Sharp Decline In Amsterdam: Stock Market Plunges 7%

Table of Contents

Causes of the Amsterdam Stock Market Plunge

The 7% drop in the Amsterdam stock market wasn't an isolated event; it reflects a confluence of factors impacting global markets and the Dutch economy specifically.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Rising inflation rates in many countries are forcing central banks to implement aggressive interest rate hikes. This, in turn, increases borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability. The impact of inflation on stocks is substantial, as higher interest rates make bonds more attractive, diverting investment away from the equity market. Furthermore, ongoing geopolitical tensions, such as the war in Ukraine and escalating trade disputes, add to the overall sense of global economic slowdown and contribute to market volatility. Keywords such as "global economic slowdown," "inflation impact on stocks," "geopolitical risks," and "interest rate hikes" are all highly relevant here.

- High Inflation: Persistently high inflation erodes purchasing power and increases uncertainty about future earnings.

- Aggressive Interest Rate Hikes: Central banks globally are raising interest rates to combat inflation, but this can stifle economic growth.

- Geopolitical Instability: The ongoing war in Ukraine and other geopolitical tensions create significant uncertainty in the markets.

Sector-Specific Factors

While the overall market suffered, the decline wasn't uniform across all sectors. Analysis reveals that [mention specific sectors, e.g., the technology sector] experienced a disproportionately large drop, possibly due to [explain specific reasons, e.g., concerns about overvaluation or decreased consumer spending]. Conversely, [mention sectors that performed relatively better, e.g., the energy sector] showed some resilience. Understanding sectoral performance is crucial for navigating stock market volatility. Keywords like "sectoral performance," "stock market volatility," and "individual stock performance" help contextualize this section.

- Technology Sector Weakness: [Explain specific factors impacting the technology sector in Amsterdam.]

- Energy Sector Resilience: [Explain reasons for the relatively better performance of the energy sector.]

- Individual Stock Performance: Analyzing the performance of individual companies within each sector offers deeper insights into the market's behavior.

Investor Sentiment and Panic Selling

The sharp decline in the Amsterdam stock market was exacerbated by a shift in investor sentiment. Reports of [mention specific news or events that fueled negative sentiment] fueled panic selling, leading to a self-reinforcing downward spiral. Investor confidence plays a crucial role in market stability, and a loss of confidence can trigger rapid price declines. Keywords such as "investor confidence," "market sentiment," "panic selling," and "stock market crash" are essential for SEO optimization within this context.

- Negative News Reports: Negative news, even if not directly related to the Amsterdam market, can trigger a sell-off.

- Algorithmic Trading: Algorithmic trading can amplify market swings, leading to rapid price drops.

- Herding Behavior: Investors often mimic each other's actions, exacerbating both upward and downward trends.

Impact of the 7% Drop on the Amsterdam Stock Market

The 7% drop in the Amsterdam stock market has had far-reaching consequences, both immediate and long-term.

Immediate Consequences

The immediate impact on investors was substantial, with significant stock market losses incurred by many. Trading volume spiked as investors reacted to the decline, reflecting the heightened volatility in the market. Keywords like "stock market losses," "investor losses," and "trading volume" capture the immediate consequences of the plunge.

- Investor Losses: Many investors experienced significant losses in their portfolios.

- Increased Trading Volume: The sharp drop led to a surge in trading activity as investors scrambled to react.

- Market Volatility: The event underscores the inherent volatility of the stock market.

Long-Term Implications

The long-term implications for the Dutch economy are uncertain but potentially significant. The decline could negatively impact future investments and hinder economic growth. Reduced investor confidence might lead to decreased capital investment and slower job creation. Keywords like "economic impact," "long-term investment," and "economic growth" highlight the longer-term effects.

- Reduced Investment: The market decline could discourage both domestic and foreign investment.

- Slower Economic Growth: Decreased investment and consumer confidence could lead to slower economic growth.

- Potential for Recession: In a worst-case scenario, the downturn could contribute to a broader economic recession.

