Should You Invest In MicroStrategy Stock Or Bitcoin In 2025?

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy's significant Bitcoin holdings are a cornerstone of its business model. This bold strategy has made the company a prominent player in the cryptocurrency space.

- Massive Holdings: MicroStrategy has amassed a substantial Bitcoin treasury, making it one of the largest corporate holders of Bitcoin globally. The exact size fluctuates with market conditions, but this substantial investment significantly influences its financial performance.

- Rationale: The company's rationale centers on the belief that Bitcoin represents a sound long-term store of value and a hedge against inflation. This reflects a long-term investment strategy focused on Bitcoin's potential for growth.

- Associated Risks: This strategy, however, is not without risk. The volatility of Bitcoin directly impacts MicroStrategy's stock price. A significant drop in Bitcoin's value could severely affect the company's financial health and the value of its MicroStrategy Bitcoin holdings. This is a key factor to consider in your 2025 investment plan.

Analyzing the Correlation Between MicroStrategy Stock and Bitcoin Price

A strong correlation exists between MicroStrategy's stock performance and Bitcoin's price fluctuations. Understanding this relationship is vital for any investor considering either asset.

- Historical Data: Historical data clearly demonstrates a positive correlation. When Bitcoin's price rises, MicroStrategy's stock price tends to follow suit, and vice versa. However, the correlation isn't always perfect, and other factors can influence MicroStrategy's stock price.

- Future Correlations: Predicting future correlations with certainty is impossible. However, the strong historical link suggests that future price movements of Bitcoin will likely influence MicroStrategy stock significantly.

- Investor Implications: This correlation presents both opportunities and risks. While potential gains can be substantial, investors need to be prepared for significant volatility and potential losses tied to the price action of Bitcoin.

Direct Bitcoin Investment: Advantages and Disadvantages

Potential for High Returns (and Losses)

Direct Bitcoin investment offers the potential for substantial returns, but also carries significant risks due to its inherent volatility.

- High Volatility: Bitcoin's price has historically been extremely volatile, experiencing significant swings in short periods. This volatility makes it a high-risk investment, unsuitable for risk-averse investors.

- Price Influencers: Various factors influence Bitcoin's price, including regulatory developments, adoption rates, macroeconomic conditions, and market sentiment. Understanding these factors is crucial before investing.

- Risk Tolerance: Only investors with a high risk tolerance and a long-term investment horizon should consider a direct Bitcoin investment. It's essential to only invest what you can afford to lose.

Self-Custody and Security Concerns

Managing Bitcoin directly involves self-custody, which presents significant security challenges.

- Private Key Risks: Losing your private keys means losing access to your Bitcoin. This is an irreversible situation.

- Exchange Hacks: Exchanges are vulnerable to hacking, and users' funds could be stolen.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, creating uncertainty and potential risks.

MicroStrategy Stock vs. Direct Bitcoin Investment: A Comparison

Risk Tolerance and Investment Goals

The choice between MicroStrategy stock and direct Bitcoin investment depends heavily on your risk tolerance and investment goals.

- Risk Levels: Direct Bitcoin investment carries significantly higher risk than investing in MicroStrategy stock. MicroStrategy, as a publicly traded company, provides some diversification and reduces the extreme volatility associated with only holding Bitcoin.

- Potential Returns: Both options offer the potential for significant returns, but the volatility of direct Bitcoin investment significantly increases the risk and potential for loss. MicroStrategy's stock price may react more slowly to Bitcoin's price swings.

- Long-Term Growth: The long-term growth prospects of both options depend on Bitcoin's adoption and price performance, but with MicroStrategy stock, a portion of risk is mitigated.

Diversification and Portfolio Management

Both options play different roles in a diversified investment portfolio.

- Diversification Strategies: Investing solely in either MicroStrategy stock or Bitcoin is risky. A diversified portfolio that includes other asset classes is crucial for mitigating risk.

- Asset Allocation: The optimal allocation between MicroStrategy stock, Bitcoin, and other assets will depend on your individual risk tolerance and investment goals.

- Risk Management: Careful risk management is essential regardless of your investment choice. Understanding the potential downsides is crucial for successful investment in the stock market or the cryptocurrency market.

