Trump's 100-Day Plan & Bitcoin: A $100,000 Price Prediction Analysis

Table of Contents

Trump's 100-Day Plan and its Economic Impact

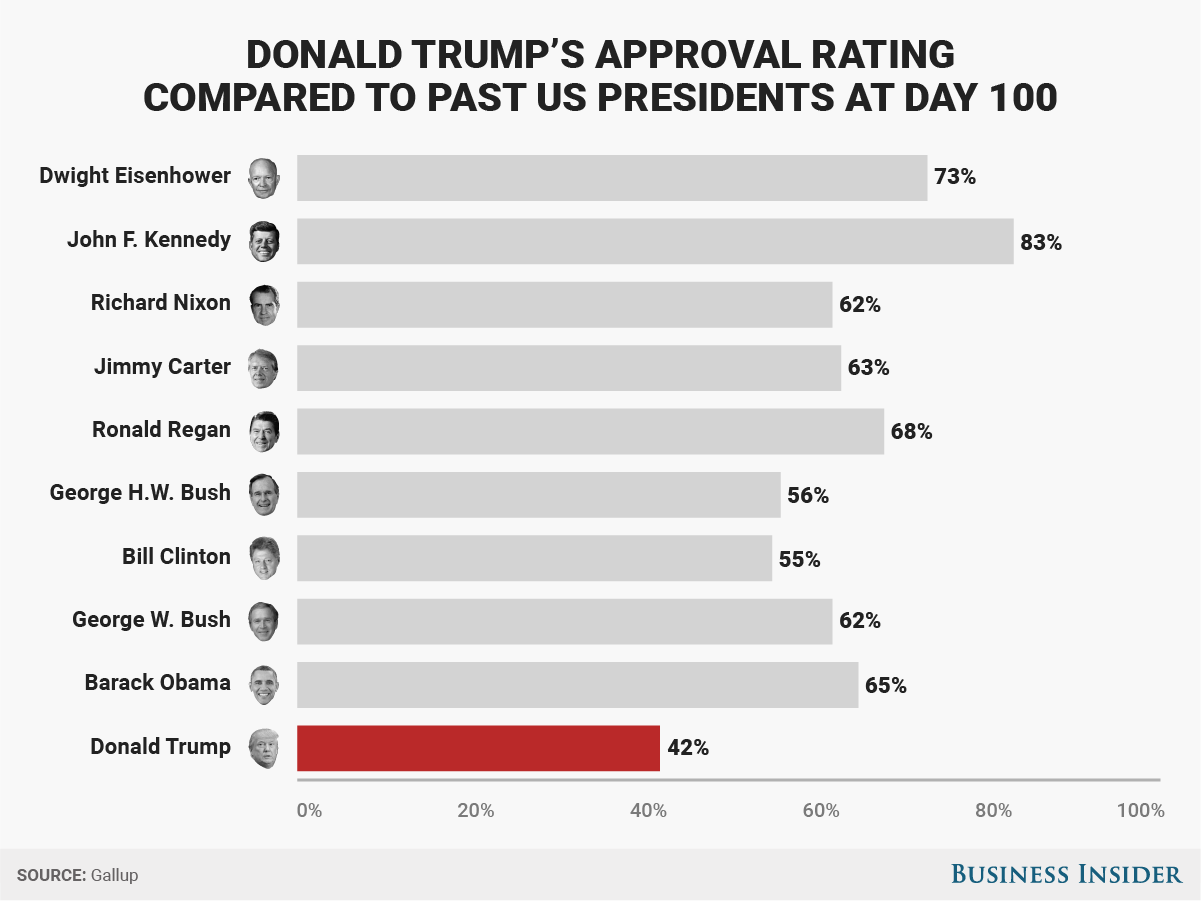

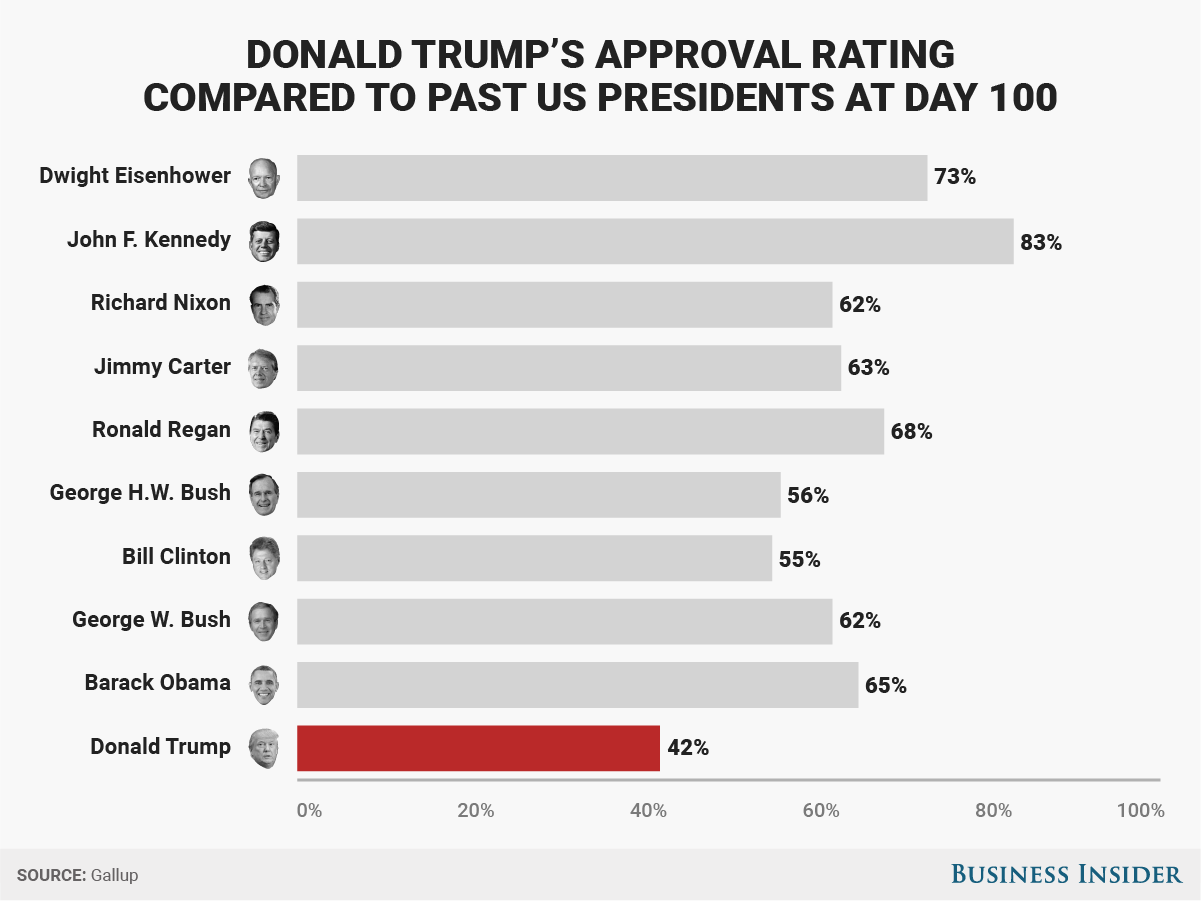

Trump's 100-Day Plan, a set of ambitious policy proposals, aimed to revitalize the American economy through various measures. Its potential impact on Bitcoin's price is a complex issue, intertwined with several key economic factors.

Fiscal Policy and Inflation

Trump's plan included significant tax cuts and increased government spending. These measures, while aiming for economic growth, could potentially lead to increased inflation.

- Tax Cuts: Lowering corporate and individual income taxes could boost disposable income, leading to increased consumer spending and demand-pull inflation.

- Increased Government Spending: Investments in infrastructure and other areas could inject significant funds into the economy, potentially creating inflationary pressures.

- Impact on the US Dollar: Increased inflation could weaken the US dollar, making Bitcoin, as a relatively scarce asset, a more attractive investment.

Historical data shows a correlation between periods of high inflation and increased demand for alternative assets like gold and, increasingly, Bitcoin. The potential for high inflation under Trump's fiscal policies could drive investors seeking a hedge against inflation toward Bitcoin.