Government Response

The Dutch government is likely to monitor the situation closely and may implement measures to mitigate the economic impact. [Mention any specific government actions or proposed policies]. The effectiveness of these measures will depend on various factors, including the severity and duration of the market decline. Keywords such as "government intervention," "economic policy," and "market regulation" are key for this section.

Conclusion: Navigating the Sharp Decline in Amsterdam's Stock Market

The sharp decline in Amsterdam stock market values represents a significant event with potentially far-reaching consequences. The causes are multifaceted, stemming from global economic uncertainty, sector-specific factors, and a significant shift in investor sentiment. The impact has been substantial, resulting in immediate investor losses and raising concerns about long-term economic implications. Understanding the complexities of this sharp decline in Amsterdam's stock market is crucial for effective risk management. Investors need to adopt diversified portfolios, carefully assess risk tolerance, and stay informed about market developments. Stay updated on future fluctuations in the Amsterdam stock market by subscribing to our newsletter!

Featured Posts

-

Dax Surge Will A Wall Street Rebound Dampen Celebrations

May 24, 2025

Dax Surge Will A Wall Street Rebound Dampen Celebrations

May 24, 2025 -

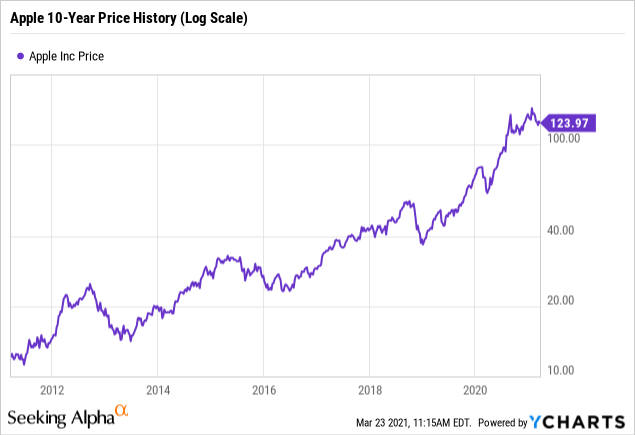

Apples Stock Price Should You Buy At 200 With A Potential 254 Target

May 24, 2025

Apples Stock Price Should You Buy At 200 With A Potential 254 Target

May 24, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Daily Nav Updates And Their Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Daily Nav Updates And Their Significance

May 24, 2025 -

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025

Latest Posts

-

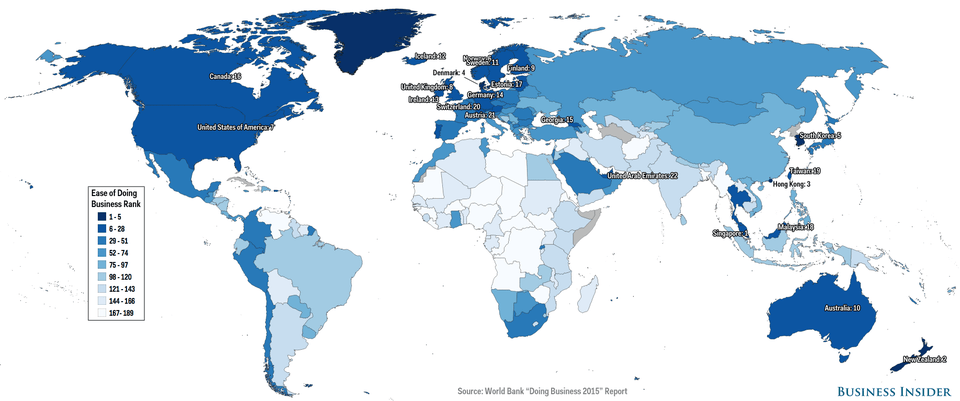

Investment Guide The Countrys Promising New Business Centers

May 24, 2025

Investment Guide The Countrys Promising New Business Centers

May 24, 2025 -

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025 -

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025 -

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025