Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

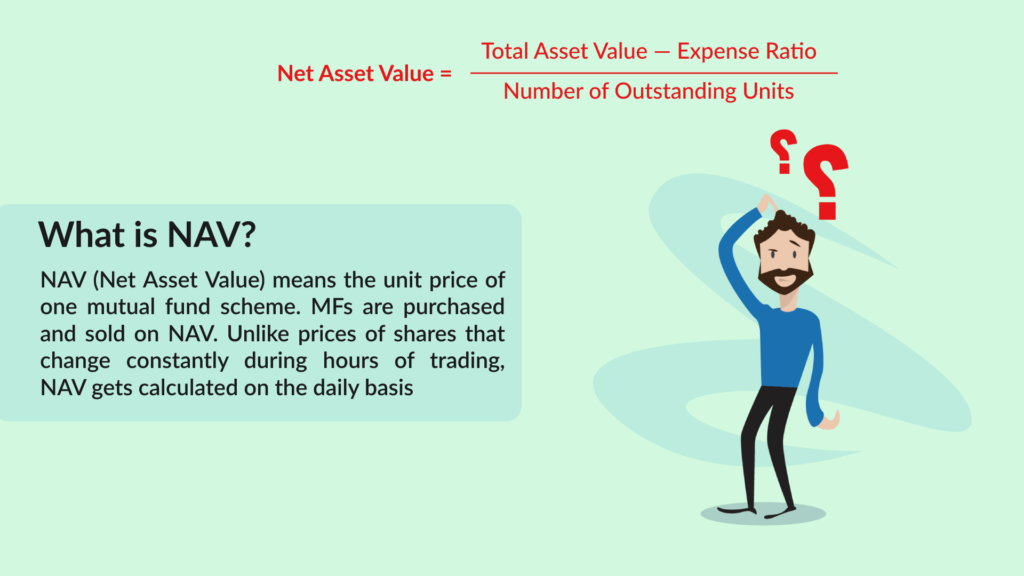

Defining NAV:

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated by subtracting the ETF's liabilities from the total market value of its assets, then dividing by the number of outstanding shares. For example, if an ETF holds $10 million in assets and has $100,000 in liabilities with 1 million shares outstanding, its NAV would be $9.90 per share (($10,000,000 - $100,000) / 1,000,000). This is a simplified example; real-world calculations are more complex. Understanding the NAV provides a snapshot of the intrinsic value of the ETF.

NAV Calculation for the Amundi Dow Jones Industrial Average UCITS ETF:

The Amundi Dow Jones Industrial Average UCITS ETF's NAV calculation reflects the value of its holdings, which mirror the composition of the Dow Jones Industrial Average. This means the ETF's NAV is directly influenced by the price movements of the 30 constituent companies within the Dow Jones Industrial Average. The calculation involves determining the market value of each holding, weighting it according to its representation in the index, summing these values, deducting any liabilities (management fees, expenses etc.), and then dividing by the total number of outstanding shares.

- Factors Influencing Daily NAV Fluctuations: The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF fluctuates due to several factors:

- Changes in the market prices of the 30 Dow Jones Industrial Average components.

- Fluctuations in currency exchange rates (if the ETF holds assets denominated in currencies other than the base currency).

- Dividend payments received from the underlying companies.

- NAV vs. Market Price: While NAV represents the intrinsic value, the market price is the price at which the ETF trades on the exchange. Discrepancies can arise due to supply and demand, trading volume, and market sentiment. These discrepancies are usually small and tend to converge over time.

- NAV for Performance Evaluation: Tracking NAV changes over time is crucial for assessing the ETF's performance. Comparing the NAV against the initial investment allows investors to calculate their returns, excluding the impact of market price fluctuations.

How to Track the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Official Sources for NAV Data:

The most reliable source for the Amundi Dow Jones Industrial Average UCITS ETF's NAV is the official Amundi website. Many financial data providers, such as Bloomberg Terminal, Refinitiv Eikon, and others, also provide this data.

Using Brokerage Platforms:

Most brokerage platforms display the NAV of ETFs held in your portfolio. This information is usually updated daily, often with a slight delay after market close. [Insert example screenshot of a brokerage platform showing NAV data if possible].

Utilizing Financial News Websites:

Reputable financial news websites and investment portals often publish ETF NAV information. However, always verify the source's reliability before making any investment decisions.

- Links to Relevant Websites and Data Sources: [Insert links to Amundi's website and a few reputable financial data providers].

- Time Lag: There's typically a small time lag (usually a few hours) between market close and the publication of the official NAV.

- Reliable Sources: Using reliable sources is crucial to avoid misinformation that could lead to poor investment choices.

Interpreting NAV Changes and Their Implications for Your Investment

Analyzing NAV Trends:

Analyzing the NAV trends of the Amundi Dow Jones Industrial Average UCITS ETF helps understand its performance relative to the Dow Jones Industrial Average. An upward trend generally indicates positive performance, while a downward trend suggests underperformance. However, it's vital to consider the broader market context and the performance of the Dow Jones Industrial Average itself.

