Analyzing XRP (Ripple): A Potential Lifetime Investment?

Table of Contents

Understanding XRP and Ripple's Technology

XRP is a cryptocurrency designed for fast and efficient cross-border payments. Unlike cryptocurrencies like Bitcoin that rely on Proof-of-Work, XRP utilizes a unique consensus mechanism, offering significantly faster transaction speeds and lower fees. This makes it attractive for financial institutions looking to streamline international transactions.

RippleNet and its Role in Global Payments

RippleNet is Ripple's payment network that leverages XRP to facilitate faster and cheaper cross-border payments. It connects banks and financial institutions globally, allowing them to send and receive money almost instantly.

- Faster Cross-Border Payments: RippleNet utilizes XRP's speed to significantly reduce the time it takes to transfer money internationally, compared to traditional methods which can take days or even weeks.

- Key Partnerships and Banks: Many major banks and financial institutions have partnered with Ripple, including Santander, Bank of America, and SBI Holdings, demonstrating its growing adoption in the financial sector. This institutional adoption is a key factor influencing XRP's potential long-term value.

- Scalability of the Ripple Network: The Ripple network boasts high scalability, handling a large volume of transactions efficiently, a crucial aspect for its potential use in large-scale financial operations.

XRP's Consensus Mechanism

XRP uses a unique consensus mechanism called the "Ripple Protocol Consensus Algorithm" (RPCA). Unlike Proof-of-Work (used by Bitcoin) or Proof-of-Stake (used by Ethereum), RPCA is designed for speed and efficiency. It requires less energy and achieves faster transaction confirmation times, making it a more environmentally friendly and cost-effective solution for large-scale transactions.

Market Analysis and Price Volatility

Analyzing XRP's potential as a lifetime investment necessitates a thorough examination of its market performance and price volatility.

