Ripple (XRP) Price Increase: Is Trump's Influence A Contributing Factor?

Table of Contents

Trump's Statements and Their Impact on Cryptocurrency Markets

The potential impact of Donald Trump's words and actions on the cryptocurrency market, and XRP specifically, is a crucial aspect to consider. Let's examine both his direct mentions and the indirect influence of his policies.

Direct Mentions of XRP or Cryptocurrencies

While there haven't been direct, explicit mentions of XRP by Trump, his statements regarding cryptocurrencies in general can have a ripple effect (pun intended!) on the entire market, influencing investor sentiment and consequently, the price of XRP. Analyzing these statements is crucial.

- Example 1: (Insert example of a tweet, interview, or press conference where Trump mentions cryptocurrencies positively or negatively. Include a link to the source if possible). The immediate market reaction to this statement was [Describe the market reaction – e.g., a price surge, a slight dip, no significant change].

- Example 2: (Insert another example). The sentiment expressed was [positive/negative/neutral] towards cryptocurrencies. A positive statement could lead to increased investment, while a negative one could trigger a sell-off. This directly affects the market capitalization and price of assets like XRP.

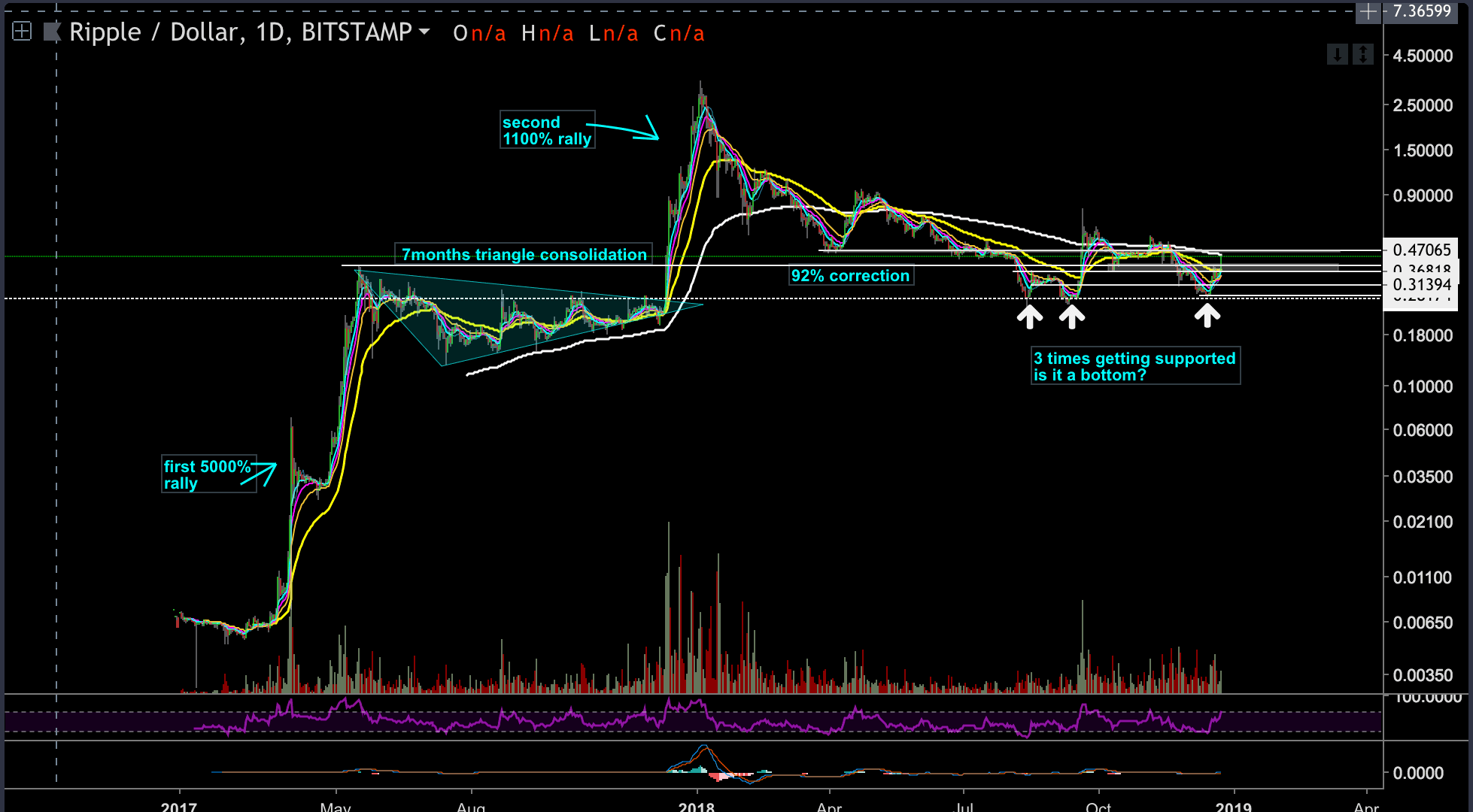

Indirect Influence Through Policy and Regulatory Changes

Trump's past policies and potential future plans could indirectly impact the cryptocurrency regulatory landscape, significantly affecting investor confidence in XRP.

- Policy Example 1: (Mention a specific policy enacted during Trump's presidency that impacted the crypto market, e.g., potential tax implications). This policy could have [Describe the impact – e.g., increased uncertainty, spurred investment].

- Potential Future Policy: If Trump were to run again and win, potential changes to cryptocurrency regulation could significantly alter the market landscape. Experts suggest [cite expert opinions and their sources on the potential impact of these policies]. This uncertainty could either boost or dampen investor enthusiasm for XRP.

Market Sentiment and Speculation Around XRP

The connection between Trump and XRP price movements is often amplified by social media and news coverage, which can generate speculation and significantly influence market sentiment.

The Role of Social Media and News Coverage

Social media plays a crucial role in shaping public perception and driving market trends. The correlation between Trump's actions or statements and the XRP price is frequently discussed online.

- Example 1: The hashtag #TrumpXRP was trending on Twitter [insert date and context]. This suggests a significant level of online discussion correlating Trump's influence with XRP's price.

- Example 2: (Cite specific news articles or social media posts that link Trump and XRP price movements). The potential for misinformation and hype to manipulate the price is substantial. This highlights the importance of critical analysis of online information.

