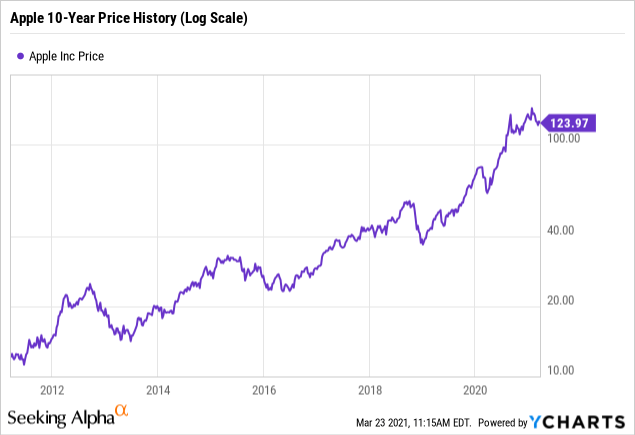

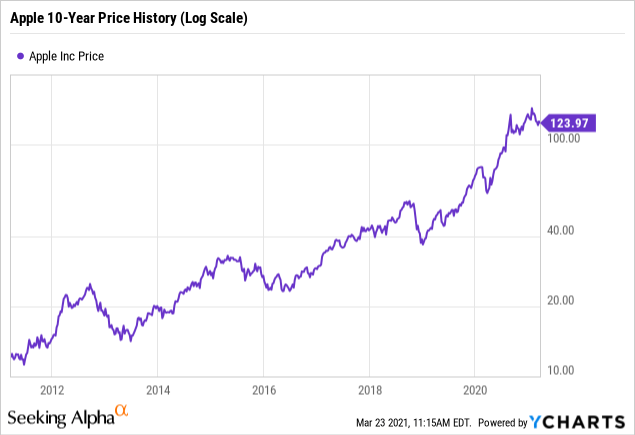

Apple's Stock Price: Should You Buy At $200 With A Potential $254 Target?

Table of Contents

H2: Apple's Current Financial Performance and Future Outlook

Apple's recent financial reports paint a picture of robust growth and profitability, fueling much of the optimism surrounding the Apple share price. However, a comprehensive analysis requires looking at both the positives and negatives.

H3: Strong Revenue Growth and Profitability

- Apple's revenue consistently exceeds expectations, driven largely by strong iPhone sales and a rapidly expanding services sector.

- Earnings per share (EPS) have shown consistent growth, reflecting improved profitability and efficient management of resources.

- Profit margins remain healthy, indicating Apple's ability to command premium prices for its products and services. This contributes significantly to a positive outlook for the Apple stock price. Analysis of Apple's financial performance shows a strong foundation.

H3: Innovation and New Product Launches

Apple's continued innovation is a key driver of its stock price. The anticipation of new products always generates excitement and potential for increased Apple revenue growth.

- The upcoming iPhone 15 series is expected to feature significant upgrades, potentially boosting sales and further impacting the Apple stock price positively.

- New Apple Watch models and potential advancements in augmented reality (AR) and virtual reality (VR) technologies could also contribute to future growth.

- Apple's robust product pipeline signals a commitment to innovation, supporting a positive outlook for the AAPL stock price.

H3: Market Competition and Challenges

Despite Apple's success, challenges remain that could influence the Apple stock price.

- Intense competition from Android manufacturers in the smartphone market is a persistent pressure point.

- Global economic downturns can impact consumer spending, potentially affecting iPhone and other product sales.

- Supply chain disruptions and geopolitical instability are risks that could affect Apple's production and profitability. Analyzing Apple competition and its ability to navigate these challenges is vital for a complete stock assessment.

H2: Analyzing the $254 Target Price: Realistic or Overly Optimistic?

The $254 target price for Apple stock is a bold prediction, requiring a thorough evaluation of various valuation methods and influencing factors.

H3: Valuation Methods

Various methods are used to determine a stock's target price, and understanding them is key to evaluating the $254 projection for Apple stock.

- Discounted Cash Flow (DCF) analysis projects future cash flows and discounts them to their present value. This method is crucial for long-term Apple stock valuation.

- Comparable company analysis compares Apple's valuation metrics to those of similar companies in the tech sector. This provides a comparative perspective on the Apple stock price.

H3: Factors Affecting the Target Price

Several factors could push Apple stock towards $254 or hinder its progress.

- Positive market sentiment and investor confidence are crucial for price appreciation. Conversely, negative market sentiment can suppress the Apple stock price.

- Strong economic conditions can boost consumer spending, benefiting Apple's sales. Conversely, an economic downturn could put downward pressure on the Apple share price.

- Technological advancements and successful new product launches will significantly impact investor perception and the Apple stock forecast.

H3: Risk Assessment

Investing in Apple stock, even with a potential $254 target, involves risk.

- The stock price could fall below the purchase price, leading to potential losses. Market volatility is a significant factor in AAPL investment strategy.

- Unforeseen events, such as major supply chain disruptions or negative regulatory changes, could impact Apple's performance and the Apple stock price negatively.

H2: Investment Strategies and Considerations

Making informed decisions about Apple stock requires considering broader investment strategies.

H3: Diversification

Diversification is crucial for managing risk. Don't put all your eggs in one basket.

- Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Diversify within the stock market itself, investing in different sectors and companies. This is essential to a sound risk management strategy and is especially relevant when considering the Apple stock price.

H3: Long-Term vs. Short-Term Investment

Your investment time horizon significantly impacts your Apple stock investment strategy.

- Long-term investors can ride out market fluctuations and potentially benefit from Apple's long-term growth. This is a crucial consideration for anyone analyzing Apple's stock price.

- Short-term investors are more exposed to market volatility and may need to react quickly to price changes. A short-term outlook requires a very different Apple stock investment strategy.

3. Conclusion: Should You Buy Apple Stock at $200?

Apple's financial performance is strong, and the $254 target isn't entirely unrealistic given the company's innovation and market position. However, significant risks exist. Whether buying Apple stock at $200 is a good idea depends on your individual risk tolerance, investment goals, and time horizon. Consider diversifying your portfolio and conduct thorough research before investing. Make a smart investment decision with careful analysis of Apple's stock price and its potential for growth. Learn more about Apple's stock price and its future prospects by consulting reliable financial resources and staying updated on market trends.

Featured Posts

-

Notenmanipulation An Nrw Universitaet Angeklagte Muessen Ins Gefaengnis

May 24, 2025

Notenmanipulation An Nrw Universitaet Angeklagte Muessen Ins Gefaengnis

May 24, 2025 -

Trumps Tariff Decision Sends Euronext Amsterdam Stocks Soaring

May 24, 2025

Trumps Tariff Decision Sends Euronext Amsterdam Stocks Soaring

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Istoriya I Kontekst Publikatsii V Trude

May 24, 2025

Gryozy Lyubvi Ili Ilicha Istoriya I Kontekst Publikatsii V Trude

May 24, 2025

Latest Posts

-

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025 -

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025