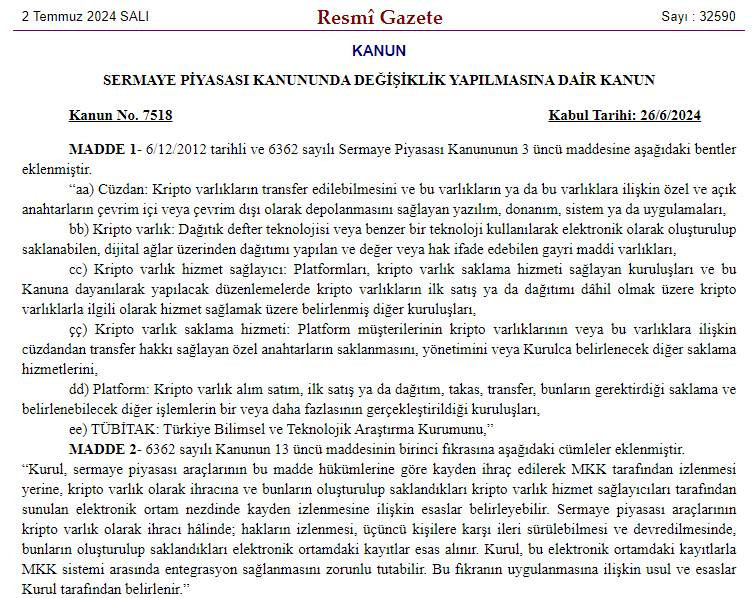

Regulatory Uncertainty and Bitcoin

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Trump's administration's approach to regulation (or lack thereof) could have significantly impacted Bitcoin's trajectory.

- Potential for Regulatory Clarity: Clearer regulatory frameworks could boost investor confidence and potentially lead to wider adoption of Bitcoin by institutional investors.

- Regulatory Uncertainty: Conversely, a lack of clear regulatory guidelines or unpredictable regulatory actions could create uncertainty and volatility in the Bitcoin market.

- Past Regulatory Impacts: Previous instances of regulatory uncertainty have historically led to both sharp price drops and surges in Bitcoin's price, demonstrating the significant impact of regulatory actions or pronouncements.

Geopolitical Instability and Safe-Haven Assets

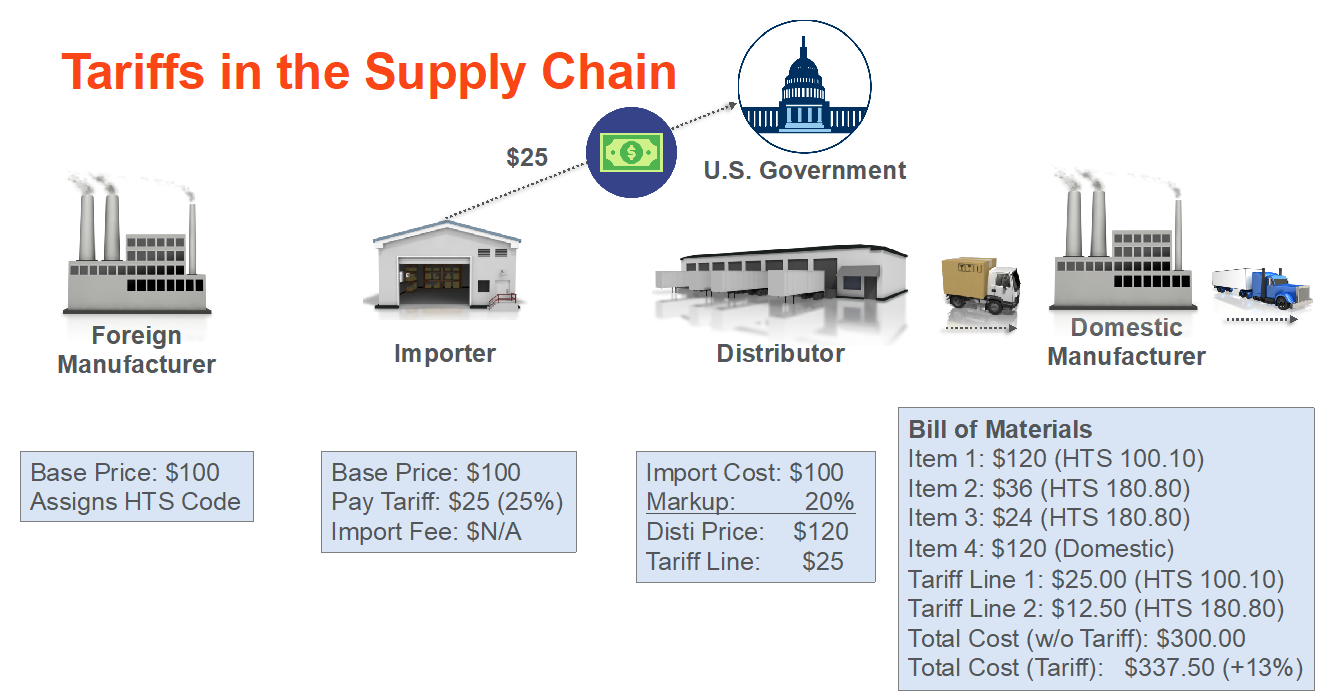

Trump's foreign policy stances and international trade disputes could create geopolitical instability. In times of uncertainty, investors often seek refuge in safe-haven assets.

