Should Investors Worry About High Stock Market Valuations? BofA's Answer.

Table of Contents

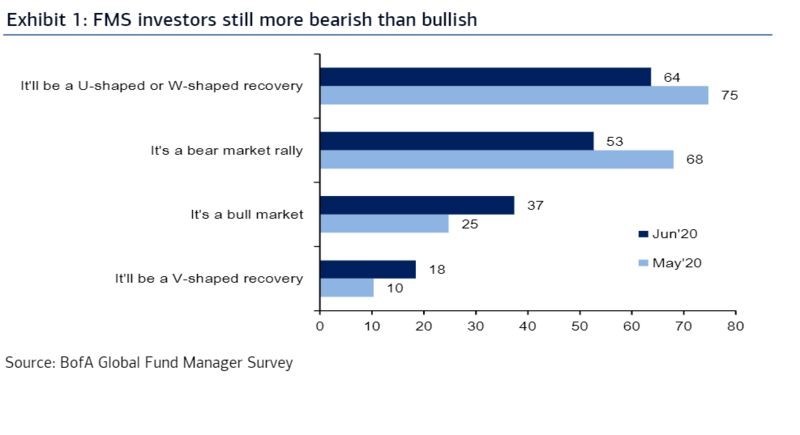

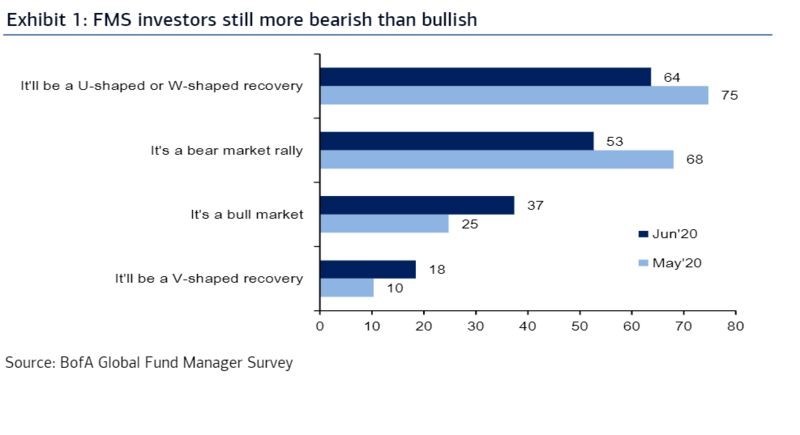

BofA's Assessment of Current Market Valuations

Bank of America's market outlook frequently incorporates a detailed analysis of stock market valuations using various metrics. Their reports regularly assess the Price-to-Earnings Ratio (P/E), often comparing the current P/E ratio to historical averages and the Shiller PE (cyclically adjusted price-to-earnings ratio), a measure that smooths out earnings fluctuations over time. These valuation metrics provide BofA with a crucial benchmark for determining whether the market is overvalued, undervalued, or trading within a historically reasonable range.

BofA's recent reports have often highlighted specific sectors as either overvalued or undervalued based on their intrinsic value assessments and projected future growth. For example, certain technology sectors might be flagged as potentially overvalued due to high P/E ratios relative to their projected earnings growth, while others, like certain energy or financial sectors, may be identified as relatively undervalued based on their current market capitalization compared to their perceived intrinsic value.

-

Key findings from BofA's research on current valuations: Recent reports show mixed signals, with some sectors displaying high valuations compared to historical averages while others remain relatively low. The exact findings will vary based on the specific report and timeframe.

-

Comparison of current valuations to historical averages: BofA's analysis often shows that certain market segments are trading at multiples exceeding historical averages, indicating a potentially elevated level of risk.

-

BofA's predicted market movements based on valuation analysis: Predicting future market movements is inherently uncertain, but BofA typically uses valuation data as one input in their broader market outlook, often suggesting caution in the face of highly elevated valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to high stock market valuations. Understanding these factors is crucial for interpreting BofA's analysis and making informed investment decisions.

-

The impact of low interest rates on stock valuations: Low interest rates make borrowing cheaper for companies, encouraging investment and boosting corporate earnings. Simultaneously, they reduce the attractiveness of bonds, pushing investors towards higher-yielding assets like stocks.

-

The role of inflation and its effect on investor behavior: Inflation erodes the purchasing power of money. When inflation is high, investors may seek assets that offer protection against inflation, such as stocks, driving up valuations. However, high inflation also increases uncertainty and can impact investor confidence.

-

The influence of economic growth projections on market sentiment: Positive economic growth projections generally lead to increased investor confidence and higher stock prices. Conversely, concerns about slowing economic growth can negatively impact market sentiment and valuations.

-

The impact of government policies and central bank actions (monetary policy): Government policies and central bank decisions on interest rates and monetary supply significantly influence investor behavior and market valuations. Expansionary monetary policies, for instance, tend to support higher stock prices.

