D-Wave Quantum Inc. (QBTS) Stock Drop On Monday: Reasons Explained

Table of Contents

Market Sentiment and Overall Tech Stock Performance

The D-Wave Quantum Inc. (QBTS) stock drop didn't occur in a vacuum. Understanding the broader market context is crucial. Monday saw a general downturn in the tech sector, impacting many companies beyond just D-Wave. This wasn't necessarily a sector-specific issue but rather a reflection of a wider market trend. Was this a result of specific economic news or a general risk-off sentiment amongst investors?

- NASDAQ Performance: The NASDAQ Composite, a key indicator of the tech sector's health, experienced a [Insert Percentage]% decline on Monday, mirroring the downward trend observed in QBTS stock.

- Economic News: [Mention any significant economic news released on Monday, e.g., inflation data, interest rate announcements, geopolitical events]. These factors could have contributed to the overall negative market sentiment.

- Analyst Reports: Several analyst reports highlighted concerns about [mention specific concerns mentioned in analyst reports, e.g., rising interest rates, slowing economic growth] affecting the tech sector's performance. These reports likely influenced investor decisions and contributed to the sell-off.

Lack of Recent Positive Catalysts for D-Wave Quantum Inc. (QBTS)

The absence of positive catalysts for D-Wave Quantum Inc. likely exacerbated the already negative market sentiment. Without significant positive news to counter the broader market downturn, QBTS stock became vulnerable to selling pressure.

- Recent Press Releases: A review of recent D-Wave press releases reveals [mention any recent press releases and assess their impact on investor confidence. Were there any announcements that might have disappointed investors?].

- Financial Performance: D-Wave's recent financial reports may have shown [mention any performance shortfalls or missed expectations]. This lack of strong financial performance could have contributed to the decline in investor confidence.

- Investor Interest: The lack of significant new investor interest indicates a potential concern about D-Wave's future prospects. This could be linked to the company's current performance or the intense competition within the quantum computing sector.

Increased Competition in the Quantum Computing Space

The quantum computing industry is rapidly evolving, with numerous players vying for market share. This intense competition is a factor that investors need to consider when assessing the risks associated with QBTS stock.

- Key Competitors: Companies like [mention key competitors such as IBM, Google, IonQ] are making significant advancements in quantum computing technology, potentially diverting investor attention and resources away from D-Wave.

- Competitor Breakthroughs: Recent breakthroughs by competitors, such as [mention specific announcements or achievements by competitors], highlight the increasing competition and potentially affect investor confidence in D-Wave's leading position.

- Investment Trends: The quantum computing sector is attracting significant investment, but this investment is not uniformly distributed across all players. The shift in investment towards other companies could explain some of the pressure on D-Wave's stock price.

Investor Reaction and Trading Volume

The D-Wave Quantum Inc. (QBTS) stock drop was accompanied by [mention trading volume statistics, e.g., unusually high trading volume]. This suggests significant sell-off pressure. Analyzing investor sentiment on social media and online forums reveals a [describe the prevailing sentiment, e.g., mixture of concern and speculation] about the company’s future.

- Trading Volume: Monday's trading volume for QBTS was [insert data], significantly [higher/lower] than the average daily volume, suggesting [panic selling/calculated trading].

- Social Media Sentiment: [Insert examples of social media comments or forum discussions if available]. This data provides valuable insight into investor sentiment.

- Short Selling: The possibility of increased short-selling activity should also be considered as a potential contributor to the stock price decline.

Conclusion: Understanding the D-Wave Quantum Inc. (QBTS) Stock Drop and Moving Forward

The D-Wave Quantum Inc. (QBTS) stock drop on Monday was a complex event influenced by a combination of factors. The overall negative market sentiment towards tech stocks, the absence of recent positive catalysts for D-Wave, and the growing competition in the quantum computing industry all contributed to the decline. The high trading volume further underscores the significant investor reaction.

Investing in the quantum computing sector, and specifically in D-Wave stock, involves significant risks due to the inherent volatility of the market and the uncertainties of this emerging technology. Before making any decisions regarding D-Wave stock (QBTS), or other quantum computing stock investments, conduct thorough research and consult with a qualified financial advisor. Understanding the complexities of QBTS stock performance and the broader quantum computing market is crucial for informed investment decisions.

Featured Posts

-

Zuckerbergs Leadership In The Age Of Trump A Shifting Political Landscape

May 20, 2025

Zuckerbergs Leadership In The Age Of Trump A Shifting Political Landscape

May 20, 2025 -

Technologies Spatiales Le Marche Africain Des Solutions Spatiales Mass Ouvre Ses Portes A Abidjan

May 20, 2025

Technologies Spatiales Le Marche Africain Des Solutions Spatiales Mass Ouvre Ses Portes A Abidjan