XRP's Historical Performance

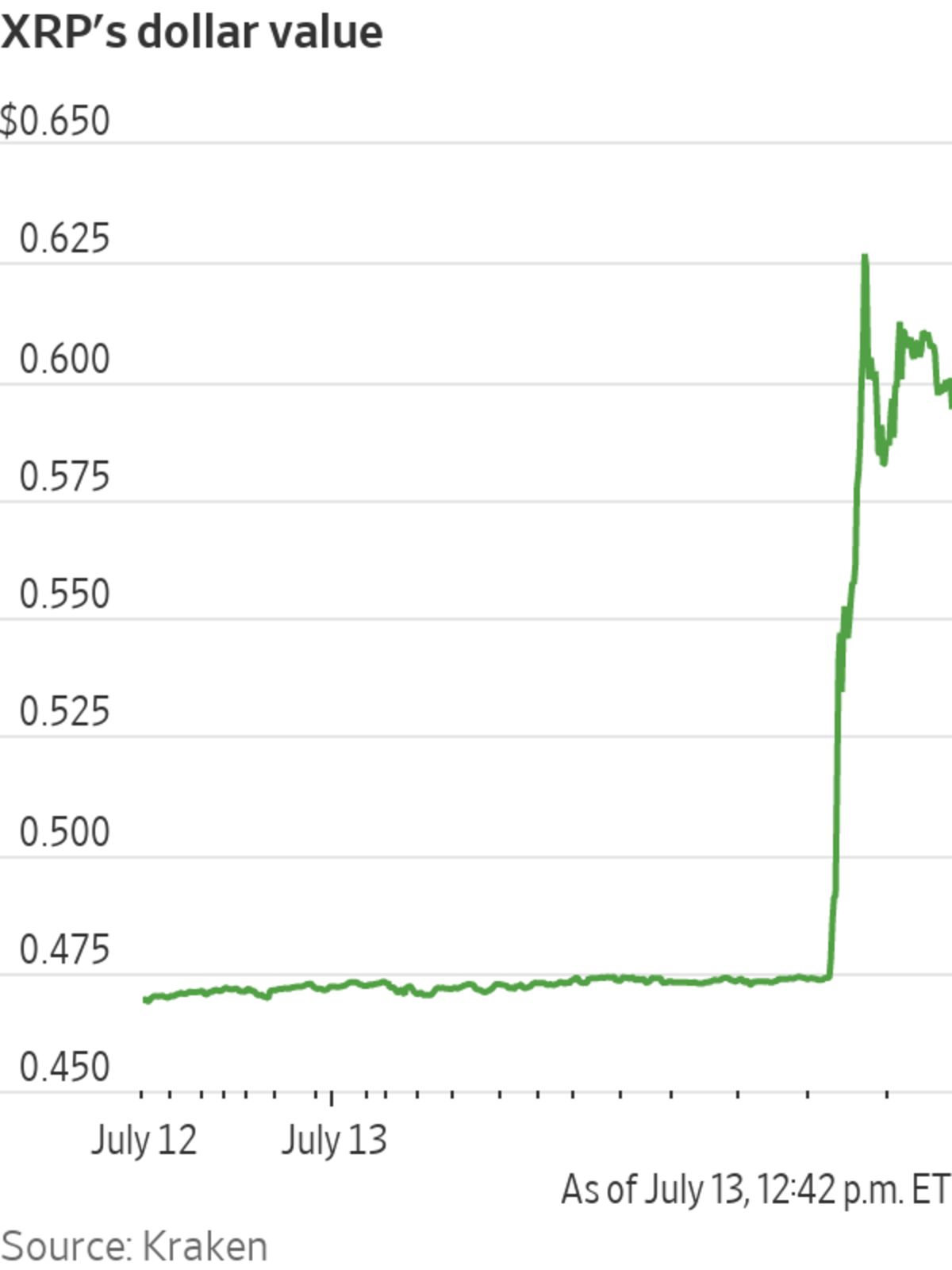

XRP's price history has been characterized by significant volatility, mirroring the broader cryptocurrency market. [Insert relevant chart/graph showing XRP's price history]. While it has experienced periods of substantial growth, it has also undergone considerable corrections. Understanding this volatility is crucial for assessing its long-term viability.

- Factors Affecting XRP's Price Volatility: Market sentiment, regulatory news, and technological advancements all heavily influence XRP's price. Broader macroeconomic factors also play a role.

- Comparison to Bitcoin and Ethereum: Comparing XRP's performance to established cryptocurrencies like Bitcoin and Ethereum provides context for its market position and potential growth.

- Market Capitalization and Trading Volume: Monitoring XRP's market capitalization and trading volume offers insights into its overall market strength and liquidity.

Predicting Future Price Movements

Predicting cryptocurrency prices is notoriously difficult. However, certain factors may influence XRP's future value:

- Increased Adoption by Banks: Widespread adoption of RippleNet by major banks could significantly increase demand for XRP.

- Regulatory Clarity: Resolution of the ongoing legal battle between Ripple and the SEC could positively impact XRP's price.

- Technological Advancements: Continued development and improvements to Ripple's technology could enhance its competitiveness in the payment processing sector.

Regulatory Landscape and Legal Challenges

The regulatory landscape surrounding XRP is a significant factor influencing its long-term potential.

The ongoing legal battle between Ripple and the SEC regarding the classification of XRP as a security has cast a shadow over its future. This uncertainty affects investor confidence and adoption rates.

Global Regulatory Scrutiny of Cryptocurrencies

Globally, cryptocurrency regulation is still evolving, creating uncertainty for investors. Different jurisdictions have varying approaches, leading to a complex and fragmented regulatory environment. This regulatory ambiguity presents both risks and opportunities for XRP.

- Potential Implications of Different Regulatory Outcomes: A favorable ruling in the Ripple-SEC case could lead to increased adoption and a rise in XRP's price. Conversely, an unfavorable ruling could negatively impact its value and adoption.

- Effect of Regional Differences in Cryptocurrency Regulation: The varying regulatory approaches across different countries can impact XRP's accessibility and trading volumes in those regions.

- Future Regulatory Scenarios and Their Impact on XRP: Understanding potential future regulatory scenarios – from stricter regulations to more crypto-friendly policies – is vital for assessing the risks and opportunities for XRP.

Investing in XRP: Risks and Rewards

Investing in XRP presents both significant potential rewards and substantial risks.

Potential Benefits of Long-Term XRP Investment

- Significant Returns on Investment: XRP's potential for significant long-term growth is a major draw for investors.

- Diversification in a Cryptocurrency Portfolio: XRP can serve as a diversifier within a broader cryptocurrency investment strategy.

- Passive Income Opportunities: Depending on available platforms and offerings, there may be opportunities to earn passive income through staking or lending XRP.

Risks Associated with XRP Investment

- Significant Losses Due to Market Fluctuations: XRP's high volatility means significant losses are possible due to market fluctuations.

- Risks Associated with Unregulated Markets: The cryptocurrency market is still relatively unregulated in many jurisdictions, presenting risks to investors.

- Importance of Thorough Research: Before investing in XRP, thorough research and understanding of its inherent risks are essential.

Conclusion

Analyzing XRP as a potential lifetime investment requires a comprehensive understanding of its technology, market dynamics, and regulatory environment. While XRP offers the potential for high returns, it also carries significant risks stemming from its volatility and the ongoing legal uncertainties. Before investing in XRP, carefully consider your risk tolerance, diversify your portfolio, and stay informed about the latest developments concerning Ripple and the cryptocurrency market. Remember that this analysis should not be considered financial advice. Conduct your own thorough research before making any investment decisions regarding XRP or any other cryptocurrency. Is XRP right for your lifetime investment strategy? Only you can decide.

Featured Posts

-

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025 -

Saving Private Ryan Dethroned A New War Film Takes The Crown

May 08, 2025

Saving Private Ryan Dethroned A New War Film Takes The Crown

May 08, 2025 -

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025 -

Improved Graphics Best Ps 5 Pro Enhanced Exclusive Titles

May 08, 2025

Improved Graphics Best Ps 5 Pro Enhanced Exclusive Titles

May 08, 2025 -

Dbss Stance On Environmental Reform Breathing Room For Major Polluters

May 08, 2025

Dbss Stance On Environmental Reform Breathing Room For Major Polluters

May 08, 2025

Latest Posts

-

Cowherd On Tatum A Post Game 1 Celtics Loss Analysis

May 08, 2025

Cowherd On Tatum A Post Game 1 Celtics Loss Analysis

May 08, 2025 -

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025 -

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025