increases is difficult, but analysts suggest that even a small percentage increase in manufacturing costs can translate to millions, if not billions, in lost profits for the company, directly affecting the Apple stock price. This situation forces Apple to navigate a difficult pricing strategy, balancing the need to maintain profitability with the risk of reduced consumer demand. Locations like Vietnam and India are emerging as potential alternatives for some manufacturing processes, but a complete shift is a long-term undertaking.

Buffett's Investment Strategy and its Vulnerability to Trade Wars

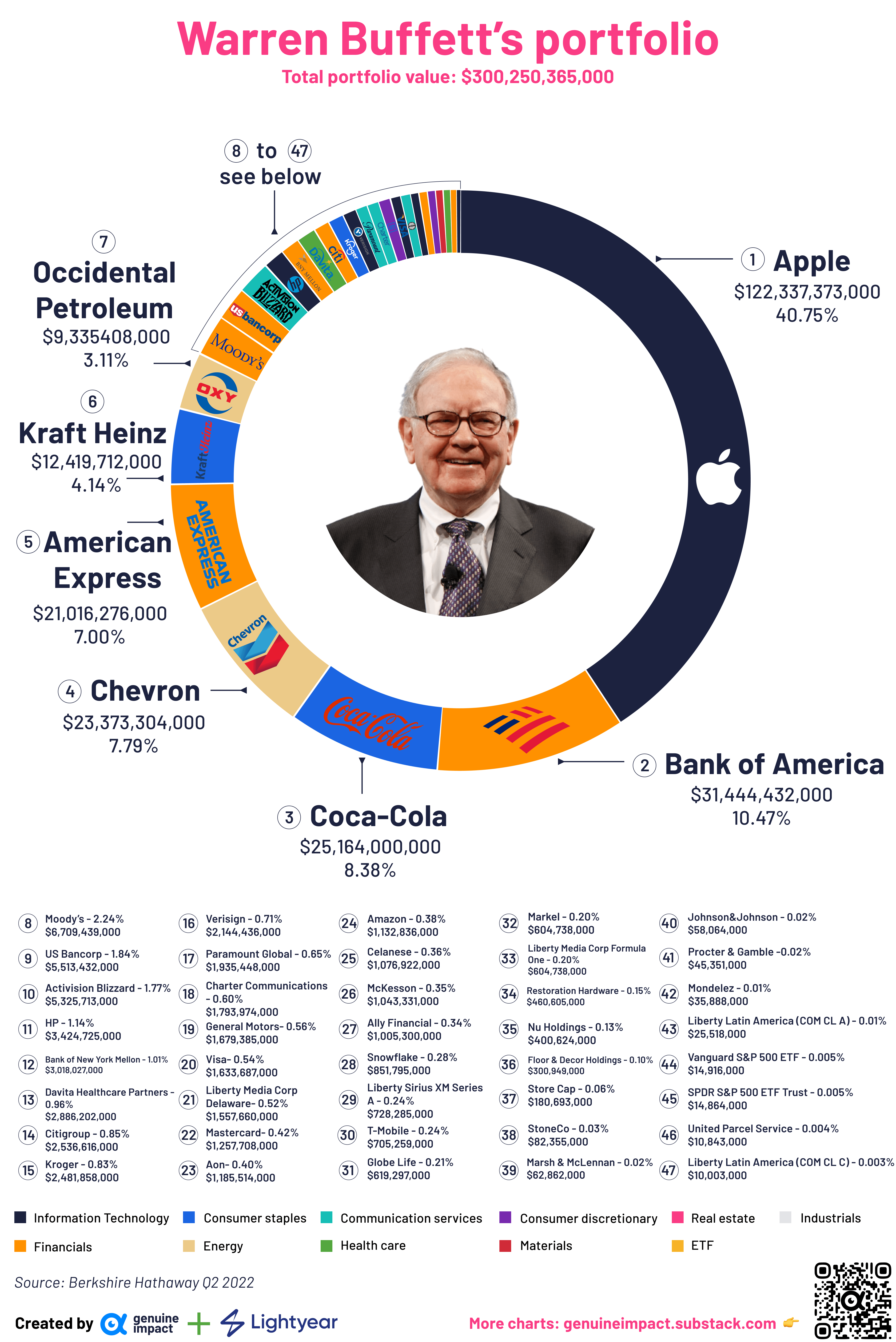

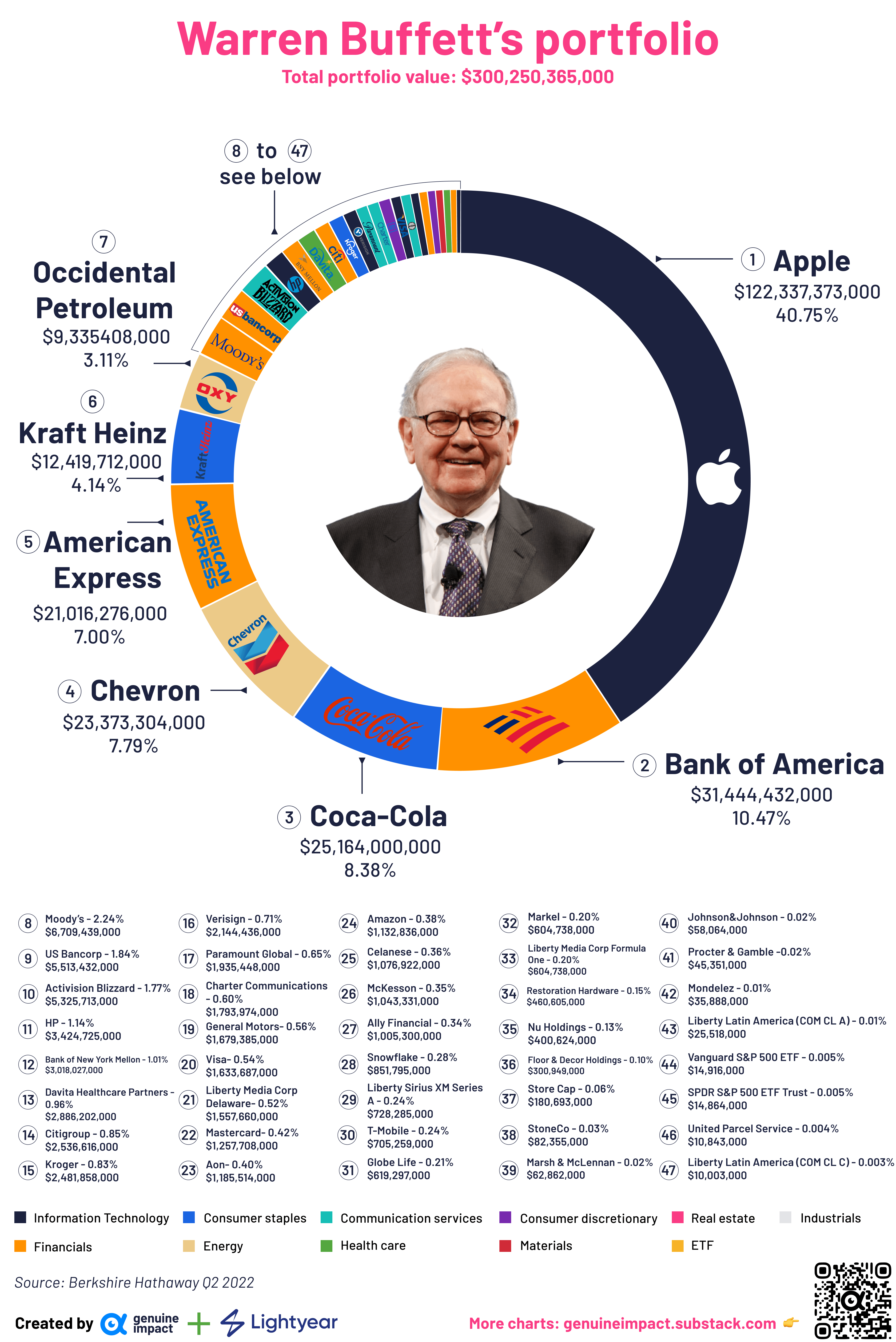

Warren Buffett, known for his long-term investment approach and value investing philosophy, has seen his significant Apple investment face headwinds due to the trade war. His typically resilient strategy, focused on identifying undervalued companies and holding them for the long term, is being tested by these external, geopolitical factors.

