Increased Institutional Interest In XRP Following Trump's Endorsement

Table of Contents

Trump's Endorsement: A Catalyst for Institutional Attention

The power of celebrity endorsements in the volatile cryptocurrency market cannot be understated. High-profile figures often wield significant influence over investor sentiment and market trends. Trump's endorsement of XRP is no exception.

The Power of Celebrity Endorsements in Crypto

- Amplified Visibility and Credibility: Trump's endorsement instantly catapults XRP into the mainstream spotlight, boosting its visibility and perceived credibility among potential institutional investors. This increased awareness can attract a larger pool of investors previously hesitant about less-known cryptocurrencies.

- Psychological Impact on Investor Sentiment: Endorsements from influential figures like Trump can significantly sway investor sentiment. The perceived endorsement creates a positive psychological bias, encouraging confidence and potentially triggering a buying frenzy. This is a common psychological phenomenon impacting stock markets and now increasingly influencing the crypto sphere.

- Increased Media Coverage and Public Awareness: Trump's involvement guarantees widespread media coverage, resulting in increased public awareness of XRP. This heightened visibility can lead to organic growth and wider acceptance of the digital asset, thereby boosting investor interest. The increased media attention might even indirectly benefit Ripple's ongoing legal battles.

Analyzing the Implications for Ripple's Legal Battle

The SEC lawsuit against Ripple remains a significant hurdle for XRP's widespread adoption. However, Trump's endorsement might indirectly influence the legal proceedings.

- Shifts in Public Opinion: A positive public perception, fueled by Trump's endorsement, could sway public opinion in favor of Ripple, potentially influencing the judicial process and the outcome of the lawsuit. This is particularly important in cases where public sentiment plays a role.

- Impact on Ripple's Legal Strategy: The endorsement could embolden Ripple's legal strategy, potentially influencing their approach and arguments presented to the court. It might also attract more support from legal professionals willing to take on the case.

- Potential Scenarios and Price Effects: A favorable resolution to the lawsuit could significantly boost XRP's price, while an unfavorable outcome could have the opposite effect. Trump's involvement adds another layer of complexity to predicting the eventual outcome and its market implications.