- Trade Wars and Sanctions: Trump's trade protectionist policies and use of sanctions could increase global economic uncertainty.

- Bitcoin as a Safe Haven: Bitcoin's decentralized and censorship-resistant nature makes it an attractive alternative to traditional assets during geopolitical turmoil.

- Historical Precedents: Bitcoin's price has historically shown resilience and even appreciation during periods of geopolitical uncertainty, highlighting its potential as a safe-haven asset.

Analyzing the $100,000 Bitcoin Price Prediction

The prediction of Bitcoin reaching $100,000 is a bold one, but several factors could contribute to such a significant price surge.

Factors Supporting the Prediction

- Increased Adoption: Wider adoption by institutional investors and mainstream users could dramatically increase demand for Bitcoin.

- Technological Advancements: Improvements like the Lightning Network aim to enhance Bitcoin's scalability and transaction speed, boosting its usability and appeal.

- Scarcity: Bitcoin's limited supply (21 million coins) is a key factor contributing to its potential for long-term price appreciation.

Challenges and Counterarguments

Despite the bullish arguments, several factors could hinder Bitcoin reaching $100,000.

- Regulatory Crackdowns: Stricter regulations in major markets could dampen investor enthusiasm and limit Bitcoin's growth.

- Market Manipulation: The potential for market manipulation and price volatility remains a significant risk.

- Competition: The emergence of alternative cryptocurrencies could divert investment away from Bitcoin.

Realistic Price Projections

Predicting Bitcoin's price is inherently challenging. A balanced perspective considers both bullish and bearish scenarios. Factors like market sentiment, adoption rates, and technological progress will all play a role in determining future price movements. While a $100,000 price point remains speculative, a significant price increase is certainly within the realm of possibility depending on macroeconomic factors and regulatory developments.

Conclusion

Trump's 100-Day Plan, with its potential for inflation, regulatory uncertainty, and geopolitical instability, could indeed have significant ramifications for Bitcoin's price. While the $100,000 prediction is ambitious, the interplay between political events and the cryptocurrency market is undeniable. The factors supporting and challenging this prediction must be carefully considered. Ultimately, informed decision-making is crucial when investing in Bitcoin. Conduct further research, explore additional resources on Bitcoin price prediction, and engage in informed discussions about "Trump's 100-Day Plan & Bitcoin" to make well-informed investment choices. Remember, investing in cryptocurrency involves significant risk.

Featured Posts

-

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025 -

Us Tariffs A Convenient Excuse For Gms Reduced Canadian Presence

May 08, 2025

Us Tariffs A Convenient Excuse For Gms Reduced Canadian Presence

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025 -

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

Latest Posts

-

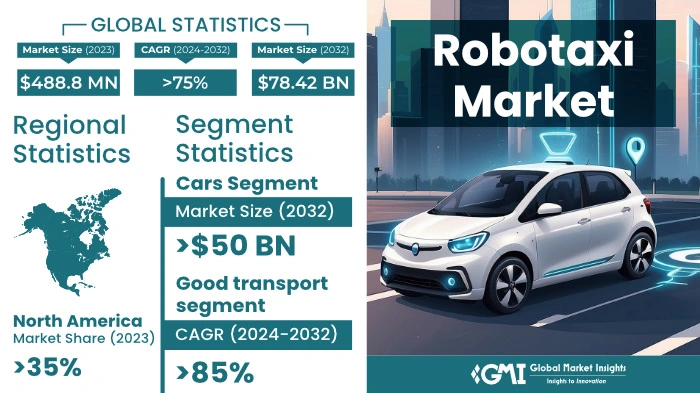

Analyzing Uber Stock Performance The Robotaxi Factor

May 08, 2025

Analyzing Uber Stock Performance The Robotaxi Factor

May 08, 2025 -

El Brasileirao Suspende A Futbolista Argentino Por Un Mes

May 08, 2025

El Brasileirao Suspende A Futbolista Argentino Por Un Mes

May 08, 2025 -

Confirmado Neymar Jugara En El Monumental Contra Argentina En Las Eliminatorias

May 08, 2025

Confirmado Neymar Jugara En El Monumental Contra Argentina En Las Eliminatorias

May 08, 2025 -

Is Ubers Robotaxi Investment A Smart Bet For Investors

May 08, 2025

Is Ubers Robotaxi Investment A Smart Bet For Investors

May 08, 2025 -

Brasileirao Sancion De Un Mes Para Futbolista Argentino

May 08, 2025

Brasileirao Sancion De Un Mes Para Futbolista Argentino

May 08, 2025