The Bank Of England And The Half-Point Cut: A Necessary Preemptive Strike?

Table of Contents

Interest rate adjustments are a powerful tool used by central banks to manage the economy. A reduction, like the recent half-point cut, aims to stimulate economic activity by making borrowing cheaper. However, such decisions are fraught with complexity, balancing the need to boost growth against the risk of fueling inflation. This article will delve into the rationale behind the Bank's decision, exploring both its potential benefits and inherent risks.

The Economic Rationale Behind the Half-Point Cut

The Bank of England's justification for the half-point cut rests on a complex interplay of inflationary pressures and slowing economic growth.

Inflationary Pressures

While inflation has shown signs of easing, it remains significantly above the Bank's 2% target. Several factors have contributed to this persistent inflationary pressure:

- Supply chain disruptions: The lingering effects of the pandemic continue to constrain supply, driving up prices.

- Soaring energy prices: The global energy crisis has significantly increased household and business energy costs, feeding into broader inflation.

- Robust wage growth: While necessary to maintain living standards, strong wage increases can add to inflationary pressures if not matched by productivity gains.

The Bank's inflation report indicates that inflation, while declining from its peak, is expected to remain elevated for some time. This necessitates careful consideration of monetary policy to avoid a wage-price spiral. The UK's inflation rate, currently hovering around [insert current inflation rate]%, contrasts sharply with the Bank's target, emphasizing the challenge ahead.

Slowing Economic Growth

The UK's GDP growth rate has significantly slowed, raising concerns about an impending recession. Several factors contribute to this deceleration:

- Brexit-related uncertainties: The long-term economic impact of Brexit remains unclear and continues to affect business investment and trade.

- Global economic slowdown: The global economic landscape is characterized by uncertainty, impacting UK exports and investor confidence.

- Weakening consumer confidence: Falling real incomes and rising living costs are dampening consumer spending, a crucial driver of economic growth.

Recent GDP figures reveal a concerning trend, with forecasts from reputable institutions like the Office for Budget Responsibility projecting [insert GDP growth forecast] for the coming year. This paints a picture of a weakening economy vulnerable to a sharp downturn.

The Preemptive Argument

The Bank of England likely opted for a preemptive cut to prevent a more severe recession. The rationale is that a proactive approach, even with associated risks, might be less damaging than allowing the economy to fall into a deeper crisis.

- Early intervention: By acting early, the Bank aims to mitigate the potential for a sharper economic contraction.

- Stimulating demand: Lower interest rates can boost investment and consumer spending, preventing a prolonged downturn.

- Preventing deflationary spirals: A preemptive cut can prevent a deflationary spiral, where falling prices lead to reduced spending and further price drops.

Potential Risks and Criticisms of the Half-Point Cut

Despite the potential benefits, the half-point cut carries significant risks and has drawn criticism from various quarters.

Inflationary Risks

The primary concern is that the cut could exacerbate inflationary pressures in the long run.

- Increased consumer spending: Lower borrowing costs could lead to increased consumer spending, further fueling demand-pull inflation.

- Higher business investment: Easier access to credit may encourage businesses to invest, but this could also lead to increased price pressures if supply cannot keep pace.

- Reduced incentive to save: Lower interest rates can reduce the incentive to save, potentially increasing consumption and inflationary pressures.

Impact on the Pound Sterling

A lower interest rate can weaken the pound sterling, making imports more expensive and potentially increasing inflation further.

- Exchange rate fluctuations: Historically, lower interest rates have been associated with a weaker pound.

- Impact on trade balance: A weaker pound can increase the cost of imported goods, widening the trade deficit.

Effectiveness of Monetary Policy

The effectiveness of monetary policy in the current climate is a subject of ongoing debate.

- Supply-side constraints: Monetary policy primarily addresses demand-side issues. The current inflation is partly driven by supply-side constraints, which monetary policy may not fully address.

- Global factors: Many of the factors influencing the UK economy are global in nature, limiting the impact of domestic monetary policy.

- Alternative policy measures: Fiscal policy, involving government spending and taxation, may be more effective in addressing some of the underlying issues.