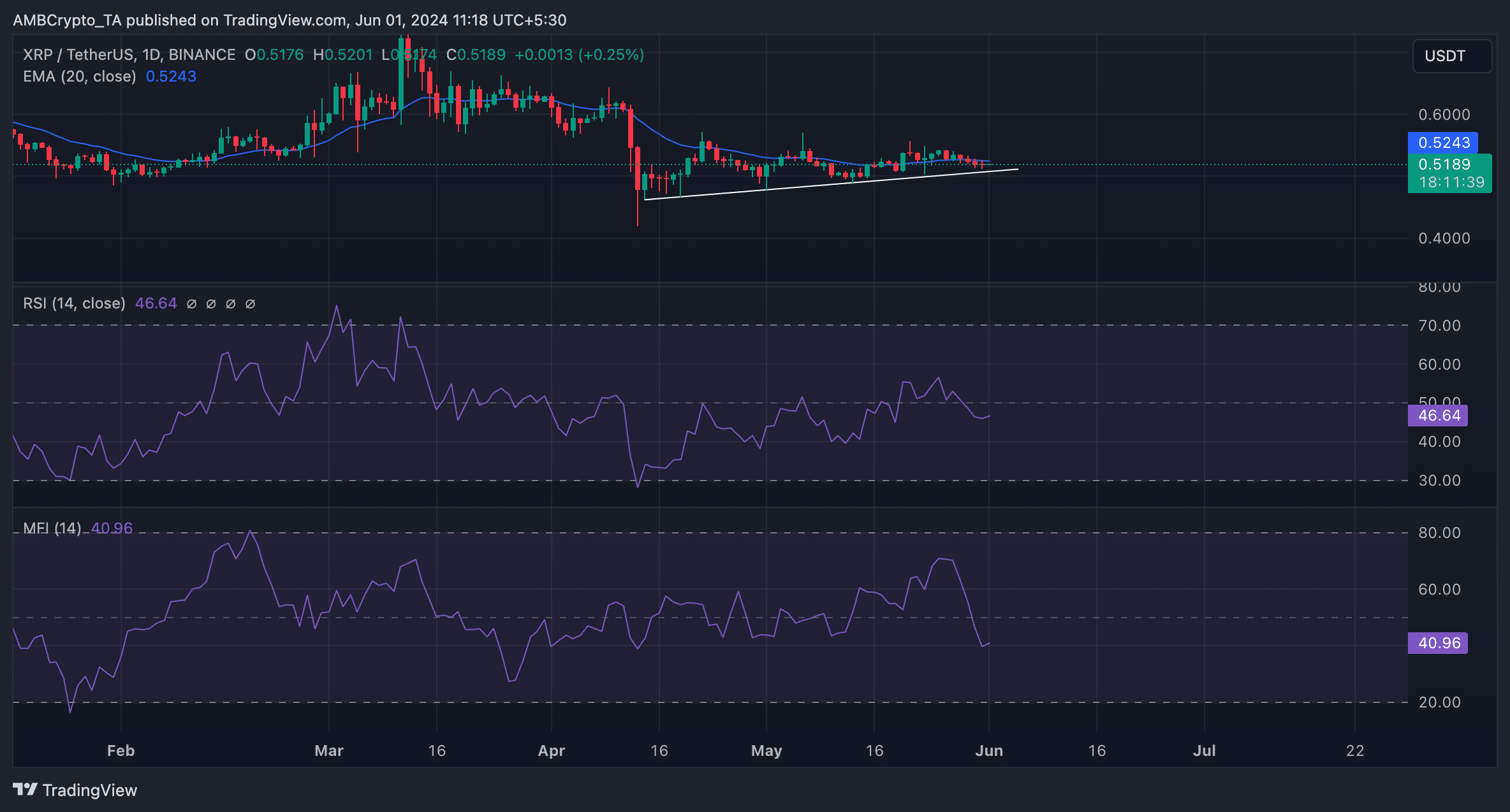

Increased Institutional Investment: A Deep Dive into the Numbers

While precise figures on post-endorsement institutional investment in XRP are currently unavailable, anecdotal evidence and market trends suggest a notable increase.

Tracking Institutional Holdings of XRP

- Visual Representation of Growth: (Insert chart or graph here illustrating growth in institutional XRP holdings if data becomes available post-publication. Placeholder: Data unavailable at time of publication. Further analysis pending.)

- Identification of Major Institutional Investors: (Insert names of known institutional investors increasing XRP holdings if data becomes available. Placeholder: Information pending verification.)

- Allocation of Funds Compared to Other Crypto Assets: (Compare XRP's allocation within institutional portfolios to other cryptocurrencies like Bitcoin or Ethereum. Placeholder: Comparative analysis pending further data collection.)

Reasons Behind the Institutional Shift

The renewed interest from institutional investors in XRP can be attributed to several factors:

- Potential for Higher Returns: Institutional investors are always seeking higher returns. XRP, with its potential for significant price appreciation, especially given recent events, is an attractive investment opportunity.

- Perceived Lower Risk Profile (relative to other altcoins): Compared to other less established altcoins, XRP, despite the ongoing SEC lawsuit, might be perceived as relatively less risky by some institutional players, especially given its established network and use cases.

- Potential Long-Term Growth Opportunities: Many believe XRP has the potential for long-term growth based on Ripple's technological advancements and its potential for widespread adoption in cross-border payments.

Navigating the Regulatory Landscape: Challenges and Opportunities

The regulatory landscape surrounding XRP remains complex and uncertain, primarily due to the ongoing SEC lawsuit.

The SEC Lawsuit and its Ongoing Impact

- Regulatory Clarity and Investor Confidence: A clear resolution to the SEC lawsuit, regardless of the outcome, will bring much-needed regulatory clarity and significantly impact investor confidence. This clarity is vital for attracting further institutional investment.

- Impact on Market Capitalization: A positive resolution could potentially catapult XRP's market capitalization to new heights, whereas a negative outcome could significantly depress its value.

- Future Regulations Surrounding XRP: The outcome of the SEC lawsuit will likely set a precedent for future regulations concerning cryptocurrencies, particularly those operating within the payment processing sector.

Global Regulatory Differences and Their Influence

Regulatory approaches to cryptocurrencies vary significantly across jurisdictions. This presents both challenges and opportunities for XRP.

- Influence on Institutional Investment Decisions: Institutional investors are highly sensitive to regulatory risks. Jurisdictions with favorable regulatory frameworks are more likely to attract significant institutional investment in XRP.

- Thriving in Favorable Regulatory Environments: XRP could experience significant growth in regions with more lenient or supportive cryptocurrency regulations.

- Increased Cross-Border Transactions: XRP's potential as a facilitator of cross-border payments could be significantly enhanced in jurisdictions that support its use within their financial systems.

Conclusion

Trump's endorsement of XRP, coupled with the ongoing SEC lawsuit and the evolving regulatory landscape, has created a dynamic and uncertain environment. The surge in institutional interest, however, presents a compelling case for further investigation. While the long-term impact remains to be seen, the potential for significant growth in the XRP market is undeniable.

While the impact of Trump's endorsement on XRP remains to be seen, the increased institutional interest presents a compelling case for further investigation. Stay informed about the evolving landscape of XRP and the unfolding legal battles by following our updates and engaging in further research on the future of this digital asset. Learn more about the current state of XRP investment and potential risks involved.

Featured Posts

-

Ps 5 Pro Disassembly A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025

Ps 5 Pro Disassembly A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025 -

Bayern Munichs Champions League Hopes Dented By Inter Milan Defeat

May 08, 2025

Bayern Munichs Champions League Hopes Dented By Inter Milan Defeat

May 08, 2025 -

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Lotto 6aus49 Gewinnzahlen Des 19 April 2025

May 08, 2025

Lotto 6aus49 Gewinnzahlen Des 19 April 2025

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025