BigBear.ai (BBAI) Stock: Analyst Downgrade Sparks Investor Uncertainty

The Analyst Downgrade and its Rationale

A leading analyst firm, [Insert Analyst Firm Name Here], recently issued a downgrade for BBAI stock, revising their rating from [Original Rating] to [New Rating]. This significant change sent shockwaves through the market, prompting a sharp decline in BBAI's share price. The rationale behind the downgrade cited several key concerns:

-

Slower-Than-Expected Revenue Growth: The analysts expressed concerns about BigBear.ai's ability to meet its projected revenue targets, citing slower-than-anticipated growth in key segments of its business. This includes potential challenges in securing new government contracts and delays in implementing existing projects. The revenue forecast for the coming quarters appears less optimistic than previously anticipated.

-

Intense Competition in the AI and Government Contracting Sectors: BigBear.ai operates in a highly competitive landscape. The analyst report highlighted the increasing pressure from both established players and emerging competitors in the artificial intelligence and government contracting spaces, potentially impacting BBAI's market share and profitability.

-

Valuation Concerns: The downgrade also reflected concerns about BBAI's current valuation. The analysts argued that the stock price did not accurately reflect the company's current financial performance and future growth prospects, considering the competitive pressures and revenue growth concerns. Key valuation metrics like the Price-to-Earnings ratio (P/E) were cited as being too high relative to comparable companies.

-

Risks Associated with the Company's Business Model: The analyst report highlighted potential risks inherent in BBAI's business model, such as its reliance on government contracts, the cyclical nature of government spending, and the potential for project delays or cancellations.

"[Insert a relevant quote from the analyst report here, e.g., 'We believe that BBAI's current valuation does not adequately reflect the challenges it faces in a rapidly evolving market.']"

Market Reaction to the BBAI Stock Downgrade

The immediate market reaction to the BBAI stock downgrade was swift and severe. The stock price experienced a [Percentage]% drop within [Timeframe], accompanied by a significant surge in trading volume, indicating heightened investor activity and concern. Market sentiment towards BBAI shifted dramatically, with many investors expressing negative views about the company's short-term prospects. While the downgrade was the primary catalyst, other factors, such as broader market trends or sector-specific news, may have also contributed to the negative performance.

Long-Term Implications for BigBear.ai (BBAI) Investors

The long-term implications of this analyst downgrade remain uncertain. Several scenarios are possible:

-

A Rebound: BigBear.ai could successfully address the concerns raised by the analyst firm, demonstrating improved revenue growth and market share. This could lead to a rebound in the stock price.

-

Continued Decline: If the company fails to meet expectations or faces further headwinds, the stock price could continue its downward trajectory.

-

Consolidation: The stock price may consolidate around a certain level, remaining relatively stable for an extended period as investors await further information and developments.

To assess the long-term outlook, a comprehensive fundamental analysis is crucial. This includes examining BBAI's revenue streams, profitability, debt levels, and cash flow. Furthermore, the success of the company's strategic initiatives will play a key role in determining its future growth potential. Analyzing the company's competitive landscape and its ability to innovate and adapt to market changes is also critical for assessing the long-term prospects of BBAI stock.

Alternative Investment Strategies for BBAI Stock

Investors holding BBAI stock now face important decisions. Several strategies are possible:

-

Hold: Maintaining the current position, believing that the downgrade is an overreaction and that the company will recover. This approach requires a long-term perspective and a high risk tolerance.

-

Sell: Exiting the position to limit potential losses. This is a more conservative approach, particularly for investors with lower risk tolerance.

-

Average Down: Purchasing additional shares at a lower price to reduce the average cost basis. This strategy is riskier but can potentially lead to higher returns if the stock price rebounds.

-

Options Strategies: Employing options strategies, such as covered calls or protective puts, can help mitigate risk and potentially generate income. However, these strategies have their own complexities and risks and are suitable only for experienced investors.

It's crucial to remember that any investment strategy should align with your individual risk tolerance, investment goals, and overall portfolio diversification.

Navigating the Uncertainty Surrounding BigBear.ai (BBAI) Stock

The analyst downgrade of BigBear.ai (BBAI) stock has created significant uncertainty in the market. While the short-term outlook appears challenging, the long-term prospects depend on the company's ability to address the concerns raised and deliver on its growth strategy. Thorough research and due diligence are crucial before making any investment decisions related to BBAI or any other stock. Stay informed about the latest developments regarding BigBear.ai (BBAI) stock and make informed investment decisions based on thorough research and your personal risk tolerance. For further information, consult reliable financial news sources and the official BigBear.ai investor relations page.