Conclusion

Investing in either MicroStrategy stock or Bitcoin in 2025 presents both opportunities and challenges. Direct Bitcoin investment offers higher potential returns but significantly higher risk due to its volatility and security concerns. MicroStrategy stock provides exposure to Bitcoin with somewhat reduced volatility but with potential limitations on return compared to direct ownership. Remember, the decision of whether to invest in MicroStrategy stock or Bitcoin ultimately hinges on your risk tolerance and investment goals. Understanding the intricacies of both MicroStrategy's Bitcoin strategy and the inherent volatility of Bitcoin is essential for making informed investment choices.

Before making any investment decisions regarding MicroStrategy stock or Bitcoin in 2025, conduct thorough research and consider consulting a financial advisor. Carefully evaluating your risk tolerance is crucial when deciding whether to invest in MicroStrategy stock or Bitcoin, or both. Remember to diversify your portfolio to mitigate risks.

Featured Posts

-

Analyzing The Impact Of Trumps Xrp Endorsement On Institutional Adoption

May 08, 2025

Analyzing The Impact Of Trumps Xrp Endorsement On Institutional Adoption

May 08, 2025 -

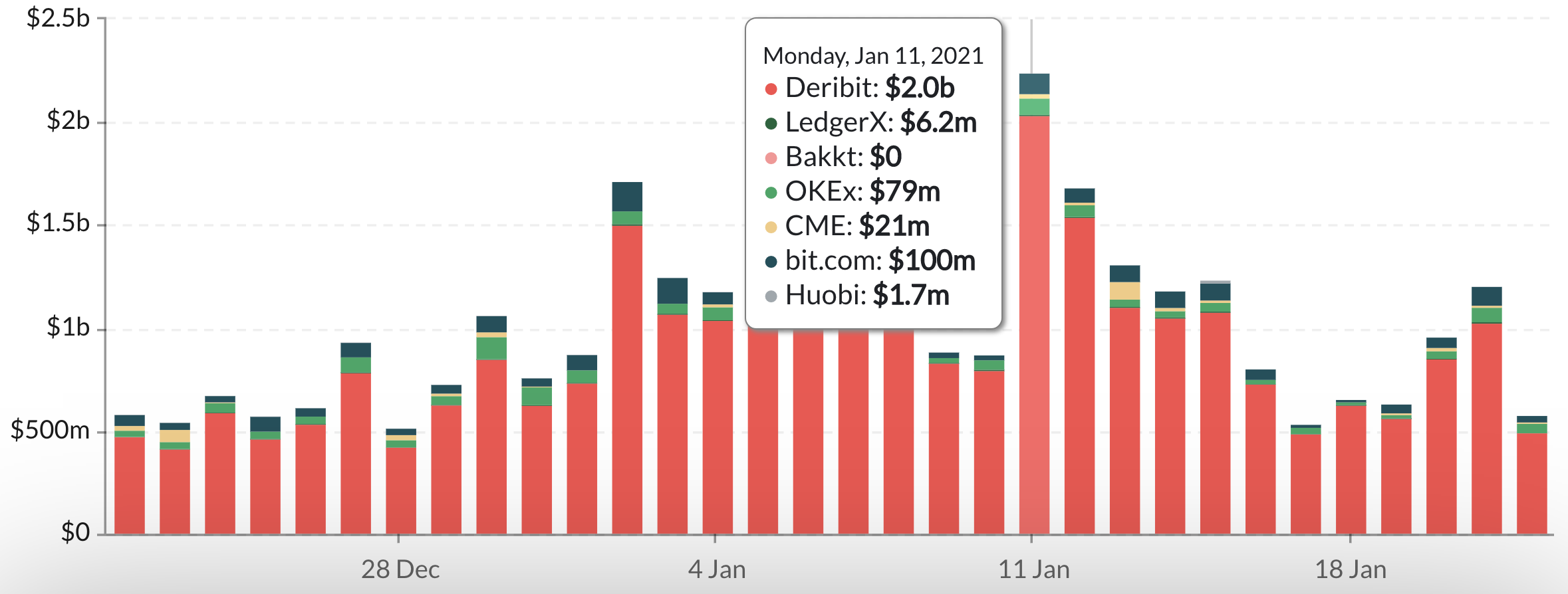

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Another 13 Strikeouts Angels Hitters Continue Slump Against Twins

