BigBear.ai (BBAI) Stock: Buy Rating Holds Amidst Defense Sector Growth

Table of Contents

Strong Buy Rating for BBAI: A Closer Look

Analyst Ratings and Consensus

Several reputable financial analysts have issued buy ratings for BBAI stock, contributing to a generally positive consensus. For instance, [Analyst Name] at [Firm Name] recently issued a buy rating with a price target of $[Price Target], citing [Reason cited by the analyst]. Another analyst, [Analyst Name] from [Firm Name], holds a similar view, projecting a [Price Target] price target based on [Reason cited by the analyst]. This confluence of positive analyst opinions suggests a strong belief in BBAI's future performance. Tracking these analyst ratings and price targets is crucial for monitoring market sentiment towards BBAI stock.

Rationale Behind the Buy Rating

The buy ratings for BBAI stock are underpinned by several key factors:

- Expected Revenue and Earnings Growth: Analysts anticipate significant growth in BBAI's revenue and earnings driven by increased demand for its AI-powered solutions.

- Strong Government Contracts and Partnerships: BigBear.ai benefits from a robust pipeline of government contracts and strategic partnerships, providing a stable revenue stream and a strong foundation for future growth.

- Competitive Advantages in AI and Data Analytics for Defense: BBAI possesses cutting-edge AI and data analytics capabilities specifically tailored to the defense and intelligence sectors, giving it a considerable competitive edge.

- Potential for Future Market Share Expansion: The company is well-positioned to capitalize on the growing market for AI-driven solutions within the defense industry, paving the way for substantial market share expansion.

Risks Associated with the Buy Rating

While the outlook for BBAI is positive, investors should carefully consider the following risks:

- Dependence on Government Contracts: A significant portion of BBAI's revenue comes from government contracts, making it vulnerable to changes in defense spending or procurement policies.

- Competition in the AI and Defense Technology Markets: The AI and defense technology landscape is fiercely competitive, with established players and emerging startups vying for market share.

- Geopolitical Risks Impacting Defense Spending: Global geopolitical instability could lead to unpredictable shifts in defense budgets, impacting BBAI's revenue streams.

- Fluctuations in Stock Market Performance: Like any stock, BBAI is subject to broader market fluctuations, which could lead to price volatility.

Defense Sector Growth Fueling BBAI's Potential

Expanding Defense Budget

The global defense sector is experiencing robust growth, fueled by escalating geopolitical tensions and increasing national security concerns. The US, in particular, has seen a considerable increase in its defense budget, creating a fertile ground for companies like BigBear.ai. This expanded budget directly translates to increased opportunities for securing lucrative government contracts and expanding operations.

Demand for AI and Data Analytics in Defense

The demand for AI-powered solutions within the defense industry is surging. National security agencies and military organizations are increasingly relying on AI and data analytics for:

- Intelligence gathering and analysis.

- Cybersecurity threat detection and mitigation.

- Predictive modeling and scenario planning.

- Optimizing resource allocation and logistics.

BBAI is uniquely positioned to meet this growing demand with its advanced AI technologies.

BBAI's Competitive Advantages

BigBear.ai differentiates itself through:

- Proprietary AI algorithms for advanced data analysis.

- Robust data analytics platforms tailored to the unique needs of the defense sector.

- A proven track record of successful project deployments for government clients.

These competitive advantages solidify its position as a key player in the burgeoning defense technology market.

BBAI's Financial Performance and Future Outlook

Recent Financial Results

BBAI's recent financial reports [cite specific reports and key data points, e.g., quarterly earnings reports] showcase [mention key financial indicators, e.g., revenue growth, profitability margins, and cash flow]. A detailed analysis of these reports is essential to understanding the company's current financial health and performance trajectory.

Future Projections and Growth Strategy

BBAI's management has outlined a clear growth strategy focused on [mention key aspects of the growth strategy, e.g., expanding into new markets, developing innovative AI technologies, and securing additional government contracts]. Their projections indicate [mention projected growth rates and key financial targets].

Key Performance Indicators (KPIs)

Monitoring key performance indicators (KPIs) such as contract wins, customer acquisition rate, and technological advancements is crucial for assessing BBAI's progress towards its growth objectives.

Conclusion: Investing in BigBear.ai (BBAI) Stock – A Strategic Decision?

The strong buy rating for BBAI stock is supported by its robust position within the expanding defense sector, its competitive advantages in AI and data analytics, and its promising future growth prospects. While risks associated with government contract dependence and market competition exist, the potential for significant returns makes BBAI an intriguing investment opportunity. However, potential investors must conduct thorough due diligence, considering their risk tolerance and investment strategy before making any decisions. Consider adding BigBear.ai (BBAI) stock to your portfolio, given the strong buy rating and the promising growth trajectory within the expanding defense sector. Remember to carefully weigh the potential benefits against the inherent risks. Remember to research BigBear.ai (BBAI) stock, BBAI investment, and the defense sector thoroughly before making any investment decisions.