Aldhkae Alastnaey Wrwayat Ajatha Krysty Thlyl Wttbyqat

Aldhkae Alastnaey Wrwayat Ajatha Krysty Thlyl Wttbyqat

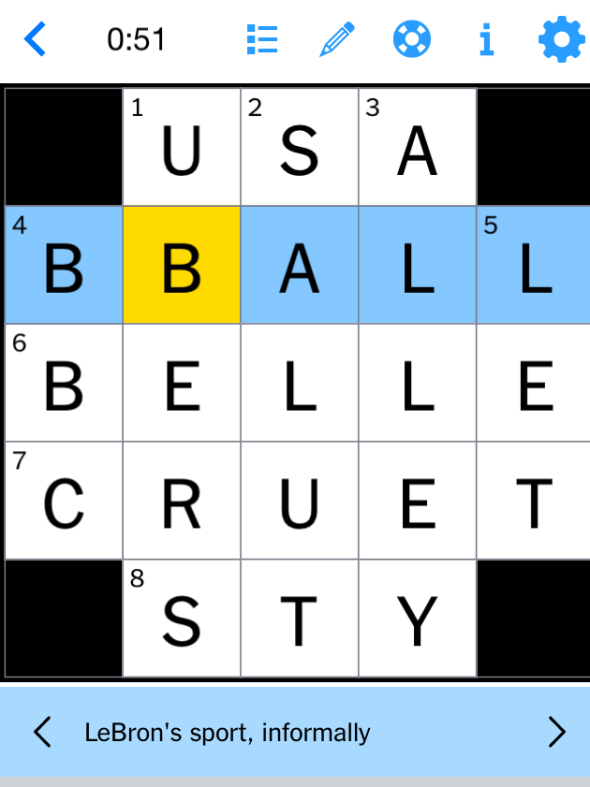

Find The Answers Nyt Mini Crossword March 20 2025

Find The Answers Nyt Mini Crossword March 20 2025

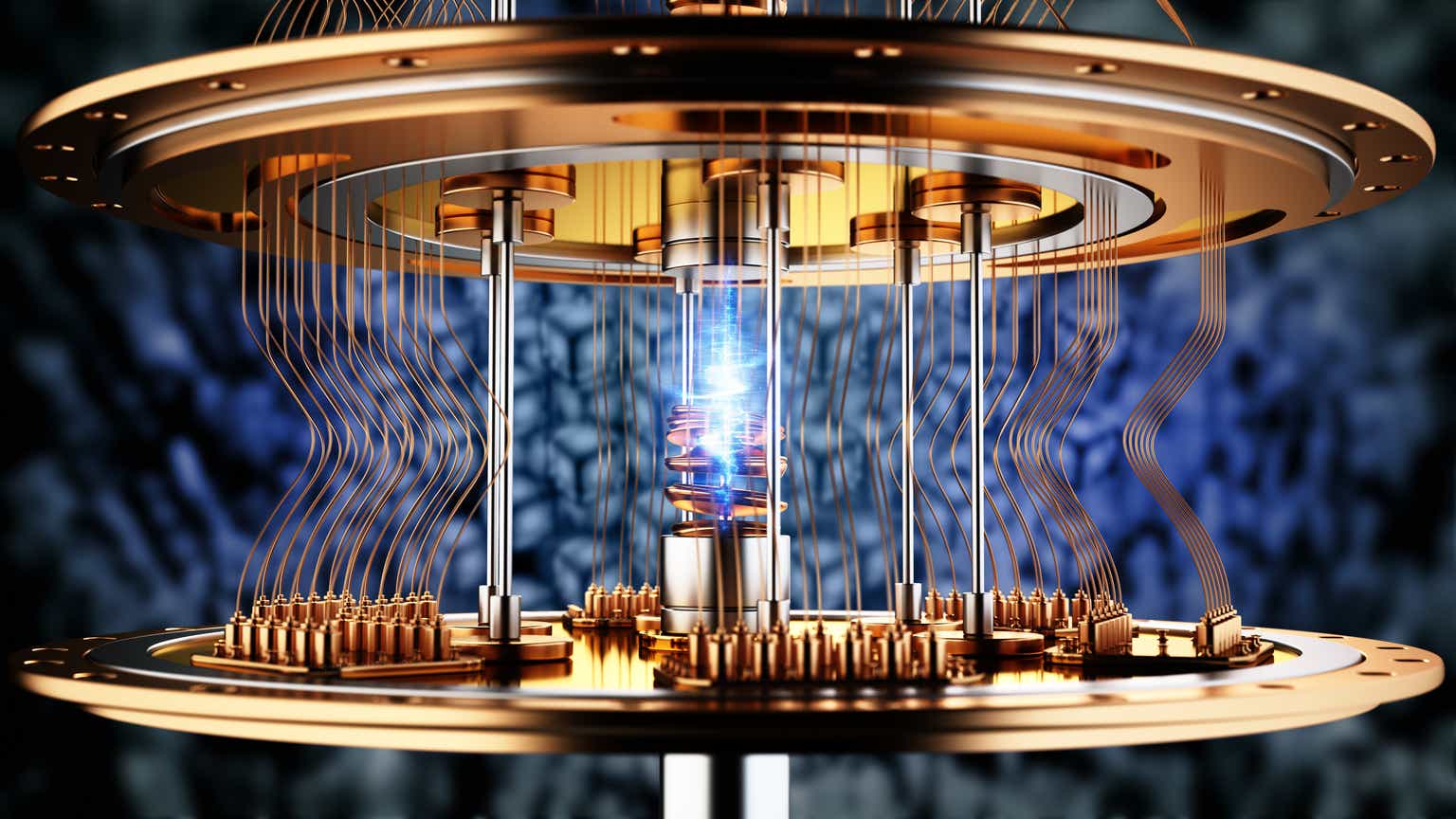

D Wave Quantum Qbts Stock Deciphering Thursdays Price Drop

D Wave Quantum Qbts Stock Deciphering Thursdays Price Drop

Hamiltonin Ferrarin Siirto Kariutui Mikae Meni Vikaan

Hamiltonin Ferrarin Siirto Kariutui Mikae Meni Vikaan

Delving Into The World Of Agatha Christies Poirot A Critical Examination

Delving Into The World Of Agatha Christies Poirot A Critical Examination