Investing In XRP (Ripple): Risks And Rewards

Table of Contents

Potential Rewards of XRP Investment

XRP investment offers several potential rewards, attracting investors seeking high returns and exposure to a rapidly evolving financial technology.

High Growth Potential

XRP's price history showcases periods of impressive growth, making it an attractive proposition for those with a higher risk tolerance.

- Significant Capital Appreciation: The potential for substantial capital gains is a primary driver for XRP investment. Past performance, while not indicative of future results, demonstrates the possibility of significant returns.

- Early Adoption Advantage: Investing early in promising cryptocurrencies can yield substantial profits if the project gains widespread adoption. XRP's established presence in the market gives it a head start.

- Technological Advancements: Ripple's ongoing development and improvements to its technology could drive XRP's price upward. Innovation within the Ripple ecosystem is a key factor to watch.

- Institutional Adoption: Growing partnerships with financial institutions and the increasing use of XRP for cross-border payments could significantly boost demand. This institutional interest can stabilize the price and increase its overall value.

Use Cases and Utility

Unlike many cryptocurrencies focused solely on speculation, XRP boasts real-world utility, significantly enhancing its long-term prospects.

- Lower Transaction Fees: XRP offers lower transaction fees compared to traditional banking systems, making it a cost-effective solution for international transfers.

- Faster Transaction Speeds: XRP's transaction speed is considerably faster than traditional banking systems, improving efficiency for businesses and individuals alike.

- Enhanced Global Payment Efficiency: XRP's technology facilitates smoother, faster, and cheaper cross-border payments, potentially revolutionizing the global financial landscape.

- Strategic Partnerships: Ripple's strategic partnerships with various financial institutions are expanding XRP's reach and solidifying its position in the payments industry.

Liquidity and Accessibility

XRP's high liquidity and accessibility make it a relatively straightforward cryptocurrency to trade.

- Wide Exchange Availability: XRP is listed on most major cryptocurrency exchanges, offering investors easy access to buying and selling.

- High Trading Volume: The high trading volume ensures relatively low slippage and easy entry and exit points, reducing the risk of significant price impacts during trades.

- Competitive Trading Fees: Some exchanges offer competitive trading fees for XRP compared to other cryptocurrencies.

Risks Associated with XRP Investment

While the potential rewards are enticing, investing in XRP carries significant risks that should be carefully considered.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain, posing a substantial risk to XRP's future.

- Ripple Lawsuit: The ongoing legal battle between Ripple Labs and the SEC creates considerable uncertainty regarding XRP's regulatory status in the United States and globally.

- Jurisdictional Variations: Cryptocurrency regulations vary significantly across different jurisdictions, leading to potential legal and compliance issues.

- Government Intervention: The risk of future government restrictions or bans on cryptocurrencies, including XRP, cannot be discounted.

Market Volatility

XRP's price is highly volatile, experiencing significant price swings.

- High Risk of Losses: The unpredictable nature of the cryptocurrency market means substantial losses are possible due to sudden price drops.

- External Factors: Market sentiment, news events, and overall economic conditions can heavily influence XRP's price.

- Long-Term Perspective Required: Investing in XRP requires a high-risk tolerance and a long-term investment horizon to weather potential price volatility.

Security Risks

Like all cryptocurrencies, XRP investment carries inherent security risks.

- Exchange Hacks: The risk of losing funds due to exchange hacks or security breaches remains a significant concern.

- Secure Wallet Usage: Employing secure wallets and exchanges is crucial to mitigate the risk of theft or loss of funds.

- Fraudulent Activities: Investors need to be aware of phishing scams, fraudulent platforms, and other malicious activities.

Conclusion

Investing in XRP presents a compelling opportunity with potentially high rewards, but also substantial risks. The high growth potential and real-world utility are balanced by regulatory uncertainty, market volatility, and security concerns. Thorough research, a clear understanding of your risk tolerance, and portfolio diversification are crucial before considering any XRP investment. Only invest what you can afford to lose. Before making any decisions regarding XRP investment, carefully evaluate the potential rewards against the inherent risks. Remember to conduct your own due diligence before investing in XRP or any other cryptocurrency.