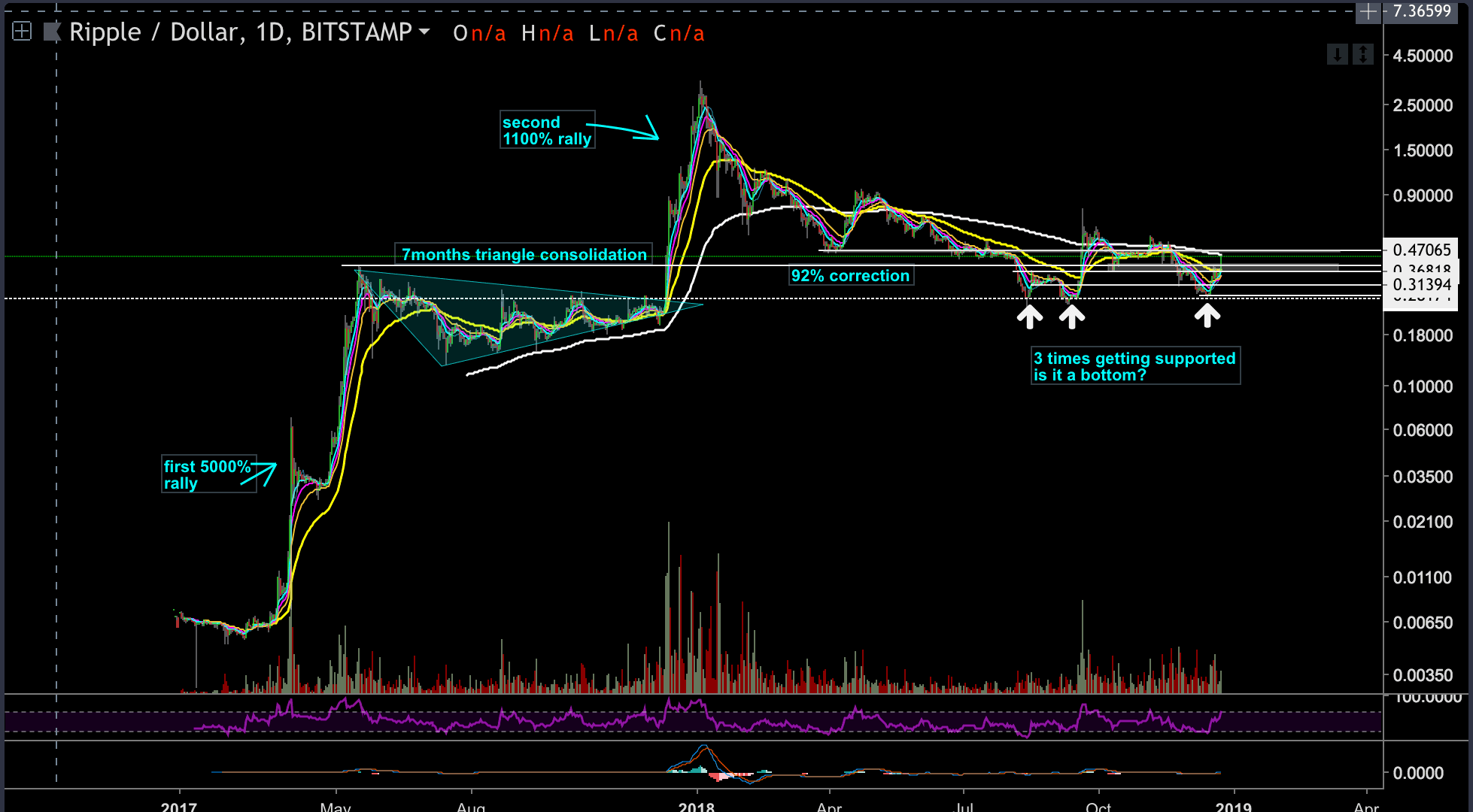

Technical Analysis and Fundamental Factors

Beyond the external factors like Trump's influence, it's vital to examine XRP's technical analysis and fundamental factors to understand its price movements.

- Technical Indicators: (Mention specific technical indicators like moving averages, trading volume, etc., and their current status). These indicators suggest [explain what these indicators suggest about the potential price trends of XRP].

- Fundamental Factors: Ripple's partnerships, technological advancements, and adoption rate are key fundamental factors. [List key partnerships or developments]. These developments contribute to a more positive outlook on XRP, irrespective of Trump's influence.

Alternative Explanations for the XRP Price Increase

While Trump's potential influence is a factor, other elements significantly contribute to XRP's price increase. It's essential to consider broader market trends and Ripple's own activities.

Broader Crypto Market Trends

The overall cryptocurrency market heavily influences individual cryptocurrencies like XRP.