Featured Posts

-

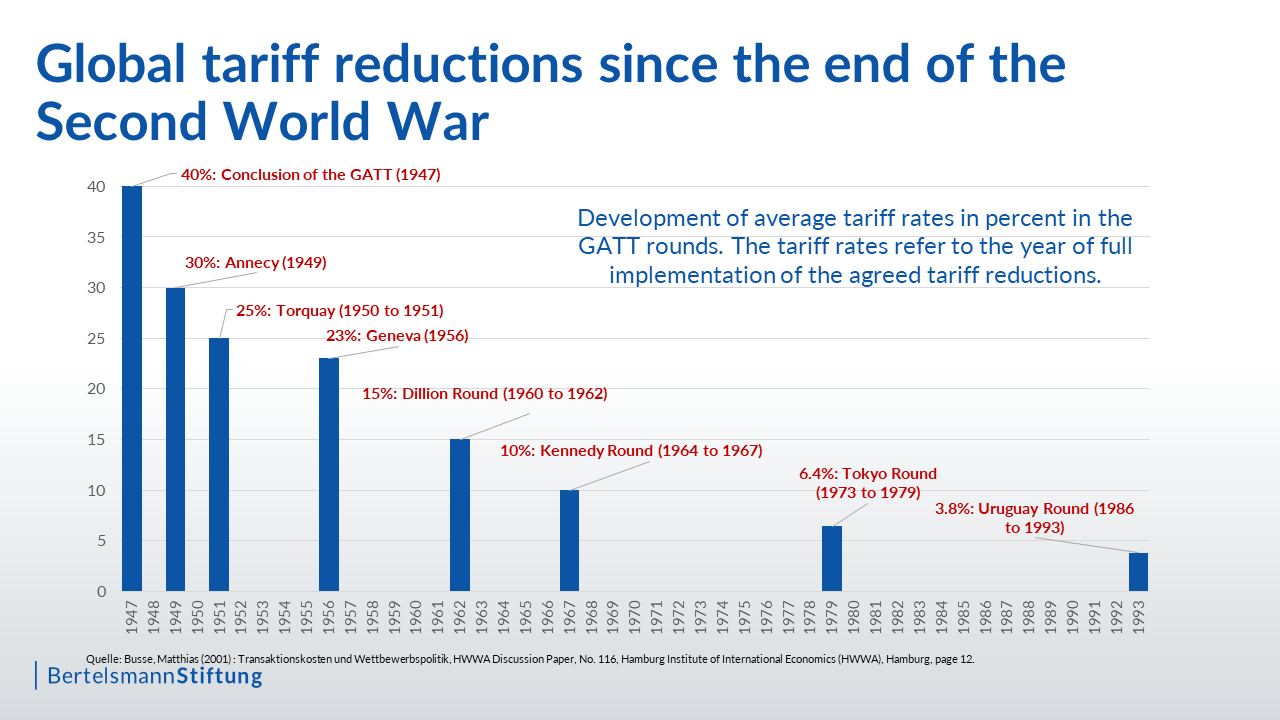

Fp Video Understanding And Responding To Global Tariff Changes

May 20, 2025

Fp Video Understanding And Responding To Global Tariff Changes

May 20, 2025 -

Dzhennifer Lourens Ta Yiyi Drugiy Sin Ostanni Novini

May 20, 2025

Dzhennifer Lourens Ta Yiyi Drugiy Sin Ostanni Novini

May 20, 2025 -

Enhanced Balikatan Exercises Philippines And Us Strengthen Military Cooperation

May 20, 2025

Enhanced Balikatan Exercises Philippines And Us Strengthen Military Cooperation

May 20, 2025 -

Cassidy Hutchinson Memoir Details On Her January 6th Testimony

May 20, 2025

Cassidy Hutchinson Memoir Details On Her January 6th Testimony

May 20, 2025 -

The Futility Of Michael Schumachers Return Ignoring Red Bulls Warning

May 20, 2025

The Futility Of Michael Schumachers Return Ignoring Red Bulls Warning

May 20, 2025

Latest Posts

-

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025 -

Cubs Game Lady And The Tramp Hot Dog Moment Goes Viral

May 21, 2025

Cubs Game Lady And The Tramp Hot Dog Moment Goes Viral

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025 -

Cubs Fans Share A Lady And The Tramp Moment With A Hot Dog

May 21, 2025

Cubs Fans Share A Lady And The Tramp Moment With A Hot Dog

May 21, 2025