Featured Posts

-

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025 -

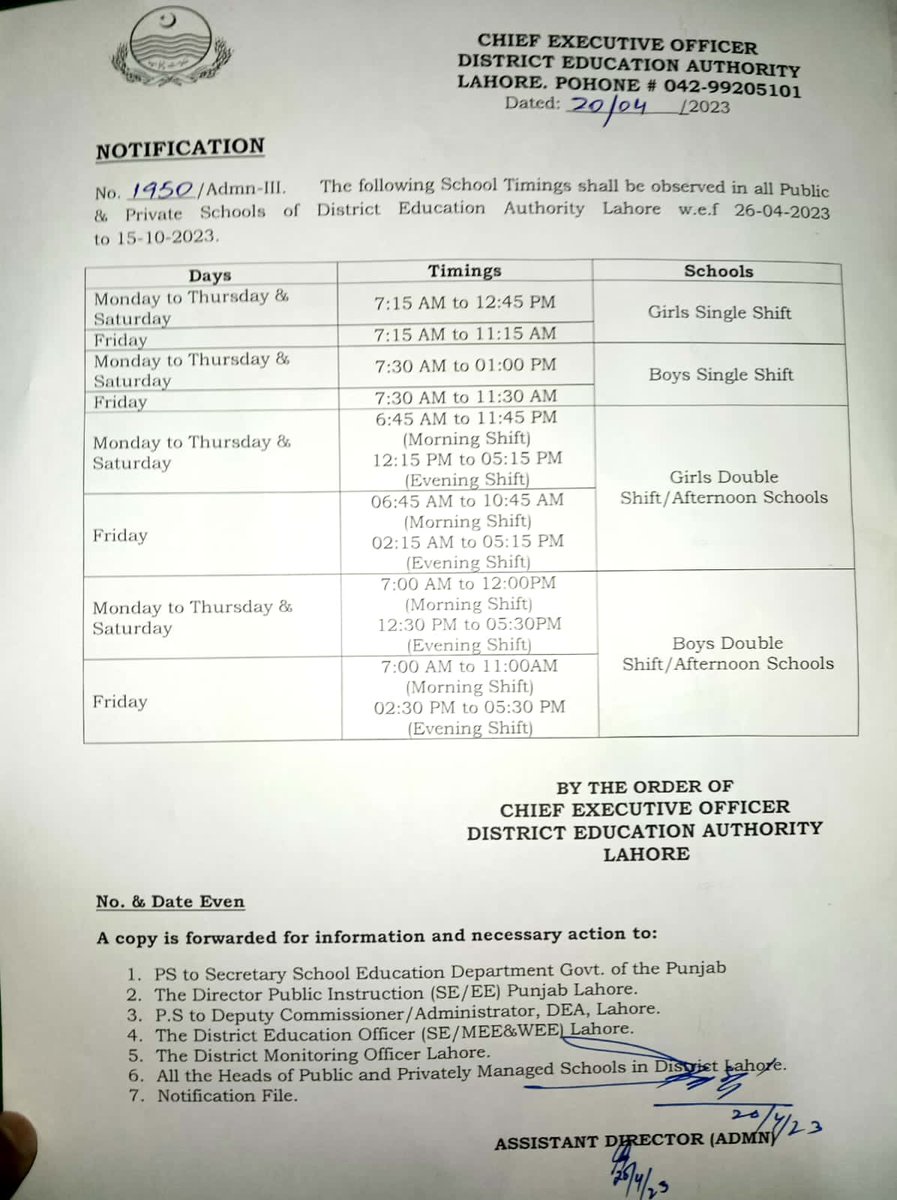

Py Ays Ayl Ky Wjh Se Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025

Py Ays Ayl Ky Wjh Se Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025 -

Hargreaves Predicts Arsenal Psg Champions League Final Clash

May 08, 2025

Hargreaves Predicts Arsenal Psg Champions League Final Clash

May 08, 2025 -

Analyzing The Long Term Effects Of Liberation Day Tariffs On Stock Investments

May 08, 2025

Analyzing The Long Term Effects Of Liberation Day Tariffs On Stock Investments

May 08, 2025 -

Prelazna Vlada Grbovic Psg Spreman Za Kompromis

May 08, 2025

Prelazna Vlada Grbovic Psg Spreman Za Kompromis

May 08, 2025

Latest Posts

-

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Jayson Tatums Ankle Details On The Injury And Potential Recovery Timeline

May 08, 2025

Jayson Tatums Ankle Details On The Injury And Potential Recovery Timeline

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025