-

Bullet Points:

- Explanation of each factor's influence on stock prices: Each factor interacts in a complex way to shape overall market valuation.

- Supporting data and examples for each factor: BofA's reports typically provide detailed data supporting their analysis of these factors.

- Analysis of the interplay between these factors: The combined effect of these factors shapes the overall valuation picture.

BofA's Recommendations for Investors

BofA's recommendations to investors often hinge on their valuation assessments. Given their analysis of potentially high valuations in certain market sectors, their advice typically emphasizes cautious optimism and careful risk management.

-

Suggestions for portfolio adjustments (e.g., diversification, sector rotation): BofA might advise investors to diversify their portfolios to reduce exposure to overvalued sectors and increase allocations to undervalued ones. Sector rotation – moving investments from one sector to another – is often suggested.

-

Recommendations on risk management strategies: This usually includes emphasizing a long-term investment horizon, appropriate risk tolerance, and possibly reducing overall equity exposure in the face of elevated valuations.

-

Guidance on whether to favor growth or value stocks in the current environment: The choice between growth and value investing depends on the specific market conditions and BofA's assessment. With potentially overvalued growth stocks, value stocks might be favored in specific instances.

-

Bullet Points:

- Specific strategies recommended by BofA: These strategies are often detailed in their research reports and investor briefings.

- Justification for these recommendations based on valuation analysis: BofA’s recommendations are closely tied to their assessment of market valuations and potential risks.

- Examples of how investors can implement these strategies: This could involve adjusting portfolio weightings, selecting specific stocks, or using specific investment vehicles.

Addressing Investor Concerns About Market Volatility

High stock market valuations often raise investor concerns about potential market volatility, including the possibility of a market correction or even a crash. BofA addresses these concerns by acknowledging the risks associated with high valuations while also emphasizing the importance of a long-term investment perspective.

-

BofA's assessment of the likelihood of a market correction: While BofA doesn't provide precise predictions, their analysis of valuations helps inform their assessment of the potential for a market downturn. They often highlight the increased risk associated with elevated valuations.

-

Strategies for mitigating the impact of market volatility: These strategies include diversification, a long-term investment horizon, and a focus on risk management techniques appropriate to the investor's risk tolerance.

-

Importance of maintaining a long-term investment horizon: BofA emphasizes that short-term market fluctuations should not dictate long-term investment strategies. Long-term investors can generally weather market corrections if they have a well-diversified portfolio and a sound investment plan.

-

Bullet Points:

- BofA's assessment of the likelihood of a market correction: This assessment is often communicated indirectly through their recommendations and cautions.

- Strategies for mitigating the impact of market volatility: These strategies are essential for investors to manage risk in any market environment.

- Importance of maintaining a long-term investment horizon: A long-term outlook is crucial for weathering short-term market fluctuations.

Conclusion

BofA's analysis of high stock market valuations highlights the need for careful consideration and proactive risk management. By understanding the factors contributing to these valuations and following BofA's recommendations for diversification and risk mitigation, investors can navigate this potentially volatile market more effectively. Remember, understanding high stock market valuations is crucial for making informed investment decisions. Use BofA's analysis to assess your current portfolio and plan your next steps in navigating this complex market. Always conduct further research and seek professional financial advice tailored to your individual risk tolerance and financial goals.

Featured Posts

-

Michael Kors Jet Set Luxury Lands On Amazon Suki Waterhouse Collaboration

May 20, 2025

Michael Kors Jet Set Luxury Lands On Amazon Suki Waterhouse Collaboration

May 20, 2025 -

The Unintended Consequences Of The Philippines Typhon Mid Range Missile System

May 20, 2025

The Unintended Consequences Of The Philippines Typhon Mid Range Missile System

May 20, 2025 -

Leclercs Outburst Ferrari Team Orders And Hamiltons Reaction

May 20, 2025

Leclercs Outburst Ferrari Team Orders And Hamiltons Reaction

May 20, 2025 -

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 20, 2025

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 20, 2025 -

Arsenals Transfer Pursuit 17m Rated Premier League Winger Targeted

May 20, 2025

Arsenals Transfer Pursuit 17m Rated Premier League Winger Targeted

May 20, 2025

Latest Posts

-

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Defense Sector Growth

May 20, 2025

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Defense Sector Growth

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons Explained

May 20, 2025 -

Bbai Stock Analyzing The Recent Analyst Downgrade And Future Growth Prospects

May 20, 2025

Bbai Stock Analyzing The Recent Analyst Downgrade And Future Growth Prospects

May 20, 2025 -

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 20, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 20, 2025 -

D Wave Quantum Inc Qbts Reasons Behind The 2025 Stock Market Dip

May 20, 2025

D Wave Quantum Inc Qbts Reasons Behind The 2025 Stock Market Dip

May 20, 2025