HKD/USD Exchange Rate: Significant Interest Rate Fall Impacts Hong Kong Dollar

Table of Contents

The Recent Interest Rate Cut and its Implications

On [Date of Interest Rate Cut], the HKMA announced a significant interest rate cut of [Specific Percentage] in response to [Reasons for Interest Rate Cut, e.g., slowing economic growth, global economic uncertainty]. This decision was detailed in a press release available on the HKMA's official website [Link to Press Release, if available]. The move signaled a proactive approach to address weakening economic conditions in Hong Kong, mirroring similar actions taken by central banks globally. The lower interest rate aims to stimulate borrowing and investment, thereby boosting economic activity.

- Specific Percentage of Interest Rate Cut: [Specific Percentage]

- Date of Announcement: [Date of Interest Rate Cut]

- Related Press Releases/Statements: [Link to relevant sources]

Impact on the HKD/USD Exchange Rate

The interest rate cut has had a noticeable impact on the HKD/USD exchange rate. Interest rates and currency exchange rates are intrinsically linked. Lower interest rates generally lead to a weaker currency. This is because lower rates reduce the return on investment in that currency, making it less attractive to foreign investors. The concept of interest rate differentials is key here – the difference in interest rates between two countries influences the relative value of their currencies. A smaller interest rate differential between the HKD and USD has led to a weakening of the HKD against the USD.

- Changes Observed in HKD/USD Exchange Rate: [Specific changes, e.g., "The HKD depreciated by X% against the USD in the week following the announcement."]

