Analyzing The Impact Of Trump's XRP Endorsement On Institutional Adoption

Table of Contents

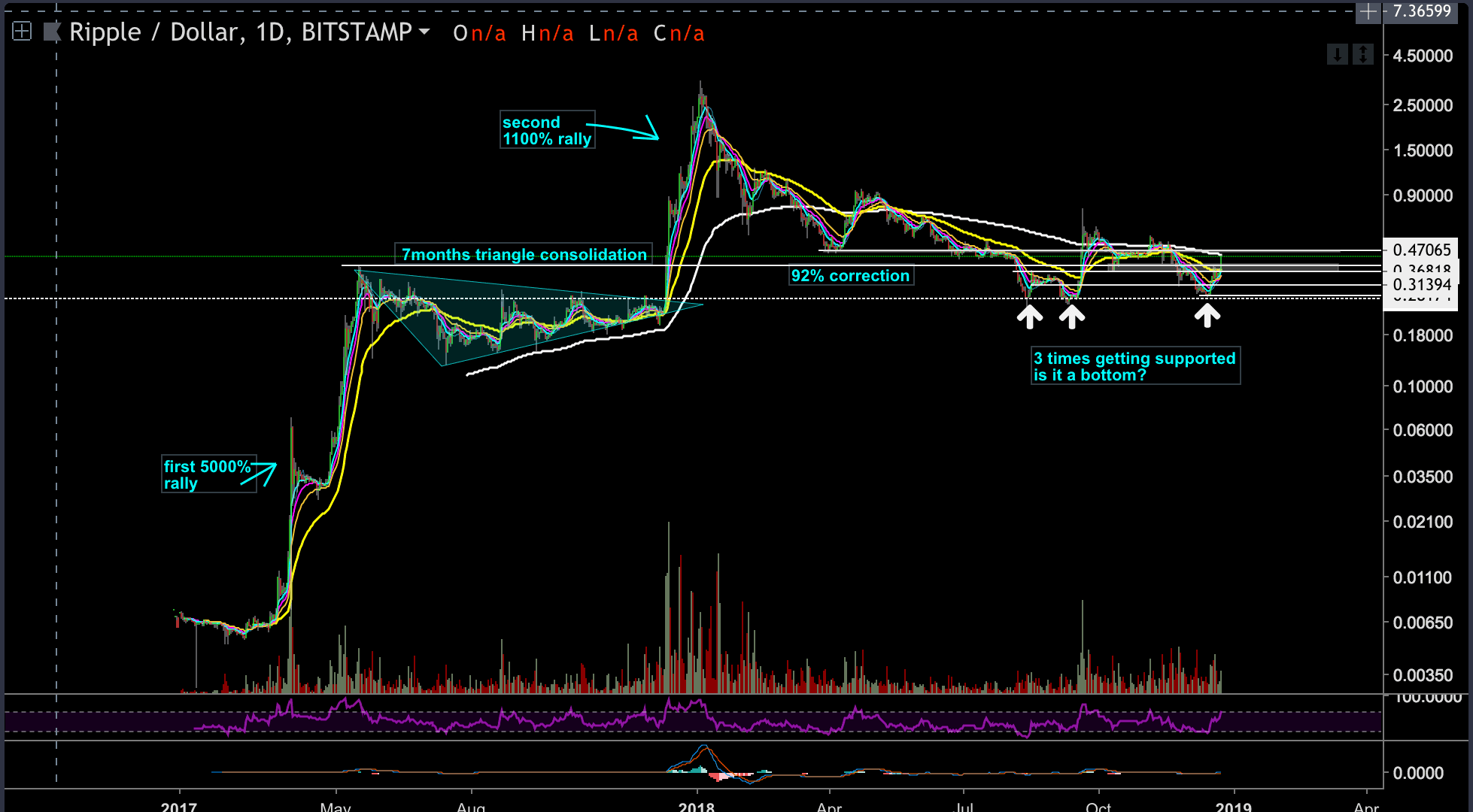

Pre-Endorsement Landscape: XRP's Position in the Institutional Market

Before we dive into the hypothetical impact of a Trump endorsement, it's important to understand XRP's standing in the institutional cryptocurrency market. While XRP has established itself as a significant player in the crypto space, its institutional adoption lags behind other cryptocurrencies like Bitcoin and Ethereum. This is partly due to several factors:

- Regulatory Uncertainty: The ongoing legal battle between Ripple Labs and the SEC casts a shadow over XRP's regulatory landscape, creating hesitation among institutional investors wary of regulatory risks.

- Security Concerns: Like all cryptocurrencies, XRP is susceptible to security breaches and hacks. Institutional investors prioritize robust security measures, demanding high levels of assurance before committing significant capital.

