Analyzing Uber Stock Performance: The Robotaxi Factor

Table of Contents

The Current State of Uber's Robotaxi Program

Uber's Advanced Technologies Group (Uber ATG), now largely integrated into the core business, is spearheading the company's autonomous vehicle efforts. While fully autonomous, driverless robotaxis are not yet widely deployed, Uber's progress is noteworthy. The company's approach involves strategic partnerships and a phased rollout.

-

Current operational areas for robotaxis: While initially focused on select cities in the US, Uber's robotaxi operations are expanding geographically, though the exact locations and operational scale remain dynamic. Testing and limited deployments are occurring in carefully chosen areas where infrastructure and regulatory frameworks are more supportive.

-

Number of autonomous vehicles currently deployed: The exact number of autonomous vehicles currently in operation fluctuates and isn't publicly released in granular detail. However, it’s safe to say the number is significant and continuously growing as Uber refines its technology.

-

Key partnerships and collaborations in the autonomous vehicle space: Uber has forged key partnerships, notably with Motional, a joint venture between Hyundai and Aptiv, to leverage their expertise in autonomous driving technology. These collaborations allow Uber to access advanced sensor technologies and shared development resources.

-

Technological advancements and challenges faced by Uber's robotaxi program: Uber's robotaxi program is constantly evolving. Significant advancements are being made in areas such as sensor fusion, mapping technology, and machine learning algorithms. However, challenges remain, including ensuring safety in complex driving scenarios and navigating unpredictable human behavior.

Potential Impact of Robotaxi Technology on Uber's Profitability

The long-term potential for robotaxis to significantly impact Uber's profitability is immense. The elimination of driver costs and increased operational efficiency could reshape the company's financial landscape.

-

Projected cost savings from eliminating driver wages and benefits: A major driver (pun intended!) of cost savings would come from eliminating driver wages and associated benefits. This represents a potentially massive reduction in Uber's operational expenses.

-

Potential increase in ride volume due to increased availability and reduced pricing: Robotaxis could increase ride volume due to greater availability (24/7 operation) and potentially lower prices due to reduced labor costs. This could lead to exponential revenue growth.

-

Impact on margins and profitability: The reduction in operational costs coupled with an increase in ride volume suggests significantly improved margins and overall profitability. The extent of this improvement will depend on several factors, including the successful scaling of the robotaxi fleet and regulatory hurdles.

-

Discussion of potential challenges like infrastructure investment and regulatory approvals: Challenges remain. Significant infrastructure investments are needed to support a large-scale robotaxi deployment, and regulatory approvals may be complex and time-consuming.

Investor Sentiment and Market Reaction to Uber's Autonomous Vehicle Progress

Investor sentiment towards Uber's autonomous vehicle progress significantly influences its stock price. Announcements related to technological advancements, partnerships, and regulatory milestones often trigger market reactions.

-

Stock price performance following major announcements related to the robotaxi program: Positive announcements generally lead to short-term stock price increases, reflecting investor optimism. Conversely, setbacks or delays can negatively impact the stock price.

-

Analyst opinions and predictions on the impact of robotaxis on Uber's stock valuation: Financial analysts closely monitor Uber's robotaxi progress and incorporate their assessments into stock valuations. Their opinions and predictions influence investor decisions.

-

Comparison to competitors' progress in autonomous vehicle technology and its effect on their stock prices: Investors also compare Uber's progress to that of competitors like Waymo and Cruise, and market reactions often reflect relative performance.

-

Investor focus on long-term potential vs. short-term financial performance: The long-term potential of robotaxis is a key driver of investor interest, though short-term financial performance also plays a significant role in shaping stock prices.

Risks and Challenges Associated with Robotaxi Implementation

Despite its potential, the implementation of robotaxis presents significant risks and challenges for Uber.

-

Technological challenges: safety, reliability, software glitches: Ensuring the safety and reliability of autonomous vehicles is paramount. Software glitches and unforeseen circumstances pose significant technological challenges.

