Is Uber's Robotaxi Investment A Smart Bet For Investors?

Table of Contents

The Potential Rewards of Uber's Robotaxi Investment

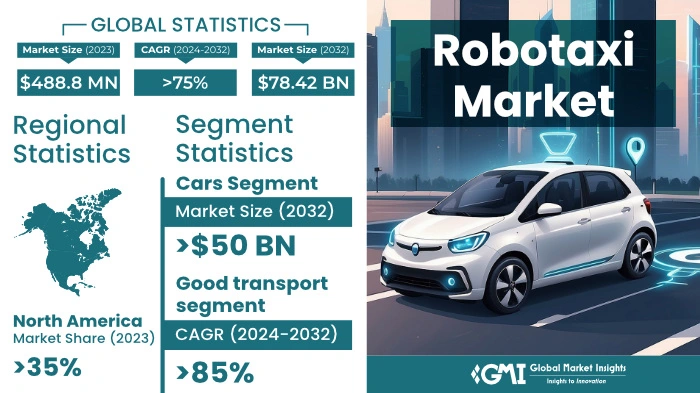

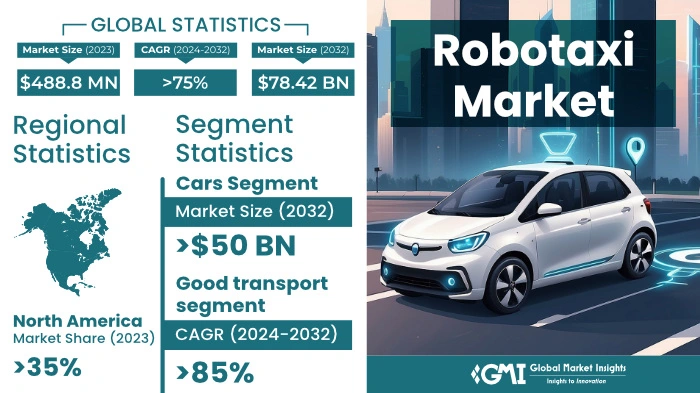

Uber's foray into robotaxis offers several potential avenues for substantial financial gain. If successful, this could reshape the company's profitability and investor appeal.

Reduced Operational Costs

Autonomous vehicles promise to drastically cut labor costs, a major expense for ride-sharing services. This is arguably the most significant potential benefit for Uber.

- Lower driver salaries and benefits: Eliminating the need for human drivers represents massive savings on wages, healthcare, and other employment-related costs.

- Reduced insurance premiums (potentially): While initial premiums might be high, improved safety features in self-driving cars could lead to lower insurance costs in the long run.

- Fewer accidents due to improved safety features: Theoretically, robotaxis, with their advanced sensors and AI, could significantly reduce accidents, leading to lower insurance claims and legal fees.

These cost reductions translate directly to higher profit margins. A significant reduction in operational expenses could boost Uber's bottom line and increase its attractiveness to investors. Analysts predict that fully autonomous fleets could drastically reduce per-ride costs, leading to substantial profit increases within a few years, assuming successful implementation.

Increased Efficiency and Scalability

Robotaxis offer the potential for unparalleled efficiency and scalability compared to human-driven vehicles.

- Optimized routes: Autonomous systems can calculate the most efficient routes, minimizing travel time and maximizing the number of rides completed per day.

- Reduced downtime: Robotaxis can operate 24/7 without breaks or rest periods, maximizing vehicle utilization.

- Potential for expansion into underserved areas: The ability to operate continuously could allow Uber to expand its service to remote or underserved areas currently unprofitable with human drivers.

Increased efficiency directly translates to greater revenue generation. By optimizing routes and maximizing vehicle utilization, Uber can handle more rides and generate higher revenue per vehicle, potentially increasing market share significantly.

Enhanced Customer Experience

Improved safety, convenience, and consistency are key to boosting customer satisfaction and loyalty.

- Reduced wait times: Optimized dispatch and routing systems can minimize wait times for passengers.

- Predictable fares: Transparent and consistent pricing can enhance the customer experience.

- Improved safety features: Autonomous vehicles equipped with advanced safety systems could lead to a safer and more comfortable ride.