May 08, 2025

Another 13 Strikeouts Angels Hitters Continue Slump Against Twins

May 08, 2025

Latest Posts

-

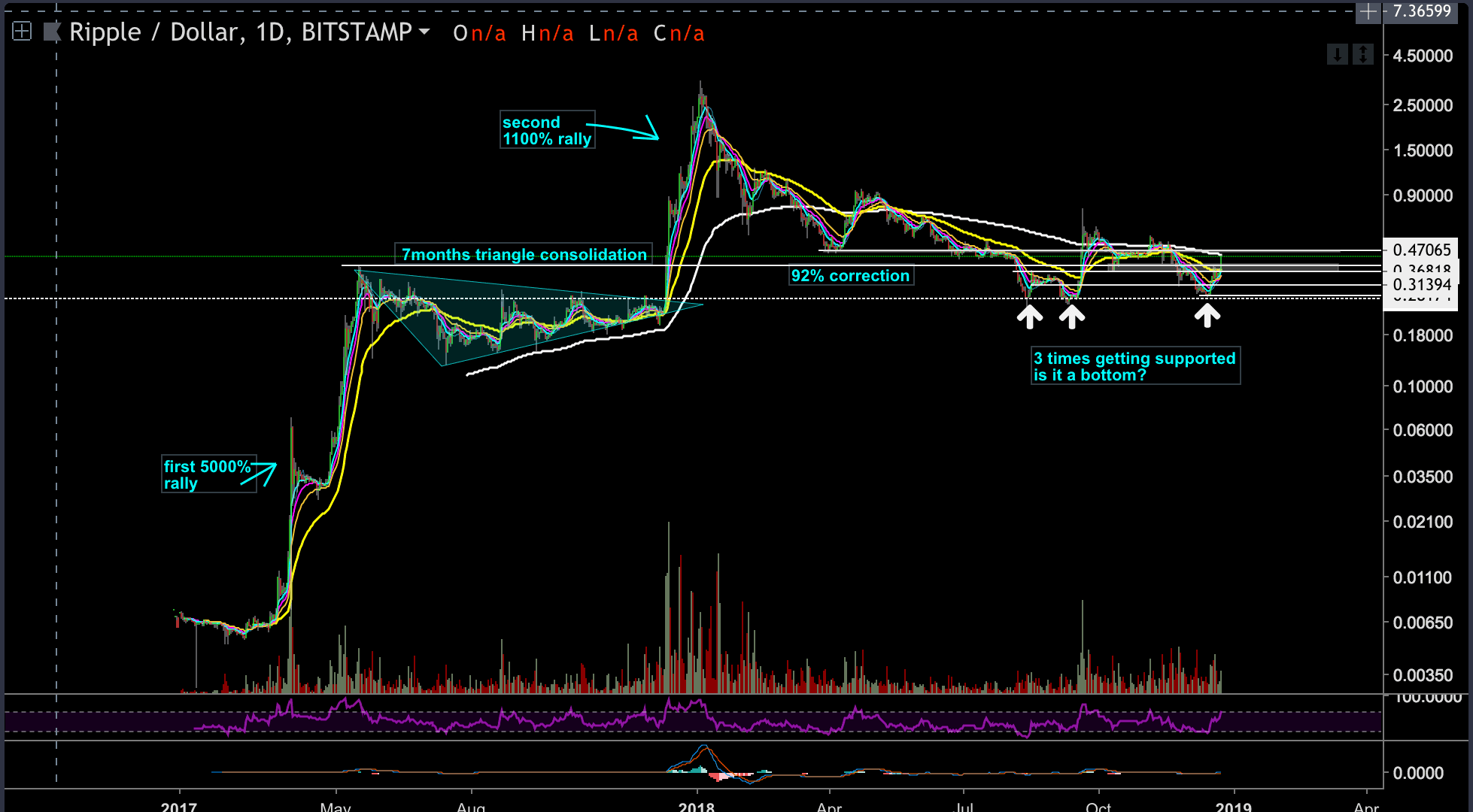

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025 -

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025 -

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025