Using NAV for Investment Decisions:

NAV data, in conjunction with other metrics like the ETF's expense ratio and trading volume, helps inform investment decisions. A rising NAV, coupled with positive market sentiment and strong Dow Jones Industrial Average performance, might signal a potential holding opportunity or even a buying opportunity, depending on your investment goals.

- Examples of Scenarios: A consistently declining NAV, despite positive market trends, could indicate underlying issues with the ETF's management or the index it tracks. This might be a signal to consider selling.

- Investment Goals and Risk Tolerance: Your investment goals and risk tolerance should significantly influence your investment decisions, in conjunction with NAV analysis.

- Limitations of Relying Solely on NAV: While NAV is an important metric, don't rely solely on it. Consider other factors like market sentiment, economic indicators, and your personal investment strategy.

Frequently Asked Questions (FAQs) about Amundi Dow Jones Industrial Average UCITS ETF NAV

- How often is the NAV updated? The NAV is typically updated daily, after the close of the market.

- What is the difference between bid and ask prices and the NAV? The bid and ask prices reflect the current market prices at which you can buy or sell the ETF. The NAV represents the underlying asset value. These values may differ slightly due to market dynamics.

- Where can I find historical NAV data? You can find historical NAV data on the Amundi website, through your brokerage platform, and on many financial data websites.

Conclusion:

Tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is a vital aspect of informed investment management. By utilizing official sources like the Amundi website and your brokerage platform, you can access reliable data to analyze performance trends and make informed buy, hold, or sell decisions. Remember to consider NAV alongside other investment metrics and your overall investment strategy. Stay informed about your investment and proactively track the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF holdings to optimize your investment strategy.