-

Regulatory hurdles: obtaining permits and navigating safety regulations: Navigating the regulatory landscape is crucial. Obtaining the necessary permits and meeting stringent safety regulations will be a long and complex process.

-

Public perception and acceptance of autonomous vehicles: Public acceptance of autonomous vehicles is crucial for widespread adoption. Addressing public concerns about safety and security is essential for successful implementation.

-

Competition from other companies in the autonomous vehicle market: The autonomous vehicle market is highly competitive. Uber faces stiff competition from established players and emerging startups.

Conclusion

Uber's investment in robotaxi technology has the potential to significantly impact its stock performance, both positively and negatively. While the potential cost savings and increased revenue from eliminating drivers and increasing efficiency are substantial, challenges related to technological hurdles, regulatory approval, and competition remain. The successful implementation of robotaxis represents a high-stakes gamble with potentially enormous rewards. Understanding the interplay of these factors is crucial for assessing Uber stock performance.

Stay informed on the evolving landscape of Uber stock performance and the future of autonomous driving. Keep track of Uber's robotaxi developments and their impact on Uber stock performance to make informed investment decisions.

Featured Posts

-

Growth Opportunities Mapping The Countrys Newest Business Hot Spots

May 08, 2025

Growth Opportunities Mapping The Countrys Newest Business Hot Spots

May 08, 2025 -

The Role Of Saturday Night Live In Counting Crows Success Story

May 08, 2025

The Role Of Saturday Night Live In Counting Crows Success Story

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Inter Milans Upset Victory Over Bayern Munich Champions League Quarterfinal Analysis

May 08, 2025

Inter Milans Upset Victory Over Bayern Munich Champions League Quarterfinal Analysis