- Long-Term vs. Short-Term Impacts: Buffett’s long-term strategy usually mitigates the effects of short-term market volatility. However, prolonged trade tensions present a longer-term challenge.

- Portfolio Diversification: While Apple is a substantial holding in Berkshire Hathaway's portfolio, it's still part of a diversified investment strategy. The impact on the overall portfolio depends on the extent of the Apple stock decline.

- Past Responses to Economic Challenges: Buffett has navigated various economic crises in the past, demonstrating adaptability. His response to the current situation will be closely watched by investors.

- Potential Strategy Adjustments: While unlikely to make drastic changes, Buffett may reassess his allocation to Apple or explore other opportunities within the technology sector.

Buffett's value investing philosophy hinges on identifying intrinsic value that transcends short-term market fluctuations. However, the current situation challenges this approach, as geopolitical uncertainty and trade wars introduce significant external factors impacting Apple's fundamentals and, consequently, its stock price. Whether the current situation warrants a significant change in his investment approach regarding Apple remains to be seen, but his actions will be a key indicator of the impact of tariffs on major investment strategies.

The Broader Market Reaction and Investor Sentiment towards Apple Stock

The tariffs and the resulting trade war have created significant market volatility, impacting investor sentiment towards Apple stock. The Apple stock price has shown a correlation with tariff-related news, fluctuating based on positive and negative developments.

- Market Volatility and Investor Confidence: Negative news regarding tariffs often leads to a decline in Apple's stock price, reflecting diminished investor confidence.

- Correlation between Apple Stock Price and Tariff News: Charts clearly illustrate a relationship between tariff announcements and the subsequent fluctuations in Apple's stock price.

- Expert Opinions and Forecasts: Analyst opinions are divided, with some predicting a recovery in Apple's stock price while others express concerns about the long-term impact of tariffs.

- Fundamental and Technical Analysis: Both fundamental and technical analysis play a crucial role in assessing the future trajectory of Apple's stock price.

- Potential for Recovery: The potential for a recovery depends on various factors, including the resolution of trade tensions and Apple's ability to mitigate the impact of tariffs.

Analyzing Apple's stock price performance requires considering both fundamental factors (earnings, revenue growth) and technical indicators (chart patterns, trading volume). While some analysts remain bullish on Apple's long-term prospects, the current uncertainty surrounding tariffs and their impact on the Apple supply chain and cost structure undeniably weighs on investor confidence and the Apple stock price forecast.

Conclusion

This article highlighted the significant pressure Apple stock is under due to tariffs. The increased manufacturing costs, potential price hikes, supply chain disruptions, and their impact on investor sentiment paint a complex picture. Buffett's investment strategy, while generally resilient, is being tested by the prolonged trade tensions, forcing him to possibly adapt his approach. The broader market reaction reflects the uncertainty surrounding the future of global trade and its impact on major tech companies.

Stay updated on the latest developments concerning Apple stock and the ongoing impact of tariffs to make sound investment choices. Understanding the interplay between global trade policy and the performance of companies like Apple is crucial for informed investing in today's dynamic market. Monitoring Apple financials and news related to trade negotiations remains essential for navigating the challenges posed by the current geopolitical climate and assessing the future of Apple stock.