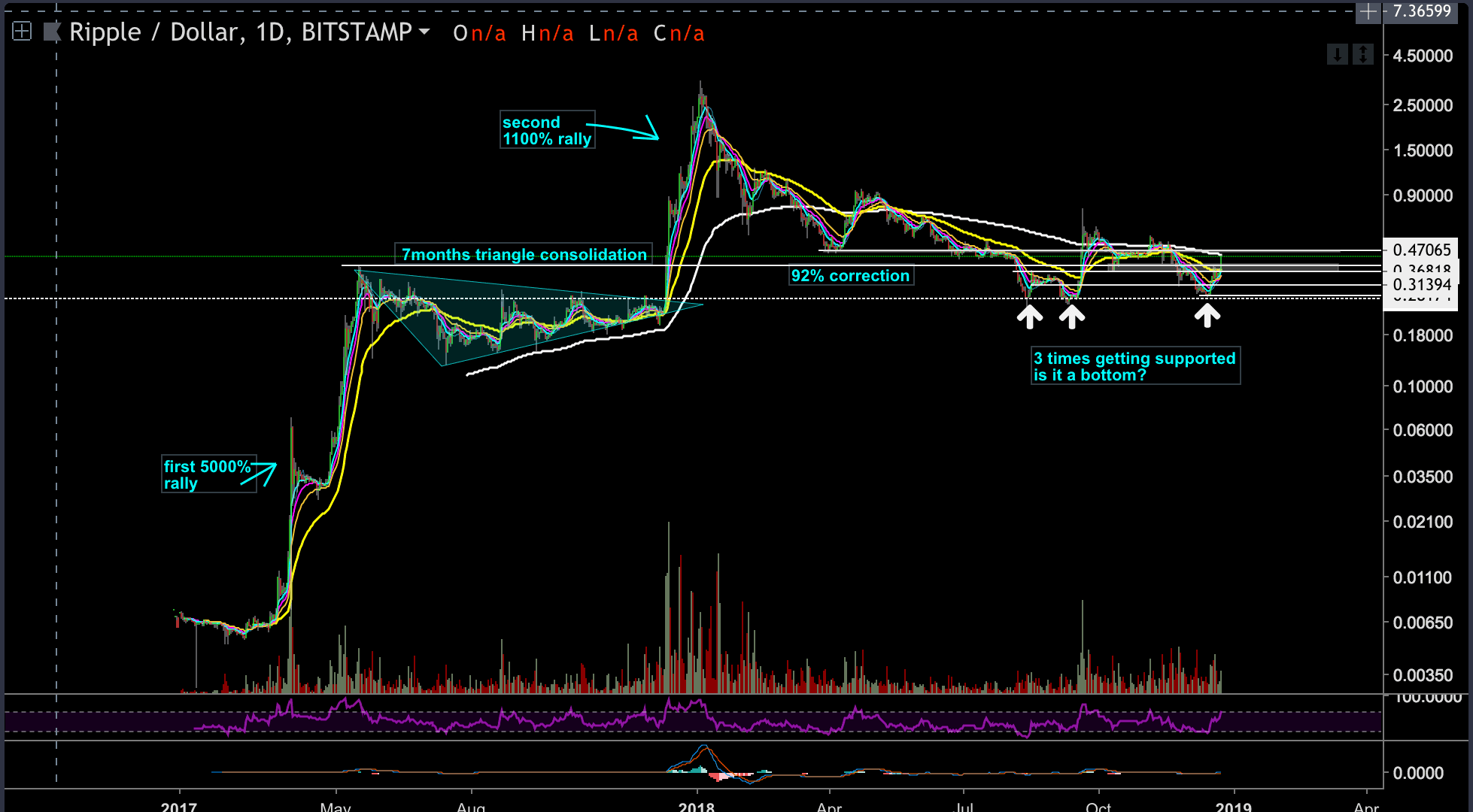

- Relevant Charts/Graphs: [Include relevant visuals if possible]

- Potential Future Predictions: [Mention any expert forecasts or projections, citing sources]

Effects on Hong Kong's Economy

The HKD/USD exchange rate shift, influenced by the interest rate cut, has far-reaching consequences for Hong Kong's economy. A weaker HKD can boost exports by making Hong Kong goods cheaper for international buyers. However, it can also lead to increased import costs, potentially fueling inflation. The tourism sector could see a mixed impact, with increased inbound tourism offset by higher costs for Hong Kong residents traveling abroad. The financial markets will also experience adjustments as investors react to the changed economic landscape.

- Potential Positive Impacts: Increased exports, potentially increased tourism from certain markets.

- Potential Negative Impacts: Increased import costs, inflation, decreased investment in certain sectors.

- Government Measures: [Mention any government initiatives to mitigate negative effects, such as fiscal stimulus packages.]

Strategies for Businesses and Individuals

Navigating the fluctuating HKD/USD exchange rate requires careful planning and proactive risk management. Businesses involved in international trade can employ hedging strategies like forward contracts or options to mitigate currency risk. Individuals planning international travel or investments should closely monitor the exchange rate and consider timing their transactions strategically. Consulting a financial professional is highly recommended for personalized advice.

- Recommendations for Businesses: Implement hedging strategies, diversify currency exposure, forecast exchange rate movements.

- Tips for Individuals: Monitor the HKD/USD exchange rate, consider timing transactions wisely for travel or investments, seek professional financial advice.

- Consult Financial Professionals: Seek advice from financial advisors experienced in foreign exchange markets.

Conclusion: Navigating the Future of the HKD/USD Exchange Rate

The recent interest rate fall has undeniably impacted the HKD/USD exchange rate and Hong Kong's economy. Understanding the relationship between interest rates, exchange rates, and economic conditions is crucial for making informed decisions. The volatility of the HKD/USD exchange rate necessitates continuous monitoring. Businesses and individuals should proactively manage their exposure to HKD/USD exchange rate fluctuations by implementing appropriate strategies and seeking professional financial guidance. Staying informed about the latest developments in the Hong Kong dollar exchange rate and the overall economic climate is essential for navigating the uncertainties ahead and effectively managing HKD/USD risk.

Featured Posts

-

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025 -

Sony Ps 5 Pro Speculation And Confirmed Features Compared

May 08, 2025

Sony Ps 5 Pro Speculation And Confirmed Features Compared

May 08, 2025 -

Nba Playoffs Trivia How Well Do You Know The Triple Doubles Leaders

May 08, 2025

Nba Playoffs Trivia How Well Do You Know The Triple Doubles Leaders

May 08, 2025 -

Xrps 400 Rally Further Growth Potential

May 08, 2025

Xrps 400 Rally Further Growth Potential

May 08, 2025 -

Penny Pritzker A Deep Dive Into The Life Of The Billionaire Hotel Heiress At The Heart Of The Harvard Controversy

May 08, 2025

Penny Pritzker A Deep Dive Into The Life Of The Billionaire Hotel Heiress At The Heart Of The Harvard Controversy

May 08, 2025

Latest Posts

-

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025 -

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025 -

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025