- Scalability: While XRP boasts impressive transaction speeds, questions remain about its scalability to handle the immense volume of transactions required by large institutional players.

XRP's primary use case revolves around cross-border payments, a sector where it competes with established players like SWIFT and newer entrants such as Stellar. However, regulatory hurdles, especially in the US, hinder broader institutional adoption. This pre-endorsement landscape paints a picture of a cryptocurrency with significant potential but facing considerable challenges in attracting institutional investors.

Immediate Impact: Short-Term Market Reactions and Investor Sentiment

A hypothetical Trump endorsement of XRP would likely trigger an immediate and dramatic market reaction. We can anticipate:

- Price Surge: The price of XRP would almost certainly experience a significant and rapid increase driven by increased demand.

- Trading Volume Explosion: Trading volume would skyrocket as investors rush to buy XRP, capitalizing on the perceived positive news.

- Increased Volatility: The market would likely become significantly more volatile in the short term due to the influx of speculative trading.

This surge would be fueled by a combination of factors, including:

- FOMO (Fear Of Missing Out): Investors fearing they'll miss out on potential profits will contribute to the price increase.

- Speculation: The endorsement would attract speculative traders hoping to profit from short-term price fluctuations.

- Increased Media Coverage: The news would generate substantial media attention, further influencing investor sentiment and driving up demand.

However, concerns about market manipulation would inevitably arise, potentially leading to regulatory scrutiny and investigations. Historical price reactions to similar celebrity endorsements offer some insight, although the scale of a Trump endorsement would be unprecedented.

Long-Term Effects: Institutional Adoption and Regulatory Scrutiny

While a short-term price surge is probable, the long-term effects of Trump's hypothetical XRP endorsement on institutional adoption remain uncertain. While it could:

- Attract Institutional Investors: The endorsement might attract institutional investors seeking exposure to the cryptocurrency market and looking for opportunities in less-established coins.

- Facilitate Partnerships: The increased visibility could facilitate partnerships with financial institutions seeking to integrate XRP into their payment systems.

It also presents significant challenges:

- Increased Regulatory Scrutiny: The endorsement could invite increased scrutiny from regulatory bodies like the SEC, potentially leading to further regulatory hurdles for XRP.

- Sustainability Concerns: A price surge solely based on a celebrity endorsement is not necessarily sustainable, and long-term price stability and market capitalization would depend on underlying utility and adoption.

The impact would ultimately hinge on how the endorsement is perceived by both institutional investors and regulators. A positive reception could be transformative, but a negative one could be disastrous for XRP’s long-term prospects.

Alternative Scenarios: Considering the "What Ifs"

It's crucial to consider alternative scenarios beyond a purely positive outcome. What if:

- Negative Perception: The endorsement is met with widespread negativity, potentially damaging XRP's reputation and deterring institutional investment.

- Minimal Impact: The endorsement fails to generate significant market movement or attract substantial institutional interest.

- Lack of Follow-Through: Trump, or his associates, don't follow up on the endorsement, leaving it without lasting impact.

These scenarios highlight the unpredictable nature of celebrity endorsements in the cryptocurrency market. The potential for both significant gains and devastating losses underlines the importance of thorough due diligence and risk assessment.

Conclusion: Assessing the True Impact of Trump's (Hypothetical) XRP Endorsement

Analyzing the hypothetical impact of Trump's XRP endorsement reveals a complex interplay of short-term market reactions and potentially significant long-term consequences for institutional adoption. While a short-term price surge and increased trading volume are likely, the long-term effects depend heavily on several factors, including regulatory responses and the broader market sentiment. The unpredictable nature of high-profile endorsements highlights the risks and opportunities inherent in the cryptocurrency market. This analysis demonstrates the importance of considering various scenarios and the limitations of predicting future outcomes accurately. We urge you to conduct your own thorough research to further analyze the potential consequences of high-profile endorsements on cryptocurrency adoption – specifically, Trump's influence on XRP and XRP's institutional future, as well as the impact of celebrity endorsements on crypto in general.

Featured Posts

-

April 9th Lotto Winning Numbers Full Results And Details

May 08, 2025

April 9th Lotto Winning Numbers Full Results And Details

May 08, 2025 -

Prv Mech Od Ligata Na Shampioni Arsenal Vs Ps Zh

May 08, 2025

Prv Mech Od Ligata Na Shampioni Arsenal Vs Ps Zh

May 08, 2025 -

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025 -

Jokics Birthday Westbrooks Special Nuggets Rendition

May 08, 2025

Jokics Birthday Westbrooks Special Nuggets Rendition

May 08, 2025 -

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025

Latest Posts

-

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025 -

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025 -

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025