Featured Posts

-

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Frenzy

May 24, 2025

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Frenzy

May 24, 2025 -

Eurovision Village 2025 Conchita Wurst And Jj Live Performance

May 24, 2025

Eurovision Village 2025 Conchita Wurst And Jj Live Performance

May 24, 2025 -

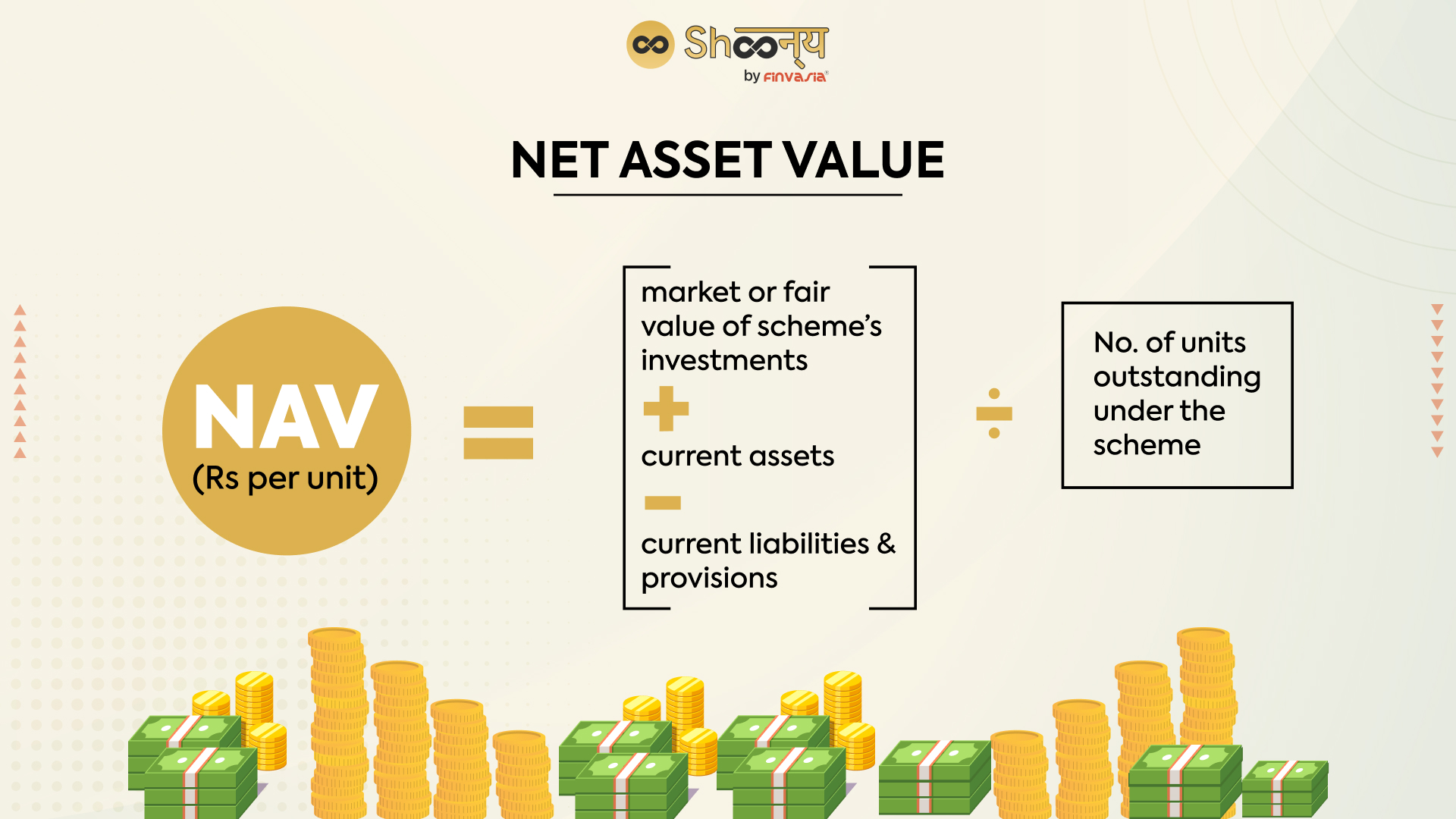

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025 -

G 7 Nations To Discuss Reducing Tariffs On Chinese Goods

May 24, 2025

G 7 Nations To Discuss Reducing Tariffs On Chinese Goods

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Latest Posts

-

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025