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025 -

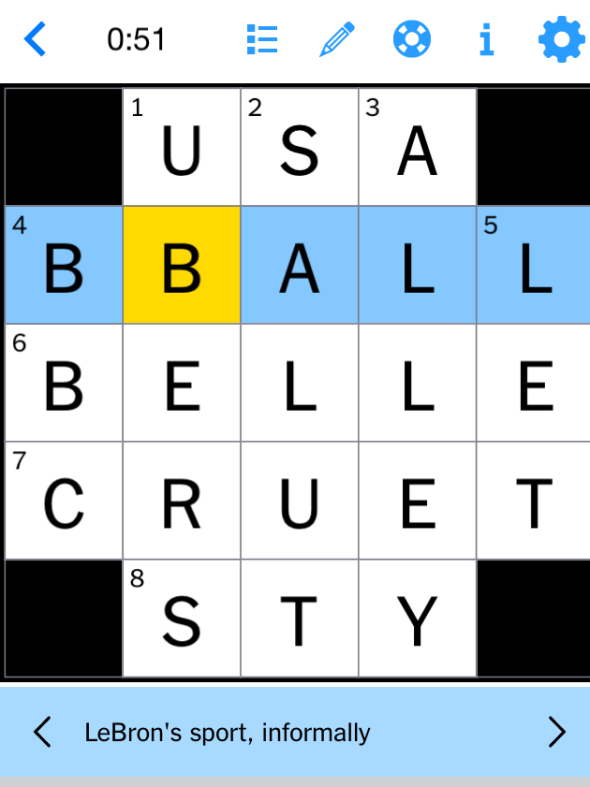

Todays Nyt Mini Crossword Answers May 9th Solutions

May 20, 2025

Todays Nyt Mini Crossword Answers May 9th Solutions

May 20, 2025 -

Todays Nyt Mini Crossword Answers March 24 2025

May 20, 2025

Todays Nyt Mini Crossword Answers March 24 2025

May 20, 2025

Latest Posts

-

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025

Wwe Talent Critiques Hinchcliffes Unsuccessful Appearance

May 20, 2025 -

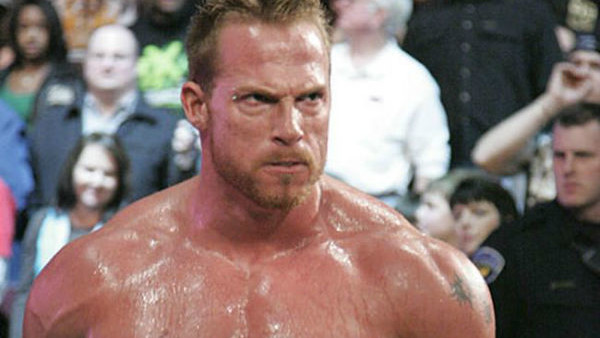

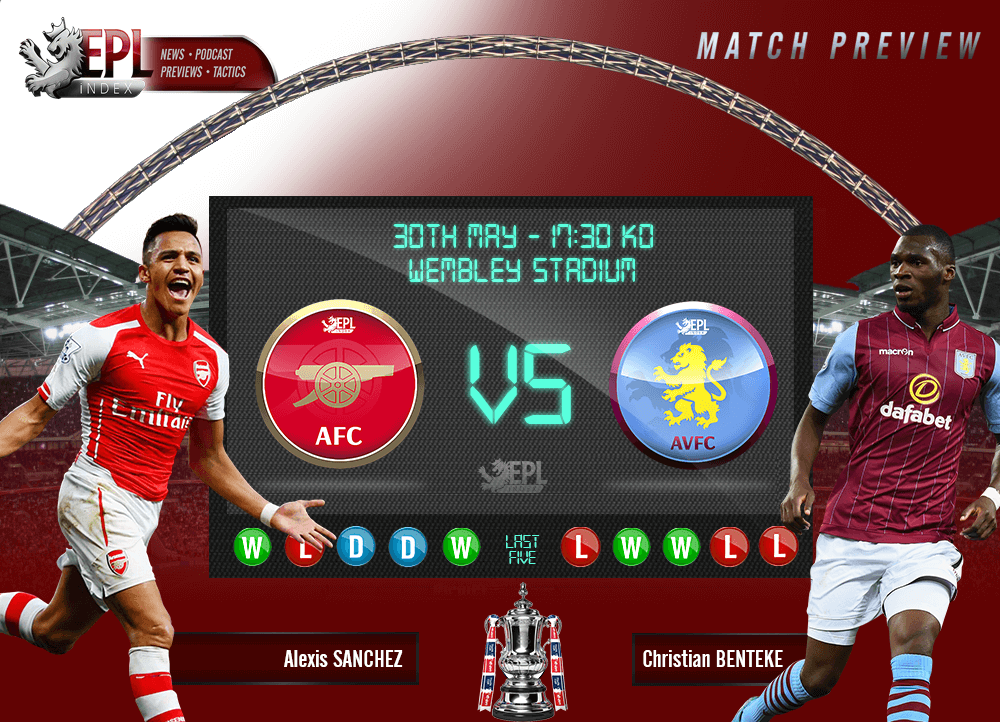

Aston Villa Ease Past Preston Rashfords Brace Fuels Fa Cup Triumph

May 20, 2025

Aston Villa Ease Past Preston Rashfords Brace Fuels Fa Cup Triumph

May 20, 2025 -

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup

May 20, 2025

Rashford Scores Twice As Manchester United Defeat Aston Villa In Fa Cup

May 20, 2025 -

Rashfords First Aston Villa Goals Secure Fa Cup Win Over Preston

May 20, 2025

Rashfords First Aston Villa Goals Secure Fa Cup Win Over Preston

May 20, 2025 -

Rashfords Double Sends Preston Packing Aston Villa Fa Cup Victory

May 20, 2025

Rashfords Double Sends Preston Packing Aston Villa Fa Cup Victory

May 20, 2025