Trump Appointee Predicts Bitcoin Rally Amidst Market Volatility

Table of Contents

The Trump Appointee's Prediction and Rationale

[Name of Trump Appointee], a former [Former Position], recently predicted a substantial Bitcoin price increase, suggesting a potential price target of [Price Target] within [Timeframe]. Their rationale centers on several converging factors:

- Macroeconomic factors influencing Bitcoin's price: [Appointee's explanation of macroeconomic factors, e.g., inflationary pressures driving investors towards alternative assets like Bitcoin, potential weakening of the US dollar].

- Regulatory developments impacting cryptocurrency markets: [Appointee's perspective on regulatory changes, e.g., increasing clarity and acceptance of cryptocurrencies by governments could boost investor confidence].

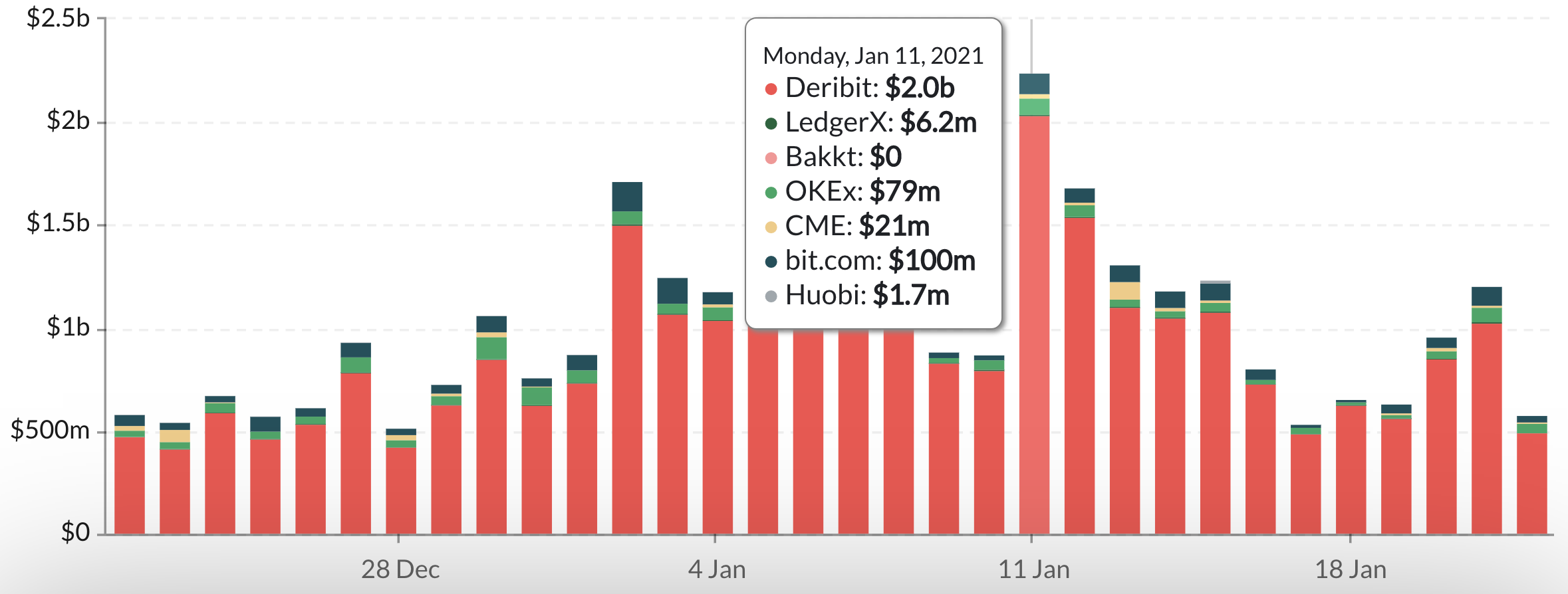

- Increasing institutional adoption of Bitcoin: [Appointee's viewpoint on institutional investment, e.g., large corporations and financial institutions are increasingly allocating funds to Bitcoin, signaling growing legitimacy and demand].

- Technological upgrades enhancing Bitcoin's scalability and security: [Appointee's comments on technological advancements, e.g., the Lightning Network and other scaling solutions are addressing Bitcoin's limitations, making it more efficient and attractive for wider adoption].