A superior customer experience fosters brand loyalty and positive word-of-mouth marketing, attracting more riders and solidifying Uber's market position within the ride-sharing and autonomous vehicle sectors.

The Challenges and Risks Associated with Uber's Robotaxi Investment

Despite the considerable potential, Uber's robotaxi venture faces numerous challenges and risks.

Technological Hurdles and Development Costs

Developing fully autonomous vehicles is incredibly complex and expensive.

- Software glitches: Self-driving software is prone to unexpected errors and requires continuous refinement.

- Unpredictable weather conditions: Adverse weather conditions can significantly impact the performance of autonomous vehicles.

- Ethical considerations surrounding accidents: Determining liability in the event of an accident involving a robotaxi presents significant ethical and legal challenges.

The ongoing investment required for research, development, and testing is substantial. Delays in achieving full autonomy could significantly impact Uber's timeline and financial projections, presenting a substantial risk for investors.

Regulatory and Legal Uncertainties

The legal and regulatory landscape for autonomous vehicles is still evolving, creating uncertainty.

- Licensing requirements: Obtaining the necessary licenses and permits to operate robotaxis varies significantly across jurisdictions.

- Liability in case of accidents: Determining liability in case of accidents involving autonomous vehicles is a complex legal issue.

- Data privacy regulations: Collecting and using passenger data raises significant privacy concerns.

Navigating these regulatory complexities will require substantial resources and could lead to unexpected delays and costs, adding further risk to the investment.

Public Perception and Acceptance

Public trust and acceptance are critical for the widespread adoption of robotaxis.

- Safety concerns: Public apprehension about the safety of autonomous vehicles remains a major obstacle.

- Job displacement fears: Concerns about job displacement for human drivers could fuel public opposition.

- Ethical considerations: Questions regarding the ethical implications of autonomous vehicles need to be addressed.

Addressing public concerns and building trust through transparency and education is crucial for the successful market penetration of robotaxis.

Conclusion

Uber's robotaxi investment presents a high-risk, high-reward scenario for investors. While the potential for reduced costs, increased efficiency, and improved customer experience is significant, considerable technological, regulatory, and public perception hurdles remain. The success of this ambitious venture hinges on overcoming these challenges effectively and efficiently.

Ultimately, whether Uber's robotaxi investment proves to be a smart bet will depend on several factors. Further research and analysis are needed before making any investment decisions regarding Uber's robotaxi strategy. Stay informed about the latest developments in autonomous vehicle technology and Uber's progress to make well-informed choices regarding your investments in this rapidly evolving sector of the transportation industry. Understanding the potential rewards and risks associated with robotaxi technology is crucial for navigating the complexities of this innovative market.

Featured Posts

-

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025 -

Dissecting The Thunder Bulls Offseason Trade A Critical Analysis

May 08, 2025

Dissecting The Thunder Bulls Offseason Trade A Critical Analysis

May 08, 2025 -

Flamengo Vence Gremio Com Dois Gols De Arrascaeta No Brasileirao

May 08, 2025

Flamengo Vence Gremio Com Dois Gols De Arrascaeta No Brasileirao

May 08, 2025 -

Should You Invest In This Spac Targeting Micro Strategys Market

May 08, 2025

Should You Invest In This Spac Targeting Micro Strategys Market

May 08, 2025

Latest Posts

-

Can Cryptocurrencies Survive A Trade War One Potential Winner

May 09, 2025

Can Cryptocurrencies Survive A Trade War One Potential Winner

May 09, 2025 -

Cryptocurrencys Resilience Amidst Global Trade Tensions

May 09, 2025

Cryptocurrencys Resilience Amidst Global Trade Tensions

May 09, 2025 -

The Trade Wars Impact One Cryptocurrency Poised To Thrive

May 09, 2025

The Trade Wars Impact One Cryptocurrency Poised To Thrive

May 09, 2025 -

Bitcoin Price Recovery What You Need To Know

May 09, 2025

Bitcoin Price Recovery What You Need To Know

May 09, 2025 -

Bitcoin Seoul 2025 Networking And Innovation In Asias Crypto Hub

May 09, 2025

Bitcoin Seoul 2025 Networking And Innovation In Asias Crypto Hub

May 09, 2025