Comparing the Half-Point Cut to Previous Bank of England Actions

Comparing this half-point cut to previous Bank of England actions reveals both similarities and crucial differences. While previous cuts were often implemented during periods of economic slowdown, the current situation is unique due to the high inflation levels. Unlike past instances, where inflation was closer to the target, this decision involves a considerable risk of fueling further price increases. [Insert specific historical data points and comparisons here – e.g., comparing the 2008 financial crisis response with the current situation].

Conclusion

The Bank of England's half-point cut presents a complex economic dilemma. While aiming to preempt a deeper recession by stimulating demand, it risks exacerbating already high inflation and potentially weakening the pound. The decision's success will hinge on a delicate balancing act, and its ultimate effectiveness remains to be seen. Whether it proves to be a necessary preemptive strike or a risky gamble is a question that only time will answer. To understand the ongoing impact of this decision, it is vital to continue following the Bank of England's official publications, stay updated on economic news, and seek professional financial advice tailored to your specific circumstances. Analyzing the long-term effects of the Bank of England and the half-point cut on the UK economy will be crucial in assessing the effectiveness of this unconventional monetary policy.

Featured Posts

-

Deandre Dzordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025

Deandre Dzordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025 -

Champions League Final Preview Hargreaves Arsenal Psg Prediction

May 08, 2025

Champions League Final Preview Hargreaves Arsenal Psg Prediction

May 08, 2025 -

Psg Nice Macini Canli Olarak Nereden Izleyebilirim

May 08, 2025

Psg Nice Macini Canli Olarak Nereden Izleyebilirim

May 08, 2025 -

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025 -

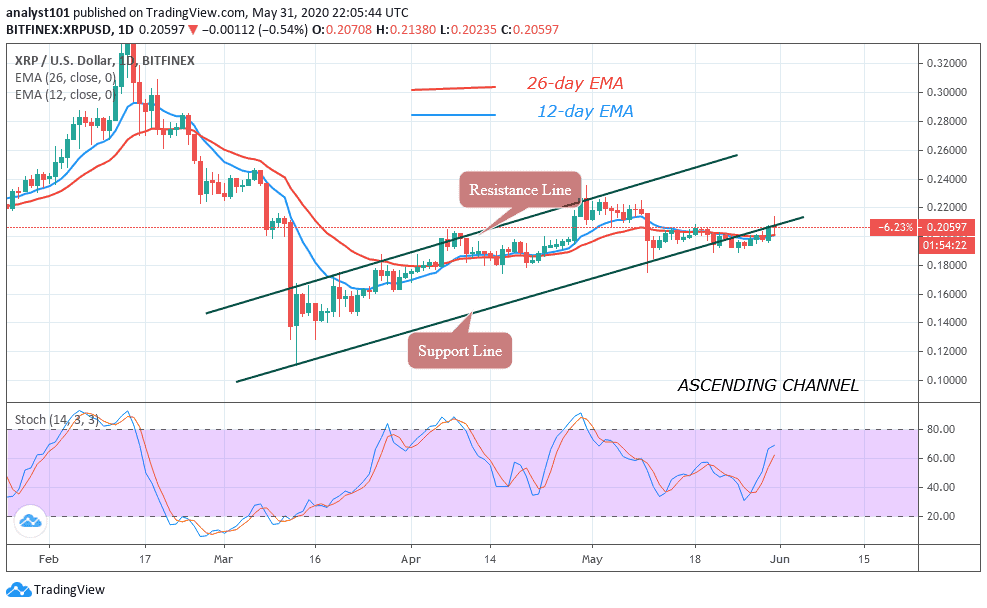

Increased Institutional Interest In Xrp Following Trumps Endorsement

May 08, 2025

Increased Institutional Interest In Xrp Following Trumps Endorsement

May 08, 2025

Latest Posts

-

Ripples Xrp Can It Overcome Resistance And Reach 3 40

May 08, 2025

Ripples Xrp Can It Overcome Resistance And Reach 3 40

May 08, 2025 -

Investing In Xrp Ripple Risks And Rewards

May 08, 2025

Investing In Xrp Ripple Risks And Rewards

May 08, 2025 -

Xrp Price Prediction Breaking Resistance And Reaching 3 40

May 08, 2025

Xrp Price Prediction Breaking Resistance And Reaching 3 40

May 08, 2025 -

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025 -

Analyzing Xrp Ripple A Potential Lifetime Investment

May 08, 2025

Analyzing Xrp Ripple A Potential Lifetime Investment

May 08, 2025