Investment Guide: The Country's Promising New Business Centers

Table of Contents

Identifying Key Emerging Business Centers

Choosing the right location is paramount for successful investment. We'll examine two key aspects: economic indicators and supportive government policies.

Economic Indicators and Growth Potential

Analyzing economic indicators provides a strong foundation for investment decisions. Strong GDP growth, increased foreign direct investment (FDI), and robust job creation are key signals of a thriving business environment. Infrastructure development plays a vital role, impacting economic activity and attracting further investment.

- High GDP growth forecasts for City A and City B: Both cities project annual GDP growth exceeding 7% for the next five years, driven by robust domestic consumption and export-oriented industries.

- Significant FDI increase in City C due to government incentives: City C's attractive tax policies and streamlined regulatory environment have led to a 30% surge in FDI in the last year, primarily in the manufacturing and renewable energy sectors.

- Booming tech sector driving job creation in City D: City D's rapidly expanding tech sector is creating thousands of high-paying jobs, attracting skilled workers and fueling economic growth. This makes it an attractive location for investment in tech startups and related services.

Government Initiatives and Supportive Policies

Government support is critical for the success of new business centers. Favorable policies, streamlined regulations, and efficient bureaucracy create a welcoming environment for investors.

- Tax breaks for startups in City E: City E offers substantial tax incentives for newly established businesses, significantly reducing their operational costs during the critical initial growth phase. This makes it particularly appealing for entrepreneurs and investors in early-stage companies.

- Streamlined business registration process in City F: City F has implemented a simplified and efficient business registration process, significantly reducing the time and cost associated with setting up a new business. This attracts both domestic and international investors.

- Government funding for innovation hubs in City G: City G is actively investing in innovation hubs and technology parks, providing funding, resources, and mentorship to startups and fostering a collaborative ecosystem. This attracts cutting-edge companies and innovative entrepreneurs.

Analyzing Sector-Specific Opportunities

While overall economic strength is important, understanding sector-specific opportunities is crucial for targeted investment. We'll look at technology and real estate, two particularly dynamic sectors in these emerging centers.

Technology and Innovation Hubs

The technology sector offers significant investment potential in many emerging business centers. The presence of incubators, accelerators, and venture capital funding indicates a vibrant and supportive entrepreneurial ecosystem.

- City H is emerging as a leading AI and fintech center: City H has attracted a significant number of AI and fintech startups, creating a dynamic cluster and attracting further investment in these high-growth areas.

- City I boasts a thriving startup ecosystem with abundant venture capital: City I’s abundant venture capital funding and strong network of angel investors provide crucial support to startups, fostering innovation and driving rapid growth.

- City J attracts international tech giants with its skilled workforce: City J's highly skilled and educated workforce attracts major tech companies, creating a robust and stable tech job market and fostering further investment.

Real Estate and Infrastructure Development

Investment in real estate and infrastructure offers long-term growth potential, particularly in rapidly developing business centers. Population growth and economic expansion drive property value appreciation.

- High demand for commercial space in City K's new business district: City K's new business district is experiencing high demand for commercial real estate, presenting attractive investment opportunities in office buildings and retail spaces.

- Government investment in large-scale infrastructure projects in City L: Significant government investment in transportation, utilities, and other infrastructure projects in City L is boosting economic activity and increasing property values.

- Strong potential for rental income in City M's rapidly developing areas: City M's rapidly developing areas offer strong potential for rental income from residential and commercial properties, providing a stable and consistent return on investment.

Mitigating Risks and Due Diligence

While these centers offer significant opportunities, thorough risk assessment and due diligence are essential for successful investment.

Political and Economic Stability

Political stability and sound economic fundamentals are crucial for long-term investment success. Analyzing historical data and current trends helps assess the risk profile of each location.

- City N enjoys a stable political environment and strong economic fundamentals: City N offers a relatively low-risk investment environment with a stable political landscape and strong economic indicators.

- City O faces some political uncertainty, requiring careful risk assessment: City O presents a higher risk profile due to some political uncertainty; investors should conduct thorough due diligence and consider hedging strategies.

- Thorough due diligence is essential before making any investment decisions: Regardless of the location, comprehensive due diligence, including legal, financial, and market research, is crucial before committing to any investment.

Conducting Thorough Market Research

Comprehensive market research is fundamental to identifying promising investment opportunities and understanding the competitive landscape. This includes detailed financial analysis, competitor analysis, and risk assessment.

- Analyze market size, growth potential, and target customer demographics: Understanding the market size, growth rate, and target customer base is crucial for determining the potential success of an investment.

- Identify key competitors and assess their strengths and weaknesses: Analyzing the competitive landscape helps investors understand their market position and potential challenges.

- Develop a comprehensive financial model to evaluate potential returns and risks: A well-structured financial model helps investors assess the potential profitability and risks associated with an investment.

Conclusion

This investment guide highlights the country's most promising new business centers, offering a range of opportunities across various sectors. By carefully analyzing economic indicators, government policies, sector-specific trends, and mitigating potential risks, investors can identify lucrative investment opportunities in these dynamic locations. Remember, thorough due diligence and market research are crucial for successful investments in emerging business centers. Start exploring these promising new business centers today and unlock significant investment potential. Don't miss out on the chance to capitalize on the growth of these thriving new business centers!

Featured Posts

-

Severe M56 Crash Causes Significant Traffic Disruption

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Philips Agm 2024 Review Of Financial Performance And Future Outlook

May 24, 2025

Philips Agm 2024 Review Of Financial Performance And Future Outlook

May 24, 2025 -

Ueberraschender Eis Trend In Nrw Der Unangefochtene Favorit

May 24, 2025

Ueberraschender Eis Trend In Nrw Der Unangefochtene Favorit

May 24, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Latest Posts

-

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025 -

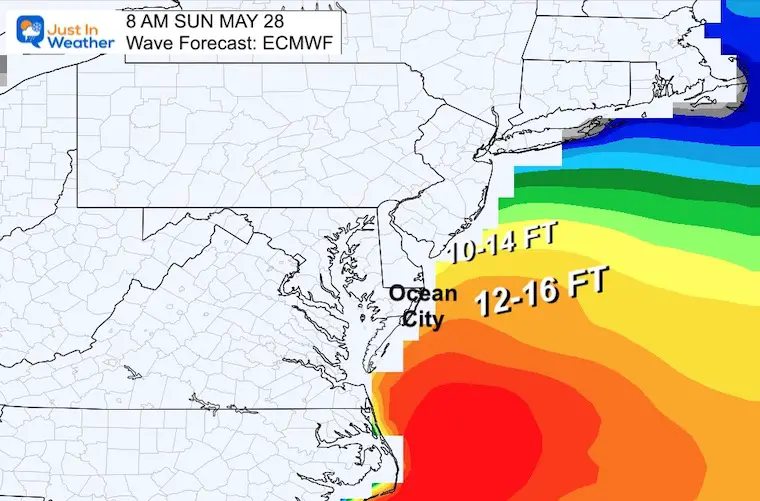

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025 -

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025