Featured Posts

-

Guccis New Designer Demna Gvasalias Vision And Future Direction

May 24, 2025

Guccis New Designer Demna Gvasalias Vision And Future Direction

May 24, 2025 -

Moja Opinia O Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025

Moja Opinia O Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025 -

Hand In Hand Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025

Hand In Hand Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025 -

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025 -

Konchita Vurst Dnes Neyniyat Zhivot Sled Pobedata Na Evroviziya

May 24, 2025

Konchita Vurst Dnes Neyniyat Zhivot Sled Pobedata Na Evroviziya

May 24, 2025

Latest Posts

-

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025 -

Ai

May 24, 2025

Ai

May 24, 2025 -

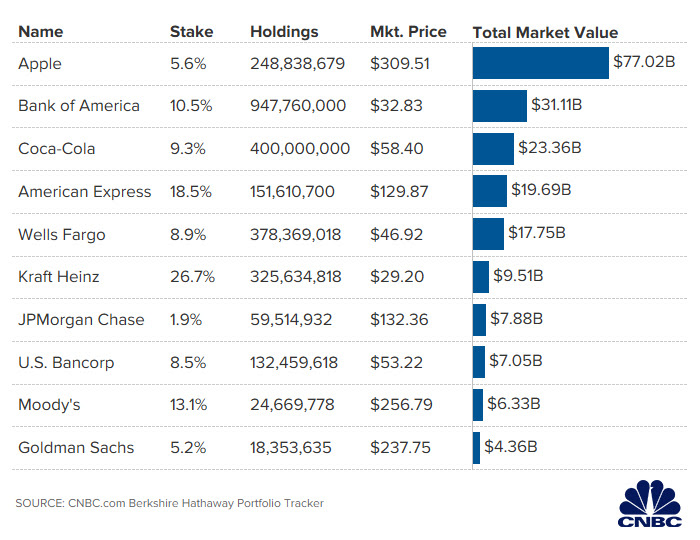

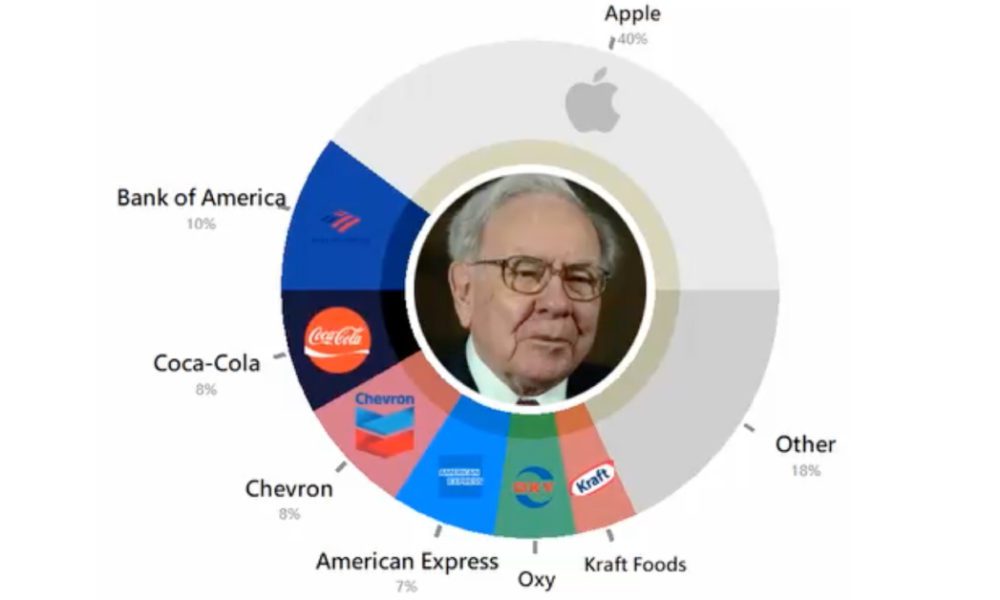

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

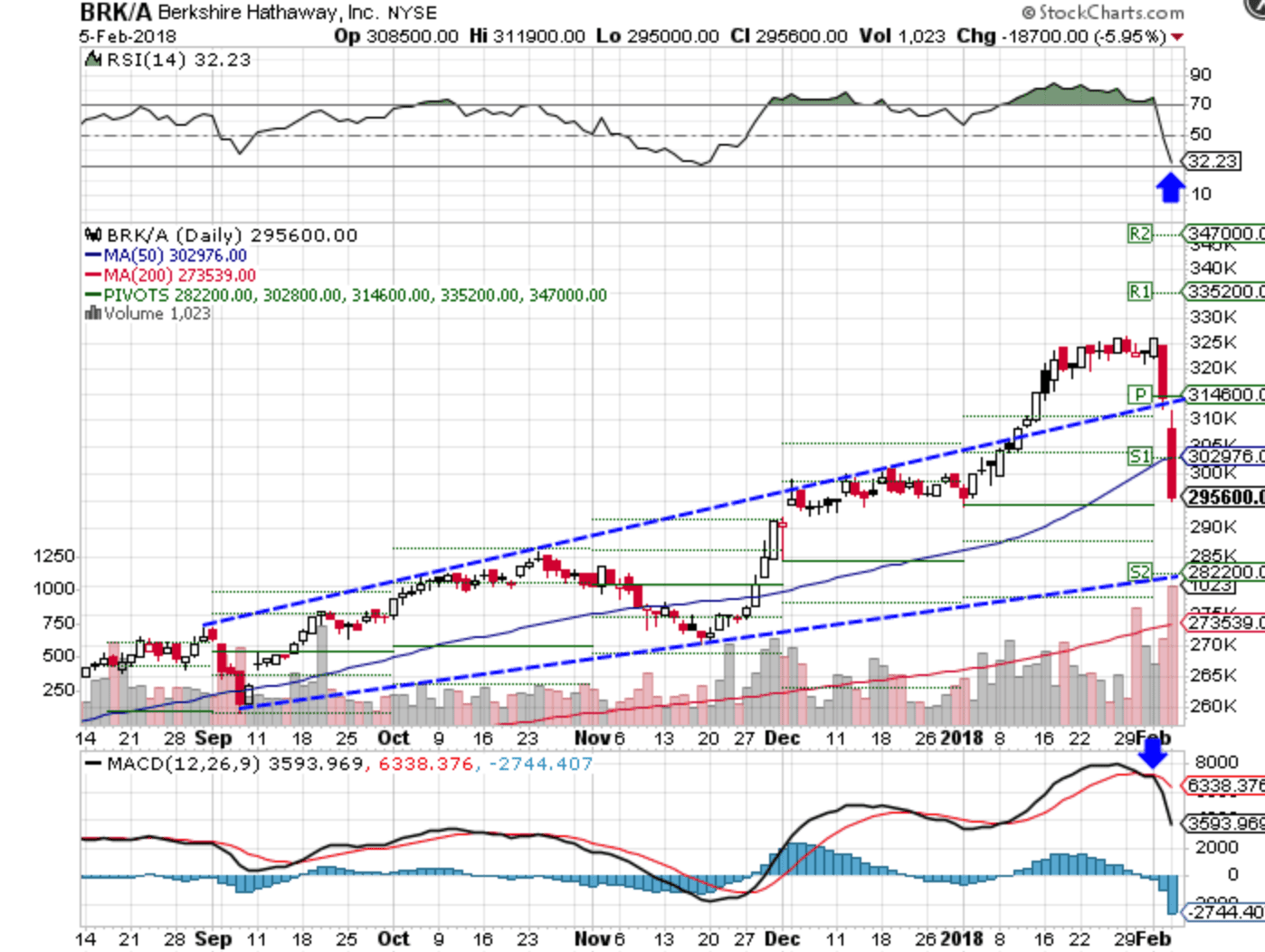

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025