These factors, according to [Appointee's name], suggest a strong underlying foundation for a significant Bitcoin price rally.

Market Volatility and its Impact on Bitcoin

The current market volatility is undeniable, impacting Bitcoin's price significantly. Historically, Bitcoin has often shown a negative correlation with traditional markets, meaning that during downturns in the stock market, Bitcoin can experience increased demand as investors seek safe havens or alternative investments. However, this relationship isn't always consistent. Factors contributing to the current volatility include:

- Inflationary pressures and interest rate hikes: Rising inflation and interest rate increases by central banks globally create uncertainty and can impact risk appetite for assets like Bitcoin.

- Geopolitical instability and its influence on financial markets: Global conflicts and political instability often trigger market fluctuations, influencing investor sentiment toward riskier assets.

- Overall investor sentiment and risk aversion: Periods of heightened uncertainty often lead to increased risk aversion, causing investors to move away from volatile assets like Bitcoin.

This volatility makes predicting Bitcoin's price inherently challenging, even for experienced analysts.

Analyzing the Credibility of the Prediction

Assessing the credibility of [Appointee's name]'s prediction requires considering their background and expertise. Their experience in [Relevant Field] could lend weight to their analysis of macroeconomic trends. However, potential biases or conflicts of interest must also be considered. For instance, [Mention any potential biases or conflicts].

Different viewpoints exist on the prediction:

- Arguments supporting the bullish prediction: The convergence of macroeconomic factors, regulatory developments, and institutional adoption creates a plausible case for a Bitcoin rally.

- Arguments suggesting a more cautious approach to Bitcoin investment: The inherent volatility of Bitcoin and the unpredictable nature of market sentiment caution against overly optimistic projections.

- Expert opinions from other cryptocurrency analysts: [Summarize opinions from other prominent analysts, highlighting varying perspectives].

A balanced assessment requires careful consideration of all viewpoints.

Investing in Bitcoin: Risks and Opportunities

Investing in Bitcoin presents both significant risks and potential rewards. Its volatility is well-documented, and investors could experience substantial losses. However, a successful Bitcoin rally, as predicted by [Appointee's Name], could yield substantial returns. Therefore, a measured approach is crucial.

Effective risk mitigation strategies include:

- Diversification of investment portfolio: Don't put all your eggs in one basket. Diversify across different asset classes to reduce overall risk.

- Dollar-cost averaging investment strategy: Invest a fixed amount at regular intervals, regardless of price fluctuations, reducing the impact of market volatility.

- Understanding personal risk tolerance: Only invest what you can afford to lose and choose an investment strategy aligned with your personal risk tolerance.

Conclusion

[Appointee's Name]'s bullish Bitcoin price prediction, while intriguing, should be considered within the context of significant market volatility and the inherent risks of cryptocurrency investment. Their rationale, based on macroeconomic factors, regulatory changes, and institutional adoption, presents a compelling argument. However, counterarguments and diverse expert opinions highlight the uncertainty inherent in any market prediction. Remember to conduct thorough research, understand your risk tolerance, and diversify your investments. Stay informed about the latest developments influencing the Bitcoin rally and make informed investment decisions based on your own risk tolerance. Consider exploring various Bitcoin investment strategies to navigate the potential of a Bitcoin price increase while mitigating associated risks.

Featured Posts

-

Papal Conclave Cardinals Weigh Candidate Dossiers

May 08, 2025

Papal Conclave Cardinals Weigh Candidate Dossiers

May 08, 2025 -

Counting Crows Slip Into The Shadows An Analysis Of Lyrics And Musical Style From Aurora

May 08, 2025

Counting Crows Slip Into The Shadows An Analysis Of Lyrics And Musical Style From Aurora

May 08, 2025 -

Navigating The Stock Market Amidst The Liberation Day Tariffs

May 08, 2025

Navigating The Stock Market Amidst The Liberation Day Tariffs

May 08, 2025 -

Hkd Usd Exchange Rate Significant Interest Rate Fall Impacts Hong Kong Dollar

May 08, 2025

Hkd Usd Exchange Rate Significant Interest Rate Fall Impacts Hong Kong Dollar

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025

Latest Posts

-

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025 -

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025 -

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025