May 08, 2025 -

Seged Shokirao Pariz I Plasirao Se U Chetvrtfinale Lige Shampiona

May 08, 2025

Seged Shokirao Pariz I Plasirao Se U Chetvrtfinale Lige Shampiona

May 08, 2025

Latest Posts

-

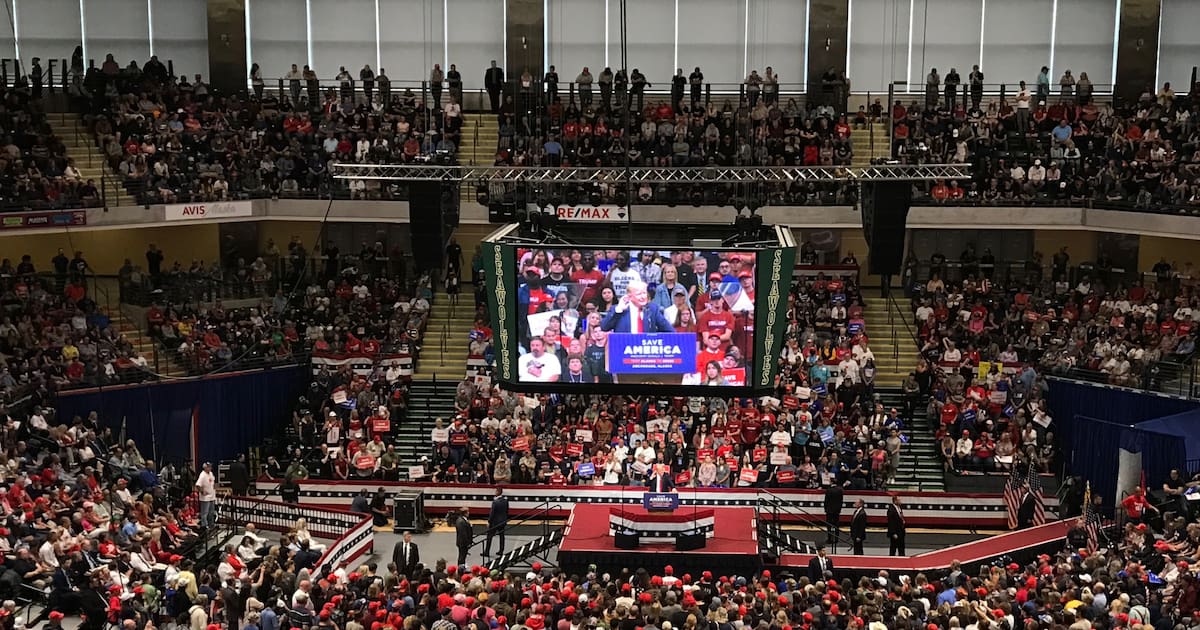

Anchorage Protests Against Trump Policies Continue Thousands Participate

May 09, 2025

Anchorage Protests Against Trump Policies Continue Thousands Participate

May 09, 2025 -

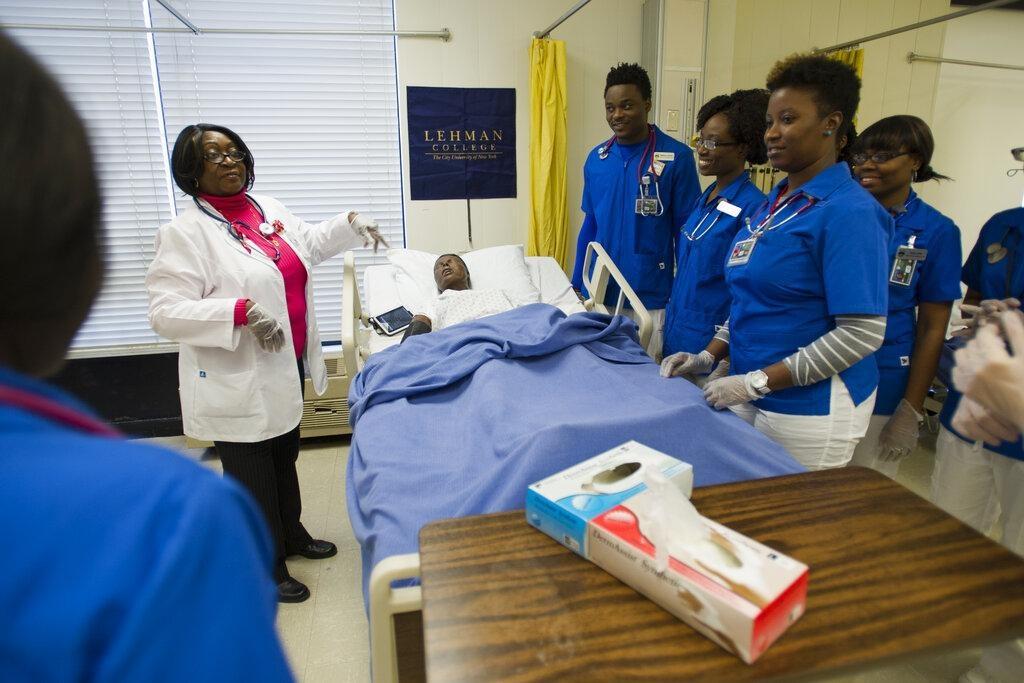

New Funding For Community Colleges To Fight Nursing Staff Shortages 56 M

May 09, 2025

New Funding For Community Colleges To Fight Nursing Staff Shortages 56 M

May 09, 2025 -

Second Week Of Anti Trump Protests In Anchorage Draws Thousands

May 09, 2025

Second Week Of Anti Trump Protests In Anchorage Draws Thousands

May 09, 2025 -

56 Million Boost For Community Colleges To Combat Nursing Shortage

May 09, 2025

56 Million Boost For Community Colleges To Combat Nursing Shortage

May 09, 2025 -

Anchorage Witnesses Second Anti Trump Protest In Two Weeks

May 09, 2025

Anchorage Witnesses Second Anti Trump Protest In Two Weeks

May 09, 2025