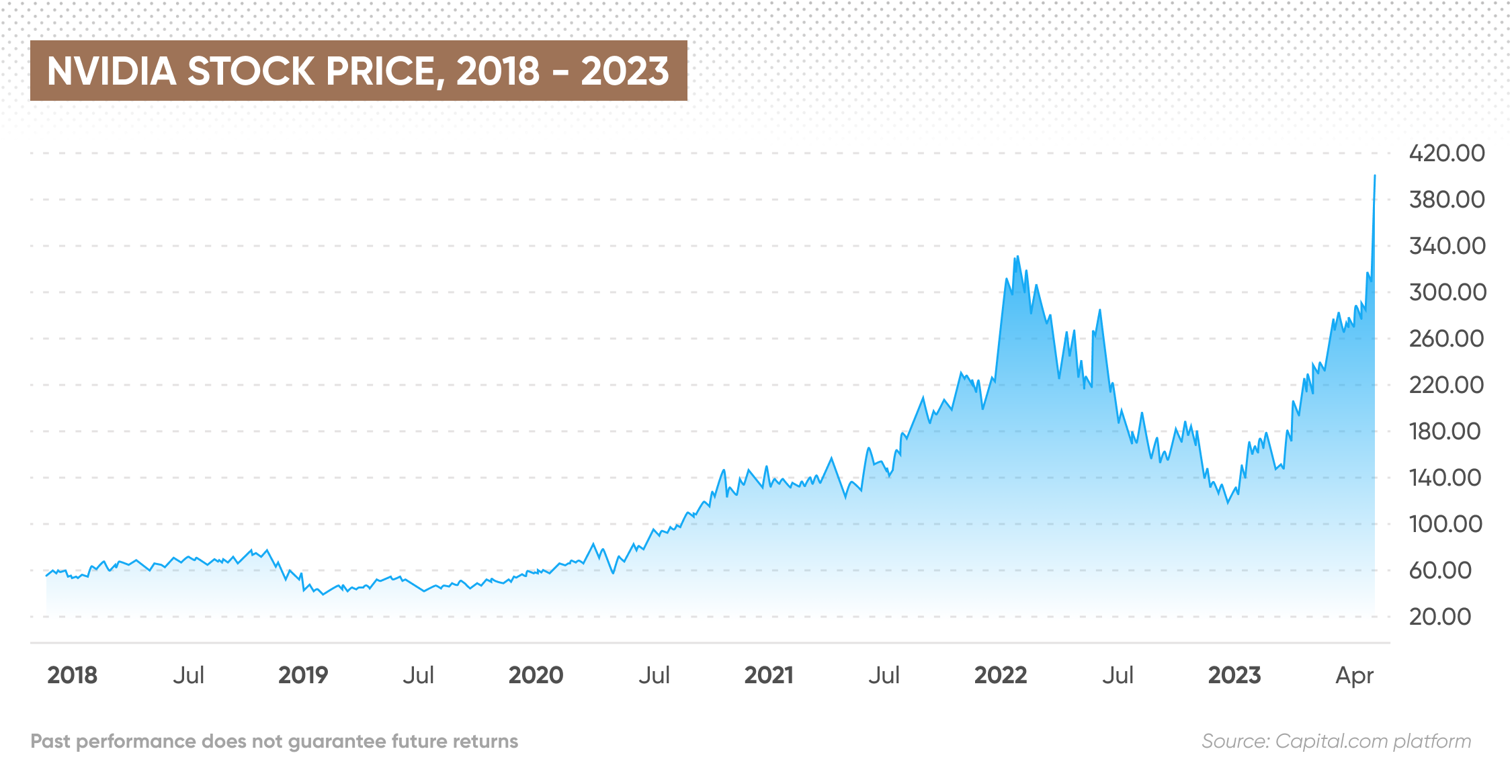

- Bitcoin's Performance: When Bitcoin's price rises, it often triggers a positive sentiment across the crypto market, including XRP.

- General Market Sentiment: Positive news or developments in the broader crypto space can lead to increased investment and price increases for various cryptocurrencies.

Ripple's Own Activities and Developments

Ripple's strategic partnerships, product releases, and regulatory approvals directly impact XRP's price.

- Partnership Example: (Mention a significant partnership Ripple recently announced). This partnership has broadened XRP's utility and increased investor confidence.

- Technological Advancements: (Highlight any significant technological developments by Ripple). These improvements contribute to XRP's long-term potential and influence its price positively.

Conclusion: Ripple (XRP) Price Increase: Separating Fact from Speculation

The Ripple (XRP) price increase is a complex phenomenon influenced by various factors. While Donald Trump's potential indirect influence, through his statements and potential future policies, cannot be completely disregarded, it is only one piece of a much larger puzzle. Market sentiment, speculation fueled by social media, broader crypto market trends, and Ripple's own strategic initiatives all play significant roles. Isolating Trump's precise impact is challenging due to the interplay of numerous market forces. The key takeaway is that the XRP price increase is a result of a confluence of factors, including (but not limited to) Trump's potential indirect influence.

To make informed decisions about your Ripple (XRP) investments, stay informed about Ripple (XRP) price movements, research the current market conditions impacting XRP, and understand the inherent risks involved in cryptocurrency investments. Conduct your own thorough research before investing, considering both the potential benefits and risks, especially those associated with external factors like the influence of prominent public figures.

Featured Posts

-

Dwp Benefit Cuts Final Payment Dates Announced

May 08, 2025

Dwp Benefit Cuts Final Payment Dates Announced

May 08, 2025 -

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025 -

The Great Decouplings Impact On Geopolitics And Trade

May 08, 2025

The Great Decouplings Impact On Geopolitics And Trade

May 08, 2025 -

Decouverte Scientifique Les Corneilles Et Leurs Aptitudes Geometriques Inegalees

May 08, 2025

Decouverte Scientifique Les Corneilles Et Leurs Aptitudes Geometriques Inegalees

May 08, 2025 -

Assessing The Risks And Rewards Of The Great Decoupling

May 08, 2025

Assessing The Risks And Rewards Of The Great Decoupling

May 08, 2025

Latest Posts

-

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025 -

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025 -

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025